Key Insights

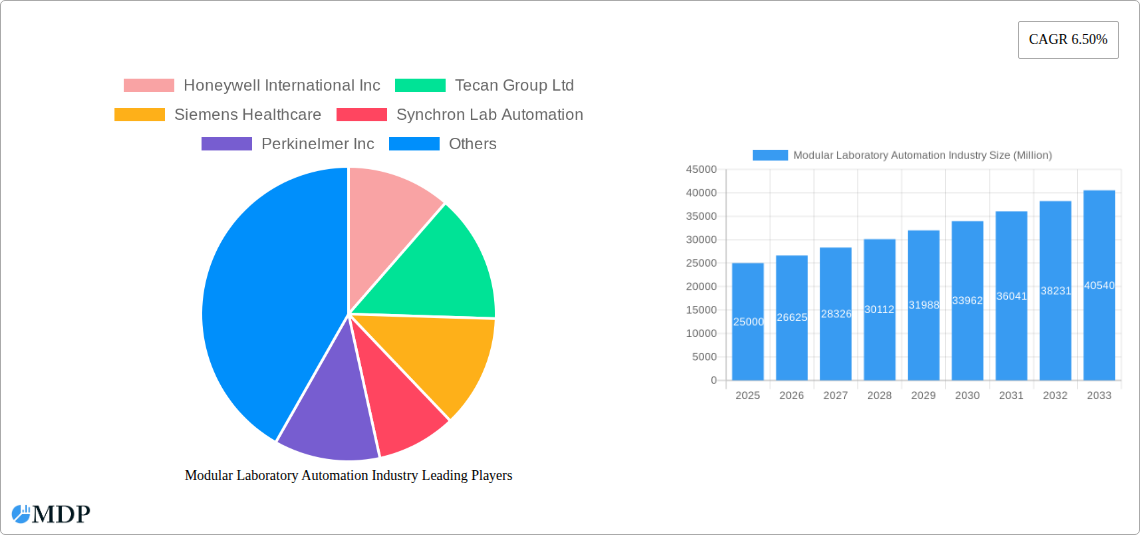

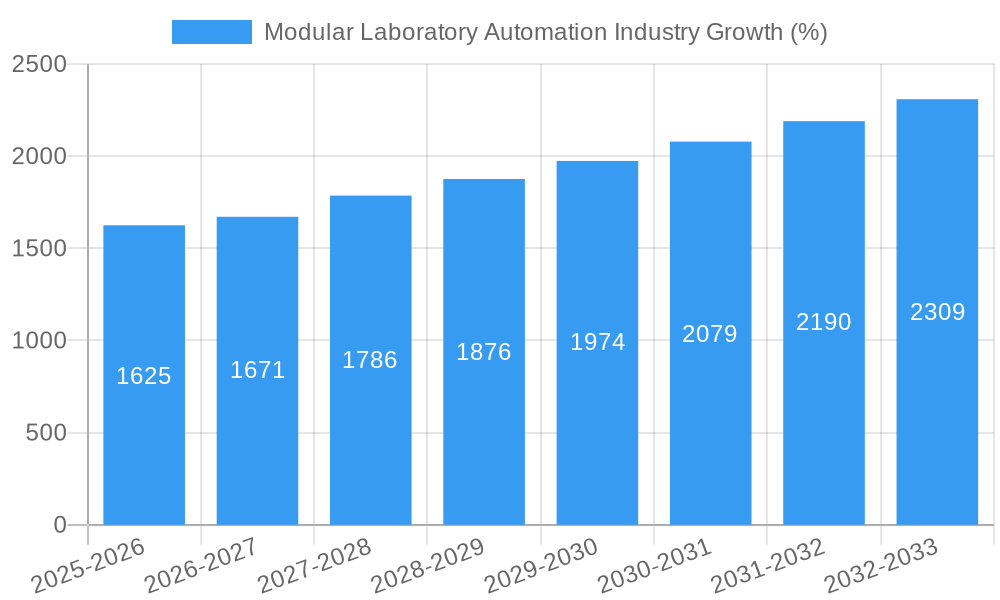

The global modular laboratory automation market is experiencing robust growth, driven by the increasing demand for high-throughput screening, automation in drug discovery and development, and the rising adoption of personalized medicine. The market, valued at approximately $X billion in 2025 (assuming a reasonable value based on the provided CAGR and industry averages), is projected to maintain a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the pharmaceutical and biotechnology industries are increasingly adopting automation to improve efficiency, reduce costs, and accelerate drug development timelines. Secondly, advancements in robotics, artificial intelligence, and software are leading to more sophisticated and adaptable automation solutions, making them suitable for a broader range of applications. Thirdly, the growing need for high-throughput screening and analysis in genomics, proteomics, and clinical diagnostics is significantly contributing to market growth. Automation reduces human error, improves data quality, and allows for faster processing of large volumes of samples, resulting in quicker diagnosis and more effective treatments.

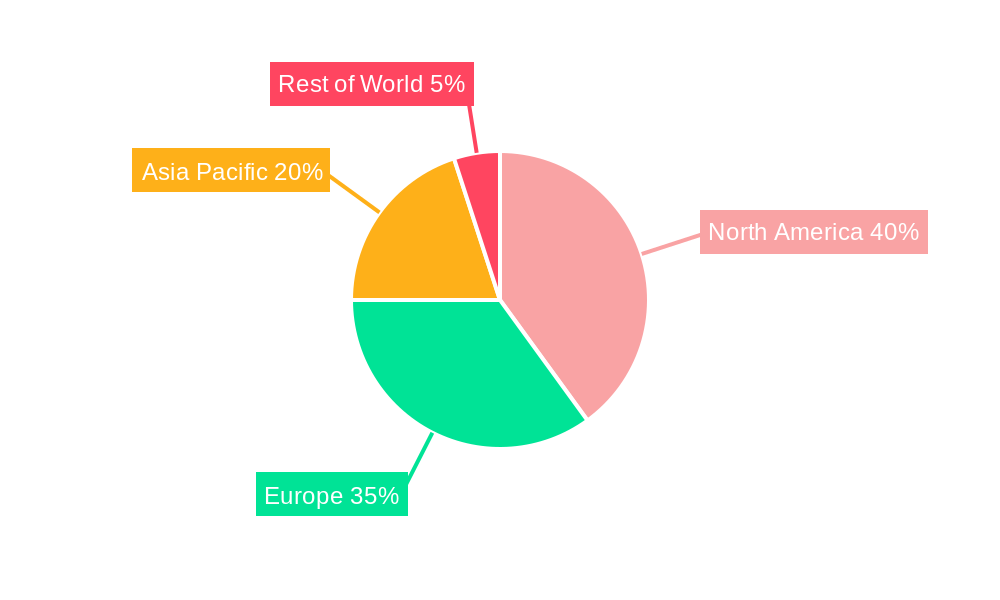

Despite the positive outlook, certain challenges could moderate market growth. The high initial investment cost of modular laboratory automation systems can be a significant barrier for smaller laboratories and research facilities. Furthermore, the complexity of integrating various automated systems and the need for specialized training and maintenance can also present hurdles. However, ongoing technological advancements, decreasing costs of components, and the rising adoption of cloud-based solutions are gradually mitigating these challenges. The market is segmented by equipment and software (automated liquid handlers, automated plate handlers, robotic arms, ASRS, software, and analyzers) and by field of application (drug discovery, genomics, proteomics, clinical diagnostics, and other fields). North America and Europe currently hold significant market shares, but the Asia-Pacific region is expected to witness substantial growth in the coming years due to increasing research activities and investments in healthcare infrastructure. Key players such as Thermo Fisher Scientific, Danaher Corporation, and Tecan Group Ltd are driving innovation and expanding their market presence through strategic partnerships, acquisitions, and product development.

Modular Laboratory Automation Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Modular Laboratory Automation Industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, technological advancements, and future growth prospects. The study period encompasses historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). Expect a xx Million USD market value by 2033.

Modular Laboratory Automation Industry Market Dynamics & Concentration

The modular laboratory automation market is characterized by a moderately concentrated landscape, with key players such as Honeywell International Inc, Tecan Group Ltd, Siemens Healthcare, Synchron Lab Automation, PerkinElmer Inc, Becton Dickinson, Danaher Corporation, Agilent Technologies, Hudson Robotics Inc, and Thermo Fisher Scientific holding significant market share. However, the market also features numerous smaller, specialized companies contributing to innovation and competition.

Market concentration is influenced by factors such as R&D investments, strategic partnerships, and mergers and acquisitions (M&A). The M&A activity in the sector has been relatively robust in recent years, with approximately xx M&A deals recorded between 2019 and 2024, resulting in a consolidated market structure with larger players acquiring smaller companies to expand their product portfolios and market reach. Market share distribution shows a top 5 player concentration of approximately xx%, leaving considerable room for smaller players to expand.

Innovation is a key driver, fueled by the increasing demand for high-throughput screening, automation in drug discovery, and personalized medicine. Stringent regulatory frameworks, particularly in the healthcare and pharmaceutical sectors, impact product development and market entry. The market experiences competition from manual laboratory processes and alternative automation technologies, though the modularity and scalability of these systems offer a significant advantage. End-user trends indicate a strong preference for adaptable, scalable systems that can be easily integrated into existing workflows.

Modular Laboratory Automation Industry Industry Trends & Analysis

The Modular Laboratory Automation Industry is experiencing robust growth, driven by several key factors. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the increasing adoption of automation in various fields, including drug discovery, genomics, proteomics, and clinical diagnostics. Technological advancements such as artificial intelligence (AI) and machine learning (ML) integration are enhancing the capabilities of modular automation systems, leading to improved efficiency and accuracy. The market penetration rate for automated liquid handlers is expected to reach xx% by 2033, representing a significant increase compared to the xx% in 2024.

Consumer preferences are shifting towards modular systems offering flexibility, scalability, and ease of integration. The competitive dynamics are intense, with both large multinational corporations and specialized smaller companies vying for market share. This competition fuels innovation and drives down prices, making modular automation more accessible to a wider range of laboratories. The market is also witnessing the emergence of cloud-based solutions that offer remote monitoring and control capabilities, further enhancing the convenience and efficiency of these systems.

Leading Markets & Segments in Modular Laboratory Automation Industry

The North American region currently holds the dominant position in the modular laboratory automation market, followed by Europe and Asia Pacific. This dominance is attributed to factors including robust R&D spending, a high concentration of pharmaceutical and biotechnology companies, and a well-established regulatory framework.

- Key Drivers in North America: Strong government funding for research and development, presence of major pharmaceutical companies, advanced healthcare infrastructure.

- Key Drivers in Europe: Significant investments in life sciences research, growing demand for personalized medicine, adoption of advanced technologies in laboratories.

- Key Drivers in Asia Pacific: Rapid economic growth, increasing investments in healthcare infrastructure, rising prevalence of chronic diseases.

Within the segments, Automated Liquid Handlers and Automated Plate Handlers constitute the largest market shares due to their widespread application across various fields. The Drug Discovery segment is currently the largest application area, driven by the high demand for automation in research and development. However, the Genomics and Clinical Diagnostics segments are experiencing the fastest growth rates, driven by advancements in personalized medicine and the increasing adoption of high-throughput screening methods.

Modular Laboratory Automation Industry Product Developments

Recent product innovations focus on enhancing system integration, improving data management capabilities, and expanding the range of applications. Miniaturization and integration of AI/ML are key technological trends. New products emphasize user-friendly interfaces, improved accuracy, and reduced operational costs. The market fit for these new products is strong, driven by the growing demand for automation in various laboratory settings.

Key Drivers of Modular Laboratory Automation Industry Growth

Several factors contribute to the growth of the Modular Laboratory Automation Industry:

- Technological advancements: AI and ML integration, miniaturization, and improved software capabilities enhance efficiency and accuracy.

- Economic growth: Increased R&D investments by pharmaceutical and biotechnology companies fuel demand for advanced laboratory equipment.

- Regulatory support: Government initiatives and funding programs promote the adoption of automation technologies in laboratories. For example, many countries have implemented policies prioritizing research in genomics and personalized medicine, hence fuelling the market.

Challenges in the Modular Laboratory Automation Industry Market

The Modular Laboratory Automation market faces challenges such as:

- High initial investment costs: The purchase and implementation of these systems can be expensive, creating a barrier for smaller laboratories.

- Regulatory compliance: Meeting stringent regulatory requirements for healthcare and pharmaceutical applications can be complex and costly.

- Intense competition: The market is highly competitive, with established players and new entrants constantly vying for market share. This pressure affects pricing and profit margins.

Emerging Opportunities in Modular Laboratory Automation Industry

Several factors present significant opportunities for growth:

The expansion into emerging markets, especially in developing countries, offers substantial growth potential. Strategic partnerships and collaborations can unlock new applications and accelerate technological advancements. Technological breakthroughs such as the integration of advanced robotics and AI hold significant promise for further automation and efficiency gains.

Leading Players in the Modular Laboratory Automation Industry Sector

- Honeywell International Inc

- Tecan Group Ltd

- Siemens Healthcare

- Synchron Lab Automation

- PerkinElmer Inc

- Becton Dickinson

- Danaher Corporation

- Agilent Technologies

- Hudson Robotics Inc

- Thermo Fisher Scientific

Key Milestones in Modular Laboratory Automation Industry Industry

- June 2022: MegaRobo Technologies Ltd secured USD 300 Million in Series C funding, signifying significant investor confidence and a commitment to expanding its automation solutions in life sciences.

- May 2022: MGI Tech Co. Ltd and King Abdullah International Medical Research Center (KAIMRC) formed a strategic partnership to establish a high-throughput sequencing center, boosting the demand for laboratory automation technologies in genomics.

Strategic Outlook for Modular Laboratory Automation Industry Market

The future of the Modular Laboratory Automation Industry is bright. Continued technological innovation, coupled with increasing demand from various sectors, promises robust growth. Strategic partnerships, market expansions into developing economies, and diversification into new applications will be key to unlocking the full market potential and creating new opportunities for existing players and new entrants.

Modular Laboratory Automation Industry Segmentation

-

1. Equipment and Software

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (ASRS)

- 1.5. Analyzers

-

2. Field of Application

- 2.1. Drug Discovery

- 2.2. Genomics

- 2.3. Proteomics

- 2.4. Clinical Diagnostics

- 2.5. Other Fields of Application

Modular Laboratory Automation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Modular Laboratory Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Higher Reproducibility and Effective Management of Vast Amounts of Data; Need for Reliable Automation Solution to Substitute the Unavailability of Skilled Personnel

- 3.3. Market Restrains

- 3.3.1. Slower Adoption Rates in Small- and Medium-sized Organizations; High Capital Requirements

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers Account for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (ASRS)

- 5.1.5. Analyzers

- 5.2. Market Analysis, Insights and Forecast - by Field of Application

- 5.2.1. Drug Discovery

- 5.2.2. Genomics

- 5.2.3. Proteomics

- 5.2.4. Clinical Diagnostics

- 5.2.5. Other Fields of Application

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 6. North America Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (ASRS)

- 6.1.5. Analyzers

- 6.2. Market Analysis, Insights and Forecast - by Field of Application

- 6.2.1. Drug Discovery

- 6.2.2. Genomics

- 6.2.3. Proteomics

- 6.2.4. Clinical Diagnostics

- 6.2.5. Other Fields of Application

- 6.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 7. Europe Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (ASRS)

- 7.1.5. Analyzers

- 7.2. Market Analysis, Insights and Forecast - by Field of Application

- 7.2.1. Drug Discovery

- 7.2.2. Genomics

- 7.2.3. Proteomics

- 7.2.4. Clinical Diagnostics

- 7.2.5. Other Fields of Application

- 7.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 8. Asia Pacific Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (ASRS)

- 8.1.5. Analyzers

- 8.2. Market Analysis, Insights and Forecast - by Field of Application

- 8.2.1. Drug Discovery

- 8.2.2. Genomics

- 8.2.3. Proteomics

- 8.2.4. Clinical Diagnostics

- 8.2.5. Other Fields of Application

- 8.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 9. Rest of the World Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (ASRS)

- 9.1.5. Analyzers

- 9.2. Market Analysis, Insights and Forecast - by Field of Application

- 9.2.1. Drug Discovery

- 9.2.2. Genomics

- 9.2.3. Proteomics

- 9.2.4. Clinical Diagnostics

- 9.2.5. Other Fields of Application

- 9.1. Market Analysis, Insights and Forecast - by Equipment and Software

- 10. North America Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United Kingdom

- 11.1.2 Germany

- 11.1.3 Spain

- 11.1.4 Rest of Europe

- 12. Asia Pacific Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 South Korea

- 12.1.4 Rest of Asia Pacific

- 13. Rest of the World Modular Laboratory Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Honeywell International Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tecan Group Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Siemens Healthcare

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Synchron Lab Automation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Perkinelmer Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Becton Dickinson

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Danaher Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Agilent Technologies*List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Hudson Robotics Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Thermo Fisher Scientific

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Modular Laboratory Automation Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Modular Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Modular Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Modular Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Modular Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Modular Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Modular Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Modular Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Modular Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Modular Laboratory Automation Industry Revenue (Million), by Equipment and Software 2024 & 2032

- Figure 11: North America Modular Laboratory Automation Industry Revenue Share (%), by Equipment and Software 2024 & 2032

- Figure 12: North America Modular Laboratory Automation Industry Revenue (Million), by Field of Application 2024 & 2032

- Figure 13: North America Modular Laboratory Automation Industry Revenue Share (%), by Field of Application 2024 & 2032

- Figure 14: North America Modular Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Modular Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Modular Laboratory Automation Industry Revenue (Million), by Equipment and Software 2024 & 2032

- Figure 17: Europe Modular Laboratory Automation Industry Revenue Share (%), by Equipment and Software 2024 & 2032

- Figure 18: Europe Modular Laboratory Automation Industry Revenue (Million), by Field of Application 2024 & 2032

- Figure 19: Europe Modular Laboratory Automation Industry Revenue Share (%), by Field of Application 2024 & 2032

- Figure 20: Europe Modular Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Modular Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Modular Laboratory Automation Industry Revenue (Million), by Equipment and Software 2024 & 2032

- Figure 23: Asia Pacific Modular Laboratory Automation Industry Revenue Share (%), by Equipment and Software 2024 & 2032

- Figure 24: Asia Pacific Modular Laboratory Automation Industry Revenue (Million), by Field of Application 2024 & 2032

- Figure 25: Asia Pacific Modular Laboratory Automation Industry Revenue Share (%), by Field of Application 2024 & 2032

- Figure 26: Asia Pacific Modular Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Modular Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Modular Laboratory Automation Industry Revenue (Million), by Equipment and Software 2024 & 2032

- Figure 29: Rest of the World Modular Laboratory Automation Industry Revenue Share (%), by Equipment and Software 2024 & 2032

- Figure 30: Rest of the World Modular Laboratory Automation Industry Revenue (Million), by Field of Application 2024 & 2032

- Figure 31: Rest of the World Modular Laboratory Automation Industry Revenue Share (%), by Field of Application 2024 & 2032

- Figure 32: Rest of the World Modular Laboratory Automation Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Modular Laboratory Automation Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Equipment and Software 2019 & 2032

- Table 3: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Field of Application 2019 & 2032

- Table 4: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Spain Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Equipment and Software 2019 & 2032

- Table 21: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Field of Application 2019 & 2032

- Table 22: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United States Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Equipment and Software 2019 & 2032

- Table 26: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Field of Application 2019 & 2032

- Table 27: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Europe Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Equipment and Software 2019 & 2032

- Table 33: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Field of Application 2019 & 2032

- Table 34: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Korea Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Asia Pacific Modular Laboratory Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Equipment and Software 2019 & 2032

- Table 40: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Field of Application 2019 & 2032

- Table 41: Global Modular Laboratory Automation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Modular Laboratory Automation Industry?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Modular Laboratory Automation Industry?

Key companies in the market include Honeywell International Inc, Tecan Group Ltd, Siemens Healthcare, Synchron Lab Automation, Perkinelmer Inc, Becton Dickinson, Danaher Corporation, Agilent Technologies*List Not Exhaustive, Hudson Robotics Inc, Thermo Fisher Scientific.

3. What are the main segments of the Modular Laboratory Automation Industry?

The market segments include Equipment and Software, Field of Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Higher Reproducibility and Effective Management of Vast Amounts of Data; Need for Reliable Automation Solution to Substitute the Unavailability of Skilled Personnel.

6. What are the notable trends driving market growth?

Automated Liquid Handlers Account for the Largest Market Share.

7. Are there any restraints impacting market growth?

Slower Adoption Rates in Small- and Medium-sized Organizations; High Capital Requirements.

8. Can you provide examples of recent developments in the market?

June 2022 - MegaRobo Technologies Ltd announced the completion of a USD 300 million Series C fundraising round. MegaRobo would use the funds to continue its R&D investments, capacity growth, and global expansion. MegaRobo has offered the life sciences industry a comprehensive set of automation solutions. Ranging from benchtop workflow automation for simple workflows to a fully automated platform for complex workflows in large system journey applications, with plans to expand into the next-generation life sciences infrastructure system for R&D and AI drug development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Modular Laboratory Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Modular Laboratory Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Modular Laboratory Automation Industry?

To stay informed about further developments, trends, and reports in the Modular Laboratory Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence