Key Insights

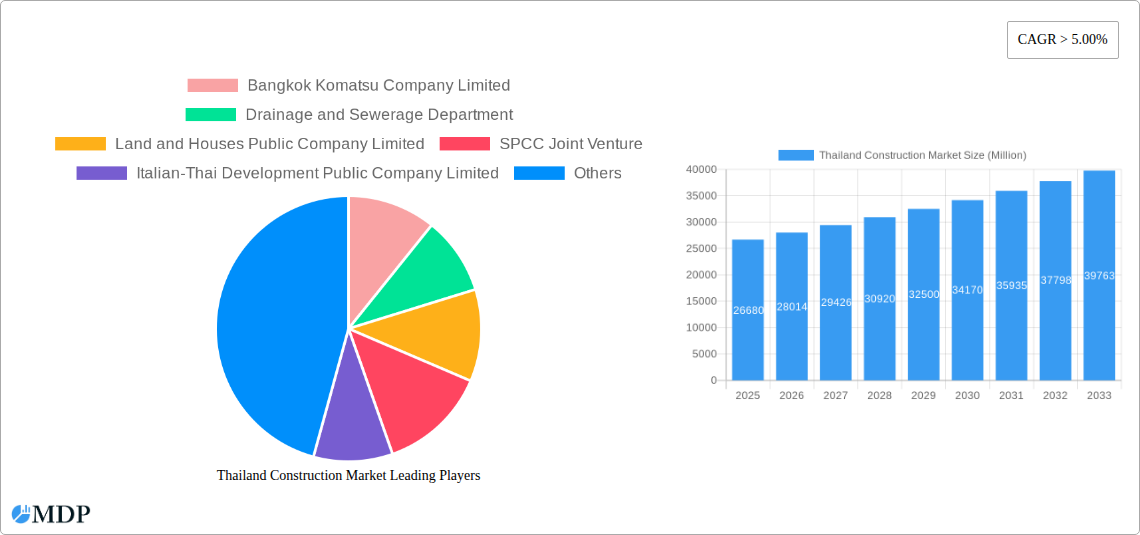

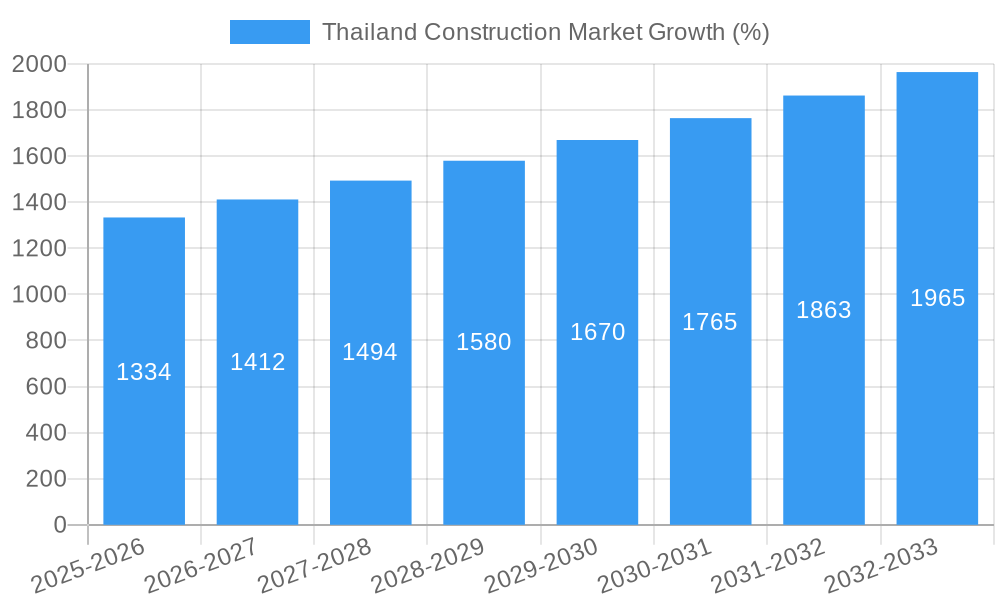

The Thailand construction market, valued at 26.68 billion USD in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 5% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, substantial government investments in infrastructure projects, particularly in transportation networks and energy infrastructure, are creating significant demand for construction services. Secondly, a burgeoning population and rapid urbanization, especially in major cities like Bangkok, are driving increased demand for residential and commercial construction. Finally, tourism's continuous growth necessitates further development of hospitality and related infrastructure, further bolstering market expansion. The market is segmented by sector (residential, commercial, industrial, infrastructure, energy & utilities) and construction type (new construction, additions, alterations). While data on specific segment shares is unavailable, it’s reasonable to assume that residential and infrastructure construction currently hold the largest shares, given Thailand's ongoing urbanization and government initiatives. However, the commercial and industrial segments are poised for considerable growth, driven by foreign investment and expanding manufacturing capacity. Major players like Bangkok Komatsu, SCG International, and several prominent Thai construction and materials companies are actively participating in this expanding market. Despite the positive outlook, challenges such as fluctuating material costs, skilled labor shortages, and potential economic uncertainties could moderate growth in the forecast period.

The Thailand construction market's future hinges on sustained government support for infrastructure development, successful management of economic volatility, and proactive efforts to address the skilled labor shortage. The market's diverse segmentation offers significant opportunities for specialized contractors and material suppliers. Companies focusing on sustainable and technologically advanced construction methods are likely to gain a competitive edge. The increasing focus on green building practices and energy efficiency will likely reshape the market landscape in the coming years, driving demand for environmentally friendly materials and technologies. Continued expansion of the tourism sector will maintain consistent demand for hospitality construction projects, contributing to overall market growth. Strategic partnerships and collaborations between international and domestic companies will play a crucial role in leveraging global expertise and technological advancements within the Thai construction industry.

Thailand Construction Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Thailand construction market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, trends, and future potential. It incorporates detailed analysis across various segments, including residential, commercial, industrial, infrastructure, and energy & utilities, examining both new construction and renovation projects. The report also highlights key players like Bangkok Komatsu, SCG International, and Land & Houses, shaping the future of Thailand's dynamic construction landscape. Expect actionable insights derived from rigorous market research, ensuring you're well-equipped to navigate this thriving sector.

Thailand Construction Market Market Dynamics & Concentration

The Thai construction market, valued at xx Million in 2024, demonstrates a complex interplay of factors driving its growth and concentration. Market concentration is moderate, with a few large players holding significant shares, but a substantial number of smaller firms contributing significantly to overall activity. Innovation is driven primarily by the adoption of advanced technologies like Building Information Modeling (BIM) and prefabrication methods to enhance efficiency and reduce project timelines. The regulatory framework, while generally supportive of development, presents certain hurdles related to permitting and environmental clearances. Product substitution is limited, with concrete and steel remaining dominant, though sustainable materials are gaining traction. End-user trends reflect a shift towards sustainable and technologically advanced buildings, influencing design and material choices. Mergers and acquisitions (M&A) activity is moderate, with xx M&A deals recorded between 2019 and 2024, primarily focused on consolidating market share and expanding geographical reach. Specific examples include [mention 2-3 specific M&A deals if available with values, else mention "limited publicly available data prevents detailed analysis of specific deals"]. Market share data is fragmented, but key players like SCG International and Italian-Thai Development hold significant positions within their respective niches.

Thailand Construction Market Industry Trends & Analysis

The Thai construction market exhibits a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors including sustained economic growth, government investment in infrastructure projects, and a burgeoning urban population. Technological disruptions, such as the increasing adoption of BIM and advanced construction equipment, are enhancing productivity and project efficiency. Consumer preferences are shifting towards sustainable, energy-efficient buildings, creating opportunities for innovative green building materials and technologies. Competitive dynamics are intense, with both domestic and international players vying for market share. Market penetration of sustainable building materials is currently at xx%, projected to reach xx% by 2033. The increasing adoption of prefabrication techniques is improving project completion times and reducing labor costs, leading to increased market penetration in the residential and commercial sectors. Government initiatives promoting sustainable construction practices further fuel this trend.

Leading Markets & Segments in Thailand Construction Market

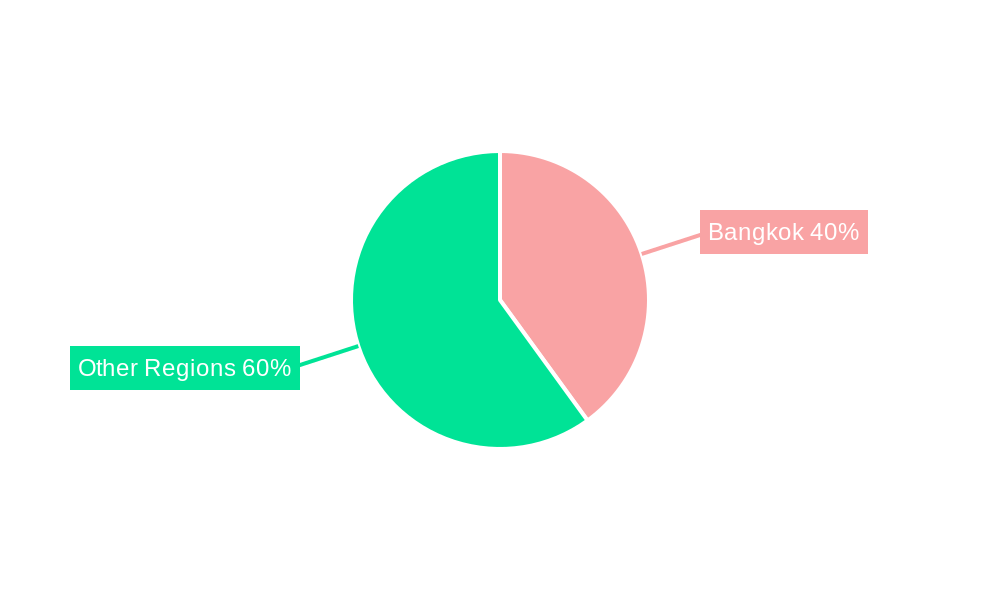

The residential segment dominates the Thai construction market, driven by rapid urbanization and rising disposable incomes. The Bangkok metropolitan area, along with other major cities, accounts for a significant share of construction activity.

Key Drivers for Dominant Segments:

- Residential: Rising population, increasing urbanization, government housing initiatives, and favorable mortgage rates.

- Infrastructure (Transportation): Government investments in road, rail, and airport expansion projects under Thailand 4.0.

- Commercial: Growth of the tourism sector, expansion of retail and office spaces, and foreign direct investment.

The "New Construction" type holds the largest share within the "By Type" segment, followed by "Addition" and "Alteration," reflecting the substantial growth in new developments across various sectors. The dominance of the residential sector is further fueled by government policies aimed at affordable housing and infrastructure development to support population growth.

Thailand Construction Market Product Developments

Recent product innovations in the Thai construction market focus on sustainable and technologically advanced building materials. The adoption of prefabricated components, BIM software for project management, and advanced construction equipment are significantly impacting project efficiency and reducing costs. These innovations offer several competitive advantages, including reduced construction time, improved quality control, and enhanced sustainability. The market is witnessing increased demand for energy-efficient building materials and designs to meet evolving environmental regulations and consumer preferences.

Key Drivers of Thailand Construction Market Growth

Several factors fuel the growth of Thailand's construction market. Government initiatives like the Eastern Economic Corridor (EEC) development stimulate large-scale infrastructure projects. The country's robust tourism sector consistently drives the demand for hospitality and commercial infrastructure. A growing population fuels the need for additional residential and urban developments. Technological advancements such as BIM enhance project efficiency and reduce costs.

Challenges in the Thailand Construction Market Market

The Thai construction market faces challenges such as fluctuating material prices, skill shortages in the labor force, and sometimes complex permitting procedures that can lead to delays. Supply chain disruptions caused by global events like the pandemic also impact project timelines and costs. Furthermore, intense competition among contractors may compress profit margins, creating pressure on businesses.

Emerging Opportunities in Thailand Construction Market

The Thai construction market presents substantial long-term growth opportunities. The expansion of smart city initiatives and the adoption of sustainable building practices offer new avenues for growth. Strategic partnerships between local and international companies are driving technological advancements and improving project delivery. Further market expansion into emerging regions and the development of specialized construction services are promising areas of opportunity.

Leading Players in the Thailand Construction Market Sector

- Bangkok Komatsu Company Limited

- Drainage and Sewerage Department

- Land and Houses Public Company Limited

- SPCC Joint Venture

- Italian-Thai Development Public Company Limited

- CRC Thai Watsadu Limited

- SCG International Corporation Company Limited

- Caterpillar (Thailand) Limited

- Dohome Public Company Limited

- Siam Global House Public Company Limited

Key Milestones in Thailand Construction Market Industry

- 2020: Launch of several large-scale infrastructure projects under the EEC initiative.

- 2021: Introduction of stricter environmental regulations impacting construction practices.

- 2022: Significant increase in the adoption of BIM technology across major projects.

- 2023: Several mergers and acquisitions among construction companies to enhance market consolidation.

- [Add other milestones with dates as available]

Strategic Outlook for Thailand Construction Market Market

The future of Thailand's construction market is promising, driven by sustained economic growth and government investment in infrastructure. The integration of technology and sustainable practices will define the industry's trajectory. Strategic partnerships and investments in R&D will be crucial for long-term success. The increasing focus on sustainable development and smart cities presents significant opportunities for companies to innovate and capture market share. The market's resilience and government support position it for substantial long-term growth.

Thailand Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

-

2. Type

- 2.1. New Construction

- 2.2. Addition

- 2.3. Alteration

Thailand Construction Market Segmentation By Geography

- 1. Thailand

Thailand Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Thailand was emphasizing renewable energy projects and sustainable construction practices; Thai government was investing in various infrastructure projects to improve connectivity

- 3.2.2 transportation

- 3.3. Market Restrains

- 3.3.1. Construction projects in Thailand often experienced delays and cost overruns due to factors such as unforeseen site conditions; Political and Economic Uncertainty

- 3.4. Market Trends

- 3.4.1. Increase in road infrastructure projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. New Construction

- 5.2.2. Addition

- 5.2.3. Alteration

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bangkok Komatsu Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Drainage and Sewerage Department

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Land and Houses Public Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SPCC Joint Venture

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Italian-Thai Development Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CRC Thai Watsadu Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SCG International Corporation Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Caterpillar (Thailand) Limited**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dohome Public Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siam Global House Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bangkok Komatsu Company Limited

List of Figures

- Figure 1: Thailand Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Thailand Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Thailand Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Thailand Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Thailand Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 7: Thailand Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Thailand Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Construction Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Thailand Construction Market?

Key companies in the market include Bangkok Komatsu Company Limited, Drainage and Sewerage Department, Land and Houses Public Company Limited, SPCC Joint Venture, Italian-Thai Development Public Company Limited, CRC Thai Watsadu Limited, SCG International Corporation Company Limited, Caterpillar (Thailand) Limited**List Not Exhaustive, Dohome Public Company Limited, Siam Global House Public Company Limited.

3. What are the main segments of the Thailand Construction Market?

The market segments include Sector, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Thailand was emphasizing renewable energy projects and sustainable construction practices; Thai government was investing in various infrastructure projects to improve connectivity. transportation.

6. What are the notable trends driving market growth?

Increase in road infrastructure projects.

7. Are there any restraints impacting market growth?

Construction projects in Thailand often experienced delays and cost overruns due to factors such as unforeseen site conditions; Political and Economic Uncertainty.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Construction Market?

To stay informed about further developments, trends, and reports in the Thailand Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence