Key Insights

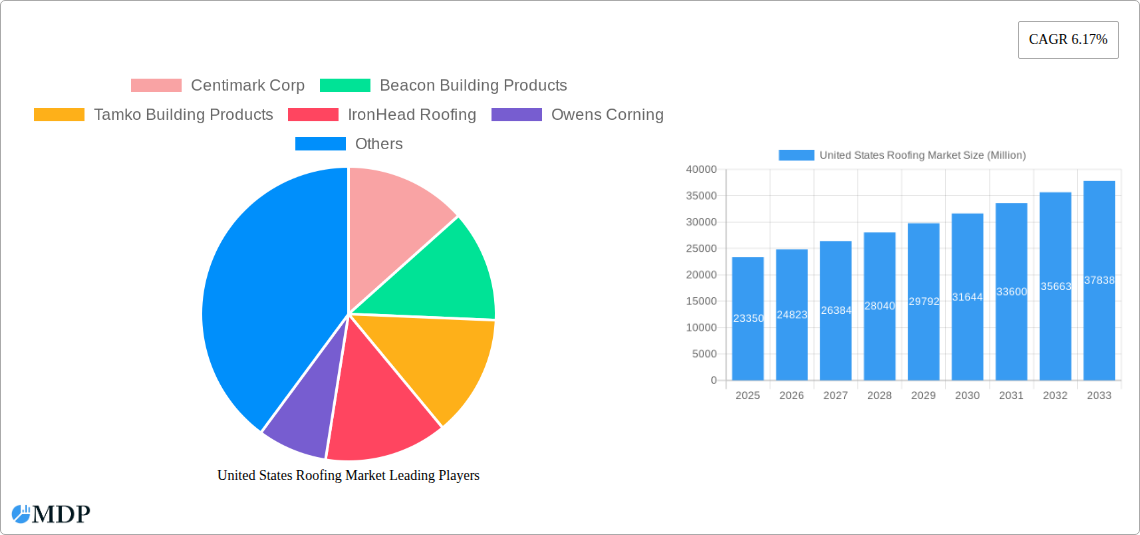

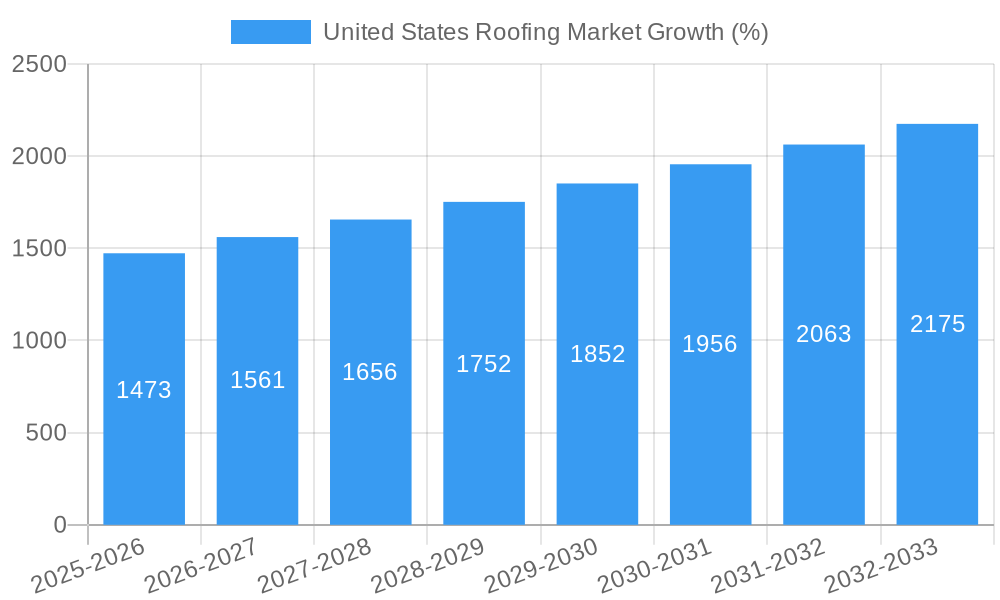

The United States roofing market, valued at $23.35 billion in 2025, is projected to experience robust growth, driven by several key factors. A significant driver is the aging housing stock in the US, necessitating increased roof replacements and repairs. Furthermore, increased construction activity across residential, commercial, and industrial sectors fuels demand for new roofing installations. Government initiatives promoting energy efficiency are also contributing to market expansion, as homeowners and businesses increasingly opt for energy-efficient roofing materials like modified bitumen and thermoplastic polyolefins. While material cost fluctuations and labor shortages present some challenges, the overall market outlook remains positive, with the continued adoption of innovative roofing technologies and sustainable materials expected to further stimulate growth. The market segmentation reveals a strong preference for modified bitumen and asphalt shingles in residential construction, while commercial projects increasingly favor more durable and longer-lasting options like EPDM rubber and TPO membranes. The flat roof segment holds a substantial market share, driven by the prevalence of flat roofs in commercial buildings. Major players like Centimark, GAF, and Owens Corning are expected to maintain their market leadership through strategic investments in research and development, expanding distribution networks, and acquisitions.

The projected Compound Annual Growth Rate (CAGR) of 6.17% from 2025 to 2033 indicates a steady expansion of the US roofing market. This growth will be distributed across various segments, with the residential sector anticipated to be a major contributor due to the large existing housing stock and new construction. However, the industrial construction sector is also expected to show significant growth, driven by the ongoing expansion of manufacturing and warehousing facilities. The increasing focus on sustainable building practices will influence material choices, pushing the adoption of environmentally friendly options. Competitive pressures are likely to intensify, leading to further innovation in product design, improved installation methods, and more competitive pricing strategies. This competitive landscape will benefit consumers, leading to a wider range of options and potentially lower costs in the long run.

United States Roofing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States roofing market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. The report leverages extensive data analysis to forecast market value and growth trajectories, offering actionable intelligence to navigate this dynamic sector. This report is crucial for understanding the competitive landscape, identifying lucrative segments, and developing successful strategies within the US roofing market. Market values are expressed in Millions.

United States Roofing Market Market Dynamics & Concentration

The US roofing market is characterized by a moderately consolidated structure with several major players and numerous smaller regional contractors. Market concentration is influenced by factors including the scale of operations, technological capabilities, and geographic reach. While the exact market share of each company varies and specific data is proprietary, a handful of key players command a significant portion of the overall market. Innovation, driven primarily by the development of sustainable and high-performance roofing materials, is a key driver. Stringent building codes and environmental regulations further shape the market landscape. The market experiences significant M&A activity, indicating ongoing consolidation and strategic growth initiatives.

- Key Players: Centimark Corp, Beacon Building Products, Tamko Building Products, IronHead Roofing, Owens Corning, Baker Roofing, Tecta America, GAF Materials Corporation, Atlas Roofing Corporation, IKO Industries, Flynn Group, CertainTeed Corporation, and numerous other companies.

- Market Share: The exact market share for each player is not publicly available and varies significantly based on the segment. Centimark Corp, Beacon Building Products, and Owens Corning are estimated to hold a significant portion of the market based on their size and public statements.

- M&A Activity: The number of M&A deals in the US roofing market is estimated to average xx per year over the historical period (2019-2024). Recent acquisitions highlight the dynamic nature of the industry.

United States Roofing Market Industry Trends & Analysis

The US roofing market exhibits a steady growth trajectory, driven by several key factors. The aging housing stock necessitates extensive roof replacements, while continuous infrastructure development fuels demand in the commercial and industrial sectors. Technological advancements, such as the adoption of energy-efficient roofing materials and improved installation techniques, contribute to market expansion. Consumer preferences are increasingly shifting towards environmentally friendly and long-lasting roofing solutions. The market exhibits substantial competition, with companies vying for market share through product innovation, pricing strategies, and expansion efforts. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, reflecting the steady expansion anticipated in the market. Market penetration of newer roofing materials like thermoplastic polyolefin is steadily increasing, fueled by its cost-effectiveness and durability.

Leading Markets & Segments in United States Roofing Market

The residential construction sector holds the largest share of the US roofing market, followed by commercial and then industrial construction. This is due to the larger number of residential buildings requiring roofing services and the cyclical nature of the commercial and industrial sectors. Within materials, modified bitumen holds significant market share due to its cost-effectiveness and wide applicability.

- By Sector:

- Residential Construction: Driven by housing demand, aging infrastructure, and increasing disposable income.

- Commercial Construction: Influenced by new building projects and renovations, driven by economic growth and expanding urban areas.

- Industrial Construction: Dependent on industrial activity, infrastructure upgrades, and expansion projects.

- By Material:

- Modified Bitumen: Dominates due to cost-effectiveness and adaptability.

- EPDM Rubber: Strong presence in flat roofing applications.

- Thermoplastic Polyolefin (TPO): Growing rapidly due to energy efficiency and durability.

- PVC Membrane: Significant market share in specific commercial applications.

- Metals: Used primarily in high-end commercial and industrial projects.

- Tiles: Strong preference in residential applications, driven by aesthetics.

- By Roofing Type:

- Flat Roof: High demand for commercial and industrial buildings.

- Slope Roof: Predominant in residential construction.

United States Roofing Market Product Developments

The US roofing market witnesses continuous product innovation, focusing on enhanced durability, energy efficiency, and sustainability. New materials like TPO and advanced modified bitumen blends are gaining traction, offering improved performance and reduced lifecycle costs. Technological advancements in installation techniques, such as improved adhesives and automated systems, further enhance efficiency and reduce installation time. These developments are primarily driven by environmental regulations, consumer demand for sustainable products, and the need for cost-effective and high-performance solutions.

Key Drivers of United States Roofing Market Growth

Growth in the US roofing market is driven by several factors:

- Aging Infrastructure: The need for repairs and replacements in aging residential and commercial buildings.

- New Construction: Growth in both residential and commercial construction activity.

- Government Regulations: Stringent building codes and incentives for energy-efficient roofing.

- Technological Advancements: Development of new materials and installation techniques leading to improved performance and efficiency.

Challenges in the United States Roofing Market Market

The US roofing market faces several challenges:

- Supply Chain Disruptions: Fluctuations in raw material prices and availability can impact profitability. These disruptions impact project timelines and budgets, affecting market growth.

- Labor Shortages: A shortage of skilled labor can constrain installation capacity and increase project costs.

- Competitive Pressures: Intense competition among established players and new entrants puts pressure on pricing and margins.

Emerging Opportunities in United States Roofing Market

Emerging opportunities include the growing demand for sustainable roofing solutions, the increasing adoption of green building practices, and the potential for smart roofing technologies integrating sensors and automation. Strategic partnerships between roofing companies and technology providers to develop innovative products and solutions will also drive market growth. Market expansion into new geographical regions and specialized niches presents further growth potential.

Leading Players in the United States Roofing Market Sector

- Centimark Corp

- Beacon Building Products

- Tamko Building Products

- IronHead Roofing

- Owens Corning

- Baker Roofing

- Tecta America

- GAF Materials Corporation

- Atlas Roofing Corporation

- IKO Industries

- Flynn Group

- CertainTeed Corporation

Key Milestones in United States Roofing Market Industry

- December 2023: Soundcore Capital Partners completed the acquisition of Roofing Corp.

- November 2023: FirstService Corporation acquired Roofing Corporation of Americas LLC (Roofing Corp).

- February 2024: Beacon Building Products completed its largest acquisition to date, acquiring Roofers Supply.

Strategic Outlook for United States Roofing Market Market

The US roofing market is poised for continued growth, driven by several factors: increasing demand for sustainable and energy-efficient roofing solutions, technological advancements leading to improved product performance, and a robust construction industry. Strategic partnerships, innovation in roofing materials and installation techniques, and expansion into new markets are key growth accelerators. Companies focusing on sustainable practices and technological innovation will be well-positioned to capitalize on future opportunities in this dynamic market.

United States Roofing Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

-

2. Material

- 2.1. Modified Bitumen

- 2.2. EPDM Rubber

- 2.3. Thermoplastic Polyolefin

- 2.4. PVC Membrane

- 2.5. Metals

- 2.6. Tiles

- 2.7. Others

-

3. Roofing Type

- 3.1. Flat Roof

- 3.2. Slope Roof

United States Roofing Market Segmentation By Geography

- 1. United States

United States Roofing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Single-Ply Roofing Products are Expected to Gain Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Modified Bitumen

- 5.2.2. EPDM Rubber

- 5.2.3. Thermoplastic Polyolefin

- 5.2.4. PVC Membrane

- 5.2.5. Metals

- 5.2.6. Tiles

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Roofing Type

- 5.3.1. Flat Roof

- 5.3.2. Slope Roof

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Sector

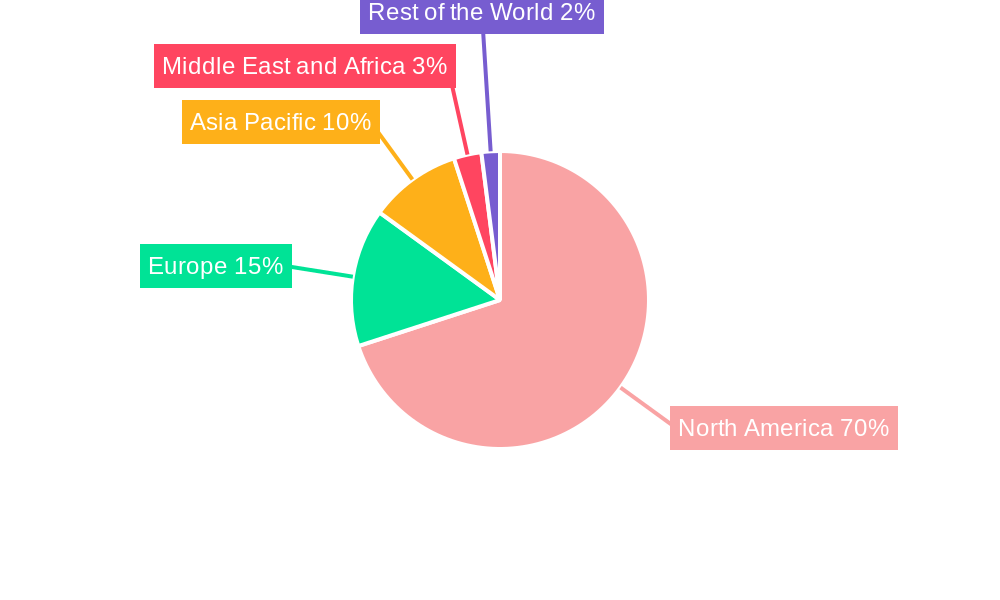

- 6. North America United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Middle East and Africa United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Rest of the World United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Centimark Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beacon Building Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tamko Building Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IronHead Roofing

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Owens Corning

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Roofing**List Not Exhaustive 7 2 *List Not Exhaustive7 3 Other Companie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tecta America

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GAF Materials Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atlas Roofing Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IKO Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Flynn Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CertainTeed Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Centimark Corp

List of Figures

- Figure 1: United States Roofing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Roofing Market Share (%) by Company 2024

List of Tables

- Table 1: United States Roofing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Roofing Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: United States Roofing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: United States Roofing Market Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 5: United States Roofing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Roofing Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: United States Roofing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 18: United States Roofing Market Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 19: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Roofing Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the United States Roofing Market?

Key companies in the market include Centimark Corp, Beacon Building Products, Tamko Building Products, IronHead Roofing, Owens Corning, Baker Roofing**List Not Exhaustive 7 2 *List Not Exhaustive7 3 Other Companie, Tecta America, GAF Materials Corporation, Atlas Roofing Corporation, IKO Industries, Flynn Group, CertainTeed Corporation.

3. What are the main segments of the United States Roofing Market?

The market segments include Sector, Material, Roofing Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Single-Ply Roofing Products are Expected to Gain Market Share.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

February 2024: Beacon, a commercial roofing distributor serving North America, announced the completion of its largest acquisition to date. Roofers Supply, based in Greenville, South Carolina, has two additional branches in Charlotte, North Carolina, and Raleigh, North Carolina. This acquisition marks Beacon’s first in 2024. In 2023, Beacon achieved its Ambition 2025 goals for revenue and shareholder return and continues to progress towards full Ambition 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Roofing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Roofing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Roofing Market?

To stay informed about further developments, trends, and reports in the United States Roofing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence