Key Insights

The North American microgrid market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a CAGR exceeding 2.00% from 2025 to 2033. This expansion is driven by several key factors. Increasing concerns regarding grid reliability and the escalating costs of electricity are prompting businesses and institutions to adopt microgrids as a resilient and cost-effective power solution. Furthermore, the growing adoption of renewable energy sources, coupled with supportive government policies promoting energy independence and sustainability, significantly fuels market growth. The institutional and commercial sectors, including hospitals, data centers, and manufacturing facilities, are leading adopters, driven by the need for uninterrupted power supply and reduced carbon footprints. Remote off-grid communities also present a significant opportunity, as microgrids offer a viable alternative to traditional grid infrastructure in underserved areas. Competitive pressures among established players like Honeywell, Schneider Electric, Toshiba, Siemens, Eaton, and General Electric are fostering innovation and driving down costs, making microgrid solutions increasingly accessible.

However, the market faces certain constraints. High initial investment costs associated with microgrid installation can be a barrier to entry for some businesses. Furthermore, regulatory complexities and the need for skilled labor to design, install, and maintain these systems can pose challenges. Nevertheless, the long-term benefits of enhanced energy security, cost savings, and environmental sustainability are expected to outweigh these hurdles, ensuring continued market expansion throughout the forecast period. The market segmentation, with custom microgrids holding a significant share due to their flexibility and adaptability, alongside remote power systems catering to geographically isolated areas, further highlights the diversity and potential of the North American microgrid landscape. The US market is expected to dominate the North American region, fueled by strong government support and a large commercial and industrial base. Canada and Mexico are also anticipated to witness substantial growth, driven by similar trends, though at potentially a slightly slower pace.

North America Drilling Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America drilling market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, identifies key trends, and forecasts future growth potential. The report leverages rigorous data analysis and expert insights to provide a clear and actionable understanding of this dynamic sector.

North America Drilling Market Market Dynamics & Concentration

The North American drilling market presents a dynamic landscape shaped by competitive forces, technological innovation, regulatory shifts, and evolving market structures. While a moderate level of concentration exists, with several key players holding substantial market share, the emergence of new competitors fosters ongoing dynamism. The market's evolution is significantly influenced by mergers and acquisitions (M&A) activity. Analysis of the period between 2019 and 2024 reveals a notable increase in M&A deals, reflecting a [Insert Percentage]% surge compared to the preceding period. This consolidation trend underscores the pursuit of economies of scale and competitive advantage within the industry.

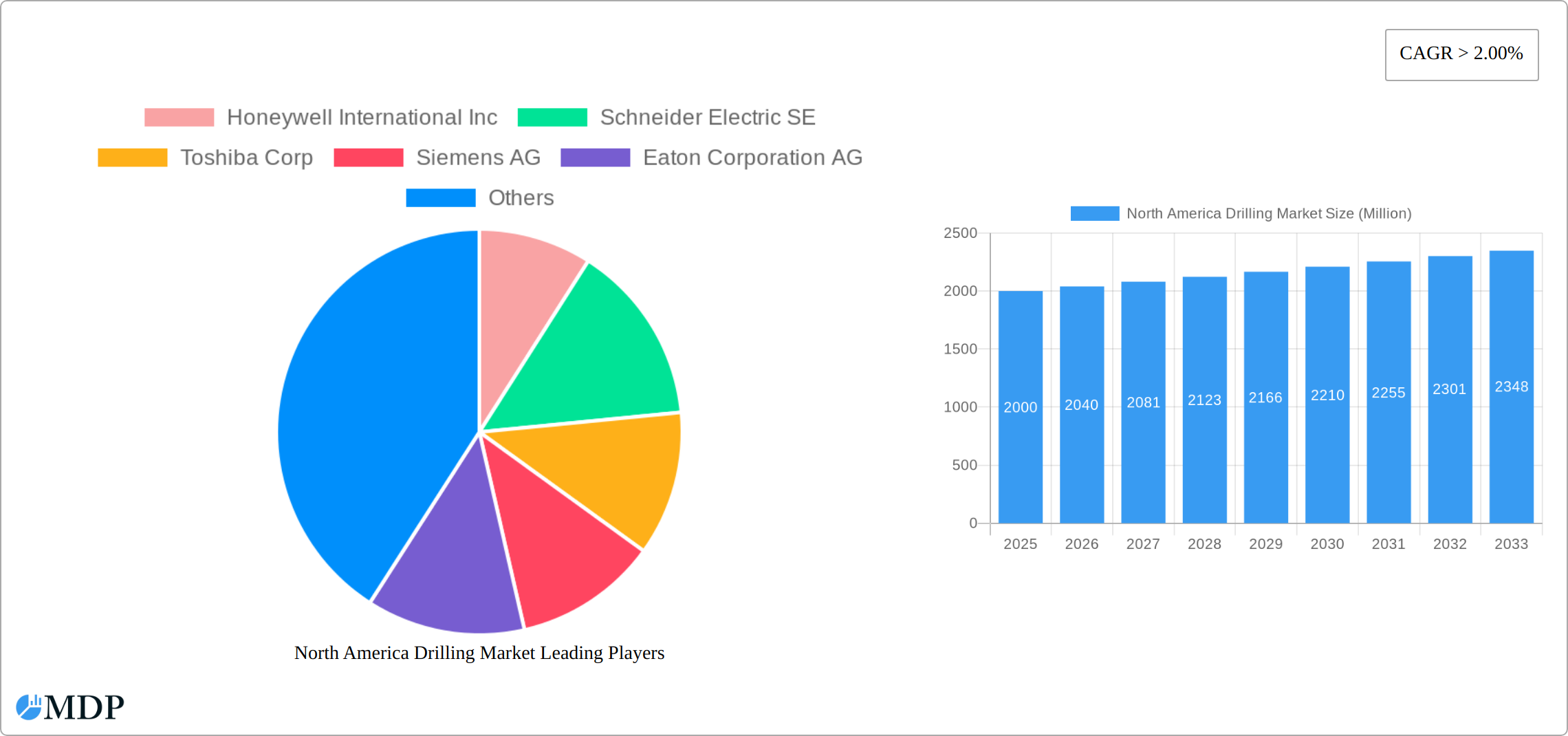

- Market Concentration: In 2025, the top five players—Honeywell International Inc, Schneider Electric SE, Toshiba Corp, Siemens AG, and Eaton Corporation AG—held an estimated [Insert Percentage]% of the market share. However, the competitive landscape is constantly evolving with the entry and growth of smaller, more specialized firms.

- Innovation Drivers: Technological advancements are paramount, driving efficiency and sustainability in drilling techniques and equipment. This includes innovations in automation, data analytics, and environmentally friendly drilling fluids. The demand for reduced environmental impact and improved operational safety is a significant factor fueling innovation.

- Regulatory Frameworks: Stringent government regulations concerning environmental protection and safety standards exert a considerable influence on market dynamics. Compliance costs are significant, and changes in these regulations can either stimulate or impede market growth. The ongoing debate surrounding environmental regulations adds an element of uncertainty to long-term investment planning.

- Product Substitutes: The increasing availability of alternative energy sources, such as wind, solar, and geothermal power, poses a substitutional threat to traditional drilling methods. This pressure necessitates ongoing innovation and adaptation to maintain market competitiveness.

- End-User Trends: The energy sector, particularly offshore drilling in the Gulf of Mexico and increasingly in Canadian waters, continues to be a major driver of market demand. However, the global shift towards renewable energy sources presents a considerable challenge, requiring drilling companies to diversify their operations and explore new opportunities.

- M&A Activities: The significant number of M&A deals observed reflects not only industry consolidation but also strategic moves to acquire specialized technologies, expand geographical reach, and secure access to resources. This trend is expected to continue as companies seek to strengthen their market position.

North America Drilling Market Industry Trends & Analysis

The North America drilling market exhibits a robust growth trajectory, driven by increasing energy demands and the exploration of new resources. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, with a market penetration rate of xx% in 2025. Technological disruptions, such as advancements in automation and digitalization, are transforming operational efficiency and safety protocols. Consumer preference shifts towards cleaner energy sources are pushing the adoption of environment-friendly drilling practices. Intense competition among existing and emerging players fuels innovation and drives market growth. The significant growth is driven by multiple factors: the continuous increase in global energy consumption, the growing need for oil and gas exploration to meet this demand and advancements in drilling technologies such as horizontal drilling, enabling access to previously inaccessible reserves.

Leading Markets & Segments in North America Drilling Market

The Gulf of Mexico remains a key region for offshore drilling, benefiting from established infrastructure and favorable geological conditions. Simultaneously, the Canadian offshore drilling market is experiencing robust growth fueled by substantial government investment and the development of new resource reserves. This expansion offers significant opportunities for drilling companies but also presents challenges related to navigating complex regulatory environments and remote operating conditions.

Type:

- Custom Microgrid: This segment demonstrates strong growth due to its reliability and suitability for remote locations, particularly within the institutional sites sector. The increasing demand for resilient power solutions is a key driver.

- Remote Power Systems: Demand for reliable power in remote off-grid communities and commercial facilities is a significant growth catalyst. This segment is particularly attractive to companies offering solutions that minimize environmental impact and maximize energy efficiency.

- Other Types: This segment shows consistent growth, driven by the diverse application of drilling technologies across various industrial sectors. This includes specialized drilling equipment and services catering to niche requirements.

Application:

- Institutional Sites: High demand from educational institutions, government buildings, and healthcare facilities continues to drive growth in this segment. Focus on energy efficiency and sustainability in these facilities is an important consideration.

- Commercial Facilities: Growth is propelled by the increasing adoption of microgrids in large commercial buildings and industrial complexes, driven by cost savings and improved reliability.

- Remote Off-grid Communities: Consistent growth in this segment reflects the critical need for reliable power access in underserved areas. This segment often involves considerations for sustainable and environmentally responsible power solutions.

- Other Applications: This category encompasses niche applications exhibiting incremental but significant growth, reflecting the expanding range of drilling technology applications.

North America Drilling Market Product Developments

Significant advancements are occurring in drilling technologies, including improved drilling fluids, automation, and data analytics. These enhancements enhance drilling efficiency, reduce environmental impact, and improve safety. New drilling techniques focusing on improved wellbore stability and reduced drilling time are gaining traction. The market is also seeing an increased focus on developing more sustainable and environmentally friendly drilling methods.

Key Drivers of North America Drilling Market Growth

Several factors are driving market growth, including:

- Rising Global Energy Demand: The continuous increase in global energy consumption fuels the demand for oil and gas exploration.

- Technological Advancements: Innovation in drilling technologies such as horizontal drilling significantly improves efficiency and reach.

- Government Support: Government policies supporting energy exploration and infrastructure development provide a favorable environment for market expansion. (e.g., Canada's approval of offshore drilling projects).

Challenges in the North America Drilling Market Market

The market faces several significant challenges:

- Environmental Regulations: Stringent environmental regulations significantly increase operating costs and impose constraints on drilling activities. Compliance requirements necessitate substantial investments in technology and operational adjustments.

- Fluctuating Oil Prices: The volatility of oil prices continues to impact investment decisions, operational planning, and overall market stability. Price fluctuations create uncertainty and make it challenging to secure long-term financing.

- Geopolitical Factors: Global political instability and trade disputes can disrupt supply chains, impact project timelines, and increase operational risks. Political and economic uncertainty adds another layer of complexity to market forecasting and planning.

- Social License to Operate: Growing public concern over environmental impact and social responsibility is placing increased pressure on drilling companies to demonstrate a strong commitment to sustainability and community engagement. Securing a "social license" is increasingly important for long-term success.

Emerging Opportunities in North America Drilling Market

The market offers significant long-term growth potential driven by:

- Technological Breakthroughs: Advancements in automation, AI, and robotics will further enhance efficiency and reduce costs.

- Strategic Partnerships: Collaborations among drilling companies, technology providers, and energy companies can unlock new opportunities.

- Market Expansion: Exploring new drilling locations and expanding into emerging markets will fuel market growth.

Leading Players in the North America Drilling Market Sector

- Honeywell International Inc

- Schneider Electric SE

- Toshiba Corp

- Siemens AG

- Eaton Corporation AG

- General Electric Company

Key Milestones in North America Drilling Market Industry

- November 2021: Lease Sale 257 announced, offering 15,148 unleased blocks in the Gulf of Mexico, signaling continued interest in offshore exploration and development.

- January 2022: US judge cancels offshore oil and gas lease sale, highlighting the ongoing legal and regulatory challenges impacting market growth and investment decisions.

- January 2020: Government of Canada approves three offshore drilling projects, indicating governmental support for continued energy development in Canadian waters.

- April 2022: Canadian government approves the USD 12 Billion Bay du Nord offshore oil project, representing a major investment and potential boost for the Canadian offshore drilling sector.

Strategic Outlook for North America Drilling Market Market

The North America drilling market is poised for sustained growth, driven by technological innovation, strategic investments, and increasing energy demands. Strategic partnerships and expansion into new geographical areas represent significant opportunities for market players. Companies that prioritize sustainability and environmental responsibility will have a competitive advantage in the long term. Focus on efficient, cost-effective, and environmentally sound drilling solutions will be critical for success.

North America Drilling Market Segmentation

-

1. Application

- 1.1. Institutional Sites

- 1.2. Commercial Facilities

- 1.3. Remote Off-grid Communities

- 1.4. Other Applications

-

2. Type

- 2.1. Custom Microgrid

- 2.2. Remote Power Systems

- 2.3. Other Types

North America Drilling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Drilling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Shift Toward Renewables-based Distributed Power Generation4.; Rising Investments in Smart Grid

- 3.3. Market Restrains

- 3.3.1. 4.; Expansion and Upgradation of Centralized Grid

- 3.4. Market Trends

- 3.4.1. United States would dominate the geographical segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Drilling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Institutional Sites

- 5.1.2. Commercial Facilities

- 5.1.3. Remote Off-grid Communities

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Custom Microgrid

- 5.2.2. Remote Power Systems

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Drilling Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Drilling Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Drilling Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Drilling Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Schneider Electric SE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Eaton Corporation AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 General Electric Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Drilling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Drilling Market Share (%) by Company 2024

List of Tables

- Table 1: North America Drilling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Drilling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: North America Drilling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Drilling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Drilling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Drilling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Drilling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Drilling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Drilling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Drilling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: North America Drilling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Drilling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Drilling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Drilling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Drilling Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Drilling Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the North America Drilling Market?

Key companies in the market include Honeywell International Inc, Schneider Electric SE, Toshiba Corp, Siemens AG, Eaton Corporation AG, General Electric Company.

3. What are the main segments of the North America Drilling Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Shift Toward Renewables-based Distributed Power Generation4.; Rising Investments in Smart Grid.

6. What are the notable trends driving market growth?

United States would dominate the geographical segment.

7. Are there any restraints impacting market growth?

4.; Expansion and Upgradation of Centralized Grid.

8. Can you provide examples of recent developments in the market?

Lease Sale 257's results were announced in November 2021, which offered approximately 15,148 unleased blocks located from three to 231 miles offshore, in the Gulf's Western, Central and Eastern Planning Areas in water depths ranging from nine to more than 11,115 feet (three to 3,400 meters). However, in January 2022, the sale of offshore oil and gas leases was canceled by a United States judge, thereby hindering the market growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Drilling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Drilling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Drilling Market?

To stay informed about further developments, trends, and reports in the North America Drilling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence