Key Insights

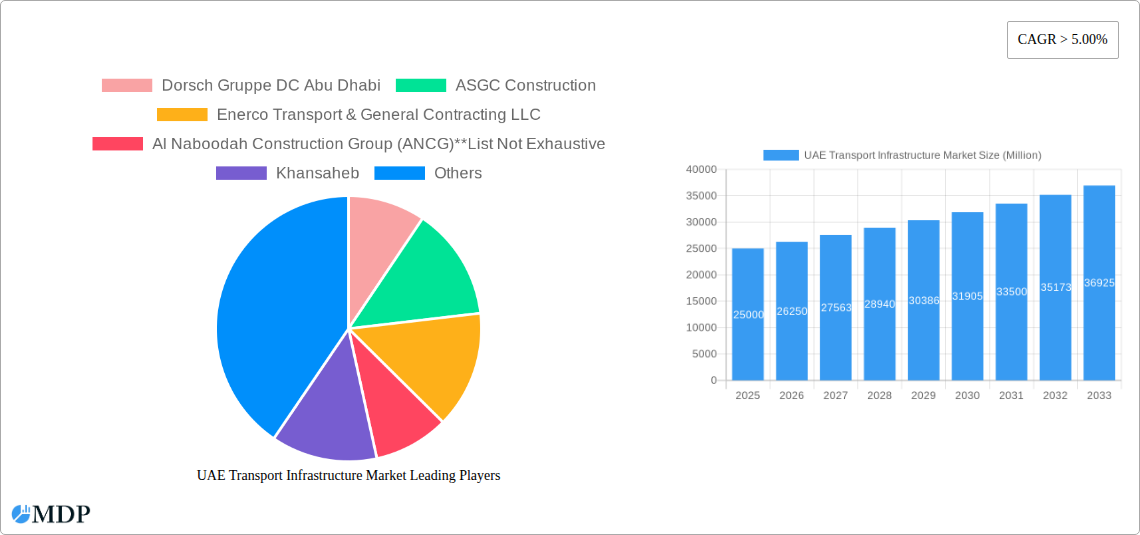

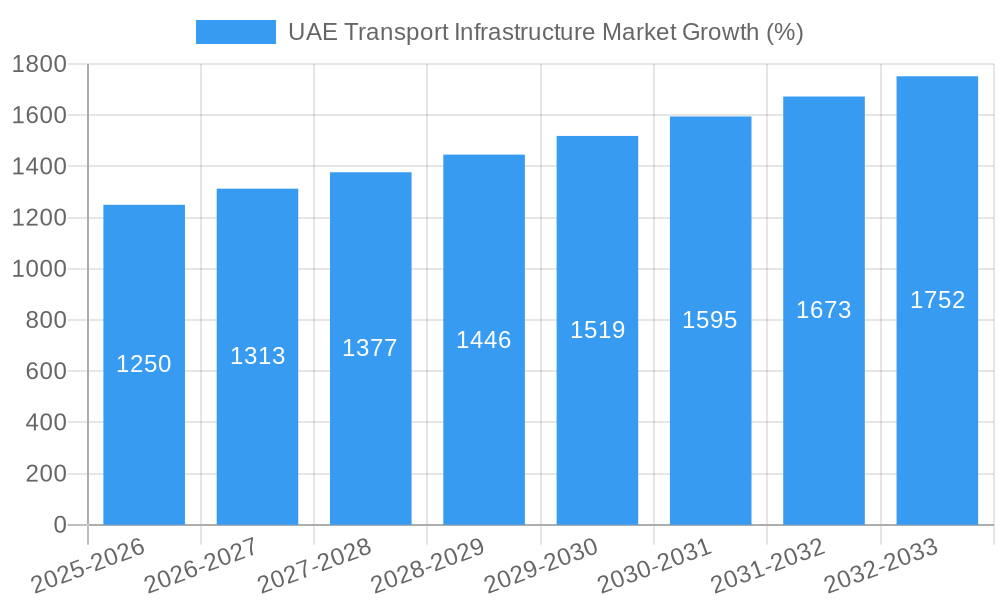

The UAE Transport Infrastructure market, valued at approximately $25 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. This expansion is driven by several key factors. Government initiatives focused on sustainable development and diversification away from oil dependence are heavily investing in modernizing and expanding the nation's transportation network. Mega-projects like the expansion of Dubai International Airport and the ongoing development of advanced rail systems are significant contributors to this growth. Furthermore, the UAE's strategic location and its role as a global trade and tourism hub necessitate a constantly evolving and high-capacity transport infrastructure. The increasing population and associated demand for efficient commuting and freight solutions further fuel market expansion. Growth is segmented across various modes, with roadways currently holding the largest share, followed by railways, airports, and waterways. However, significant investment in high-speed rail and expansion of port facilities indicates a shift towards increased contribution from railways and waterways in the coming years. While the market faces challenges such as fluctuating oil prices and global economic uncertainty, the long-term outlook remains optimistic, driven by the UAE's commitment to infrastructure development and its vision for sustainable growth. Leading companies like Dorsch Gruppe DC Abu Dhabi, ASGC Construction, and Khansaheb are actively shaping this market, competing for large-scale projects and contributing to the nation's ambitious infrastructural goals.

Competition in the UAE Transport Infrastructure market is intense, with both local and international players vying for contracts. The market's success hinges on effective project management, technological innovation, and compliance with stringent safety and environmental regulations. Future growth will likely be influenced by technological advancements such as autonomous vehicles and the integration of smart city technologies within the transport network. The government's focus on sustainable transportation solutions, including the adoption of electric vehicles and green building practices, presents opportunities for companies specializing in eco-friendly infrastructure development. The market's continued expansion will require skilled labor and robust supply chains, posing both opportunities and challenges for businesses operating within this dynamic sector.

UAE Transport Infrastructure Market Report: 2019-2033

Unlocking Growth Opportunities in the Thriving UAE Transport Sector

This comprehensive report provides an in-depth analysis of the UAE transport infrastructure market, offering invaluable insights for investors, industry stakeholders, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth potential. With a projected market value of xx Million by 2033, the UAE's transport infrastructure sector presents significant investment opportunities.

UAE Transport Infrastructure Market Market Dynamics & Concentration

The UAE's transport infrastructure market exhibits a high level of concentration, with several large players dominating the landscape. Market share is heavily influenced by government contracts and project awards. Key factors driving market dynamics include robust government investments in infrastructure development, the diversification of the national economy, and the continuous influx of both residents and tourists. Innovation within the sector primarily focuses on sustainability, smart city initiatives, and advanced technological integration, such as AI-driven traffic management systems. The regulatory framework, although supportive, is constantly evolving to keep pace with technological advancement and international best practices. Product substitutes are limited, mainly impacting certain segments like roadways (e.g., increased use of public transportation). End-user trends are shifting towards greater demand for sustainable and efficient transport solutions.

M&A activity within the sector remains fairly robust. While precise deal counts are unavailable, it's clear that strategic acquisitions play a significant role in consolidating market share and expanding geographical reach. Several large conglomerates are actively seeking opportunities to acquire smaller, specialized firms to strengthen their portfolios.

- Market Concentration: High, dominated by large national and international firms.

- Innovation Drivers: Sustainability, smart city initiatives, technological integration.

- Regulatory Framework: Supportive, but constantly evolving.

- M&A Activity: Significant, with strategic acquisitions shaping market consolidation.

- Market Share (2024): Al Naboodah Construction Group (ANCG) - xx%; Khansaheb - xx%; Al-Futtaim Group - xx%; Others - xx%

UAE Transport Infrastructure Market Industry Trends & Analysis

The UAE transport infrastructure market is experiencing robust growth, driven by substantial government investment in mega-projects and a commitment to building world-class infrastructure. The CAGR for the period 2025-2033 is projected to be xx%. This growth is fueled by several factors: the ongoing expansion of urban areas, the rise in tourism, the government's vision to boost economic diversification, and the country's commitment to hosting global events. Technological disruptions, such as the integration of smart city technologies, autonomous vehicles, and advanced data analytics are transforming the sector. Consumer preferences are shifting toward sustainable transport options, driving increased investment in public transport systems and eco-friendly infrastructure. The competitive landscape remains intense, with both domestic and international players vying for market share, creating a dynamic environment. Market penetration of new technologies varies across segments, with the railway sector showing faster adoption than others.

Leading Markets & Segments in UAE Transport Infrastructure Market

The UAE's transport infrastructure market is characterized by diverse segments, each with its own growth dynamics. Roadways currently represent the largest segment, driven by continuous urban expansion and increased vehicle ownership. However, the railways segment is experiencing rapid growth following the completion of the crucial Dubai-Abu Dhabi direct rail line. Airports are another significant contributor, fueled by the UAE's position as a major global aviation hub. Waterways play a smaller yet vital role in cargo transport and coastal development.

- Roadways: Largest segment, fueled by urban expansion and increasing vehicle ownership.

- Railways: Rapid growth, spurred by the completion of the Dubai-Abu Dhabi direct line.

- Airports: Significant contributor, reflecting the UAE's role as a major aviation hub.

- Waterways: Smaller but important role in cargo transport and coastal development.

Dominance Analysis: While roadways currently hold the largest market share, the rapid expansion of the railway network and continuous investments in airports suggest a shift in the market share dynamics in the coming years. Government policies promoting sustainable transport, coupled with significant investment in infrastructure, are key drivers.

UAE Transport Infrastructure Market Product Developments

The UAE transport infrastructure sector showcases continuous innovation in materials, construction techniques, and technological integration. Advancements include the use of sustainable building materials, prefabricated construction methods, and the implementation of smart city technologies in traffic management and public transport systems. This focus on efficiency, sustainability, and data-driven optimization ensures that new products and services are well-suited to the evolving needs of the market. The integration of advanced technologies offers significant competitive advantages, improving efficiency and optimizing resource allocation.

Key Drivers of UAE Transport Infrastructure Market Growth

The UAE's transport infrastructure market is propelled by strong government support, substantial investments in mega-projects, and a commitment to improving connectivity and efficiency. Economic diversification and the country's tourism sector also contribute substantially to growth. Technological advancements, such as the adoption of smart city technologies and sustainable infrastructure solutions, further enhance market expansion. The ambitious national infrastructure development plans, including the expansion of public transportation systems and the enhancement of existing networks, remain central to market growth.

Challenges in the UAE Transport Infrastructure Market Market

The sector faces challenges including securing skilled labor, managing escalating material costs, and navigating complex regulatory processes. Supply chain disruptions, particularly exacerbated by global events, pose significant risks. Intense competition from both local and international players adds to the pressure, demanding constant innovation and efficiency improvements. These factors can lead to project delays and cost overruns, impacting overall market growth. The impact of such delays is estimated to be a xx% decrease in project completion rates in the last year.

Emerging Opportunities in UAE Transport Infrastructure Market

The UAE's transport infrastructure market presents numerous opportunities for growth. Investments in sustainable transport solutions, integration of smart city technologies, and advancements in autonomous vehicles represent key catalysts for long-term market expansion. Strategic partnerships between government entities, private sector players, and international investors can unlock further potential. The expansion of the national transport network into new regions and the development of integrated multi-modal transportation systems offer promising avenues for future development. Expansion into high-speed rail and further development of the country's extensive air network are key future focal points.

Leading Players in the UAE Transport Infrastructure Market Sector

- Dorsch Gruppe DC Abu Dhabi

- ASGC Construction

- Enerco Transport & General Contracting LLC

- Al Naboodah Construction Group (ANCG)

- Khansaheb

- Al-Futtaim Group

- National Contracting and Transport CO

- Idroesse Infrastructure

- Consolidated Contractors Company

- ALEC Engineering & Contracting LLC

Key Milestones in UAE Transport Infrastructure Market Industry

- August 2022: Dubai's RTA reports 67% completion of Al Manama Street improvements, part of the Dubai-Al Ain Road Improvement Project, adding a new 4-lane bridge with 8000 vehicle/hour capacity per direction.

- March 2022: Etihad Rail completes the USD 13.61 Billion Dubai-Abu Dhabi rail line (256km), featuring 29 bridges, 60 crossings, and 137 drainage channels.

Strategic Outlook for UAE Transport Infrastructure Market Market

The UAE's transport infrastructure sector presents a compelling long-term growth story. The government's commitment to infrastructure development, coupled with ongoing technological advancements and the country's economic diversification, creates a favorable environment for sustained expansion. Strategic partnerships, investment in sustainable technologies, and a focus on innovation will be key to unlocking the market's full potential in the years to come. The integration of smart technologies, coupled with expansion of multimodal transportation systems, promises substantial growth and economic benefits for the nation.

UAE Transport Infrastructure Market Segmentation

-

1. Transport Mode

- 1.1. Railways

- 1.2. Roadways

- 1.3. Airports

- 1.4. Waterways

UAE Transport Infrastructure Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Transport Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transport Mode

- 5.1.1. Railways

- 5.1.2. Roadways

- 5.1.3. Airports

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Transport Mode

- 6. North America UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Transport Mode

- 6.1.1. Railways

- 6.1.2. Roadways

- 6.1.3. Airports

- 6.1.4. Waterways

- 6.1. Market Analysis, Insights and Forecast - by Transport Mode

- 7. South America UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Transport Mode

- 7.1.1. Railways

- 7.1.2. Roadways

- 7.1.3. Airports

- 7.1.4. Waterways

- 7.1. Market Analysis, Insights and Forecast - by Transport Mode

- 8. Europe UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Transport Mode

- 8.1.1. Railways

- 8.1.2. Roadways

- 8.1.3. Airports

- 8.1.4. Waterways

- 8.1. Market Analysis, Insights and Forecast - by Transport Mode

- 9. Middle East & Africa UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Transport Mode

- 9.1.1. Railways

- 9.1.2. Roadways

- 9.1.3. Airports

- 9.1.4. Waterways

- 9.1. Market Analysis, Insights and Forecast - by Transport Mode

- 10. Asia Pacific UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Transport Mode

- 10.1.1. Railways

- 10.1.2. Roadways

- 10.1.3. Airports

- 10.1.4. Waterways

- 10.1. Market Analysis, Insights and Forecast - by Transport Mode

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dorsch Gruppe DC Abu Dhabi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ASGC Construction

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Enerco Transport & General Contracting LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Naboodah Construction Group (ANCG)**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Khansaheb

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Al-Futtaim Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 National Contracting and Transport CO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Idroesse Infrastructure

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Consolidated Contractors Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ALEC Engineering & Contracting LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dorsch Gruppe DC Abu Dhabi

List of Figures

- Figure 1: Global UAE Transport Infrastructure Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 5: North America UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 6: North America UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 9: South America UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 10: South America UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 13: Europe UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 14: Europe UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 17: Middle East & Africa UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 18: Middle East & Africa UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 21: Asia Pacific UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 22: Asia Pacific UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 3: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 6: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 11: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 16: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 27: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 35: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Transport Infrastructure Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the UAE Transport Infrastructure Market?

Key companies in the market include Dorsch Gruppe DC Abu Dhabi, ASGC Construction, Enerco Transport & General Contracting LLC, Al Naboodah Construction Group (ANCG)**List Not Exhaustive, Khansaheb, Al-Futtaim Group, National Contracting and Transport CO, Idroesse Infrastructure, Consolidated Contractors Company, ALEC Engineering & Contracting LLC.

3. What are the main segments of the UAE Transport Infrastructure Market?

The market segments include Transport Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

August 2022: Dubai's Roads and Transport Authority (RTA) reported that Al Manama Street's phased improvements were 67% finished. The project is within the domain of the recently opened Dubai-Al Ain Road Improvement Project. The construction includes a new traffic corridor that links Al Meydan Street with Al Manama Street through a bridge of 4 lanes in each direction with a capacity of 8000 vehicles per hour per direction. The project also included the construction of slip lanes to link with the Dubai-Al Ain Road. The construction includes increasing the capacity of the existing road by transforming the first three intersections on Al Manama Street with Aden Street, Sanaa Street, and Nad Al Hamar Street into signalized surface junctions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Transport Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Transport Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Transport Infrastructure Market?

To stay informed about further developments, trends, and reports in the UAE Transport Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence