Key Insights

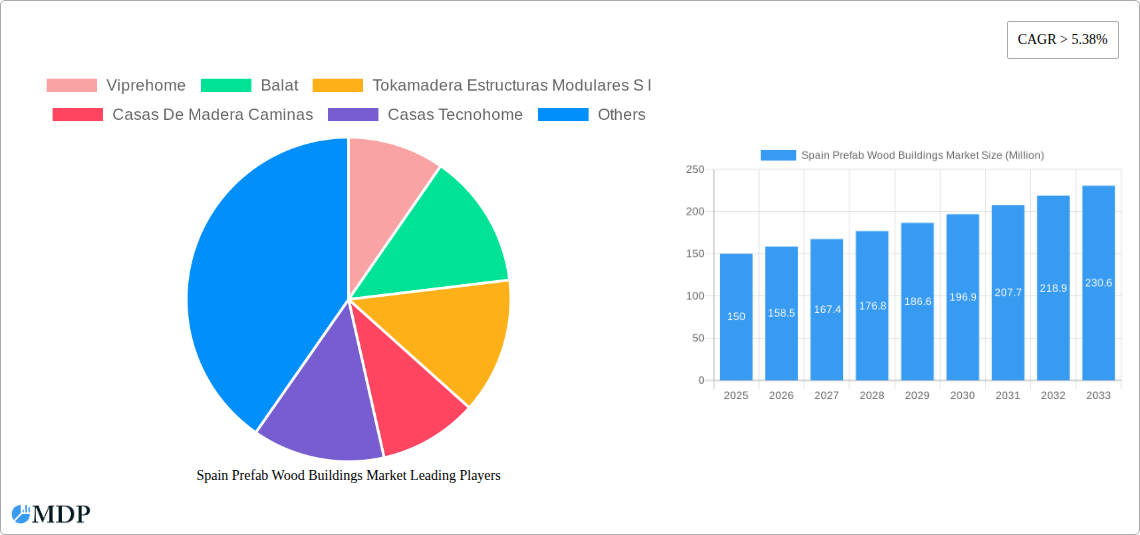

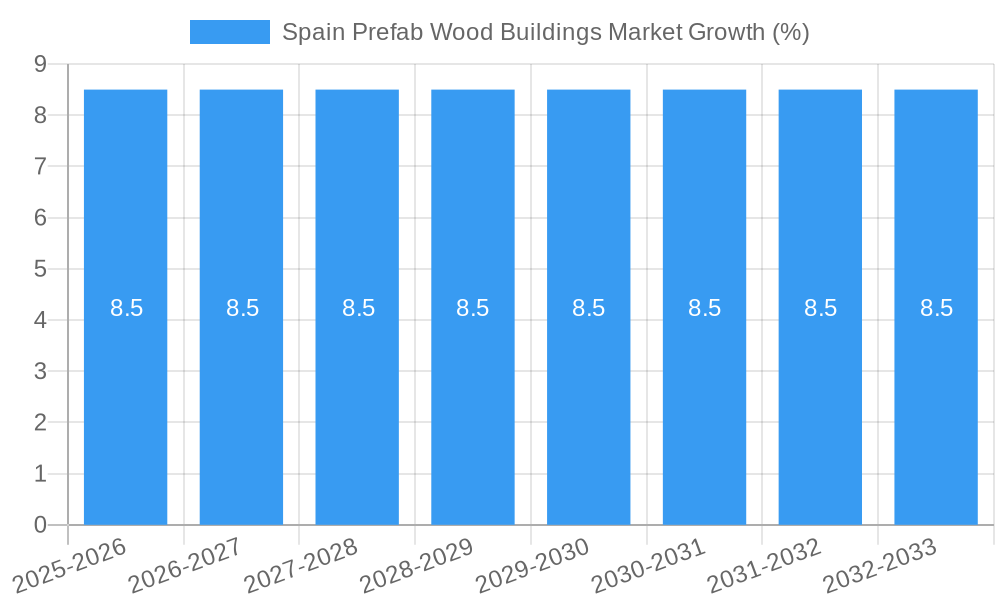

The Spain Prefab Wood Buildings market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5.38% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing demand for sustainable and environmentally friendly construction solutions is a major catalyst, aligning with global efforts to reduce carbon emissions in the building sector. Furthermore, the inherent efficiency and speed of prefab construction, resulting in shorter project timelines and reduced labor costs, are attracting both residential and commercial developers. The versatility of prefab wood buildings, allowing for diverse architectural designs and customizations, further contributes to market growth. While challenges such as potential regulatory hurdles and public perception regarding the durability of wood structures exist, these are being mitigated by advancements in wood technology and increased awareness of the benefits of sustainable construction. The market is segmented by panel systems (CLT, NLT, DLT, GLT) and applications (single-family residential, multi-family residential, office, hospitality, others), reflecting a diverse range of uses and construction techniques. The presence of numerous companies, including Viprehome, Balat, and Tokamadera Estructuras Modulares S.L., indicates a competitive market landscape with opportunities for both established players and emerging businesses. The market’s growth trajectory suggests considerable potential for investment and expansion in the coming years, driven by both market demand and technological innovation.

The significant market size in 2025, while not explicitly stated, can be reasonably estimated based on the provided CAGR and the forecast period. Assuming a base year market size for this analysis, and applying the given CAGR, we can anticipate steady expansion across all segments. The residential sector, particularly single-family homes, is likely to represent a substantial portion of the market, followed by multi-family residential and commercial applications. The adoption of advanced wood panel systems, such as CLT and GLT, will likely increase as awareness of their structural advantages grows. Regional variations within Spain may also exist, with certain areas experiencing higher growth rates depending on factors like local regulations, housing demand, and economic conditions. The ongoing evolution of design and construction techniques, coupled with government initiatives supporting sustainable building practices, will continue shaping the trajectory of the Spain Prefab Wood Buildings market.

Spain Prefab Wood Buildings Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Spain Prefab Wood Buildings Market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report offers a complete overview of past performance, current trends, and future projections. The report delves into market size, segmentation, key players, and growth drivers, delivering actionable intelligence to inform strategic decision-making. Expect detailed analysis of market dynamics, leading segments, technological advancements, and emerging opportunities within the Spanish prefab wood building landscape. The report covers Million EUR values throughout.

Spain Prefab Wood Buildings Market Dynamics & Concentration

The Spanish prefab wood buildings market exhibits a moderately concentrated structure, with several key players dominating specific segments. Market share is currently distributed across established firms and emerging players. Market concentration is expected to shift slightly by 2033, with larger players potentially consolidating their market position through acquisitions and expansion strategies. Innovation drivers, including the increasing demand for sustainable building materials and the development of advanced timber engineering techniques (CLT, NLT, DLT, GLT), are fueling market growth. The regulatory framework, including building codes and environmental regulations, plays a significant role in shaping market dynamics. Substitutes, such as concrete and steel structures, face competition from the growing preference for eco-friendly and cost-effective prefab wood buildings. End-user trends show a growing preference for sustainable and energy-efficient housing, particularly in the single-family and multi-family residential segments, driving considerable growth in this sector. The number of M&A deals in this sector has been steadily increasing in recent years, indicating a potential for further consolidation. We estimate xx M&A deals in the period 2019-2024, with an expected xx% increase in the forecast period.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Sustainable building materials, advanced timber engineering.

- Regulatory Framework: Building codes, environmental regulations.

- Product Substitutes: Concrete, steel structures.

- End-User Trends: Growing demand for sustainable and energy-efficient housing.

- M&A Activity: Increasing number of mergers and acquisitions, indicating consolidation.

Spain Prefab Wood Buildings Market Industry Trends & Analysis

The Spanish prefab wood buildings market is experiencing robust growth, driven by several key factors. The compound annual growth rate (CAGR) is estimated to be xx% during the forecast period (2025-2033), exceeding xx Million in 2033. Increasing environmental awareness and government initiatives promoting sustainable construction are major drivers. Technological advancements in timber engineering and prefabrication techniques are enhancing the efficiency and quality of prefab wood buildings. Changing consumer preferences toward sustainable and energy-efficient homes are fueling demand. The rise of innovative business models, such as modular construction and design-build partnerships, is contributing to market expansion. Competitive dynamics are marked by increasing innovation, product differentiation, and strategic partnerships. Market penetration for prefab wood buildings in the residential sector is projected to reach xx% by 2033.

Leading Markets & Segments in Spain Prefab Wood Buildings Market

The Single Family Residential segment dominates the application market, followed by Multi-family Residential. Within Panel Systems, Cross-laminated timber (CLT) panels hold the largest market share due to their superior strength and versatility. Regional analysis indicates that the market is strongest in urban areas and regions with favorable government policies and supportive infrastructure.

- Key Drivers for Single-Family Residential: Growing demand for affordable and eco-friendly housing, government incentives for sustainable construction.

- Key Drivers for CLT Panels: Superior strength and versatility, suitability for various building designs.

- Regional Dominance: Urban areas with supportive infrastructure and government policies.

Detailed Dominance Analysis: The Single Family Residential segment’s dominance is attributed to increasing urbanization and rising demand for affordable, sustainable homes. CLT panels' market share leadership stems from their structural capabilities and architectural flexibility. Government initiatives focused on sustainable construction practices further reinforce these trends.

Spain Prefab Wood Buildings Market Product Developments

Recent product innovations include advancements in CLT panel technology, resulting in lighter, stronger, and more cost-effective structures. New applications are expanding into the hospitality and commercial sectors. Competitive advantages are driven by superior designs, efficient manufacturing processes, and innovative building systems. The market trend is towards sustainable and highly prefabricated systems leading to rapid on-site construction.

Key Drivers of Spain Prefab Wood Buildings Market Growth

Several key factors are driving the growth of the Spain Prefab Wood Buildings Market:

- Technological Advancements: Innovations in timber engineering and prefabrication techniques.

- Government Initiatives: Policies promoting sustainable construction and energy efficiency.

- Economic Factors: Increasing disposable incomes and demand for affordable housing.

Challenges in the Spain Prefab Wood Buildings Market Market

Challenges include:

- Regulatory Hurdles: Navigating building codes and obtaining necessary permits.

- Supply Chain Issues: Ensuring a consistent supply of high-quality timber.

- Competitive Pressures: Competition from established construction materials and other prefab builders.

Emerging Opportunities in Spain Prefab Wood Buildings Market

Emerging opportunities include leveraging technological breakthroughs in mass timber construction, forging strategic partnerships with architects and developers, and expanding into new geographic markets, particularly in underserved rural areas.

Leading Players in the Spain Prefab Wood Buildings Market Sector

- Viprehome

- Balat

- Tokamadera Estructuras Modulares S l

- Casas De Madera Caminas

- Casas Tecnohome

- Sismoha

- Canval Empresa Constructora S L

- Casas Natura

- Cabisuar SA

- Mundocasetas

Key Milestones in Spain Prefab Wood Buildings Market Industry

- February 2022: Completion of the largest wooden-structured residential building in Spain (85 units) by Peris+Toral Arquitectes in Barcelona, showcasing the potential of modular timber construction.

- February 2022: Launch of the Green Nest House, a prefabricated wooden house emphasizing sustainability, by ON-A studio and Energreen Design, highlighting the increasing focus on eco-friendly construction.

Strategic Outlook for Spain Prefab Wood Buildings Market Market

The Spanish prefab wood buildings market holds significant potential for future growth. Strategic opportunities lie in capitalizing on technological advancements, fostering collaborations, and expanding into underserved segments. The market's focus on sustainability and efficiency positions it for continued expansion, driven by growing environmental consciousness and evolving consumer preferences.

Spain Prefab Wood Buildings Market Segmentation

-

1. Panel Systems

- 1.1. Cross-laminated timber (CLT) panels

- 1.2. Nail-laminated timber (NLT) panels

- 1.3. Dowel-laminated timber (DLT) panels

- 1.4. Glue-laminated timber (GLT) columns and beams

-

2. Application

- 2.1. Single Family Residential

- 2.2. Multi-family Residential

- 2.3. Office

- 2.4. Hospitality

- 2.5. Others

Spain Prefab Wood Buildings Market Segmentation By Geography

- 1. Spain

Spain Prefab Wood Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Rising benefits of wood fabrication has driven the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Prefab Wood Buildings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Panel Systems

- 5.1.1. Cross-laminated timber (CLT) panels

- 5.1.2. Nail-laminated timber (NLT) panels

- 5.1.3. Dowel-laminated timber (DLT) panels

- 5.1.4. Glue-laminated timber (GLT) columns and beams

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Single Family Residential

- 5.2.2. Multi-family Residential

- 5.2.3. Office

- 5.2.4. Hospitality

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Panel Systems

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Viprehome

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Balat

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tokamadera Estructuras Modulares S l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Casas De Madera Caminas

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Casas Tecnohome

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sismoha

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canval Empresa Constructora S L

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Casas Natura**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cabisuar SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mundocasetas

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Viprehome

List of Figures

- Figure 1: Spain Prefab Wood Buildings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Prefab Wood Buildings Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Prefab Wood Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Prefab Wood Buildings Market Revenue Million Forecast, by Panel Systems 2019 & 2032

- Table 3: Spain Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Spain Prefab Wood Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Spain Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Spain Prefab Wood Buildings Market Revenue Million Forecast, by Panel Systems 2019 & 2032

- Table 7: Spain Prefab Wood Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Spain Prefab Wood Buildings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Prefab Wood Buildings Market?

The projected CAGR is approximately > 5.38%.

2. Which companies are prominent players in the Spain Prefab Wood Buildings Market?

Key companies in the market include Viprehome, Balat, Tokamadera Estructuras Modulares S l, Casas De Madera Caminas, Casas Tecnohome, Sismoha, Canval Empresa Constructora S L, Casas Natura**List Not Exhaustive, Cabisuar SA, Mundocasetas.

3. What are the main segments of the Spain Prefab Wood Buildings Market?

The market segments include Panel Systems, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Rising benefits of wood fabrication has driven the market.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

February 2022- Spanish studio Peris+Toral Arquitectes has completed an 85-unit social housing project in Barcelona, featuring a modular timber framework and flexible living spaces. According to the studio, the project is the largest wooden-structured residential building in Spain, built from 8,300 cubic metres of timber harvested from the forests of the Basque Country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Prefab Wood Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Prefab Wood Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Prefab Wood Buildings Market?

To stay informed about further developments, trends, and reports in the Spain Prefab Wood Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence