Key Insights

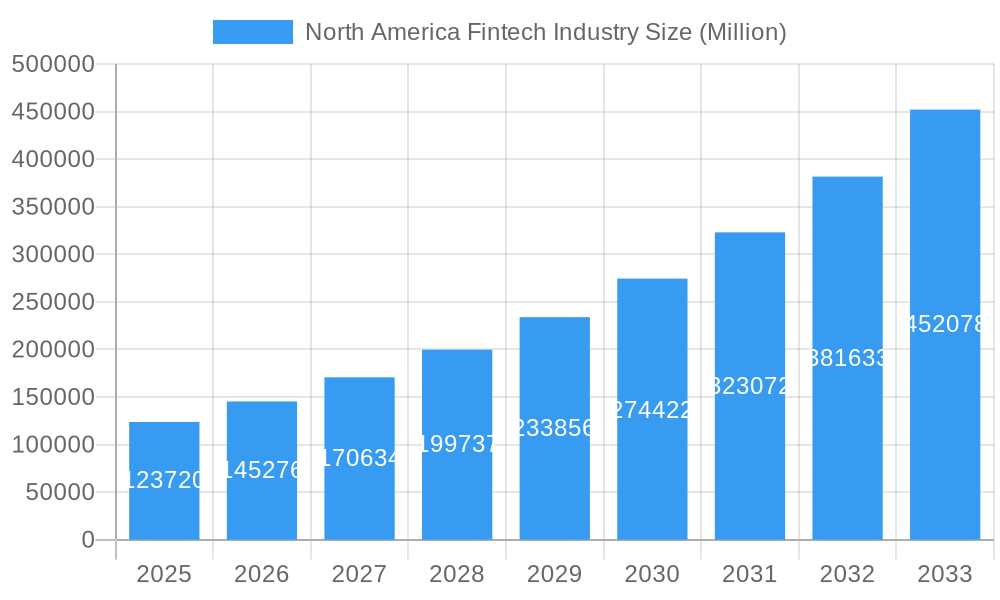

The North American Fintech industry, valued at $123.72 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 17.50% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing smartphone penetration and internet access are broadening the reach of financial services, particularly among younger demographics who are more comfortable with digital transactions. Furthermore, the rising adoption of mobile payment solutions, coupled with a growing demand for personalized and efficient financial management tools, is significantly boosting market growth. Regulatory changes promoting innovation and competition within the financial sector also play a crucial role. The industry is witnessing a surge in demand for services such as digital lending, mobile banking, investment platforms, and cryptocurrency trading, all contributing to the overall growth trajectory. Established players like Square and Stripe, along with emerging companies like Chime and SoFi, are driving innovation and competition, leading to continuous product development and improved customer experiences.

North America Fintech Industry Market Size (In Billion)

However, the industry faces certain restraints. Data security and privacy concerns remain significant hurdles, requiring robust cybersecurity measures and regulatory compliance. The increasing complexity of regulatory frameworks across different regions can also hinder growth for certain fintech companies. Competition, particularly from established financial institutions adapting to digital technologies, necessitates continuous innovation and differentiation to maintain market share. Despite these challenges, the long-term outlook remains positive, fueled by continuous technological advancements, evolving consumer preferences, and increasing opportunities for financial inclusion. The forecast period (2025-2033) anticipates further market expansion, driven by sustained demand for user-friendly, cost-effective, and technology-driven financial solutions. The industry's evolution will be shaped by its ability to address security concerns, navigate regulatory complexities, and adapt to emerging technological trends.

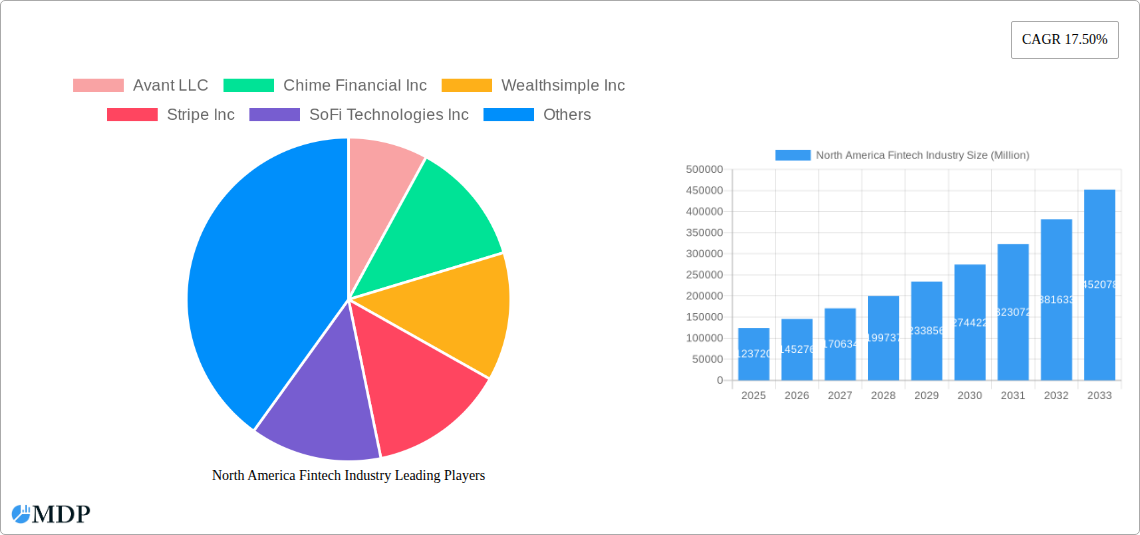

North America Fintech Industry Company Market Share

North America Fintech Industry Report: 2019-2033

Dive deep into the dynamic North American Fintech landscape with this comprehensive report, offering actionable insights and forecasts for 2019-2033. This in-depth analysis covers market dynamics, leading players, key trends, and future opportunities within the rapidly evolving Fintech sector. Discover how technological advancements, regulatory changes, and evolving consumer preferences are shaping the future of financial services in North America. Ideal for investors, industry professionals, and anyone seeking to understand this high-growth market.

North America Fintech Industry Market Dynamics & Concentration

This section analyzes the North American Fintech market's concentration, examining factors driving innovation, regulatory changes, substitute products, end-user trends, and mergers & acquisitions (M&A) activity from 2019 to 2024.

The market exhibits moderate concentration, with a few major players holding significant market share, while numerous smaller companies compete in niche segments. The estimated market size in 2025 is $XX Million, projected to reach $XX Million by 2033, representing a CAGR of XX%. M&A activity has been robust, with over XX deals recorded in the historical period (2019-2024).

- Market Leaders: Stripe, Square, and SoFi Technologies hold substantial market share, driven by their comprehensive product offerings and strong brand recognition.

- Innovation Drivers: Open banking initiatives, AI/ML advancements, and blockchain technology are fueling innovation.

- Regulatory Framework: Evolving regulations concerning data privacy, cybersecurity, and consumer protection are shaping industry practices.

- Product Substitutes: Traditional financial institutions represent significant competition, but Fintech companies are increasingly differentiating their offerings through superior user experience and personalized services.

- End-User Trends: Increasing mobile adoption, digital-first consumer preferences, and demand for personalized financial services are driving market growth.

North America Fintech Industry Industry Trends & Analysis

This section delves into the key trends shaping the North American Fintech market, focusing on growth drivers, technological disruptions, consumer preferences, and competitive dynamics from 2019–2024 and projecting to 2033.

The market experienced significant growth driven by increasing smartphone penetration, the rise of digital banking, and a growing preference for convenient and accessible financial services. Technological disruptions such as AI-powered financial advice and blockchain-based payment systems have significantly reshaped the landscape. Consumer preferences are shifting towards personalized, customized solutions and seamless user experiences. The competitive landscape is intensifying, with established players and new entrants vying for market share. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is estimated at XX%, driven largely by increased adoption of mobile payment systems and the rise of embedded finance. Market penetration in key segments continues to grow, with a projected penetration rate of XX% by 2033.

Leading Markets & Segments in North America Fintech Industry

This section identifies the dominant regions, countries, and segments within the North American Fintech industry.

The United States holds the largest market share, followed by Canada. Growth is fueled by factors including:

- United States: Robust venture capital funding, a large and tech-savvy population, and a supportive regulatory environment.

- Canada: Growing adoption of digital banking, a strong focus on innovation, and a relatively stable regulatory framework.

Dominant Segments: Payments, lending, and wealth management constitute the most significant market segments. Growth in these areas is driven by the increasing adoption of mobile payments, demand for alternative lending options, and growing interest in digital wealth management platforms.

North America Fintech Industry Product Developments

The North American Fintech industry is witnessing continuous product innovation. New solutions are emerging that leverage AI and machine learning for personalized financial advice, fraud detection, and risk management. The integration of blockchain technology is enhancing security and transparency in financial transactions. Companies are focusing on developing user-friendly interfaces and seamless integration with existing financial systems to improve customer adoption. This focus on enhancing the user experience and leveraging advanced technologies represents a key competitive advantage.

Key Drivers of North America Fintech Industry Growth

Several factors are driving the growth of the North American Fintech industry:

- Technological Advancements: AI, Machine Learning, and Blockchain are revolutionizing financial services, enhancing efficiency and security.

- Economic Factors: Increased disposable income and a growing preference for digital solutions are contributing to market expansion.

- Regulatory Support: Supportive government initiatives and regulatory frameworks are fostering innovation and competition. For example, the advancement of open banking in several states is enabling greater interoperability and innovation in financial products.

Challenges in the North America Fintech Industry Market

Despite the robust growth, challenges persist in the North American Fintech industry:

- Regulatory Hurdles: Navigating complex and evolving regulations poses a significant challenge for companies.

- Cybersecurity Threats: Protecting sensitive customer data against cyber threats is critical, demanding significant investment in security infrastructure.

- Competitive Pressure: Intense competition among established and emerging players necessitates continuous innovation and adaptation.

Emerging Opportunities in North America Fintech Industry

The North American Fintech industry presents significant long-term growth opportunities. Advancements in AI and Machine Learning will continue to drive innovation in areas like personalized financial advice and fraud detection. Strategic partnerships between Fintech companies and traditional financial institutions are expected to broaden market reach and increase adoption of new technologies. Market expansion into underserved segments, such as the unbanked and underbanked populations, offers substantial potential.

Leading Players in the North America Fintech Industry Sector

- Avant LLC

- Chime Financial Inc

- Wealthsimple Inc

- Stripe Inc

- SoFi Technologies Inc

- Square

- Kraken

- Oscar Health

- Mogo List Not Exhaustive

Key Milestones in North America Fintech Industry Industry

- June 2024: Stripe launched new features in France, including Alma’s BNPL integration and advanced Stripe Terminal capabilities. This expansion strengthens Stripe's European presence and broadens its product offerings.

- August 2024: Stripe was named a Leader in the 2024 Gartner Magic Quadrant for Recurring Billing Applications. This recognition underscores Stripe's market leadership and innovative billing solutions.

Strategic Outlook for North America Fintech Industry Market

The North American Fintech market is poised for continued growth, driven by technological advancements, increasing consumer adoption of digital financial services, and favorable regulatory environments. Strategic opportunities lie in leveraging AI and machine learning to personalize financial services, expanding into underserved markets, and forging strategic partnerships to broaden market reach. The focus on enhancing security and addressing regulatory compliance will be crucial for long-term success in this dynamic and competitive landscape.

North America Fintech Industry Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending and Lending Marketplaces

- 1.4. Online Insurance and Insurance Marketplaces

- 1.5. Other Service Propositions

North America Fintech Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

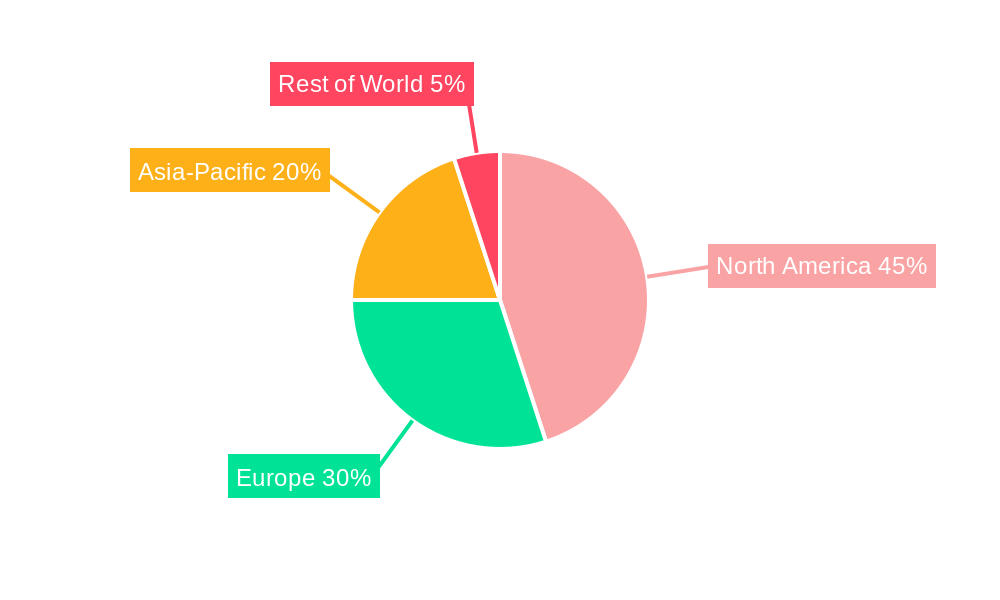

North America Fintech Industry Regional Market Share

Geographic Coverage of North America Fintech Industry

North America Fintech Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Innovations Such as Blockchain

- 3.2.2 Artificial Intelligence

- 3.2.3 and Machine Learning Enhance the Efficiency and Capabilities of Fintech Solutions

- 3.3. Market Restrains

- 3.3.1 Innovations Such as Blockchain

- 3.3.2 Artificial Intelligence

- 3.3.3 and Machine Learning Enhance the Efficiency and Capabilities of Fintech Solutions

- 3.4. Market Trends

- 3.4.1. Growth in the North American Digital Payment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fintech Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending and Lending Marketplaces

- 5.1.4. Online Insurance and Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Avant LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chime Financial Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wealthsimple Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stripe Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SoFi Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Square

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kraken

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oscar Health

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mogo*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Avant LLC

List of Figures

- Figure 1: North America Fintech Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fintech Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fintech Industry Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: North America Fintech Industry Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: North America Fintech Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Fintech Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 5: North America Fintech Industry Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 6: North America Fintech Industry Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 7: North America Fintech Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: North America Fintech Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Fintech Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States North America Fintech Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada North America Fintech Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Fintech Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Fintech Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico North America Fintech Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fintech Industry?

The projected CAGR is approximately 17.50%.

2. Which companies are prominent players in the North America Fintech Industry?

Key companies in the market include Avant LLC, Chime Financial Inc, Wealthsimple Inc, Stripe Inc, SoFi Technologies Inc, Square, Kraken, Oscar Health, Mogo*List Not Exhaustive.

3. What are the main segments of the North America Fintech Industry?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Innovations Such as Blockchain. Artificial Intelligence. and Machine Learning Enhance the Efficiency and Capabilities of Fintech Solutions.

6. What are the notable trends driving market growth?

Growth in the North American Digital Payment Market.

7. Are there any restraints impacting market growth?

Innovations Such as Blockchain. Artificial Intelligence. and Machine Learning Enhance the Efficiency and Capabilities of Fintech Solutions.

8. Can you provide examples of recent developments in the market?

August 2024: Stripe was named a Leader in the 2024 Gartner Magic Quadrant for Recurring Billing Applications. Launched in 2018, Stripe Billing manages hundreds of millions of subscriptions for over 300,000 companies, offering flexible billing models and features. This recognition highlights its strong execution and vision in the billing sector.June 2024: Stripe launched new features in France, including Alma’s BNPL integration and advanced Stripe Terminal capabilities. The strengthened CB partnership now supports CB on Apple Pay and enhanced transaction features. Stripe's French user base has grown significantly, with major companies like Accor and TF1 joining the network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fintech Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fintech Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fintech Industry?

To stay informed about further developments, trends, and reports in the North America Fintech Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence