Key Insights

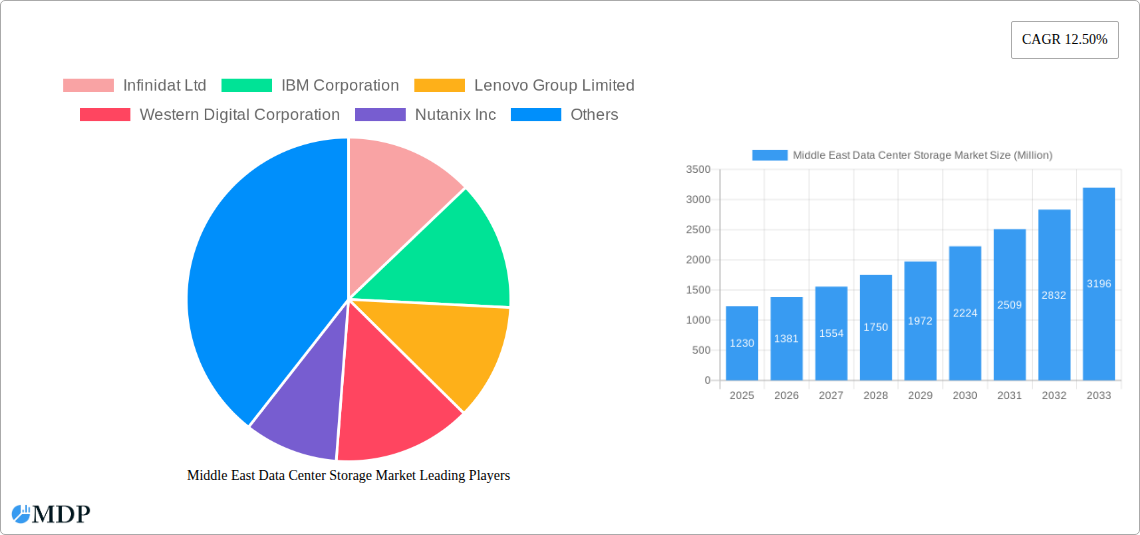

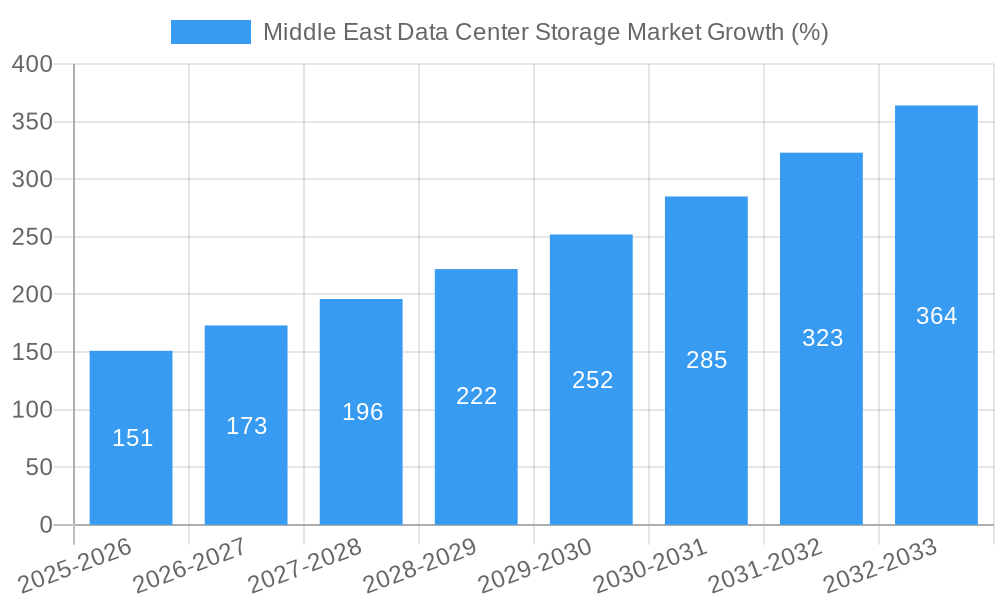

The Middle East Data Center Storage market is experiencing robust growth, projected to reach \$1.23 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.50% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing and digital transformation initiatives across various sectors, including IT & Telecommunications, BFSI (Banking, Financial Services, and Insurance), and Government, are significantly boosting demand for advanced data storage solutions. Furthermore, the region's burgeoning media and entertainment industry, along with the growing need for robust data security and disaster recovery mechanisms, are contributing to market expansion. The preference for high-performance storage technologies like All-Flash Storage and hybrid solutions is also driving market growth, as organizations prioritize speed and efficiency in data processing. Competition among major players like IBM, Dell, NetApp, and others is fostering innovation and driving down costs, making advanced storage solutions more accessible to businesses of all sizes.

However, certain challenges remain. The relatively high initial investment costs associated with implementing advanced storage infrastructure, particularly in smaller enterprises, could act as a restraint. Moreover, the market’s reliance on a limited number of major technology providers could lead to pricing pressures and potential supply chain vulnerabilities. Nevertheless, the overall outlook for the Middle East Data Center Storage market remains positive, driven by continuous technological advancements, increasing digital adoption, and significant government investment in digital infrastructure projects across the region, particularly in countries like the UAE, Saudi Arabia, and Israel. The diverse range of storage technologies (NAS, SAN, DAS), storage types (traditional, all-flash, hybrid), and end-user segments offer significant opportunities for growth in the coming years.

Middle East Data Center Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East data center storage market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a focus on key segments, leading players, and emerging trends, this report is essential for strategic decision-making. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024.

Middle East Data Center Storage Market Dynamics & Concentration

The Middle East data center storage market is experiencing significant growth driven by factors such as the increasing adoption of cloud computing, big data analytics, and the digital transformation initiatives across various sectors. Market concentration is moderate, with a few major players holding substantial market share, but also numerous smaller niche players. Innovation is a key driver, with companies continuously developing advanced storage technologies like all-flash arrays and hyper-converged infrastructure. Regulatory frameworks, while evolving, are generally supportive of technological advancement. Product substitutes, such as cloud storage services, pose a competitive challenge, influencing pricing and adoption strategies. End-user trends reveal a growing preference for flexible, scalable, and cost-effective storage solutions. M&A activity in the sector has been steady, with approximately xx deals recorded in the last five years, consolidating market share and enhancing technological capabilities.

- Market Share: Top 5 players hold approximately 60% of the market share (estimated).

- M&A Deal Count: xx deals (2019-2024).

- Key Innovation Drivers: AI-driven data management, NVMe technology, and edge computing.

- Regulatory Impact: Government initiatives promoting digitalization and data security are creating favorable market conditions.

Middle East Data Center Storage Market Industry Trends & Analysis

The Middle East data center storage market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is fueled by the region's burgeoning digital economy, expanding IT infrastructure, and increasing demand for data storage solutions across various sectors. Technological advancements, such as the adoption of all-flash storage and hyper-converged infrastructure (HCI), are transforming the market landscape, driving market penetration. Consumer preferences are shifting towards cloud-based storage solutions and hybrid models offering flexibility and scalability. Competitive dynamics are intense, with established vendors and new entrants vying for market share through innovation, strategic partnerships, and competitive pricing. Market penetration of all-flash storage is increasing steadily, projected to reach xx% by 2033, while traditional storage is gradually declining, signifying a paradigm shift towards faster and more efficient storage solutions.

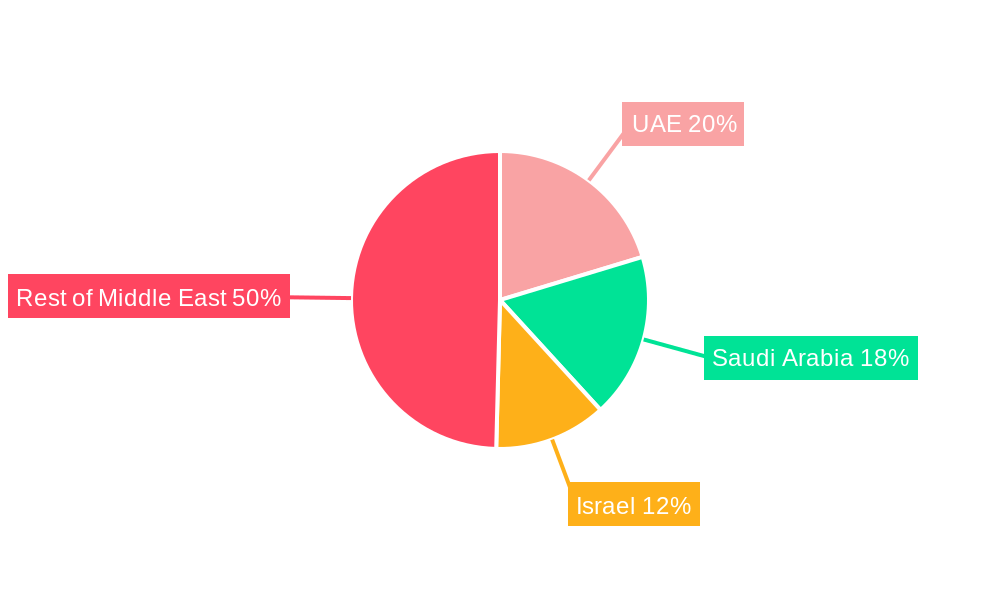

Leading Markets & Segments in Middle East Data Center Storage Market

The United Arab Emirates (UAE) currently holds the leading position in the Middle East data center storage market, followed by Saudi Arabia and Israel. This dominance is attributable to several key factors:

- UAE: Strong government support for digital transformation, robust IT infrastructure investments, and a large concentration of data centers.

- Saudi Arabia: Government's Vision 2030 initiative driving digitalization across various sectors, leading to significant demand for data storage.

- Israel: Established technology hub with a strong presence of data center providers and innovative storage solutions companies.

Segment Dominance:

- By Storage Technology: SAN currently holds the largest market share, followed by NAS. However, DAS is expected to see significant growth with the increasing demand for edge computing solutions.

- By Storage Type: All-flash storage is experiencing rapid growth, driven by its speed and efficiency, while Hybrid Storage offers a cost-effective alternative. Traditional Storage is gradually declining.

- By End-User: The IT & Telecommunication sector dominates the market due to their high data storage needs followed by the BFSI sector.

Middle East Data Center Storage Market Product Developments

Recent product innovations focus on enhancing storage performance, scalability, and security. The adoption of NVMe technology, AI-driven data management solutions, and cloud-integrated storage platforms are prominent trends. Vendors are emphasizing the development of solutions tailored to specific industry needs, such as high-performance computing for the financial sector and enhanced security features for government applications. These developments are improving the market fit of data center storage solutions, catering to a wider range of applications and increasing overall market competitiveness.

Key Drivers of Middle East Data Center Storage Market Growth

Several factors are driving the growth of the Middle East data center storage market. Firstly, the exponential growth of data generated by various sectors necessitates robust storage solutions. Secondly, government initiatives promoting digital transformation and the adoption of advanced technologies are creating a favorable environment for market expansion. Thirdly, increasing investments in cloud computing and big data analytics are fueling demand for scalable and efficient storage solutions. Finally, the rise of the Internet of Things (IoT) and edge computing is generating a significant amount of data which needs to be stored.

Challenges in the Middle East Data Center Storage Market Market

The market faces several challenges. High initial investment costs for advanced storage technologies can be a barrier to entry for smaller businesses. Supply chain disruptions and the increasing dependence on foreign technology vendors can impact market stability. Finally, intense competition amongst established vendors and new entrants creates a dynamic market, necessitating continuous innovation and adaptation. Furthermore, data security and privacy concerns are critical challenges that need effective mitigation strategies.

Emerging Opportunities in Middle East Data Center Storage Market

Significant opportunities exist in the Middle East data center storage market. Technological breakthroughs in areas such as NVMe-oF and composable infrastructure are creating new avenues for growth. Strategic partnerships between technology providers and data center operators can lead to the development of innovative and tailored solutions. Expansion into underserved markets and the increasing demand for edge computing solutions present significant growth potential.

Leading Players in the Middle East Data Center Storage Market Sector

- Infinidat Ltd

- IBM Corporation

- Lenovo Group Limited

- Western Digital Corporation

- Nutanix Inc

- Hewlett Packard Enterprise

- Zadara Inc

- Dell Inc

- SMART Modular Technologies Inc

- NetApp Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

- Pure Storage Inc

Key Milestones in Middle East Data Center Storage Market Industry

- June 2023: Huawei Technologies Co. Ltd launched its innovative data center data infrastructure architecture F2F2X (flash-to-flash-to-anything) at the Huawei Intelligent Finance Summit 2023 (HiFS 2023), enhancing data management capabilities for financial institutions.

- April 2023: Hewlett Packard Enterprise announced new data services designed to enhance performance and reduce costs, improving efficiency for businesses.

Strategic Outlook for Middle East Data Center Storage Market Market

The Middle East data center storage market is poised for sustained growth, driven by technological innovation and increasing digitalization. Strategic opportunities include investing in advanced storage technologies, expanding into new markets, and fostering strategic partnerships. Focusing on providing customized solutions that cater to the specific needs of different industry sectors will be crucial for achieving long-term success in this dynamic and competitive market. Companies focusing on cloud-native and hybrid solutions are expected to gain a significant market advantage.

Middle East Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End Users

Middle East Data Center Storage Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digitalization and Emergence of Data-centric Applications; Rising Cloud Applications Among End Users

- 3.3. Market Restrains

- 3.3.1. Compatibility and Optimum Storage Performance Issues

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. United Arab Emirates Middle East Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Infinidat Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 IBM Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Lenovo Group Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Western Digital Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nutanix Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Hewlett Packard Enterprise

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Zadara Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dell Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SMART Modular Technologies Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 NetApp Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Kingston Technology Company Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Huawei Technologies Co Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Pure Storage Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Infinidat Ltd

List of Figures

- Figure 1: Middle East Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: Middle East Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: Middle East Data Center Storage Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Middle East Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Arab Emirates Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Qatar Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Israel Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Egypt Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oman Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Middle East Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Middle East Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 15: Middle East Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 16: Middle East Data Center Storage Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Middle East Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Saudi Arabia Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Qatar Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kuwait Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Oman Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Bahrain Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Jordan Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Lebanon Middle East Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Storage Market?

The projected CAGR is approximately 12.50%.

2. Which companies are prominent players in the Middle East Data Center Storage Market?

Key companies in the market include Infinidat Ltd, IBM Corporation, Lenovo Group Limited, Western Digital Corporation, Nutanix Inc, Hewlett Packard Enterprise, Zadara Inc, Dell Inc, SMART Modular Technologies Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Pure Storage Inc.

3. What are the main segments of the Middle East Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digitalization and Emergence of Data-centric Applications; Rising Cloud Applications Among End Users.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility and Optimum Storage Performance Issues.

8. Can you provide examples of recent developments in the market?

June 2023: Huawei Technologies Co. Ltd launched its innovative data center data infrastructure architecture F2F2X (flash-to-flash-to-anything) at the Financial Data Storage Session, a part of the Huawei Intelligent Finance Summit 2023 (HiFS 2023). This architecture forms a reliable data foundation to help financial institutions handle the challenges brought by new data, new apps, and new resilience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Middle East Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence