Key Insights

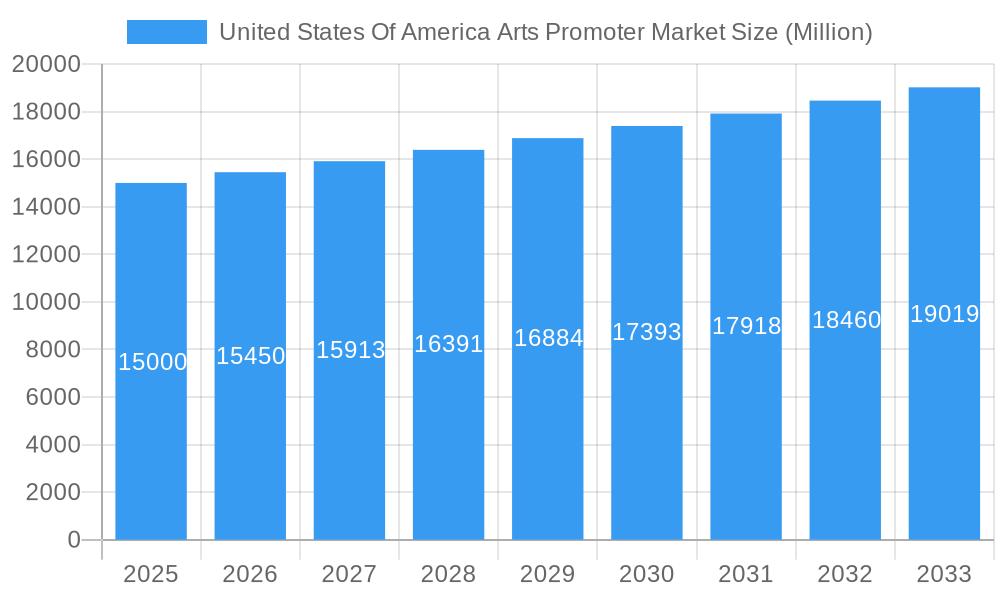

The United States arts promoter market, valued at approximately $15 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) exceeding 3% through 2033. This growth is fueled by several key drivers. Firstly, the increasing affluence of high-net-worth individuals, coupled with a rising appreciation for art as an investment and a status symbol, significantly boosts demand for art promotion services. Secondly, the expanding digital art market and the innovative use of online platforms for art auctions and exhibitions broaden accessibility and market reach. Finally, government initiatives supporting the arts and cultural tourism contribute to the market's expansion. Prominent players like Sotheby's, Christie's, and Gagosian Galleries play a significant role in shaping market trends, while newer entrants leverage technology to enhance efficiency and reach.

United States Of America Arts Promoter Market Market Size (In Billion)

However, the market faces certain restraints. Economic downturns can significantly impact high-end art purchases, thus affecting promotional activities. Furthermore, the market's concentration among established players presents challenges for smaller firms. The market is segmented by art type (painting, sculpture, digital art, etc.), service type (auction promotion, gallery representation, online marketing), and target audience (collectors, investors, general public). Geographic distribution shows strong concentration in major art hubs such as New York, Los Angeles, and Miami, although regional expansion is underway. The forecast period (2025-2033) anticipates sustained growth, driven by a continued interest in art as both a collectible asset and cultural experience. The increasing adoption of technology in promoting art, through virtual reality exhibitions and personalized marketing campaigns, will play a vital role in shaping the market's future trajectory.

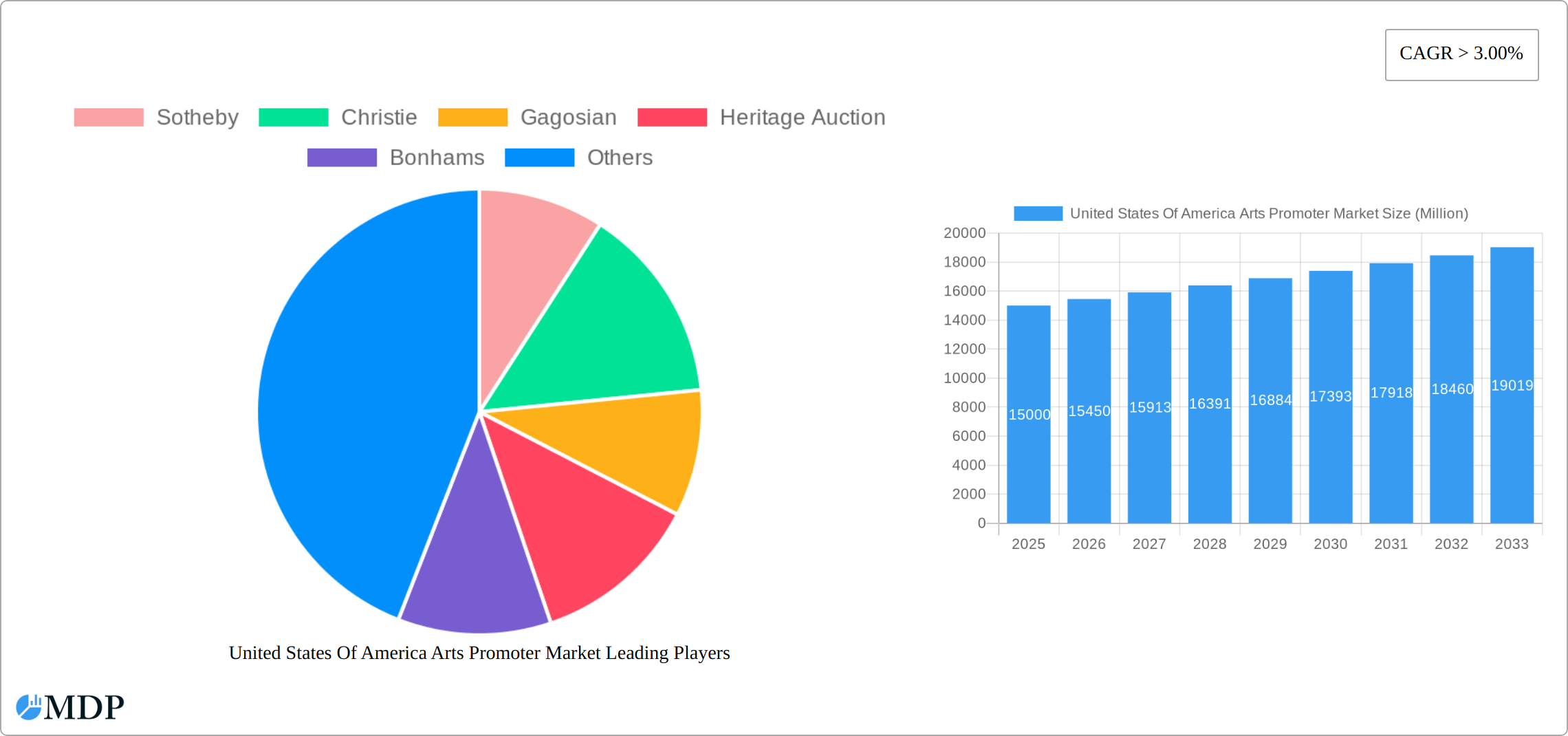

United States Of America Arts Promoter Market Company Market Share

United States of America Arts Promoter Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United States Arts Promoter Market, offering invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's current state, future trajectory, and key players shaping its evolution. Expect in-depth analysis of market size (projected to reach xx Million by 2033), growth drivers, challenges, and emerging opportunities. The report leverages data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033) to deliver accurate and actionable predictions.

United States Of America Arts Promoter Market Market Dynamics & Concentration

This section delves into the intricacies of the US Arts Promoter Market's competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, and the impact of mergers and acquisitions (M&A) activities. The report examines the market share held by key players, including Sotheby's, Christie's, Gagosian, Heritage Auction, Bonhams, Artsy, Artnet, Art Basel, MTArt Agency, and ColorWheel Art (list not exhaustive), providing a granular understanding of their strategies and market influence.

- Market Concentration: The US Arts Promoter Market exhibits a [Describe Concentration - e.g., moderately concentrated] structure with [Number] key players holding [Percentage]% of the market share in 2025. This is expected to [Increase/Decrease] slightly by 2033 due to [Reason - e.g., increased competition, consolidation].

- Innovation Drivers: Technological advancements such as NFTs and digital art platforms are driving significant innovation, expanding market reach and transforming how art is promoted and traded. This is further fueled by evolving consumer preferences for online experiences.

- Regulatory Frameworks: Existing regulations regarding art authentication, taxation, and international trade directly influence market operations and growth. [Describe Specific Regulations and their impact].

- Product Substitutes: The rise of digital art and alternative promotional channels presents substitutes for traditional art promotion methods. This is influencing the need for promoters to adapt strategies to accommodate changing consumer behaviors.

- End-User Trends: Growing interest in art and collectibles amongst millennials and Gen Z, coupled with the increasing accessibility of online art platforms, fuels the growth of the market. The shift towards experience-based consumption is driving demand for immersive art events.

- M&A Activities: The number of M&A deals in the sector [Increased/Decreased] from [Number] in 2019 to [Number] in 2024, suggesting a [Trend - e.g., consolidating] market. These deals primarily aimed at [Reason - e.g., expanding market reach, gaining access to new technologies].

United States Of America Arts Promoter Market Industry Trends & Analysis

This section provides a comprehensive overview of the US Arts Promoter Market's growth trajectory, exploring key trends influencing its evolution. We examine market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics shaping the sector. The report utilizes robust data and analysis to project a Compound Annual Growth Rate (CAGR) of [Insert CAGR Percentage]% during the forecast period (2025-2033), reflecting strong growth potential. Market penetration is anticipated to reach [Insert Penetration Percentage]% by 2033, signifying increasing adoption of art promotion services across diverse demographics. Factors influencing these trends include [Explain factors such as increased disposable income, technological advancements, changing art consumption habits, etc.].

Leading Markets & Segments in United States Of America Arts Promoter Market

The United States of America Arts Promoter Market is characterized by a dynamic landscape of leading markets and distinct segments, each contributing to the overall vibrancy and growth of the sector. While national trends are significant, specific metropolitan areas and regions emerge as powerhouses, shaping artistic discourse and commerce.

- Key Markets:

- New York City Metropolitan Area: This region stands as the undisputed epicenter of the US Arts Promoter Market. Its dominance is fueled by an unparalleled concentration of world-renowned art galleries, prestigious auction houses, and influential art institutions. The presence of a sophisticated and highly engaged collector base, coupled with a robust arts infrastructure that includes numerous museums, art schools, and cultural festivals, creates a fertile ground for art promotion. Furthermore, supportive local and state government policies that foster arts and culture, alongside a demographic with high disposable income, solidify New York's leading position.

- Los Angeles Metropolitan Area: Emerging as a significant contender, Los Angeles benefits from a growing number of contemporary art galleries, a thriving film and entertainment industry that intersects with the art world, and a diverse and increasingly affluent population. The city's expanding cultural footprint and its appeal to international artists and collectors are driving its ascent.

- Chicago Metropolitan Area: Chicago boasts a rich artistic heritage, a strong network of established galleries, and a dedicated arts patronage. Its affordability compared to New York and Los Angeles, coupled with its vibrant museum scene and robust arts education programs, continues to attract artists and collectors.

- Other Emerging Hubs: Cities like Miami, San Francisco, and even growing hubs in Texas (e.g., Austin, Houston) and the Pacific Northwest (e.g., Seattle) are witnessing increased activity in the arts promotion sector, driven by a combination of factors such as a burgeoning creative class, lower living costs, and active local arts communities.

- Key Segments:

- Fine Art Galleries: This traditional segment remains a cornerstone, showcasing established and emerging artists across various mediums. Promotions here focus on exhibitions, artist receptions, and private sales.

- Auction Houses: Major auction houses play a pivotal role in setting art market trends and facilitating high-value transactions. Their promotional efforts are geared towards showcasing significant collections and attracting global bidders.

- Online Art Platforms & Marketplaces: The digital revolution has spawned a rapidly growing segment of online platforms, offering a wider reach and accessibility to art. These platforms utilize sophisticated digital marketing strategies, virtual exhibitions, and direct-to-consumer sales models.

- Art Fairs & Festivals: These events serve as crucial marketplaces and networking opportunities, bringing together galleries, collectors, and art enthusiasts in concentrated periods. Promotions involve event marketing, sponsorship, and media outreach.

- Art Consultants & Advisors: This segment focuses on guiding collectors through the art market, offering personalized advice, acquisition services, and investment strategies. Their promotional efforts often center on building trust and demonstrating expertise.

The dominance of regions like New York City stems from a synergistic interplay of factors. The sheer density of artistic talent and commercial activity creates a self-perpetuating ecosystem. The presence of established institutions and a long history of art patronage provides a bedrock of credibility and sustained interest. Furthermore, these leading markets often serve as trendsetters, influencing artistic production and collector behavior nationwide, thereby attracting greater investment and promotional focus.

United States Of America Arts Promoter Market Product Developments

The landscape of arts promotion is undergoing a radical transformation, driven by an imperative to connect with audiences in increasingly innovative and engaging ways. Recent product developments are heavily influenced by the integration of cutting-edge digital technologies. The adoption of virtual reality (VR) and augmented reality (AR) is revolutionizing how art is showcased, allowing for immersive virtual gallery tours, interactive artist talks, and the ability to "place" artwork in a collector's home before purchase. Social media platforms are no longer just for broad outreach; sophisticated, data-driven targeted advertising campaigns are enabling promoters to reach highly specific demographics of potential buyers and enthusiasts with tailored content. Furthermore, the burgeoning realm of Non-Fungible Token (NFT) marketplaces is fundamentally altering the promotion and ownership of digital art, creating new revenue streams and attracting a new generation of collectors. These innovations are not merely technological upgrades; they are directly addressing and shaping market fit by aligning with evolving consumer preferences for digital-first, personalized, and interactive experiences. Arts promoters that strategically embrace these advancements are gaining significant competitive advantages, expanding their market reach exponentially and unlocking novel avenues for revenue generation.

Key Drivers of United States Of America Arts Promoter Market Growth

The sustained growth of the United States of America Arts Promoter Market is propelled by a confluence of powerful forces. Foremost among these are **technological advancements**, particularly the rapid evolution and widespread adoption of digital art forms and online platforms. This digital transformation has democratized access to art, breaking down geographical barriers and enabling a global audience to discover and engage with artistic creations, thereby significantly expanding the market's reach and potential. Complementing this technological surge are **economic factors**. A notable increase in disposable incomes, particularly within affluent demographics, coupled with a growing appreciation and interest in art as an investment and a lifestyle choice, are creating robust demand. Furthermore, **supportive government policies and initiatives** at federal, state, and local levels, aimed at nurturing the arts sector through grants, tax incentives, and cultural programming, foster a favorable and encouraging market environment for arts promoters. These drivers, working in concert, create a dynamic and expanding market.

Challenges in the United States Of America Arts Promoter Market Market

Despite its robust growth, the United States of America Arts Promoter Market is not without its significant challenges, which can temper its overall trajectory. **Regulatory hurdles** present a persistent concern. Complexities surrounding art authentication, provenance, and evolving taxation laws for art transactions can create administrative burdens and legal uncertainties for businesses operating within the market. Furthermore, **supply chain disruptions and fluctuations in raw material costs** can indirectly impact the profitability of art promotion activities, particularly for artists and galleries that rely on specific materials or face increased shipping and handling expenses. Perhaps the most pressing challenge is the **intense competition**. The market is experiencing a surge in new entrants, many of whom are leveraging digital technologies to disrupt traditional models and reach audiences more effectively. This heightened competition can lead to increased marketing costs and put pressure on profit margins for established players. Collectively, these challenges can increase operational costs, reduce profit margins, and slow down the rate of market expansion. The impact is estimated to potentially reduce annual growth by an estimated 2-3% if not effectively mitigated through strategic adaptation.

Emerging Opportunities in United States Of America Arts Promoter Market

Several emerging opportunities are poised to drive long-term growth. The burgeoning market for NFTs and digital art presents significant expansion potential. Strategic partnerships between art promoters and technology companies can lead to innovative promotional strategies. Expanding into new geographical markets and diversifying services to cater to a broader range of art forms can further unlock growth opportunities. These opportunities will be pivotal in shaping the market's future trajectory, particularly given the increasing demand for accessible and innovative art experiences.

Leading Players in the United States Of America Arts Promoter Market Sector

- Sotheby's

- Christie's

- Gagosian

- Heritage Auction

- Bonhams

- Artsy

- Artnet

- Art Basel

- MTArt Agency

- ColorWheel Art

Key Milestones in United States Of America Arts Promoter Market Industry

- June 2023: Sotheby's "Grails" sale featuring 40 digital artworks, with Cherniak's "Ringers#879" selling for USD 6.2 Million, highlights the growing market for digital art and its impact on the art promotion landscape.

- March 2023: The Metropolitan Museum of Art's partnership with Sulwhaso demonstrates the evolving strategies for art promotion through corporate sponsorships and broader audience engagement.

Strategic Outlook for United States Of America Arts Promoter Market Market

The United States of America Arts Promoter Market is strategically positioned for continued expansion and innovation. The trajectory of growth is firmly anchored by the relentless pace of **technological advancements**, the continuous evolution of **consumer preferences** that increasingly favor digital and immersive experiences, and the proactive development of **strategic partnerships** within the art ecosystem. The ongoing integration of digital technologies and the emergence of novel art forms will continue to redefine market dynamics, creating both opportunities and the need for agile adaptation. Future growth potential is abundant for those who can effectively embrace innovation, whether through exploring new digital promotion strategies, venturing into underserved geographic markets, or forging collaborative alliances. Building these strategic connections will be crucial for capitalizing on the ever-shifting preferences of art consumers and collectors. This market presents substantial opportunities for both established, legacy players and agile new entrants who demonstrate a keen ability to adapt to the rapidly changing cultural and technological landscape, ensuring sustained relevance and profitability.

United States Of America Arts Promoter Market Segmentation

-

1. Type

- 1.1. Fine Arts

- 1.2. Antiques

- 1.3. Collectables

- 1.4. Abstract Arts

- 1.5. Digital Art

- 1.6. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

-

3. End-User

- 3.1. Individual

- 3.2. Companies

-

4. Channel

- 4.1. Online

- 4.2. Offline

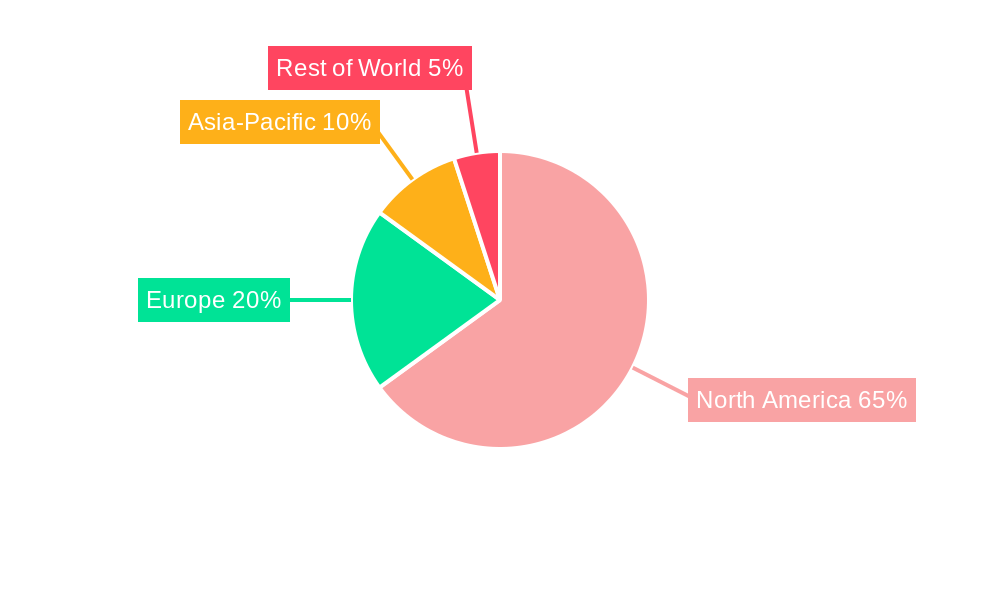

United States Of America Arts Promoter Market Segmentation By Geography

- 1. United States

United States Of America Arts Promoter Market Regional Market Share

Geographic Coverage of United States Of America Arts Promoter Market

United States Of America Arts Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales

- 3.3. Market Restrains

- 3.3.1. Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales

- 3.4. Market Trends

- 3.4.1. Digital Art Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Of America Arts Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fine Arts

- 5.1.2. Antiques

- 5.1.3. Collectables

- 5.1.4. Abstract Arts

- 5.1.5. Digital Art

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Individual

- 5.3.2. Companies

- 5.4. Market Analysis, Insights and Forecast - by Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sotheby

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Christie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gagosian

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heritage Auction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bonhams

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Artsy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Artnet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Art Basel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MTArt Agency

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ColorWheel Art**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sotheby

List of Figures

- Figure 1: United States Of America Arts Promoter Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Of America Arts Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: United States Of America Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: United States Of America Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 3: United States Of America Arts Promoter Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: United States Of America Arts Promoter Market Revenue undefined Forecast, by Channel 2020 & 2033

- Table 5: United States Of America Arts Promoter Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: United States Of America Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: United States Of America Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 8: United States Of America Arts Promoter Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 9: United States Of America Arts Promoter Market Revenue undefined Forecast, by Channel 2020 & 2033

- Table 10: United States Of America Arts Promoter Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Of America Arts Promoter Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the United States Of America Arts Promoter Market?

Key companies in the market include Sotheby, Christie, Gagosian, Heritage Auction, Bonhams, Artsy, Artnet, Art Basel, MTArt Agency, ColorWheel Art**List Not Exhaustive.

3. What are the main segments of the United States Of America Arts Promoter Market?

The market segments include Type, Revenue Source, End-User, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales.

6. What are the notable trends driving market growth?

Digital Art Driving The Market.

7. Are there any restraints impacting market growth?

Rise in Digital Art Products driving the Market; Increasing partnership with global market driving artwork sales.

8. Can you provide examples of recent developments in the market?

June 2023: Sotheby's conducted its second part of the "Grails" sale, focusing on artworks owned by 3AC, featuring 40 digital artworks. The highlight of the auction was Cherniak's highly coveted piece, "Ringers#879," affectionately known as "The Goose" due to its uncanny resemblance to a bird, which appeared to defy the algorithm's randomized logic. This remarkable artwork was sold for a staggering USD 6.2 million to the 6529 NFT Fund.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Of America Arts Promoter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Of America Arts Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Of America Arts Promoter Market?

To stay informed about further developments, trends, and reports in the United States Of America Arts Promoter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence