Key Insights

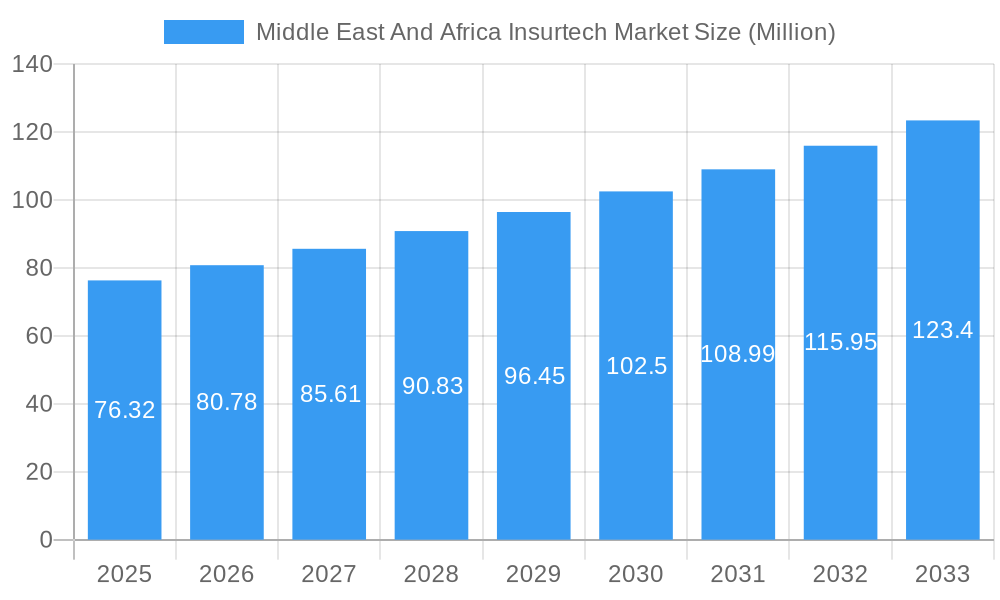

The Middle East and Africa Insurtech market, valued at $76.32 million in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising internet usage, and a burgeoning young population eager to embrace digital solutions. This surge in digital adoption fuels demand for convenient, accessible, and cost-effective insurance products and services. Key drivers include the region's increasing financial inclusion initiatives, government support for technological advancements within the financial sector, and a growing preference for personalized insurance offerings tailored to individual needs. Furthermore, the integration of artificial intelligence (AI), machine learning (ML), and big data analytics is revolutionizing claims processing, risk assessment, and customer service, enhancing operational efficiency and improving customer experience. The market's expansion is further facilitated by strategic partnerships between established insurers and innovative tech companies, fostering collaborative innovation and accelerated market penetration.

Middle East And Africa Insurtech Market Market Size (In Million)

However, challenges remain. Limited digital literacy in certain regions, concerns about data security and privacy, and regulatory hurdles in some markets present obstacles to widespread adoption. Furthermore, a lack of robust infrastructure in certain areas may hinder the seamless implementation of Insurtech solutions. Despite these constraints, the overall market trajectory is positive, with substantial growth opportunities for both established players like ERGO Sigorta, Harel Insurance, and Migdal Holdings, and emerging Insurtech startups such as Bayzat, Aqeed, and Yallacompare. The long-term forecast indicates a consistently expanding market, fueled by continued technological innovation and evolving consumer expectations. This expansion will likely see increased competition, further driving innovation and benefiting consumers with more choice and competitive pricing.

Middle East And Africa Insurtech Market Company Market Share

Middle East & Africa Insurtech Market: A Comprehensive Report (2019-2033)

Unlocking Explosive Growth in a Dynamic Market: This in-depth report provides a comprehensive analysis of the Middle East and Africa Insurtech market, offering invaluable insights for investors, insurers, and tech innovators. We delve into market dynamics, key players, emerging trends, and future growth projections, covering the period from 2019 to 2033. The report leverages extensive data analysis, identifying lucrative opportunities and potential challenges within this rapidly evolving landscape.

Middle East & Africa Insurtech Market Market Dynamics & Concentration

The Middle East and Africa Insurtech market is characterized by a dynamic interplay of factors driving both growth and consolidation. Market concentration is currently moderate, with a few major players holding significant market share, but the landscape is rapidly changing due to the influx of innovative startups and strategic acquisitions. The market exhibits a high level of innovation, fueled by increasing smartphone penetration, rising internet usage, and a growing demand for digital financial services. Regulatory frameworks are evolving, creating both opportunities and challenges for Insurtech firms. Product substitution is a key driver, with Insurtech solutions offering greater efficiency, transparency, and customer convenience compared to traditional insurance models. End-user trends reveal a preference for personalized, on-demand services, further driving the adoption of Insurtech products. M&A activity is increasing, as established insurers seek to integrate Insurtech capabilities and startups strive for scale.

- Market Share: The top 5 players currently hold an estimated xx% of the market share.

- M&A Deal Counts: An estimated xx M&A deals were recorded in the historical period (2019-2024), with an expected increase to xx deals during the forecast period (2025-2033).

- Innovation Drivers: Smartphone penetration, increasing internet access, rising demand for digital financial services.

- Regulatory Framework: Evolving regulations present both opportunities and challenges for Insurtech companies.

Middle East & Africa Insurtech Market Industry Trends & Analysis

The Middle East and Africa Insurtech market exhibits robust growth, driven by several factors. Technological advancements such as AI, blockchain, and big data analytics are transforming insurance operations and customer experiences. Consumers are increasingly demanding faster, more efficient, and personalized insurance solutions, leading to high market penetration of digital channels. The competitive dynamics are intense, with both established insurers and new entrants vying for market share. This competition is fostering innovation and driving down prices, benefiting consumers.

The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of Insurtech solutions is expected to reach xx% by 2033, driven by increasing digital adoption rates and positive consumer perception. Several factors contribute to this impressive growth, including the region's young and tech-savvy population, increasing demand for personalized insurance products, and the government's support for digital transformation initiatives.

Leading Markets & Segments in Middle East & Africa Insurtech Market

The UAE and South Africa currently dominate the Middle East and Africa Insurtech market, accounting for an estimated xx% of the total market value. This dominance is attributable to a number of factors, including:

- UAE:

- Favorable Regulatory Environment: Supportive government policies and initiatives fostering digital innovation.

- Strong Infrastructure: Well-developed telecommunications infrastructure and high internet penetration.

- High per Capita Income: High disposable incomes leading to increased demand for insurance products.

- South Africa:

- Advanced Digital Ecosystem: Relatively advanced digital infrastructure and tech-savvy population.

- Established Financial Sector: A mature financial sector providing a supportive environment for Insurtech development.

Other key markets exhibiting significant growth potential include Kenya, Nigeria, and Egypt. The health insurance segment is expected to be a major driver of growth, followed by property and casualty insurance.

Middle East & Africa Insurtech Market Product Developments

The Middle East and Africa Insurtech market is witnessing rapid product innovation, with the emergence of AI-powered risk assessment tools, personalized pricing models, and digital claims processing systems. These technologies offer significant competitive advantages, enabling faster processing times, reduced operational costs, and improved customer experiences. The integration of telematics data into motor insurance policies is gaining traction, while blockchain technology is being explored for fraud detection and improved transparency. Overall, the market exhibits a strong focus on using technology to enhance efficiency, personalize services, and improve customer satisfaction.

Key Drivers of Middle East & Africa Insurtech Market Growth

Several factors are driving the growth of the Middle East and Africa Insurtech market:

- Technological Advancements: AI, Big Data analytics, Blockchain technologies enable efficiency, personalization, and risk management.

- Economic Growth: Rising disposable incomes fuel increased demand for insurance products.

- Favorable Regulatory Environment: Supportive government policies in certain regions facilitate market growth.

- Increased Smartphone & Internet Penetration: Enhanced digital access widens the reach of Insurtech services.

Challenges in the Middle East And Africa Insurtech Market Market

The market faces several challenges, including:

- Regulatory Hurdles: Varying and sometimes inconsistent regulatory frameworks across different countries.

- Cybersecurity Risks: The digital nature of Insurtech increases vulnerability to cyberattacks.

- Data Privacy Concerns: Stricter data protection regulations impact data utilization.

- Digital Literacy Gaps: Uneven digital literacy levels across the population limit market penetration. This reduces adoption rates by xx% in certain segments.

Emerging Opportunities in Middle East And Africa Insurtech Market

Significant opportunities exist for Insurtech companies in the Middle East and Africa:

- Expansion into Underserved Markets: Significant potential to reach large populations with limited access to traditional insurance.

- Strategic Partnerships: Collaborations with established insurers and telecommunication companies can accelerate market penetration.

- Development of Microinsurance Products: Targeted products catering to low-income segments will expand market reach.

Leading Players in the Middle East & Africa Insurtech Market Sector

- ERGO Sigorta

- Harel Insurance Investments & Finance Services

- Bayzat

- Aqeed

- Yallacompare

- Migdal Holdings

- Old Mutual

- Liberty Holdings

- Clal Insurance Enterprises Holdings Ltd

- Momentum Metropolitan Life Assurers

- Emirates Retakaful Limited

List Not Exhaustive

Key Milestones in Middle East & Africa Insurtech Market Industry

- May 2022: Turtlemint Insurance Services Pvt. Ltd. launches its Dubai office, expanding into the Middle East.

- July 2022: Wellx, a UAE-based health Insurtech platform, secures USD 2 Million in seed funding.

Strategic Outlook for Middle East And Africa Insurtech Market Market

The Middle East and Africa Insurtech market presents significant long-term growth potential. Strategic opportunities lie in leveraging technological advancements, fostering strategic partnerships, and expanding into underserved markets. Continued regulatory clarity and improvements in digital infrastructure will further accelerate market expansion. Focusing on providing accessible and affordable insurance solutions tailored to the specific needs of the region will be crucial for success in this dynamic and promising sector. The market is poised for substantial growth driven by increasing adoption of digital technologies and changing consumer preferences.

Middle East And Africa Insurtech Market Segmentation

-

1. Service

- 1.1. Consulting

- 1.2. Support and Maintenance

- 1.3. Managed Services

-

2. Insurance type

- 2.1. Life

- 2.2. Non-Life

- 2.3. Other Segments

Middle East And Africa Insurtech Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

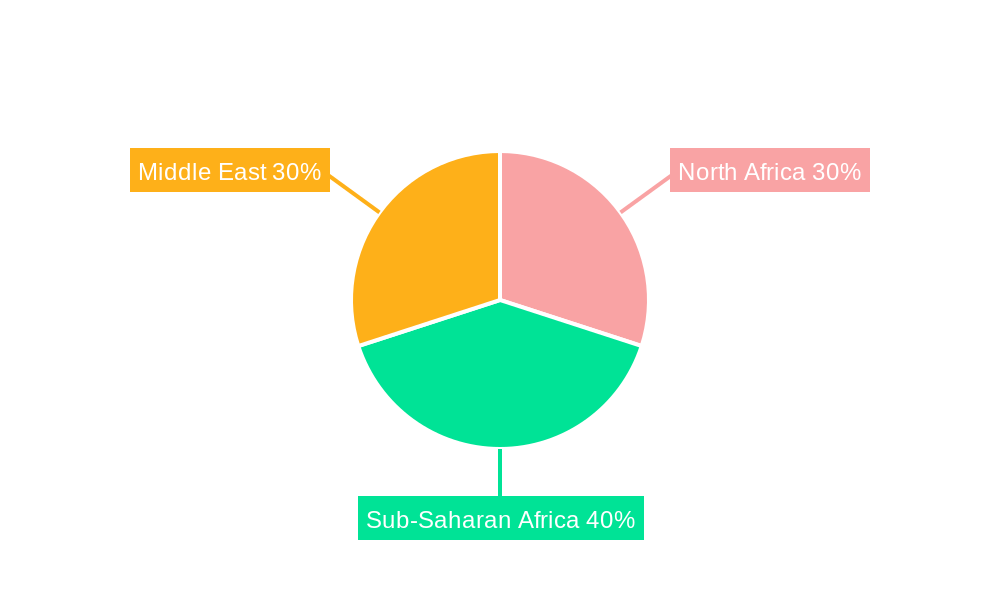

Middle East And Africa Insurtech Market Regional Market Share

Geographic Coverage of Middle East And Africa Insurtech Market

Middle East And Africa Insurtech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In Expenditure On Digital Innovation By Insurance Companies; Increase In Number Of Fintech Companies In The Region

- 3.3. Market Restrains

- 3.3.1. Rise In Expenditure On Digital Innovation By Insurance Companies; Increase In Number Of Fintech Companies In The Region

- 3.4. Market Trends

- 3.4.1. Rising Digitization of Insurance Business

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Insurtech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Consulting

- 5.1.2. Support and Maintenance

- 5.1.3. Managed Services

- 5.2. Market Analysis, Insights and Forecast - by Insurance type

- 5.2.1. Life

- 5.2.2. Non-Life

- 5.2.3. Other Segments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ERGO Sigorta

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Harel Insurance Investments & Finance Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayzat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aqeed

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yallacompare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Migdal Holdings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Old Mutual

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Liberty Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Clal Insurance Enterprises Holdings Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Momentum Metropolitan Life Assurers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Emirates Retakaful Limited**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 ERGO Sigorta

List of Figures

- Figure 1: Middle East And Africa Insurtech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Insurtech Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Insurtech Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Middle East And Africa Insurtech Market Volume Million Forecast, by Service 2020 & 2033

- Table 3: Middle East And Africa Insurtech Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 4: Middle East And Africa Insurtech Market Volume Million Forecast, by Insurance type 2020 & 2033

- Table 5: Middle East And Africa Insurtech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East And Africa Insurtech Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Insurtech Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Middle East And Africa Insurtech Market Volume Million Forecast, by Service 2020 & 2033

- Table 9: Middle East And Africa Insurtech Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 10: Middle East And Africa Insurtech Market Volume Million Forecast, by Insurance type 2020 & 2033

- Table 11: Middle East And Africa Insurtech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle East And Africa Insurtech Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle East And Africa Insurtech Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle East And Africa Insurtech Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Insurtech Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Middle East And Africa Insurtech Market?

Key companies in the market include ERGO Sigorta, Harel Insurance Investments & Finance Services, Bayzat, Aqeed, Yallacompare, Migdal Holdings, Old Mutual, Liberty Holdings, Clal Insurance Enterprises Holdings Ltd, Momentum Metropolitan Life Assurers, Emirates Retakaful Limited**List Not Exhaustive.

3. What are the main segments of the Middle East And Africa Insurtech Market?

The market segments include Service, Insurance type.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In Expenditure On Digital Innovation By Insurance Companies; Increase In Number Of Fintech Companies In The Region.

6. What are the notable trends driving market growth?

Rising Digitization of Insurance Business.

7. Are there any restraints impacting market growth?

Rise In Expenditure On Digital Innovation By Insurance Companies; Increase In Number Of Fintech Companies In The Region.

8. Can you provide examples of recent developments in the market?

In May 2022, Turtlemint Insurance Services Pvt. Ltd which exists as an Indian-based Insurtech firm launched its office in Dubai as a central hub for the company’s business expansion in the Middle East region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Insurtech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Insurtech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Insurtech Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Insurtech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence