Key Insights

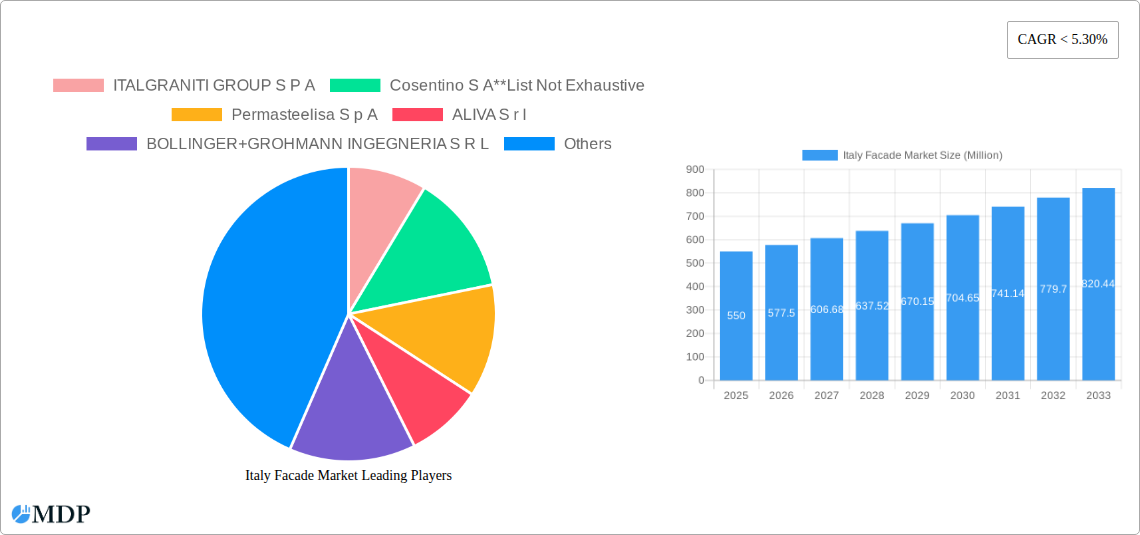

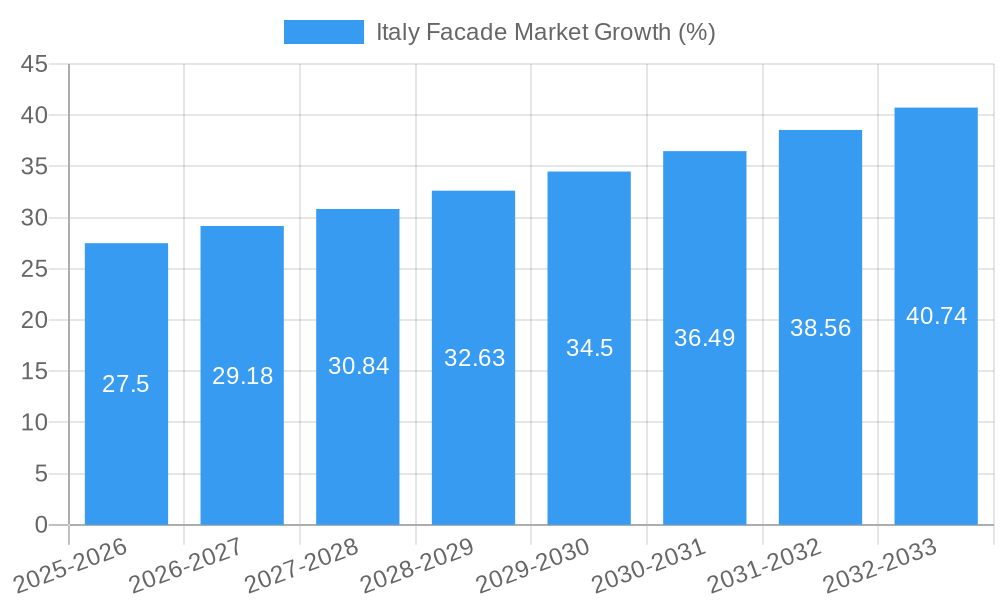

The Italy facade market, encompassing the design, manufacturing, and installation of exterior building cladding, is experiencing robust growth. While precise market size figures for 2019-2024 are unavailable, a logical estimation based on global trends and Italy's construction sector indicates a substantial market value, potentially exceeding €500 million in 2025. This growth is driven by several factors: a rising focus on building renovations and energy efficiency within existing structures, spurred by government incentives and environmental regulations. The increasing popularity of sustainable building materials, including those with improved insulation properties and lower carbon footprints, contributes to this expansion. Furthermore, Italy's strong tourism sector fuels demand for aesthetically pleasing and durable facades, enhancing the visual appeal of both new and renovated buildings. The market also benefits from technological advancements in facade systems, such as prefabricated modules, which streamline installation and reduce project timelines. This combination of factors indicates a promising outlook for the Italian facade market.

Looking ahead to the forecast period (2025-2033), continued growth is anticipated, fueled by ongoing investments in infrastructure development and a sustained interest in aesthetically pleasing and energy-efficient building designs. A conservative Compound Annual Growth Rate (CAGR) estimate of 4-5% over the forecast period suggests a market value surpassing €700 million by 2033. This growth will likely be driven by the adoption of innovative materials and techniques, along with continued government support for sustainable building practices. However, potential challenges include fluctuations in construction activity due to economic factors and the availability of skilled labor. Despite these challenges, the long-term prospects for the Italy facade market remain positive, presenting significant opportunities for manufacturers, installers, and related businesses.

Italy Facade Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy Facade Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, and includes an analysis of key market segments, leading players, and future growth opportunities. The market is segmented by end-user (Commercial, Residential, Other End-Users), type (Ventilated, Non-Ventilated, Other Types), and material (Glass, Metal, Plastic and Fibres, Stones, Other Materials). Expected market value in 2025 is estimated at xx Million.

Italy Facade Market Market Dynamics & Concentration

The Italy facade market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise market share figures for individual companies remain proprietary, ITALGRANITI GROUP S P A, Cosentino S A, Permasteelisa S p A, and Wienerberger are recognized as prominent players. The market is driven by ongoing construction activity, particularly in the commercial sector, coupled with increasing demand for aesthetically pleasing and energy-efficient building designs. Regulatory frameworks emphasizing energy efficiency and sustainability are also shaping market growth. Significant mergers and acquisitions (M&A) activity, such as the Wienerberger acquisition of Terreal assets, indicates a consolidating market. Product substitution is limited due to the specialized nature of facade systems. However, the market is witnessing the adoption of innovative materials, pushing established players to innovate and maintain their market positions.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Drivers: Demand for energy efficiency, aesthetic appeal, and sustainable materials.

- Regulatory Framework: Stringent building codes and sustainability regulations.

- M&A Activity: Significant consolidation through acquisitions like the Wienerberger/Terreal deal.

- Number of M&A Deals (2019-2024): xx

- Estimated Market Share of Top 5 Players in 2025: xx%

Italy Facade Market Industry Trends & Analysis

The Italy facade market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include rising construction investments, particularly in urban renewal projects and infrastructure development. The adoption of sustainable and energy-efficient facade systems is gaining momentum, driven by government initiatives and environmental concerns. Technological advancements, such as the incorporation of smart materials and Building Information Modeling (BIM), are further enhancing the market's growth trajectory. Competitive dynamics are characterized by intense rivalry among established players and the emergence of innovative startups offering specialized solutions. Market penetration of ventilated facades is increasing due to their superior thermal performance.

- CAGR (2025-2033): xx%

- Market Penetration of Ventilated Facades (2025): xx%

- Market Size (2025): xx Million

Leading Markets & Segments in Italy Facade Market

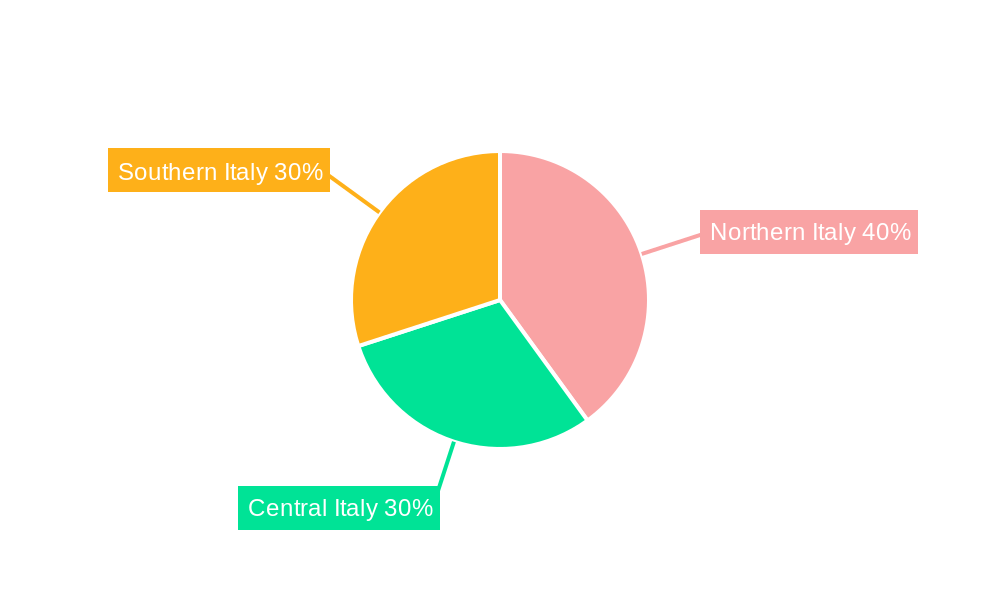

The Commercial sector currently dominates the Italy facade market, fueled by significant construction of office buildings, hotels, and retail spaces in major urban centers. However, the Residential segment is expected to experience considerable growth over the forecast period due to rising urbanization and improving living standards. Ventilated facades represent the leading type, owing to their superior energy efficiency and aesthetic qualities. Glass and metal are the most widely used materials, driven by their durability and design flexibility. Northern Italy's regions exhibit higher demand due to a strong construction industry.

- Dominant End-User Segment: Commercial

- Fastest Growing End-User Segment: Residential

- Dominant Facade Type: Ventilated

- Dominant Materials: Glass and Metal

- Key Drivers for Commercial Sector: Urban renewal, infrastructure development, tourism.

- Key Drivers for Residential Sector: Urbanization, rising disposable incomes.

Italy Facade Market Product Developments

Recent product innovations focus on enhancing energy efficiency, sustainability, and design flexibility. Smart facades integrating sensors and building management systems are gaining traction. The market is witnessing the introduction of advanced materials such as high-performance glass and lightweight composite panels. These developments offer competitive advantages through improved thermal performance, reduced maintenance costs, and enhanced aesthetic appeal, thereby catering to the evolving market needs and preferences.

Key Drivers of Italy Facade Market Growth

The Italy facade market's growth is primarily driven by the following factors:

- Construction Boom: Significant investments in infrastructure and commercial real estate.

- Government Initiatives: Policies promoting energy efficiency and sustainable building practices.

- Technological Advancements: Innovation in materials, design, and manufacturing processes.

Challenges in the Italy Facade Market Market

The market faces challenges including:

- Supply Chain Disruptions: Global supply chain volatility impacting material availability and cost.

- Economic Fluctuations: Impact of economic downturns on construction investment.

- Intense Competition: Pressure from established and emerging players.

Emerging Opportunities in Italy Facade Market

The Italy facade market presents several promising opportunities:

- Smart Facade Technology: Integration of sensors and IoT devices for improved energy management.

- Sustainable Materials: Increased demand for eco-friendly and recyclable materials.

- Modular Facade Systems: Prefabrication and modular construction for faster and more efficient installation.

Leading Players in the Italy Facade Market Sector

- ITALGRANITI GROUP S P A

- Cosentino S.A.

- Permasteelisa S p A

- ALIVA S r l

- BOLLINGER+GROHMANN INGEGNERIA S R L

- Arup

- BEMO SYSTEMS GmbH

- Bluesteel S r l

- Focchi S p A

- Ramboll Group A/S

- Aghito Zambonini S p a

- CANTORI S r l

- Wienerberger

- Zanetti Srl

- Incide Engineering SRL

Key Milestones in Italy Facade Market Industry

- February 2022: Acquisition of Memphis Milano by Italian Radical Design, enhancing artistic design in the facade industry.

- December 2022: Wienerberger's acquisition of Terreal assets expands its production footprint and market presence.

Strategic Outlook for Italy Facade Market Market

The Italy facade market is poised for robust growth, driven by ongoing construction activity, technological advancements, and increasing focus on sustainability. Strategic opportunities exist for companies to invest in innovation, expand their product portfolios, and leverage strategic partnerships to capitalize on the market's potential. Focus on sustainable and smart facade solutions will be crucial for long-term success.

Italy Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Other Types

-

2. Material

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastic and Fibres

- 2.4. Stones

- 2.5. Other Materials

-

3. End Users

- 3.1. Commercial

- 3.2. Residential

- 3.3. Other End-Users

Italy Facade Market Segmentation By Geography

- 1. Italy

Italy Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy efficiency in construction; Flexibility and customization options

- 3.3. Market Restrains

- 3.3.1. Limited availability of suitable land for construction; Lower quality compared to traditional construction

- 3.4. Market Trends

- 3.4.1. Facade as An Environmental Architecture Propelling Market Growth in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Facade Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastic and Fibres

- 5.2.4. Stones

- 5.2.5. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ITALGRANITI GROUP S P A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cosentino S A**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Permasteelisa S p A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ALIVA S r l

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BOLLINGER+GROHMANN INGEGNERIA S R L

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BEMO SYSTEMS GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bluesteel S r l

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Focchi S p A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ramboll Group A/S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aghito Zambonini S p a

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CANTORI S r l

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Wienerberger

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Zanetti Srl

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Incide Engineering SRL

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 ITALGRANITI GROUP S P A

List of Figures

- Figure 1: Italy Facade Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Facade Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Italy Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Italy Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 5: Italy Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italy Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Italy Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Italy Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 9: Italy Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 10: Italy Facade Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Facade Market?

The projected CAGR is approximately < 5.30%.

2. Which companies are prominent players in the Italy Facade Market?

Key companies in the market include ITALGRANITI GROUP S P A, Cosentino S A**List Not Exhaustive, Permasteelisa S p A, ALIVA S r l, BOLLINGER+GROHMANN INGEGNERIA S R L, Arup, BEMO SYSTEMS GmbH, Bluesteel S r l, Focchi S p A, Ramboll Group A/S, Aghito Zambonini S p a, CANTORI S r l, Wienerberger, Zanetti Srl, Incide Engineering SRL.

3. What are the main segments of the Italy Facade Market?

The market segments include Type, Material, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Energy efficiency in construction; Flexibility and customization options.

6. What are the notable trends driving market growth?

Facade as An Environmental Architecture Propelling Market Growth in Italy.

7. Are there any restraints impacting market growth?

Limited availability of suitable land for construction; Lower quality compared to traditional construction.

8. Can you provide examples of recent developments in the market?

December 2022: The Wienerberger Group, a top supplier of environmentally friendly construction materials and infrastructure solutions, announced that it has made an offer to Terreal's shareholders to purchase certain key assets of Terreal. The acquisition would cover Terreal's operations in France, Italy, Spain, and the United States, as well as Creaton's businesses in Germany and the Benelux, which Terreal acquired in 2020 and which collectively employ close to 3,000 people. After the deal, Wienerberger would add 29 new sites to its production footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Facade Market?

To stay informed about further developments, trends, and reports in the Italy Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence