Key Insights

India's Liquefied Petroleum Gas (LPG) market is projected for substantial growth, estimated at $136.548 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 4.71% from 2025 to 2033. This expansion is driven by increasing urbanization, rising disposable incomes, and government initiatives promoting cleaner cooking fuels, particularly in rural areas. The industrial sector's demand, coupled with diversification in LPG sourcing from crude oil and natural gas liquids, further supports market growth. Key challenges include fluctuating global oil prices and potential supply chain disruptions. Intense competition among major players like Shell plc, Bharat Petroleum Corporation Limited, and Indian Oil Corporation Ltd. is fostering innovation. Regional consumption is led by North and South India due to higher population density and economic activity.

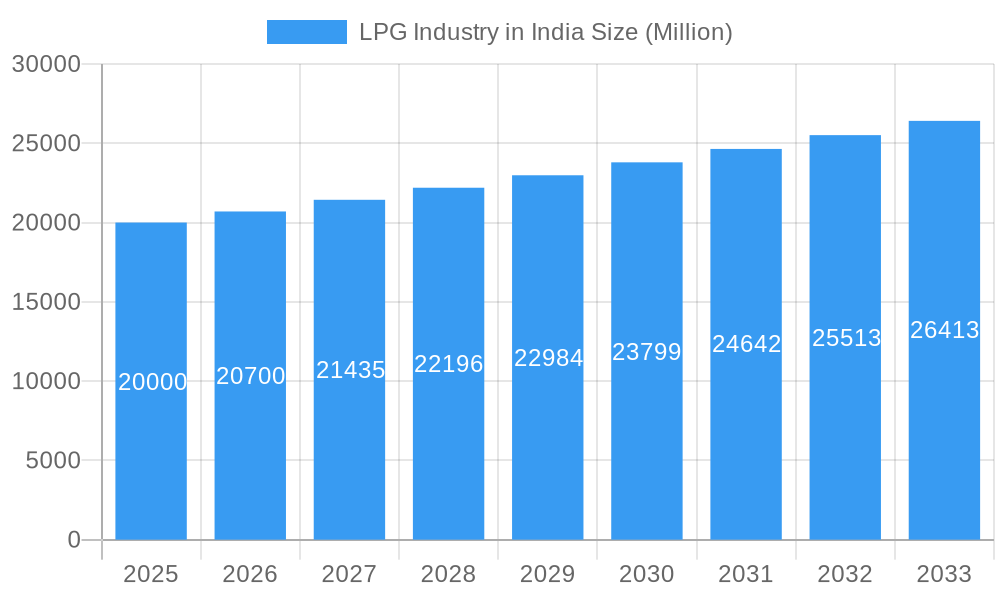

LPG Industry in India Market Size (In Billion)

The residential & commercial application segment dominates the market, followed by industrial and autofuels. The "Other Applications" segment also shows promising growth. While crude oil remains the primary production source, increasing natural gas liquid contributions signal a move towards diversification and potential long-term price stability. Strategic investments in infrastructure, technological advancements, and a shift towards cleaner fuels will shape the market's trajectory between 2025 and 2033. Understanding regional dynamics and competitive landscapes is vital for industry participants.

LPG Industry in India Company Market Share

Indian LPG Market Analysis: Trends, Size, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Indian LPG industry, covering market dynamics, key players, trends, and future growth prospects. Utilizing data from 2019-2024 (historical) and a forecast to 2033, with 2025 as the base year, this report is an indispensable resource for investors and stakeholders. Gain actionable insights into market size, growth drivers, challenges, and opportunities within the Indian LPG sector.

LPG Industry in India Market Dynamics & Concentration

The Indian LPG market, a significant sector within the nation's energy landscape, is characterized by moderate concentration. While precise valuation figures for 2025 require further specification, the market's size is substantial. Key players, including Shell plc, Bharat Petroleum Corporation Limited (BPCL), SUPERGAS (SHV Energy Pvt Ltd), Hindustan Petroleum Corporation Limited (HPCL), Reliance Petroleum Ltd, TotalEnergies SE, Indian Oil Corporation Ltd (IOCL), Eastern Gases Ltd, and Jyothi Gas Pvt Ltd, command substantial market shares. While specific 2025 market share percentages require further data, IOCL historically holds a leading position, followed by BPCL and HPCL. The remaining market share is distributed among other participants, including numerous smaller, regional distributors. This competitive landscape reflects a balance between established players and a more fragmented sector of smaller operators.

Innovation in the sector is driven by the imperative to enhance efficiency across the LPG value chain—from transportation and storage to retail distribution. The regulatory landscape, overseen primarily by the Ministry of Petroleum & Natural Gas, emphasizes safety regulations, price controls, and environmental protection. The industry faces competitive pressure from substitute fuels, such as Compressed Natural Gas (CNG) and electricity, particularly within the industrial and commercial sectors. However, LPG maintains its dominant position in the residential market. Consumer trends point towards a growing demand for safer, more efficient LPG appliances and convenient, reliable delivery services. Mergers and acquisitions (M&A) activity has been relatively subdued in recent years, suggesting a stable, albeit competitive, market structure with limited large-scale consolidation.

LPG Industry in India Industry Trends & Analysis

The Indian LPG market is experiencing robust growth, driven by rising disposable incomes, expanding urbanization, and government initiatives promoting clean cooking fuel. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. This growth is further fueled by increasing penetration in rural areas and rising demand from the industrial and commercial segments. Technological advancements, such as improved cylinder technology and automated delivery systems, are streamlining operations and enhancing safety. Consumer preferences are shifting towards convenient online ordering and doorstep delivery, pushing companies to invest in digital platforms. Competitive dynamics are primarily shaped by price competition, brand loyalty, and the expanding network of distribution channels. Market penetration in rural areas remains a key focus area for companies looking to capture significant growth.

Leading Markets & Segments in LPG Industry in India

Source of Production: By 2025, Natural Gas Liquids (NGLs) are projected to become the primary source of LPG production in India, representing an estimated [Insert Percentage]% of total production. This shift reflects the increased availability of NGLs from domestic refineries and the government's policy focus on bolstering domestic NGL production. While crude oil will continue to be a significant source, its relative contribution is anticipated to decrease gradually as NGL production expands.

Application: The Residential & Commercial sector will remain the largest consumer of LPG in 2025, accounting for approximately [Insert Percentage]% of the market. This dominance is attributed to the extensive LPG distribution network and widespread use of LPG for cooking in households and commercial kitchens throughout both urban and rural India. The Industrial segment, however, displays strong growth potential, driven by industrial expansion and increased demand for LPG in various industrial applications. Autofuel usage of LPG currently holds a comparatively small market share of approximately [Insert Percentage]%, but future growth potential is contingent on policy support and infrastructural development.

Regional Dominance: The Northern and Western regions of India are projected to lead the LPG market in 2025, owing to factors such as high population density, strong industrial activity, and a well-established distribution network. Government initiatives aimed at improving LPG access in underserved areas are however fostering substantial growth in the Eastern and Northeastern parts of the country, narrowing the regional disparities.

LPG Industry in India Product Developments

Recent product innovations focus on improving safety features in LPG cylinders, enhancing energy efficiency of appliances, and developing smart metering systems for improved monitoring and billing. The introduction of composite cylinders is expected to enhance safety and reduce weight, improving the overall user experience. These developments aim to improve market fit by addressing both safety and convenience concerns of consumers, further increasing LPG's market share against competing fuels.

Key Drivers of LPG Industry in India Growth

The growth of the Indian LPG industry is primarily driven by several factors, including increasing affordability, government subsidies and initiatives promoting LPG adoption (particularly in rural areas to reduce reliance on traditional biomass fuels), and rising urbanization leading to increased household demand. Technological improvements in cylinder production, distribution, and appliance technology also contribute to higher adoption rates. Furthermore, the expansion of the pipeline infrastructure for LPG distribution enhances efficiency and reduces reliance on transportation by road.

Challenges in the LPG Industry in India Market

The Indian LPG industry faces several key challenges. Fluctuations in crude oil prices directly impact LPG pricing and profitability, creating uncertainty for businesses. Supply chain disruptions, particularly during periods of peak demand or unforeseen events, can hinder reliable delivery to consumers. Competition from alternative fuels like CNG and electricity, particularly within the industrial sector, necessitates ongoing adaptation and innovation. Furthermore, evolving safety and environmental regulations impose significant compliance costs and operational complexities for companies operating within the sector.

Emerging Opportunities in LPG Industry in India

The expanding Indian middle class and the rising demand for cleaner cooking fuel present significant opportunities for market growth. Investments in infrastructure development and the expansion of pipeline networks are expected to reduce transportation costs and improve supply chain efficiency. Strategic partnerships between LPG companies, appliance manufacturers, and technology providers can lead to innovative product and service offerings tailored to evolving consumer preferences. Finally, exploring new applications for LPG and penetrating niche markets represent further avenues for growth within the dynamic Indian LPG market.

Leading Players in the LPG Industry in India Sector

- Shell plc

- Bharat Petroleum Corporation Limited

- SUPERGAS (SHV Energy Pvt Ltd)

- Hindustan Petroleum Corporation Limited

- Reliance Petroleum Ltd

- TotalEnergies SE

- Indian Oil Corporation Ltd

- Eastern Gases Ltd

- Jyothi Gas Pvt Ltd

Key Milestones in LPG Industry in India Industry

- February 2022: Indian Oil Corp (IOC) announced plans to construct three new plants in Northeast India, increasing LPG bottling capacity by 53% (to 8 crore cylinders annually by 2030) – a significant investment (INR 325-350 crore) reflecting strong growth expectations in the region.

Strategic Outlook for LPG Industry in India Market

The future of the Indian LPG market is bright, driven by robust demand, sustained government support, and the potential for technological advancements to further improve efficiency and safety. Strategic investments in infrastructure, expansion into new markets, and product diversification will be crucial for companies to secure a significant share of the expanding market. Companies that adapt to the evolving consumer preferences and leverage technological advancements will be best positioned to capitalize on the growth opportunities in the coming years.

LPG Industry in India Segmentation

-

1. Source of Production

- 1.1. Crude Oil

- 1.2. Natural Gas Liquids

-

2. Application

- 2.1. Residential & Commercial

- 2.2. Industrial

- 2.3. Autofuels

- 2.4. Other Applications

LPG Industry in India Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

LPG Industry in India Regional Market Share

Geographic Coverage of LPG Industry in India

LPG Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Declining Cost of Wind Energy

- 3.2.2 Increasing Investments in Wind Energy Power Generation Projects

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Alternate Clean Power Sources

- 3.4. Market Trends

- 3.4.1. LPG Extracted From Natural Gas is Expected to Have Considerable Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LPG Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Production

- 5.1.1. Crude Oil

- 5.1.2. Natural Gas Liquids

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential & Commercial

- 5.2.2. Industrial

- 5.2.3. Autofuels

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Source of Production

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bharat Petroleum Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SUPERGAS (SHV Energy Pvt Ltd )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hindustan Petroleum Corporation Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reliance Petroleum Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TotalEnergies SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eastern Gases Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jyothi Gas Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Shell plc

List of Figures

- Figure 1: Global LPG Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific LPG Industry in India Revenue (billion), by Source of Production 2025 & 2033

- Figure 3: Asia Pacific LPG Industry in India Revenue Share (%), by Source of Production 2025 & 2033

- Figure 4: Asia Pacific LPG Industry in India Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific LPG Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific LPG Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific LPG Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LPG Industry in India Revenue billion Forecast, by Source of Production 2020 & 2033

- Table 2: Global LPG Industry in India Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global LPG Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global LPG Industry in India Revenue billion Forecast, by Source of Production 2020 & 2033

- Table 5: Global LPG Industry in India Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global LPG Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 7: India LPG Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LPG Industry in India?

The projected CAGR is approximately 4.71%.

2. Which companies are prominent players in the LPG Industry in India?

Key companies in the market include Shell plc, Bharat Petroleum Corporation Limited, SUPERGAS (SHV Energy Pvt Ltd ), Hindustan Petroleum Corporation Limited, Reliance Petroleum Ltd, TotalEnergies SE, Indian Oil Corporation Ltd, Eastern Gases Lt, Jyothi Gas Pvt Ltd.

3. What are the main segments of the LPG Industry in India?

The market segments include Source of Production, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 136.548 billion as of 2022.

5. What are some drivers contributing to market growth?

Declining Cost of Wind Energy. Increasing Investments in Wind Energy Power Generation Projects.

6. What are the notable trends driving market growth?

LPG Extracted From Natural Gas is Expected to Have Considerable Growth Rate.

7. Are there any restraints impacting market growth?

Increasing Adoption of Alternate Clean Power Sources.

8. Can you provide examples of recent developments in the market?

In February 2022, Indian Oil Corp (IOC) announced the plans to construct three new plants in Northeast India to increase its LPG bottling capacity by nearly 53% or to 8 crore cylinders annually by 2030, to meet the growing demand in the region. Furthermore, the total investment in the plant expansion is likely to range between INR 325-350 crore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LPG Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LPG Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LPG Industry in India?

To stay informed about further developments, trends, and reports in the LPG Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence