Key Insights

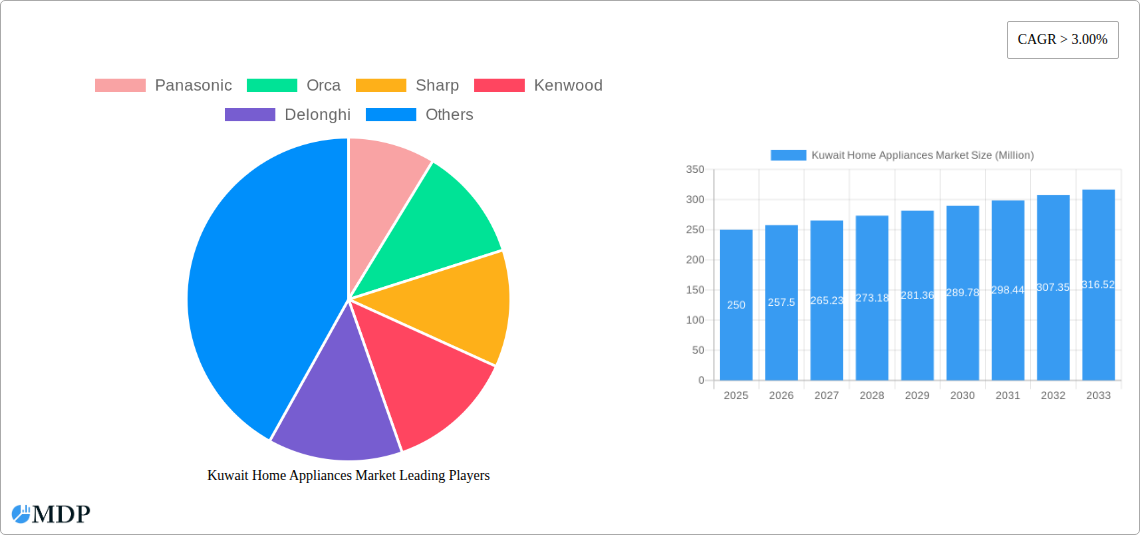

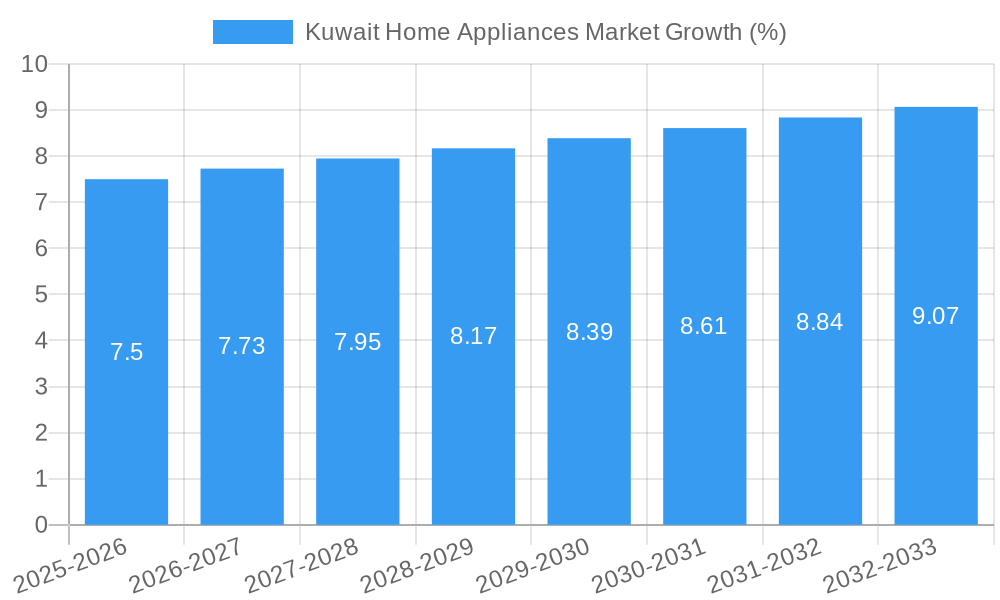

The Kuwait home appliances market, valued at approximately $250 million in 2025, exhibits robust growth potential, driven by rising disposable incomes, increasing urbanization, and a preference for modern, convenient lifestyles. The market is segmented by product type (major appliances like refrigerators and washing machines, and smaller appliances such as blenders and toasters) and distribution channels (multi-branded stores, specialty stores, and online retail). Major players like Panasonic, Orca, Sharp, Kenwood, De'Longhi, Moulinex, Whirlpool, Braun, Bosch, and Midea compete for market share, leveraging brand recognition and product innovation. Growth is further fueled by the increasing adoption of smart home technology and energy-efficient appliances, reflecting a growing awareness of sustainability among Kuwaiti consumers. However, market growth faces potential constraints, such as economic fluctuations, and competition from imported goods. The market is expected to maintain a CAGR above 3% from 2025 to 2033, indicating a steady expansion in the coming years. The online distribution channel is expected to witness significant growth due to increased internet penetration and e-commerce adoption.

The forecast period (2025-2033) suggests a gradual increase in market size, driven by the projected growth in the Kuwaiti population and a continued shift toward modern home appliances. The market’s segmentation presents opportunities for targeted marketing strategies, with brands focusing on specific product categories or distribution channels. Companies are likely to invest in improving their online presence and enhancing customer service to remain competitive. Product differentiation, emphasizing features like smart connectivity and energy efficiency, will be crucial for success. Moreover, strategic partnerships with local retailers and e-commerce platforms will be essential to gain wider market access and reach diverse consumer segments.

Kuwait Home Appliances Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Kuwait home appliances market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report leverages robust data and in-depth analysis to project a market valued at xx Million by 2033.

Kuwait Home Appliances Market Market Dynamics & Concentration

The Kuwait home appliances market exhibits a moderately concentrated structure, with key players such as Panasonic, Orca, Sharp, Kenwood, Delonghi, Moulinex, Whirlpool, Braun, Bosch, and Midea vying for market share. Market concentration is influenced by factors including brand loyalty, distribution network strength, and technological innovation. The market is driven by increasing disposable incomes, urbanization, and a growing preference for modern, energy-efficient appliances. Stringent energy efficiency regulations are also shaping product development and consumer choices. Product substitution, particularly with smart appliances featuring integrated technologies, is a significant trend.

The market witnessed xx M&A deals during the historical period (2019-2024), reflecting consolidation efforts among players. Market share distribution among the top 10 players is estimated to be as follows (2025):

- Panasonic: xx%

- Orca: xx%

- Sharp: xx%

- Kenwood: xx%

- Delonghi: xx%

- Moulinex: xx%

- Whirlpool: xx%

- Braun: xx%

- Bosch: xx%

- Midea: xx%

Kuwait Home Appliances Market Industry Trends & Analysis

The Kuwait home appliances market is experiencing robust growth, driven by rising urbanization, increasing disposable incomes, and a shift towards modern lifestyles. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. Technological disruptions, such as the rise of smart appliances and IoT integration, are significantly impacting consumer preferences and shaping competitive dynamics. Market penetration of smart appliances is expected to increase from xx% in 2025 to xx% by 2033. Consumers are increasingly prioritizing energy efficiency, smart features, and aesthetically pleasing designs. Competitive intensity is high, with established players focusing on brand building, product differentiation, and strategic partnerships.

Leading Markets & Segments in Kuwait Home Appliances Market

The Kuwait home appliances market is primarily driven by the major appliances segment, which holds a significant market share due to high demand for refrigerators, washing machines, and air conditioners. Within the distribution channels, multi-branded stores maintain dominance, although online sales are steadily growing.

- Key Drivers for Major Appliances: Rising household incomes, increasing urbanization, and replacement demand.

- Key Drivers for Small Appliances: Growing consumer preference for convenience, increasing adoption of kitchen gadgets, and rising demand for personal care appliances.

- Key Drivers for Multi-Branded Stores: Wide product availability, established distribution networks, and strong brand recognition.

- Key Drivers for Online Sales: Growing internet penetration, increasing convenience, and competitive pricing strategies.

The dominance of major appliances and multi-branded stores is expected to persist throughout the forecast period, although the online segment is poised for significant growth.

Kuwait Home Appliances Market Product Developments

Recent years have witnessed significant innovation in the Kuwait home appliances market, with companies focusing on energy efficiency, smart features, and enhanced user experience. Key trends include the integration of IoT technology, the rise of smart home ecosystems, and the development of appliances with advanced functionalities like voice control and app integration. This focus on technological advancement is enhancing product appeal and driving market growth.

Key Drivers of Kuwait Home Appliances Market Growth

Several factors fuel the growth of the Kuwait home appliances market. Technological advancements leading to energy-efficient and smart appliances are a major driver. Positive economic indicators, such as rising disposable incomes and increased consumer spending, contribute to higher demand. Furthermore, favorable government policies promoting energy conservation encourage the adoption of energy-efficient appliances.

Challenges in the Kuwait Home Appliances Market Market

Despite favorable market dynamics, several challenges hinder market growth. Supply chain disruptions, particularly during periods of global uncertainty, can impact product availability and increase prices. Intense competition from both domestic and international players necessitates continuous product innovation and effective marketing strategies. Furthermore, fluctuating energy prices can influence consumer purchasing decisions and overall market demand.

Emerging Opportunities in Kuwait Home Appliances Market

The Kuwait home appliances market presents several promising opportunities. The growing adoption of smart homes and the integration of IoT technology offer significant potential for growth. Strategic partnerships between appliance manufacturers and technology companies can unlock innovative products and expand market reach. Moreover, expansion into underserved market segments and the development of specialized appliances catering to specific consumer needs can open new avenues for growth.

Leading Players in the Kuwait Home Appliances Market Sector

Key Milestones in Kuwait Home Appliances Market Industry

- June 2022: TCL partners with Jashanmal to launch its new range of ACs, expanding its market reach.

- August 2021: GE Appliances partners with Google Cloud to develop next-generation smart home technologies, driving innovation in the sector.

Strategic Outlook for Kuwait Home Appliances Market Market

The Kuwait home appliances market presents significant long-term growth potential, driven by technological advancements, increasing consumer spending, and supportive government policies. Companies can leverage these opportunities by focusing on product innovation, strategic partnerships, and targeted marketing campaigns. Capitalizing on the growing adoption of smart appliances and expanding into emerging market segments will be key to success in this dynamic market.

Kuwait Home Appliances Market Segmentation

-

1. Product

-

1.1. Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Ovens

- 1.1.6. Air Conditioners

- 1.1.7. Other Major Appliances

-

1.2. Small Appliances

- 1.2.1. Coffee/Tea Makers

- 1.2.2. Food Processors

- 1.2.3. Grills and Roasters

- 1.2.4. Vacuum Cleaners

- 1.2.5. Other Small Appliances

-

1.1. Major Appliances

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Kuwait Home Appliances Market Segmentation By Geography

- 1. Kuwait

Kuwait Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances

- 3.4. Market Trends

- 3.4.1. Urban Areas Account for Majority of Sales in Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Ovens

- 5.1.1.6. Air Conditioners

- 5.1.1.7. Other Major Appliances

- 5.1.2. Small Appliances

- 5.1.2.1. Coffee/Tea Makers

- 5.1.2.2. Food Processors

- 5.1.2.3. Grills and Roasters

- 5.1.2.4. Vacuum Cleaners

- 5.1.2.5. Other Small Appliances

- 5.1.1. Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orca

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sharp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delonghi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moulinex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Whirlpool

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Braun

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bosch

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Kuwait Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Kuwait Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Kuwait Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Kuwait Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Kuwait Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Kuwait Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Kuwait Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Kuwait Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Kuwait Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: Kuwait Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 13: Kuwait Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Kuwait Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 15: Kuwait Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Kuwait Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Home Appliances Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Kuwait Home Appliances Market?

Key companies in the market include Panasonic, Orca, Sharp, Kenwood, Delonghi, Moulinex, Whirlpool, Braun, Bosch, Midea.

3. What are the main segments of the Kuwait Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth.

6. What are the notable trends driving market growth?

Urban Areas Account for Majority of Sales in Market.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances.

8. Can you provide examples of recent developments in the market?

June 2022: TCL partners with Jashanmal to launch it's new range of AC's. The partnership will enable TCL to reach a wider customer base with its top-of-the-line home appliances and air conditioners (AC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Home Appliances Market?

To stay informed about further developments, trends, and reports in the Kuwait Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence