Key Insights

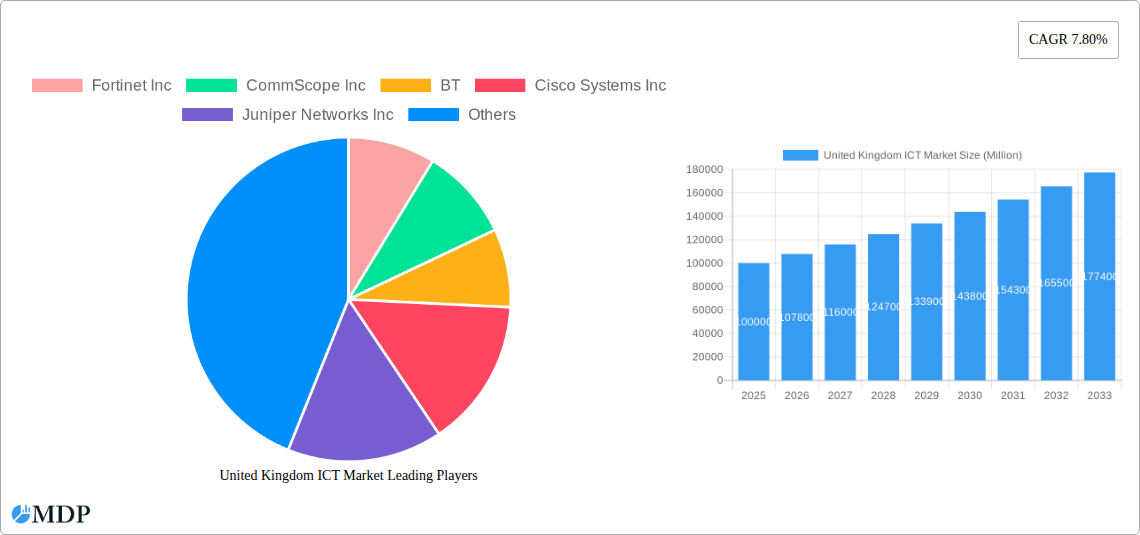

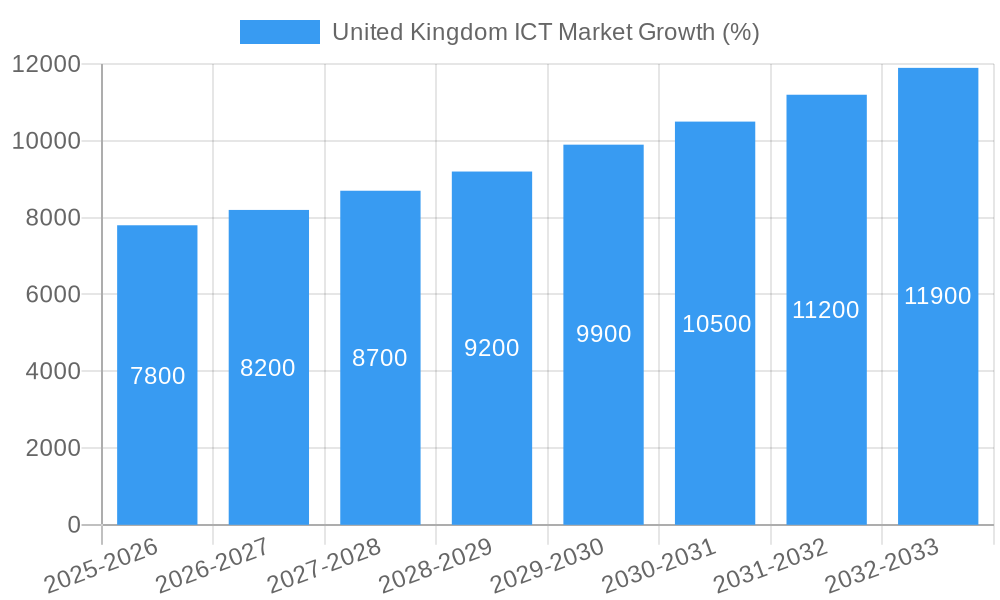

The United Kingdom's Information and Communications Technology (ICT) market is experiencing robust growth, driven by increasing digitalization across all sectors and a rising demand for advanced technologies. The market, estimated at £X billion in 2025 (assuming a global market size of XX million and UK's relative share in the global ICT market—a reasonable assumption needs to be made based on available data from other sources to calculate this value. For example, if the UK accounts for approximately 5% of the global ICT market, and the global market is XX million, then the UK market size can be calculated. This assumption should be explicitly stated), is projected to maintain a Compound Annual Growth Rate (CAGR) of approximately 7.8% through 2033. This growth is fueled by several key factors: the expanding adoption of cloud computing and Software as a Service (SaaS) solutions by both Small and Medium Enterprises (SMEs) and large enterprises; the accelerating deployment of 5G networks, enabling faster data speeds and improved connectivity; and the increasing focus on cybersecurity in response to evolving cyber threats across industries such as BFSI (Banking, Financial Services, and Insurance), IT and Telecom, and the Government. Government initiatives promoting digital transformation and innovation also significantly contribute to market expansion. While Brexit initially posed some uncertainties, the UK's strong technology infrastructure and skilled workforce continue to attract significant foreign investment and stimulate growth.

The UK ICT market is highly segmented, with notable growth observed across hardware, software, and IT services. The BFSI sector leads in ICT investment, followed closely by IT and Telecom, reflecting their reliance on robust digital infrastructure and advanced technologies for operations. The retail and e-commerce sectors are also demonstrating significant investment in ICT, fueled by the expanding online marketplace and growing demand for personalized customer experiences. However, challenges remain, including the skills gap in certain areas of the ICT sector, which could hinder growth if not addressed proactively. Moreover, the cost of implementation and ongoing maintenance of advanced technologies can pose a significant barrier for some smaller businesses, requiring strategic investments in digital literacy and training programs. Despite these restraints, the overall outlook for the UK ICT market remains highly positive, promising substantial opportunities for both established players and new entrants.

United Kingdom ICT Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK ICT market, covering market dynamics, industry trends, leading segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for businesses, investors, and policymakers operating within the UK's dynamic technology landscape. The report analyzes the market valued at £xx Million in 2025 and projects a substantial growth to £xx Million by 2033.

United Kingdom ICT Market Market Dynamics & Concentration

The UK ICT market is characterized by a moderate level of concentration, with several large multinational corporations and numerous smaller, specialized firms competing for market share. Market share distribution reveals a concentration of xx% held by the top 5 players, indicating considerable competition and the presence of significant market players. However, the market also exhibits significant dynamism, driven by ongoing innovation, evolving regulatory frameworks, and the emergence of product substitutes. The increasing adoption of cloud computing, 5G technology, and the Internet of Things (IoT) is reshaping the competitive landscape. Furthermore, M&A activity remains robust, with xx major deals recorded between 2019 and 2024, signifying strategic consolidation and expansion within the sector.

- Key Innovation Drivers: 5G deployment, AI, Cloud Computing, IoT.

- Regulatory Frameworks: Data protection regulations (GDPR), cybersecurity standards, and digital infrastructure investments.

- Product Substitutes: Open-source software, cloud-based services, alternative communication technologies.

- End-User Trends: Increased demand for digital transformation solutions, remote work capabilities, and enhanced cybersecurity.

- M&A Activity: Strategic acquisitions aimed at expanding service offerings, acquiring specialized technologies, and strengthening market positions. The average deal size was £xx Million.

United Kingdom ICT Market Industry Trends & Analysis

The UK ICT market has experienced significant growth over the past few years, driven by several factors. The increasing digitalization of businesses across various sectors fuels demand for advanced ICT solutions. This is further amplified by the government's initiatives to promote digital transformation and improve digital infrastructure. Technological disruptions, such as the widespread adoption of cloud computing and 5G, are reshaping the market and creating new opportunities. Consumer preferences are shifting towards more user-friendly, secure, and integrated solutions, driving innovation and competition. The market's CAGR during the historical period (2019-2024) was xx%, and is projected to be xx% during the forecast period (2025-2033). Market penetration of key technologies like 5G continues to increase, reaching an estimated xx% in 2025. Competitive dynamics are intense, with both established players and new entrants vying for market share.

Leading Markets & Segments in United Kingdom ICT Market

The UK ICT market demonstrates considerable segment diversity with significant variations in growth potential and market dominance. The Large Enterprises segment currently holds the largest market share, driven by significant investments in digital infrastructure and IT solutions to improve operational efficiency and enhance competitiveness. Within industry verticals, the BFSI (Banking, Financial Services, and Insurance) sector showcases substantial spending on ICT solutions due to robust regulatory requirements and a commitment to enhancing customer experience through digital platforms.

- By Size of Enterprise: Large Enterprises show dominant market share due to higher IT budgets and complex requirements. SMEs demonstrate substantial growth potential driven by increasing digital adoption.

- By Industry Vertical: BFSI displays the highest spending due to stringent regulations and focus on customer experience. IT and Telecom, and Government sectors follow with significant investments in digital infrastructure.

- By Type: Software and IT services segments experience rapid growth, reflecting the industry's software-defined nature and the increasing demand for digital transformation services.

Key Drivers:

- Economic Policies: Government initiatives promoting digital transformation and supporting innovation.

- Infrastructure Development: Investments in broadband infrastructure and 5G network deployment.

- Technological Advancements: Continued innovations in cloud computing, AI, IoT, and 5G.

United Kingdom ICT Market Product Developments

Recent product developments in the UK ICT market focus on enhanced security, improved efficiency, and integrated solutions. The industry is witnessing a surge in cloud-based offerings, AI-powered analytics tools, and IoT platforms designed to cater to the evolving needs of businesses and consumers. These innovations are not only improving operational efficiency but are also fostering competitiveness within the sector by providing businesses with more flexible and scalable ICT solutions.

Key Drivers of United Kingdom ICT Market Growth

The UK ICT market's growth is propelled by several key factors. Government initiatives aimed at digital transformation, along with substantial investments in 5G infrastructure and broadband connectivity, are crucial drivers. Furthermore, the increasing adoption of cloud computing, AI, and IoT across diverse industries significantly contributes to the market's expansion. Businesses are increasingly recognizing the importance of leveraging technology to enhance productivity, gain a competitive edge, and improve customer experiences.

Challenges in the United Kingdom ICT Market Market

The UK ICT market faces challenges, including regulatory hurdles related to data privacy and cybersecurity, supply chain disruptions, and intense competition. These factors can significantly impact market growth and profitability for businesses operating in this dynamic space. The cost of implementing new technologies and attracting skilled workforce are also contributing factors.

Emerging Opportunities in United Kingdom ICT Market

The UK ICT market presents promising opportunities. Technological advancements, such as the further development of 5G, AI, and IoT, unlock new avenues for growth. Strategic partnerships between established players and innovative start-ups are creating a fertile ground for technological advancements and market expansion. This dynamic environment fosters innovation and presents attractive prospects for future expansion and market leadership.

Leading Players in the United Kingdom ICT Market Sector

- Fortinet Inc

- CommScope Inc

- BT

- Cisco Systems Inc

- Juniper Networks Inc

- Vodafone

- ZTE Corporation

- Fujitsu

- Huawei Technologies

- Sitel Group

- Verizon

- Nokia

- Ciena Corporation

Key Milestones in United Kingdom ICT Market Industry

- September 2022: Kick ICT Group Ltd acquired Consilium UK Ltd, expanding its service portfolio and market reach.

- July 2022: The UK Telecoms Innovation Network (UKTIN) received a GBP 10 Million grant, boosting innovation within the telecoms supply chain.

- February 2022: ZTE Corporation launched new 5G products and solutions at Mobile World Congress, demonstrating commitment to 5G network development.

Strategic Outlook for United Kingdom ICT Market Market

The UK ICT market is poised for continued growth, driven by ongoing technological advancements, government support, and increasing digital adoption across various sectors. Strategic partnerships and investments in emerging technologies like AI and IoT present significant opportunities for businesses to expand their market share and drive innovation. The market's future potential is substantial, with opportunities for both established players and new entrants to thrive in this dynamic and evolving landscape.

United Kingdom ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

United Kingdom ICT Market Segmentation By Geography

- 1. United Kingdom

United Kingdom ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Surge in Demand for Software as a Service (SaaS); Rise in Need of Digital Technology in Healthcare

- 3.3. Market Restrains

- 3.3.1. Chip Shortage and Inflationary Pressures; High Risk of Data Theft

- 3.4. Market Trends

- 3.4.1. Telecommunication Sector is expected to Hold the Substantial Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

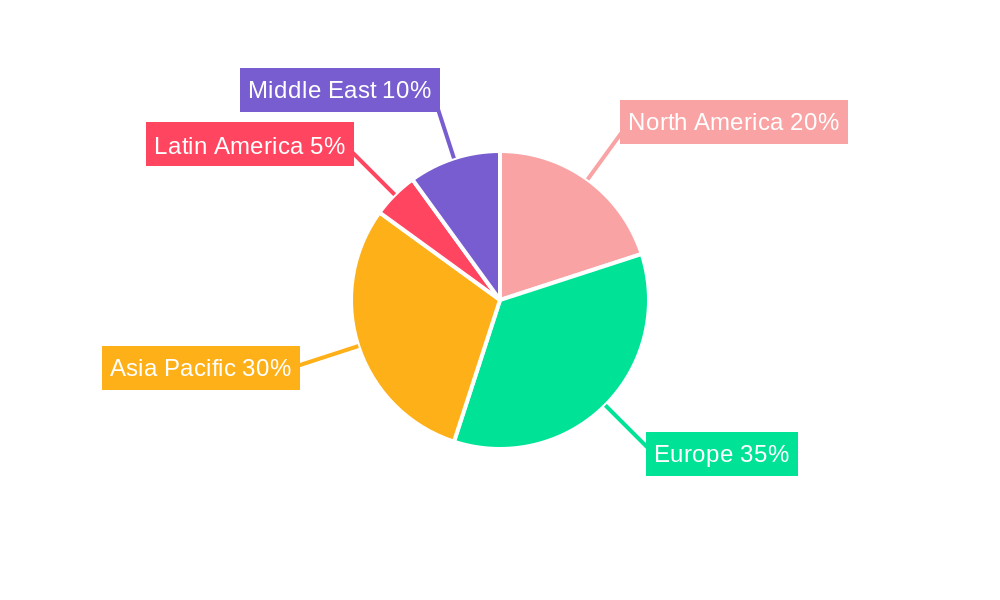

- 6. North America United Kingdom ICT Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United Kingdom ICT Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United Kingdom ICT Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United Kingdom ICT Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United Kingdom ICT Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fortinet Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CommScope Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BT

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Juniper Networks Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vodafone

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ZTE Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fujitsu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Huawei Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sitel Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Verizon

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nokia*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ciena Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Fortinet Inc

List of Figures

- Figure 1: United Kingdom ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom ICT Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United Kingdom ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: United Kingdom ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: United Kingdom ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Kingdom ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United Kingdom ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United Kingdom ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: United Kingdom ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 18: United Kingdom ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 19: United Kingdom ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom ICT Market?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the United Kingdom ICT Market?

Key companies in the market include Fortinet Inc, CommScope Inc, BT, Cisco Systems Inc, Juniper Networks Inc, Vodafone, ZTE Corporation, Fujitsu, Huawei Technologies, Sitel Group, Verizon, Nokia*List Not Exhaustive, Ciena Corporation.

3. What are the main segments of the United Kingdom ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Surge in Demand for Software as a Service (SaaS); Rise in Need of Digital Technology in Healthcare.

6. What are the notable trends driving market growth?

Telecommunication Sector is expected to Hold the Substantial Market Share.

7. Are there any restraints impacting market growth?

Chip Shortage and Inflationary Pressures; High Risk of Data Theft.

8. Can you provide examples of recent developments in the market?

September 2022 - Kick ICT Group Ltd acquired Consilium UK Ltd. Consequently, the Group's technical division has grown and improved, expanding the portfolio of IT products, services, and support available to both the Enterprise and SME sectors. Kick's takeover of a technical services provider with a presence in London is a crucial strategic move in the company's continuous expansion plan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom ICT Market?

To stay informed about further developments, trends, and reports in the United Kingdom ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence