Key Insights

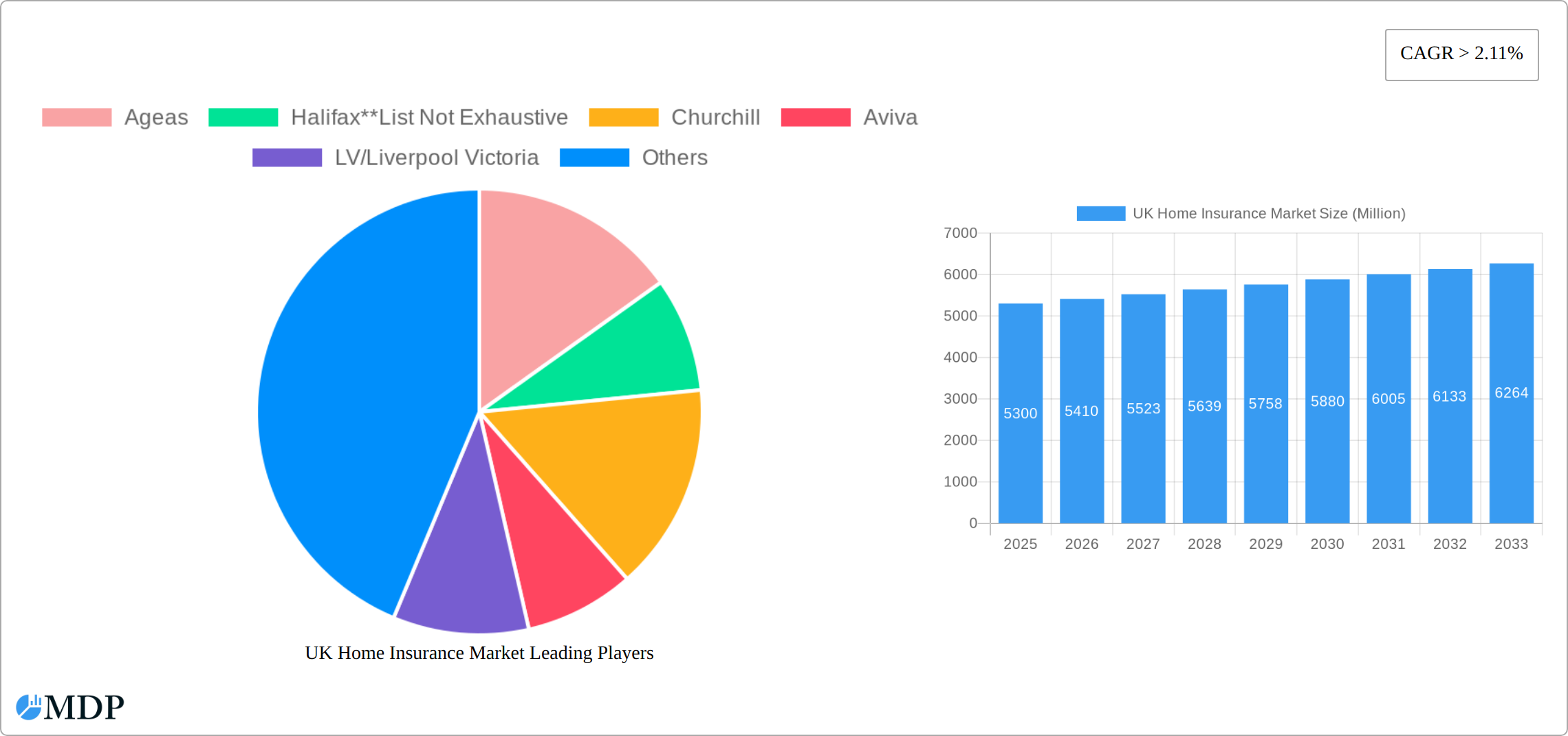

The UK home insurance market, valued at £5.3 billion in 2025, exhibits a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 2.11% from 2025 to 2033. This growth is fueled by several key drivers. Increasing property values, particularly in urban centers, necessitate higher coverage amounts, boosting overall market value. Furthermore, rising awareness of potential risks, such as flooding and severe weather events exacerbated by climate change, drives demand for comprehensive home insurance policies. The market is segmented by insurance type (building, contents, combined, renter's, landlord's, strata/holiday home) and distribution channels (direct, independent advisors, banks/building societies, utilities/retailers, company agents, online). Competition is fierce, with established players like Ageas, Aviva, Direct Line, and Admiral Group vying for market share alongside smaller, specialized insurers. The increasing adoption of digital platforms and online comparison tools is reshaping distribution strategies, leading to greater price transparency and customer empowerment. Regulatory changes and evolving consumer preferences, such as demand for personalized and flexible insurance products, present both challenges and opportunities for market participants.

Growth within the market segments is expected to vary. The building and contents insurance segment will likely maintain its dominance, driven by homeowner demand for comprehensive protection. However, the renter's and landlord's insurance segments are anticipated to experience strong growth, reflecting the increasing rental market and the associated risks. The online distribution channel is poised for significant expansion, mirroring broader digitalization trends in the financial services sector. While increased competition and economic downturns represent potential restraints, the long-term outlook remains positive, with sustained demand for home insurance fueled by demographic shifts and evolving risk landscapes within the UK's diverse regions (England, Wales, Scotland, and Northern Ireland). The market's resilience and adaptability are expected to support continuous growth in the coming years.

UK Home Insurance Market Report: 2019-2033 - A Comprehensive Analysis

Unlock the potential of the UK's dynamic home insurance market with this in-depth report. Covering the period 2019-2033, with a base year of 2025, this comprehensive analysis provides invaluable insights for industry stakeholders, investors, and strategic planners. We delve into market dynamics, leading players (including Ageas, Halifax, Churchill, Aviva, LV/Liverpool Victoria, AA Home Insurance, Zurich, Axa Insurance UK, Direct Line Group, and Admiral Group), key trends, and future opportunities, offering actionable intelligence to navigate this competitive landscape. The report projects a market valued at £XX Million in 2025, with a forecasted Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

UK Home Insurance Market Market Dynamics & Concentration

The UK home insurance market demonstrates a moderately concentrated structure, with several major players holding substantial market share. Established brands like Aviva and Direct Line Group leverage strong brand recognition and extensive distribution networks to maintain their leading positions. However, the market also supports a diverse range of smaller insurers and niche providers, particularly catering to specialized areas such as landlord or strata insurance. Market innovation is fueled by technological advancements, including telematics, AI-driven risk assessment, and sophisticated digital distribution channels. The regulatory landscape, overseen by the Financial Conduct Authority (FCA), is subject to ongoing evolution to prioritize consumer protection and market stability. This regulatory environment significantly influences product development, pricing strategies, and distribution approaches, impacting the overall competitive dynamics. The rise of online comparison platforms has heightened competition and amplified price sensitivity among consumers. Mergers and acquisitions (M&A) activity plays a crucial role in shaping market consolidation. Recent examples, such as Aviva's acquisition of a Barclays home insurance portfolio in July 2023, highlight the ongoing trend of consolidation among larger players. This dynamic interplay between established players, emerging competitors, and regulatory oversight creates a complex and evolving market landscape.

- Market Concentration (Estimated 2025): Top 5 players hold approximately [Insert Percentage]% market share. Further analysis is needed to refine this estimate.

- M&A Activity (2019-2024): Approximately [Insert Number] deals were recorded, indicating a moderate level of consolidation. Future activity will be a key factor in shaping market structure.

- Innovation Drivers: Telematics, AI, and advanced digital distribution are pivotal factors driving market transformation and shaping competitive advantages.

- Regulatory Influence: FCA regulations exert considerable influence on product design, pricing structures, and distribution strategies, impacting both insurers and consumers.

UK Home Insurance Market Industry Trends & Analysis

The UK home insurance market demonstrates robust growth, driven by several key factors. Increasing property values, coupled with growing awareness of the importance of home insurance, fuel market expansion. The shift towards online channels provides enhanced convenience and cost-effectiveness, boosting market penetration. Technological disruptions, such as AI-driven claims processing and personalized risk assessment, are improving efficiency and customer experience. Consumer preferences are increasingly shifting towards comprehensive coverage, value-added services, and personalized offerings. Intense competition among insurers drives innovation and pricing strategies, benefiting consumers with diverse options. The estimated CAGR for the market from 2025 to 2033 is XX%, indicating continued expansion during the forecast period. Market penetration is expected to reach approximately XX% by 2033.

Leading Markets & Segments in UK Home Insurance Market

The UK home insurance market is geographically diverse, with no single region dominating. However, specific segments demonstrate stronger growth potential. Building and contents insurance remain the core product offerings. The online distribution channel is experiencing rapid growth, driven by consumer preference for online convenience and access to price comparison tools. This trend is reshaping the competitive landscape and forcing traditional players to adapt.

- Dominant Segments:

- Type: Building & Contents insurance remains the most prevalent, followed by Building and Contents insurance sold as separate products.

- Distribution: Online channels and direct sales exhibit the fastest growth rates, reflecting evolving consumer behavior.

- Key Drivers:

- Regional economic variations significantly influence demand, creating pockets of higher growth.

- Government policies and regulations play a crucial role in shaping market dynamics and influencing risk profiles.

- Infrastructure development and improvements in specific areas impact risk assessments and insurance needs, creating opportunities for specialized products.

UK Home Insurance Market Product Developments

Recent product innovations emphasize personalized coverage options, leveraging technological advancements like telematics to offer tailored premiums based on individual risk profiles. Insurers are incorporating value-added services, such as emergency home repair assistance or security system discounts, to enhance customer loyalty and differentiate their offerings. These advancements cater to the evolving needs of consumers seeking both comprehensive protection and personalized service. The focus is on digitalization, creating user-friendly online platforms, and streamlining the claims process for enhanced customer experience.

Key Drivers of UK Home Insurance Market Growth

Several key factors are driving the growth of the UK home insurance market. Technological advancements, such as AI and telematics, are enhancing risk assessment and customer experience. Robust economic growth fuels higher property values, increasing demand for insurance. A constantly evolving regulatory framework aims to strengthen consumer protection and market stability. The expanding online channel significantly improves accessibility and intensifies competition. Strategic partnerships, such as the collaborations between Amazon and various UK insurers, further accelerate market expansion and reach a broader customer base. The increasing awareness of climate change related risks is also pushing the need for more comprehensive insurance solutions.

Challenges in the UK Home Insurance Market Market

The market faces several challenges, including increasing regulatory scrutiny, volatile claims costs, and intense competition leading to pressure on pricing. Natural disasters and climate change impact claims frequency and severity. Supply chain disruptions might affect the availability of materials needed for repairs, delaying claims settlements and impacting insurer costs.

Emerging Opportunities in UK Home Insurance Market

Emerging technologies like AI and IoT offer opportunities for personalized risk assessment and proactive loss prevention, driving efficiency and potentially lowering premiums. Strategic partnerships between insurers and technology providers, alongside expansion into niche segments (e.g., strata insurance), present significant growth potential. The expansion of digital distribution channels continues to unlock new markets and customer segments.

Leading Players in the UK Home Insurance Market Sector

- Ageas

- Halifax

- Churchill

- Aviva

- LV/Liverpool Victoria

- AA Home Insurance

- Zurich

- Axa Insurance UK

- Direct Line Group

- Admiral Group

Key Milestones in UK Home Insurance Market Industry

- July 2023: Aviva acquires Barclays' home insurance portfolio (350,000 customers), significantly boosting its market share.

- May 2023: Amazon partners with Ageas, Co-op, LV, and Policy Expert to simplify home insurance purchases, indicating a shift towards digital distribution and increased customer convenience.

Strategic Outlook for UK Home Insurance Market Market

The UK home insurance market presents substantial long-term growth potential fueled by technological innovation, shifting consumer preferences, and sustained economic expansion. To succeed in this competitive landscape, insurers must prioritize strategic partnerships, expand into specialized niche markets, and enhance customer experience through digitalization. Future market growth will depend on the industry's ability to adapt to evolving regulatory environments, effectively manage climate change-related risks, and leverage emerging technological opportunities. A focus on data-driven insights and personalized products will be crucial for sustained success.

UK Home Insurance Market Segmentation

-

1. Type

- 1.1. Building/ Property Insurance

- 1.2. Contents Insurance

- 1.3. Building & Content Insurance

- 1.4. Renter's or Tenant's Insuarance

- 1.5. Landlord's Insurance

- 1.6. Strata/ Holiday Home Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Independent Advisers

- 2.3. Banks/Building societies

- 2.4. Utilities/Retailers/Affinity Groups

- 2.5. Company Agents

- 2.6. Online Channels

UK Home Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Home Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Number of Households is Driving the Market; Wide Range Of Offers Provided By Insurers is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Policies Excluding Coverage for Natural Disasters is Restraining the Market; Rising Claims Costs Impacting Insurer's Profitability

- 3.4. Market Trends

- 3.4.1. Building/Property Insurance is Dominating the United Kingdom Home Insurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Building/ Property Insurance

- 5.1.2. Contents Insurance

- 5.1.3. Building & Content Insurance

- 5.1.4. Renter's or Tenant's Insuarance

- 5.1.5. Landlord's Insurance

- 5.1.6. Strata/ Holiday Home Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Independent Advisers

- 5.2.3. Banks/Building societies

- 5.2.4. Utilities/Retailers/Affinity Groups

- 5.2.5. Company Agents

- 5.2.6. Online Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Building/ Property Insurance

- 6.1.2. Contents Insurance

- 6.1.3. Building & Content Insurance

- 6.1.4. Renter's or Tenant's Insuarance

- 6.1.5. Landlord's Insurance

- 6.1.6. Strata/ Holiday Home Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Independent Advisers

- 6.2.3. Banks/Building societies

- 6.2.4. Utilities/Retailers/Affinity Groups

- 6.2.5. Company Agents

- 6.2.6. Online Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Building/ Property Insurance

- 7.1.2. Contents Insurance

- 7.1.3. Building & Content Insurance

- 7.1.4. Renter's or Tenant's Insuarance

- 7.1.5. Landlord's Insurance

- 7.1.6. Strata/ Holiday Home Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Independent Advisers

- 7.2.3. Banks/Building societies

- 7.2.4. Utilities/Retailers/Affinity Groups

- 7.2.5. Company Agents

- 7.2.6. Online Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Building/ Property Insurance

- 8.1.2. Contents Insurance

- 8.1.3. Building & Content Insurance

- 8.1.4. Renter's or Tenant's Insuarance

- 8.1.5. Landlord's Insurance

- 8.1.6. Strata/ Holiday Home Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Independent Advisers

- 8.2.3. Banks/Building societies

- 8.2.4. Utilities/Retailers/Affinity Groups

- 8.2.5. Company Agents

- 8.2.6. Online Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Building/ Property Insurance

- 9.1.2. Contents Insurance

- 9.1.3. Building & Content Insurance

- 9.1.4. Renter's or Tenant's Insuarance

- 9.1.5. Landlord's Insurance

- 9.1.6. Strata/ Holiday Home Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Independent Advisers

- 9.2.3. Banks/Building societies

- 9.2.4. Utilities/Retailers/Affinity Groups

- 9.2.5. Company Agents

- 9.2.6. Online Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Building/ Property Insurance

- 10.1.2. Contents Insurance

- 10.1.3. Building & Content Insurance

- 10.1.4. Renter's or Tenant's Insuarance

- 10.1.5. Landlord's Insurance

- 10.1.6. Strata/ Holiday Home Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Independent Advisers

- 10.2.3. Banks/Building societies

- 10.2.4. Utilities/Retailers/Affinity Groups

- 10.2.5. Company Agents

- 10.2.6. Online Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. England UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Home Insurance Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ageas

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Halifax**List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Churchill

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Aviva

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 LV/Liverpool Victoria

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 AA Home Insurance

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Zurich

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Axa Insurance UK

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Direct Line Group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Admiral Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Ageas

List of Figures

- Figure 1: Global UK Home Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Home Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Home Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Home Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UK Home Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UK Home Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America UK Home Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America UK Home Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UK Home Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UK Home Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 11: South America UK Home Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America UK Home Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America UK Home Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America UK Home Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UK Home Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UK Home Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe UK Home Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe UK Home Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe UK Home Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe UK Home Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UK Home Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UK Home Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa UK Home Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa UK Home Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa UK Home Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa UK Home Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UK Home Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UK Home Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific UK Home Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific UK Home Insurance Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific UK Home Insurance Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific UK Home Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UK Home Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Home Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Home Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global UK Home Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UK Home Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: England UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Wales UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Scotland UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global UK Home Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global UK Home Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global UK Home Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global UK Home Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global UK Home Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Global UK Home Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global UK Home Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Global UK Home Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global UK Home Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global UK Home Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 46: Global UK Home Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific UK Home Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Home Insurance Market?

The projected CAGR is approximately > 2.11%.

2. Which companies are prominent players in the UK Home Insurance Market?

Key companies in the market include Ageas, Halifax**List Not Exhaustive, Churchill, Aviva, LV/Liverpool Victoria, AA Home Insurance, Zurich, Axa Insurance UK, Direct Line Group, Admiral Group.

3. What are the main segments of the UK Home Insurance Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Number of Households is Driving the Market; Wide Range Of Offers Provided By Insurers is Driving the Market.

6. What are the notable trends driving market growth?

Building/Property Insurance is Dominating the United Kingdom Home Insurance Market.

7. Are there any restraints impacting market growth?

Policies Excluding Coverage for Natural Disasters is Restraining the Market; Rising Claims Costs Impacting Insurer's Profitability.

8. Can you provide examples of recent developments in the market?

In July 2023: Aviva, the leading home insurer in the United Kingdom, signed a contract with Barclays United Kingdom to purchase its home insurance portfolio comprising 350,000 customers. This acquisition will further support the insurer’s ambitions to grow its retail insurance business in the United Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Home Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Home Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Home Insurance Market?

To stay informed about further developments, trends, and reports in the UK Home Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence