Key Insights

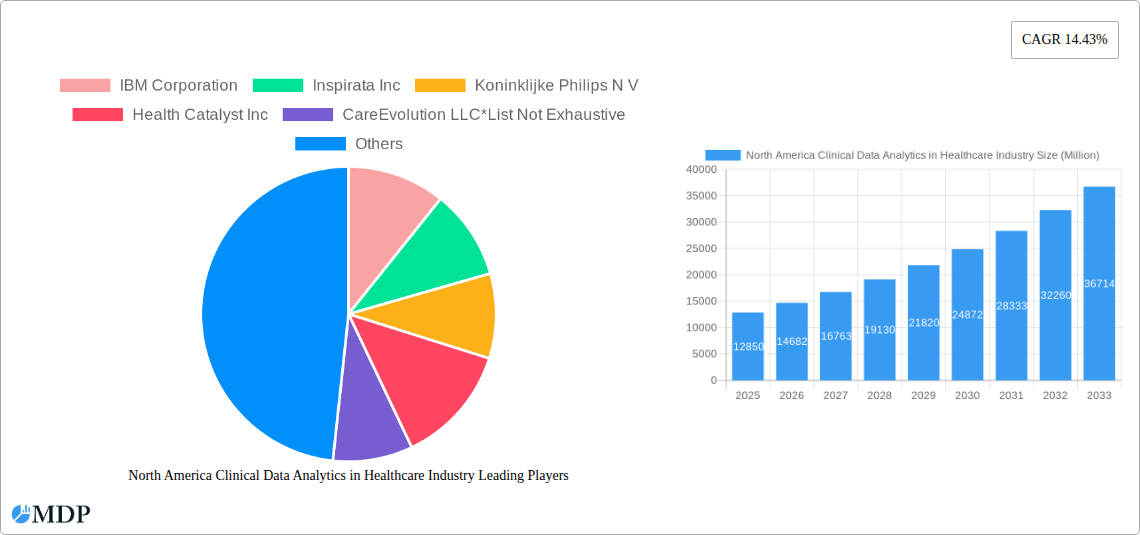

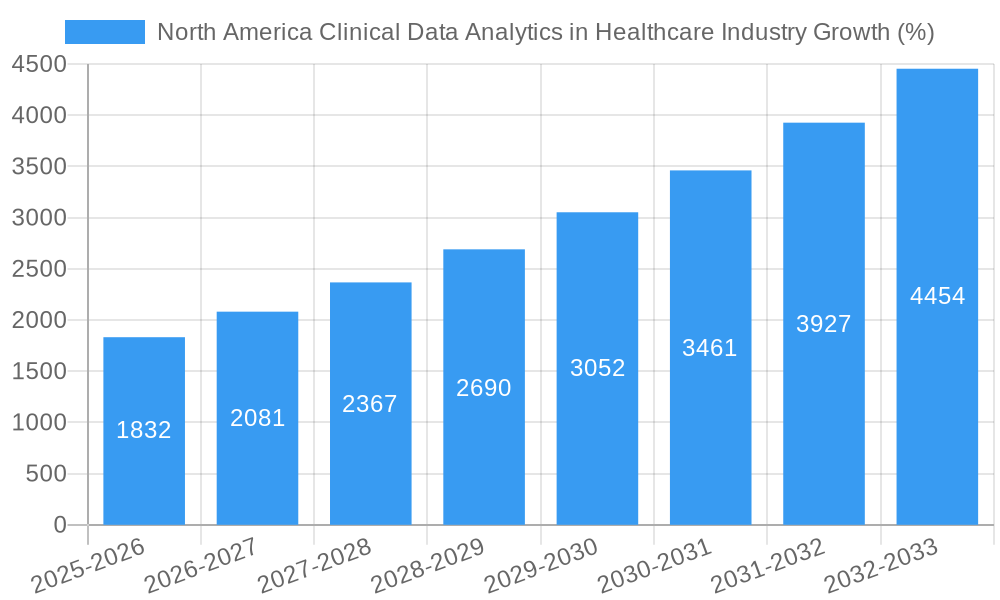

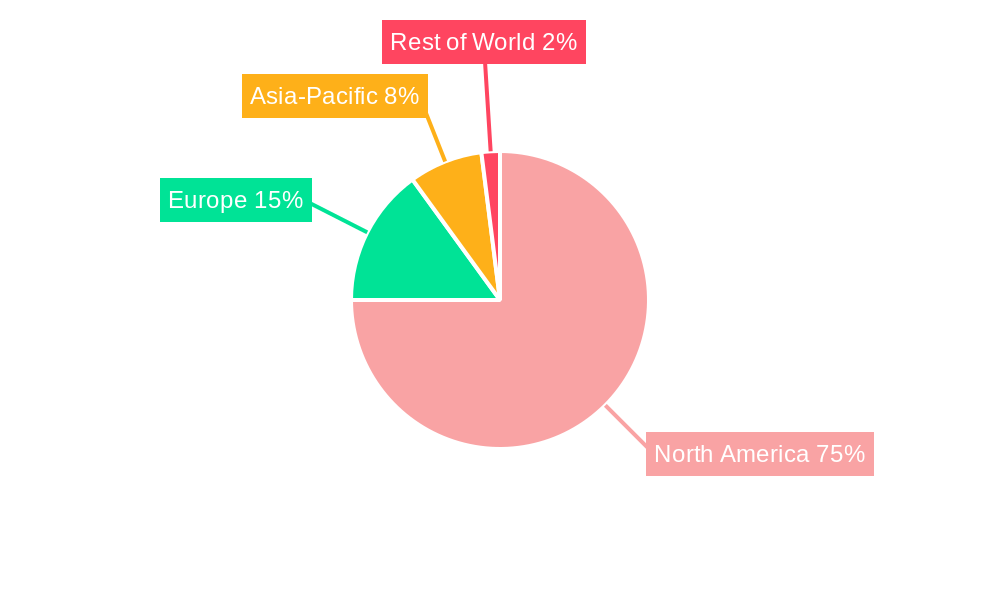

The North American Clinical Data Analytics in Healthcare market is experiencing robust growth, projected to reach $12.85 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.43% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of electronic health records (EHRs) provides a massive data pool ripe for analysis, leading to improved patient care, operational efficiencies, and reduced healthcare costs. Furthermore, the rise of value-based care models incentivizes providers to utilize data analytics for better patient outcomes and cost management. Technological advancements, such as the proliferation of cloud-based solutions and the development of sophisticated analytical tools (descriptive, diagnostic, predictive, and prescriptive analytics), are further accelerating market growth. The market is segmented by delivery mode (cloud and on-premise), analysis type, end-user (payers and providers), and geography (United States, Canada, Mexico, and the Rest of North America). The significant market share held by the United States reflects its advanced healthcare infrastructure and higher adoption rates of data analytics technologies. Leading companies like IBM, Inspirata, Philips, Health Catalyst, and others are actively shaping the market through innovation and strategic partnerships.

The market's growth is not without challenges. Data privacy and security concerns, the complexity of integrating diverse data sources, and the need for skilled professionals to interpret and act upon analytical insights represent significant restraints. However, ongoing investments in cybersecurity and data governance frameworks, along with the increasing availability of training programs for data analytics professionals, are mitigating these challenges. Future growth will be significantly influenced by advancements in artificial intelligence (AI) and machine learning (ML), enabling more precise predictive modeling and personalized medicine. The increasing focus on population health management and the potential for real-time data analysis will also drive demand for advanced clinical data analytics solutions within the healthcare sector. The market is poised for substantial growth as the adoption of data-driven decision-making becomes increasingly critical for providers and payers alike in navigating the complexities of modern healthcare.

North America Clinical Data Analytics in Healthcare Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America clinical data analytics market, offering invaluable insights for stakeholders across the healthcare ecosystem. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis to uncover key trends, challenges, and opportunities within this rapidly evolving sector. The report covers a market valued at $XX Million in 2025, projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

North America Clinical Data Analytics in Healthcare Industry Market Dynamics & Concentration

The North American clinical data analytics market is characterized by a dynamic interplay of factors driving its growth and shaping its competitive landscape. Market concentration is moderate, with several major players holding significant market share, but also a considerable number of smaller, specialized firms. Key innovation drivers include advancements in artificial intelligence (AI), machine learning (ML), and big data technologies, enabling more sophisticated analytical capabilities. Stringent regulatory frameworks, such as HIPAA in the US, influence data privacy and security protocols, impacting market development. Product substitutes, such as traditional manual data analysis methods, are gradually being replaced by automated solutions due to efficiency gains and improved accuracy. End-user trends indicate a growing preference for cloud-based solutions due to scalability and cost-effectiveness. Furthermore, M&A activities are frequent, reflecting consolidation within the market and attempts to expand service offerings.

- Market Share: The top 5 players account for approximately XX% of the market share in 2025.

- M&A Deal Count: An estimated XX M&A deals occurred in the North American clinical data analytics market between 2019 and 2024.

- Key Players: IBM Corporation, Inspirata Inc, Koninklijke Philips N.V., Health Catalyst Inc, CareEvolution LLC, Siemens Healthineers AG, Cerner Corporation, Oracle Corporation, Allscripts Healthcare Solutions Inc, McKesson Corporation.

North America Clinical Data Analytics in Healthcare Industry Industry Trends & Analysis

The North American clinical data analytics market is experiencing robust growth fueled by several key trends. The increasing volume of healthcare data generated from electronic health records (EHRs), wearable devices, and other sources is driving demand for advanced analytical tools to extract meaningful insights. Technological disruptions, such as the adoption of AI and cloud computing, are revolutionizing data processing and analysis, enabling faster and more accurate diagnoses, personalized treatment plans, and improved operational efficiency. Consumer preferences are shifting towards personalized healthcare experiences, further fueling the demand for data-driven insights. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and a focus on providing integrated solutions. The market's growth is significantly influenced by factors such as increasing adoption of value-based care models, government initiatives to improve healthcare outcomes, and rising investments in healthcare IT infrastructure.

Leading Markets & Segments in North America Clinical Data Analytics in Healthcare Industry

The United States dominates the North American clinical data analytics market, driven by its advanced healthcare infrastructure, high adoption of EHRs, and significant investments in healthcare IT. Within segments:

- By Mode of Delivery: Cloud-based solutions are experiencing faster growth than on-premise deployments, owing to scalability, cost efficiency, and accessibility.

- By Type: Predictive and prescriptive analytics are gaining traction due to their ability to forecast future trends and optimize healthcare resource allocation. Descriptive and diagnostic analytics still remain vital for understanding current healthcare practices.

- By End-user: Providers are the largest segment, followed by payers, as both seek to leverage data for improved efficiency and patient outcomes.

Key Drivers:

- United States: High adoption of EHRs, robust healthcare IT infrastructure, and significant investments in R&D.

- Canada: Growing government initiatives to improve healthcare outcomes and optimize resource allocation.

- Mexico: Increasing investment in healthcare infrastructure and growing adoption of digital health technologies.

North America Clinical Data Analytics in Healthcare Industry Product Developments

Recent product innovations focus on integrating AI and ML capabilities into existing platforms to enhance analytical accuracy and efficiency. New applications are emerging in areas such as population health management, clinical decision support, and drug discovery. Competitive advantages are driven by factors such as data security, interoperability, ease of use, and the ability to provide actionable insights. The market sees a strong push towards solutions offering real-time analytics, predictive modeling, and seamless integration with existing EHR systems.

Key Drivers of North America Clinical Data Analytics in Healthcare Industry Growth

The growth of the North American clinical data analytics market is driven by a confluence of factors, including the increasing adoption of EHRs, rising demand for personalized medicine, growing investments in healthcare IT infrastructure, supportive government regulations, and the increasing focus on improving healthcare efficiency and reducing costs. The use of AI and ML enhances clinical decision support and streamlines operations. Value-based care initiatives further encourage data-driven approaches to optimize healthcare resource allocation.

Challenges in the North America Clinical Data Analytics in Healthcare Industry Market

The market faces challenges such as high implementation costs, data security concerns, interoperability issues between various healthcare systems, the shortage of skilled professionals in data analytics, and strict regulatory compliance requirements. These factors can impede adoption, increase operational costs, and limit market expansion. For instance, the cost of integrating new analytics solutions with existing infrastructure can be a significant barrier for smaller healthcare providers. Data breaches, while rare, carry substantial financial and reputational risks.

Emerging Opportunities in North America Clinical Data Analytics in Healthcare Industry

Significant opportunities exist in expanding the application of clinical data analytics to address emerging healthcare needs, including remote patient monitoring, personalized medicine, and disease prevention. Strategic partnerships between healthcare providers, technology companies, and payers will foster innovation and market expansion. The development of more sophisticated algorithms and analytical techniques will further enhance the value proposition of data analytics solutions, leading to more accurate diagnoses, effective treatment plans, and improved patient outcomes. Focus on interoperability and data standardization will boost market growth.

Leading Players in the North America Clinical Data Analytics in Healthcare Industry Sector

- IBM Corporation

- Inspirata Inc

- Koninklijke Philips N.V.

- Health Catalyst Inc

- CareEvolution LLC

- Siemens Healthineers AG

- Cerner Corporation

- Oracle Corporation

- Allscripts Healthcare Solutions Inc

- McKesson Corporation

Key Milestones in North America Clinical Data Analytics in Healthcare Industry Industry

- June 2023: MRO Corp. launched a new technology solution, Payer Exchange, automating patient information exchange between providers and payers, streamlining workflows and reducing manual burden.

- April 2023: TripleBlind launched three new healthcare-focused products providing secure access to sensitive data for enhanced insights while maintaining privacy and compliance.

Strategic Outlook for North America Clinical Data Analytics in Healthcare Industry Market

The future of the North American clinical data analytics market is bright, driven by continued technological advancements, increasing data volumes, and a growing focus on value-based care. Strategic opportunities exist in developing innovative solutions that address specific healthcare challenges, expanding into underserved markets, and forging strategic partnerships to enhance market reach and service offerings. The integration of AI and ML will play a pivotal role in shaping the future of clinical data analytics, leading to more precise diagnoses, personalized treatment plans, and improved overall healthcare outcomes. Companies that prioritize data security, interoperability, and ease of use will be well-positioned for success in this rapidly growing market.

North America Clinical Data Analytics in Healthcare Industry Segmentation

-

1. Mode of Delivery

- 1.1. Cloud

- 1.2. On-premise

-

2. Type

- 2.1. Descriptive Analysis

- 2.2. Diagnostic Analysis

- 2.3. Predictive Analysis

- 2.4. Prescriptive Analysis

-

3. End-user

- 3.1. Payers

- 3.2. Providers

North America Clinical Data Analytics in Healthcare Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Clinical Data Analytics in Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Healthcare Spending; Increasing Adoption of Big Data in Healthcare

- 3.3. Market Restrains

- 3.3.1. High Cost of Data Analytics Solutions

- 3.4. Market Trends

- 3.4.1. Cloud to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Clinical Data Analytics in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Delivery

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Descriptive Analysis

- 5.2.2. Diagnostic Analysis

- 5.2.3. Predictive Analysis

- 5.2.4. Prescriptive Analysis

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Payers

- 5.3.2. Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Mode of Delivery

- 6. United States North America Clinical Data Analytics in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Clinical Data Analytics in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Clinical Data Analytics in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Clinical Data Analytics in Healthcare Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 IBM Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Inspirata Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Koninklijke Philips N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Health Catalyst Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 CareEvolution LLC*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens Healthineers AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cerner Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Oracle Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Allscripts Healthcare Solutions Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 McKesson Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 IBM Corporation

List of Figures

- Figure 1: North America Clinical Data Analytics in Healthcare Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Clinical Data Analytics in Healthcare Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 3: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 5: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 12: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 14: North America Clinical Data Analytics in Healthcare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Clinical Data Analytics in Healthcare Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Clinical Data Analytics in Healthcare Industry?

The projected CAGR is approximately 14.43%.

2. Which companies are prominent players in the North America Clinical Data Analytics in Healthcare Industry?

Key companies in the market include IBM Corporation, Inspirata Inc, Koninklijke Philips N V, Health Catalyst Inc, CareEvolution LLC*List Not Exhaustive, Siemens Healthineers AG, Cerner Corporation, Oracle Corporation, Allscripts Healthcare Solutions Inc, McKesson Corporation.

3. What are the main segments of the North America Clinical Data Analytics in Healthcare Industry?

The market segments include Mode of Delivery, Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Healthcare Spending; Increasing Adoption of Big Data in Healthcare.

6. What are the notable trends driving market growth?

Cloud to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Data Analytics Solutions.

8. Can you provide examples of recent developments in the market?

June 2023: MRO Corp., a clinical data exchange The company said it has started a new technology solution. The company implemented a digital and automated process of requesting and delivering patient information between providers and payers by means of this solution. MRO aims at removing the manual burden and reducing friction between providers. Payer Exchange automates the labor-intensive work previously performed by hospital staff to streamline workflows.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Clinical Data Analytics in Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Clinical Data Analytics in Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Clinical Data Analytics in Healthcare Industry?

To stay informed about further developments, trends, and reports in the North America Clinical Data Analytics in Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence