Key Insights

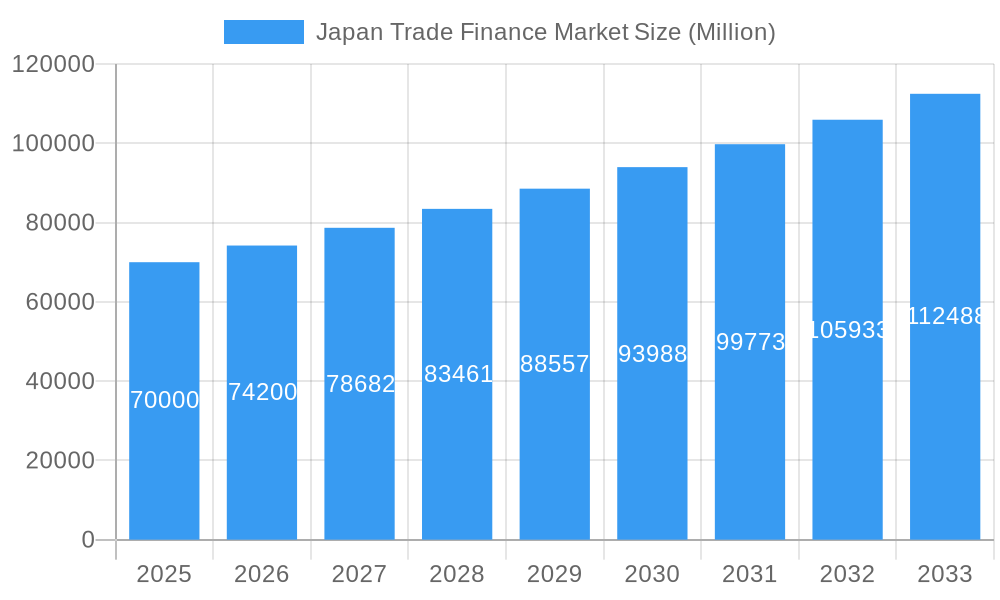

The Japan Trade Finance Market is projected for significant expansion, driven by increasing global trade volumes and Japan's influential position in the international economy. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 5.6%. Key growth catalysts include rising cross-border transactions, particularly within Asia, the escalating demand for advanced risk mitigation strategies by Japanese enterprises involved in international trade, and supportive government policies aimed at bolstering exports and foreign direct investment. The market is segmented by financial instruments, service types, and industry verticals. Prominent players such as Wells Fargo, Morgan Stanley, and Sumitomo Mitsui Banking Corporation are actively competing, offering tailored trade finance solutions to address dynamic client requirements. Sustained market expansion is anticipated throughout the forecast period.

Japan Trade Finance Market Market Size (In Billion)

The current market size is estimated at $52.39 billion in the base year 2025. This growth trajectory is expected to persist, notwithstanding potential challenges like geopolitical volatility, currency exchange rate fluctuations, and evolving regulatory frameworks. The market's increasing embrace of digitalization and fintech solutions signals substantial growth prospects. The competitive environment, characterized by the presence of major global banks, regional institutions, and specialized providers, fosters innovation and product enhancement, ultimately benefiting businesses engaged in international commerce. Future market performance will be closely linked to the success of Japan's export-driven industries and the overall health of the global economic landscape.

Japan Trade Finance Market Company Market Share

Japan Trade Finance Market Report: 2019-2033 Forecast

Dive deep into the dynamic Japan Trade Finance Market with this comprehensive report, offering actionable insights for stakeholders and investors. This in-depth analysis covers market size, growth drivers, key players, and future trends, providing a complete picture of this vital sector from 2019 to 2033. The report leverages extensive data and expert analysis to provide a detailed forecast for the period 2025-2033, with 2025 serving as the base year. Discover lucrative investment opportunities and navigate the evolving landscape of Japanese trade finance with confidence.

Japan Trade Finance Market Market Dynamics & Concentration

The Japan Trade Finance Market exhibits a moderately concentrated structure, with a handful of major global and domestic players commanding significant market share. Sumitomo Mitsui Banking Corporation (SMBC) and Mitsubishi UFJ Financial Group Inc. hold dominant positions, benefiting from established client networks and extensive branch networks. However, the market is witnessing increased competition from international banks like Wells Fargo, Morgan Stanley, Standard Chartered, Mizuho Financial Group, Royal Bank Of Scotland Plc, Bank Of America, and BNP Paribas, as well as the Asian Development Bank.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Drivers: Digitalization, blockchain technology, and AI-driven solutions are driving innovation in trade finance, enhancing efficiency and security.

- Regulatory Framework: The Japanese government's focus on promoting international trade and streamlining regulations is creating a favorable environment for market growth. Stringent regulatory compliance and anti-money laundering policies, however, present challenges.

- Product Substitutes: The emergence of fintech solutions and alternative financing platforms presents some competitive pressure, but traditional banking remains the dominant channel.

- End-User Trends: Growing demand for seamless cross-border transactions, supply chain financing, and risk mitigation solutions are shaping market demand.

- M&A Activities: An estimated xx M&A deals occurred between 2019 and 2024, primarily driven by expansion strategies and consolidation efforts. The average deal size was approximately xx Million.

Japan Trade Finance Market Industry Trends & Analysis

The Japan Trade Finance Market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing global trade, particularly with Asian economies, and the rising demand for sophisticated trade finance solutions. Technological advancements such as blockchain technology and AI are streamlining processes and reducing costs. The market penetration of digital trade finance solutions is expected to reach xx% by 2033. However, challenges persist, including geopolitical uncertainties and fluctuations in global commodity prices. Competitive pressures are intensifying, leading to innovative product offerings and strategic partnerships. Consumer preference for faster, more transparent, and cost-effective solutions is driving the adoption of digital platforms.

Leading Markets & Segments in Japan Trade Finance Market

The dominant segment within the Japanese trade finance market is the import/export financing of manufactured goods, particularly automotive parts, electronics, and machinery. The Kanto region accounts for the largest share of the market due to its concentration of major corporations and trading hubs.

- Key Drivers in the Kanto Region:

- Highly concentrated industrial base.

- Strong infrastructure supporting international trade.

- Presence of major financial institutions.

- Supportive government policies for exports.

The dominance of this sector is underpinned by Japan's significant role in global manufacturing and its robust export-oriented economy. The ongoing expansion of e-commerce and the increasing reliance on global supply chains are further driving demand for efficient and reliable trade finance services. The government's initiatives aimed at promoting digitalization are also bolstering the growth of the sector.

Japan Trade Finance Market Product Developments

Recent product developments focus on leveraging technology to enhance efficiency and transparency in trade finance. This includes the integration of blockchain technology for secure and streamlined documentation processes, AI-powered risk assessment tools, and digital platforms for seamless transaction management. These innovations provide competitive advantages by reducing processing times, minimizing costs, and enhancing security. The market is also seeing a rise in specialized solutions tailored to specific industry needs, further strengthening market fit.

Key Drivers of Japan Trade Finance Market Growth

The Japan Trade Finance Market is driven by several key factors: Firstly, the robust growth of Japan's export-oriented economy, particularly in key sectors like automotive, electronics, and machinery, fuels demand for effective trade finance solutions. Secondly, technological advancements, such as blockchain and AI, are enhancing efficiency, transparency, and security, driving market adoption. Finally, government initiatives aimed at streamlining trade processes and digitalizing trade documentation are creating a supportive regulatory environment.

Challenges in the Japan Trade Finance Market Market

The market faces several challenges: Firstly, increased regulatory scrutiny and compliance requirements increase operational costs and complexity for financial institutions. Secondly, global supply chain disruptions and geopolitical uncertainty create risks and uncertainties in trade finance transactions. Finally, intensifying competition from both traditional and fintech players puts pressure on pricing and margins. These combined factors are estimated to negatively impact the market by xx Million annually.

Emerging Opportunities in Japan Trade Finance Market

Emerging opportunities stem from several key areas: The burgeoning adoption of digital trade finance platforms driven by technology advancements presents significant growth potential. Strategic partnerships between traditional banks and fintech companies can leverage the strengths of both, creating innovative solutions. Expansion into new markets and sectors, particularly those with strong trade linkages with Japan, offers further growth avenues.

Leading Players in the Japan Trade Finance Market Sector

- Wells Fargo

- Morgan Stanley

- Sumitomo Mitsui Banking Corporation

- Standard Chartered

- Mizuho Financial Group

- Royal Bank Of Scotland Plc

- Bank Of America

- Mitsubishi UFJ Financial Group Inc

- BNP Paribas

- Asian Development Bank

List Not Exhaustive

Key Milestones in Japan Trade Finance Market Industry

- October 2022: Morgan Stanley Investment Management's partnership with Opportunity Finance Network highlights a growing focus on socially responsible investing within the trade finance sector. This move could indirectly influence the market by promoting ethical and inclusive business practices among trade finance providers.

- August 2022: The MOU between Sumitomo Mitsui Banking Corporation and Banque Misr signifies a significant step toward digitizing trade processes, accelerating efficiency, and potentially opening new trade corridors between Japan, Egypt, and other Asian nations. This directly impacts the market by driving the adoption of digital solutions.

Strategic Outlook for Japan Trade Finance Market Market

The Japan Trade Finance Market is poised for sustained growth, driven by technological advancements, supportive government policies, and the increasing complexity of global trade. Strategic opportunities lie in embracing digital transformation, fostering strategic partnerships, and expanding into high-growth markets. The focus on sustainability and ethical practices also presents a pathway for differentiation and long-term market leadership. The market is expected to surpass xx Million by 2033.

Japan Trade Finance Market Segmentation

-

1. Service Provider

- 1.1. Banks

- 1.2. Trade Finance Companies

- 1.3. Insurance Companies

- 1.4. Other Service Providers

-

2. Application

- 2.1. Domestic

- 2.2. International

Japan Trade Finance Market Segmentation By Geography

- 1. Japan

Japan Trade Finance Market Regional Market Share

Geographic Coverage of Japan Trade Finance Market

Japan Trade Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digitization is Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Trade Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 5.1.1. Banks

- 5.1.2. Trade Finance Companies

- 5.1.3. Insurance Companies

- 5.1.4. Other Service Providers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wells Fargo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Morgan Stanley

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Mitsui Banking Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Standard Chartered

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mizuho Financial Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Bank Of Scotland Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank Of America

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi UFJ Financial Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BNP Paribas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asian Development Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Wells Fargo

List of Figures

- Figure 1: Japan Trade Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Trade Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Trade Finance Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 2: Japan Trade Finance Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Japan Trade Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Trade Finance Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 5: Japan Trade Finance Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Japan Trade Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Trade Finance Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Japan Trade Finance Market?

Key companies in the market include Wells Fargo, Morgan Stanley, Sumitomo Mitsui Banking Corporation, Standard Chartered, Mizuho Financial Group, Royal Bank Of Scotland Plc, Bank Of America, Mitsubishi UFJ Financial Group Inc, BNP Paribas, Asian Development Bank**List Not Exhaustive.

3. What are the main segments of the Japan Trade Finance Market?

The market segments include Service Provider, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digitization is Boosting the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Morgan Stanley Investment Management (MSIM) chose Opportunity Finance Network (OFN) as its diversity and inclusion partner for MSIM's charity donation connected to the recently introduced Impact Class, the firm said today. The OFN is a top national network comprising 370 Community Development Finance Institutions (CDFIs). Its goal is to help underserved areas get cheap, honest financial services and products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Trade Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Trade Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Trade Finance Market?

To stay informed about further developments, trends, and reports in the Japan Trade Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence