Key Insights

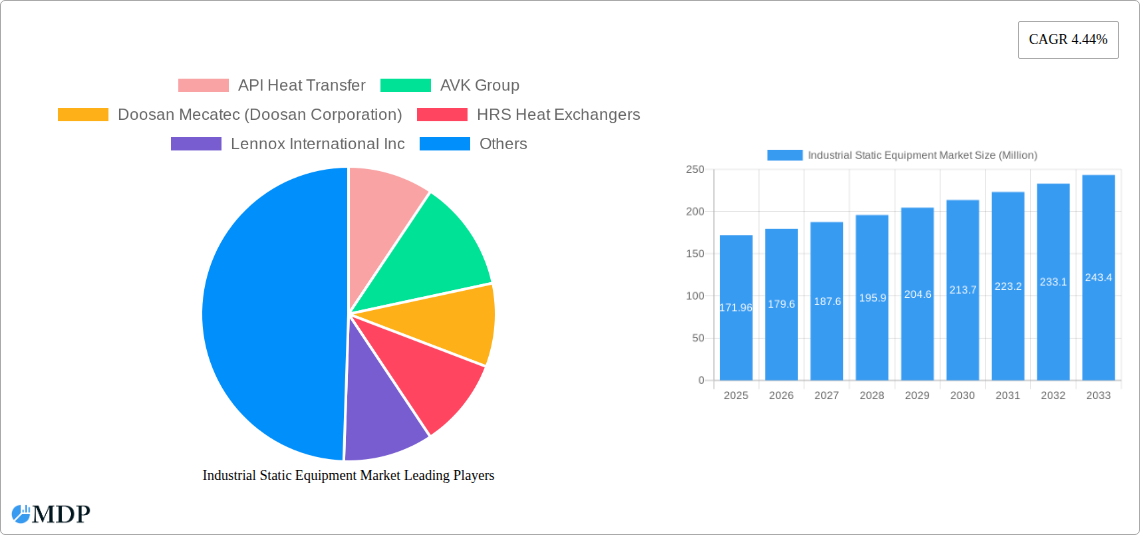

The Industrial Static Equipment market, valued at $171.96 million in 2025, is projected to experience robust growth, driven by increasing investments in infrastructure development across key sectors like oil & gas, power generation, and chemical processing. A compound annual growth rate (CAGR) of 4.44% from 2025 to 2033 indicates a steadily expanding market. This growth is fueled by the rising demand for efficient and reliable equipment in these industries, coupled with stringent regulatory requirements for safety and environmental compliance. The market segmentation reveals a significant share held by valves and pressure relief equipment within the "By Type" category, reflecting their crucial role in process control and safety. Similarly, the oil and gas sector dominates the "By End-user Industry" segment, underscoring its heavy reliance on robust and durable static equipment. Ongoing technological advancements, such as the adoption of smart sensors and predictive maintenance technologies, are further driving market expansion. However, factors like fluctuating raw material prices and potential supply chain disruptions could pose challenges to sustained growth.

The competitive landscape is marked by the presence of both established multinational corporations and specialized regional players. Companies like Emerson Electric, Alfa Laval, and General Electric represent major players with diversified product portfolios and global reach. Meanwhile, regional companies often cater to niche market segments or specific geographic regions, providing localized solutions and support. Future market expansion is likely to be driven by increasing automation in industrial processes, a growing focus on energy efficiency, and the implementation of Industry 4.0 technologies. The continued growth in emerging economies, particularly in Asia-Pacific, presents significant opportunities for market expansion, while the North American and European markets are expected to maintain a substantial share due to existing industrial infrastructure and established regulatory frameworks.

Industrial Static Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Industrial Static Equipment Market, offering invaluable insights for stakeholders across the value chain. With a detailed study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils market dynamics, industry trends, leading segments, and key players shaping this crucial sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Industrial Static Equipment Market Market Dynamics & Concentration

The Industrial Static Equipment Market exhibits a moderately concentrated landscape, with several large players holding significant market share. Market concentration is influenced by factors such as technological advancements, stringent regulatory frameworks, and the emergence of substitute products. The market share held by the top 5 players is estimated at xx%, while the remaining share is distributed among numerous smaller companies. Innovation, driven by the need for improved efficiency, safety, and sustainability, is a key driver of market growth. Regulatory changes, particularly those related to emissions and safety standards, influence product development and adoption. The market has also witnessed a moderate level of M&A activity, with xx major deals recorded in the past five years. This consolidation reflects companies' strategies to expand their product portfolios and geographical reach. End-user trends, primarily focusing on automation, digitalization and sustainable practices, significantly impact market demand, creating opportunities for specialized equipment.

- Market Concentration: Top 5 players hold xx% market share.

- M&A Activity: xx major deals in the past 5 years.

- Key Drivers: Innovation, Regulatory Changes, End-user Trends.

- Challenges: Competition, Technological Disruption.

Industrial Static Equipment Market Industry Trends & Analysis

The Industrial Static Equipment Market is experiencing significant growth driven by robust demand from various end-user industries. The expanding oil and gas sector, coupled with investments in power generation and infrastructure projects, particularly in developing economies, fuels market expansion. Technological disruptions, including the adoption of advanced materials and digital technologies like IoT and AI, are transforming the industry. These technologies enhance operational efficiency, safety, and predictive maintenance, creating new market opportunities. Consumer preferences increasingly prioritize sustainable and environmentally friendly solutions, pushing manufacturers to develop more energy-efficient and low-emission equipment. The market demonstrates strong competitive dynamics with players vying for market share through product innovation, strategic partnerships, and geographical expansion. The market is expected to grow at a CAGR of xx% from 2025 to 2033, with market penetration rates steadily increasing in emerging economies. Specific market segments such as valves for high-pressure hydrogen applications have experienced rapid growth exceeding xx% CAGR in the last two years.

Leading Markets & Segments in Industrial Static Equipment Market

The Oil and Gas sector remains the dominant end-user industry for industrial static equipment, with its large-scale infrastructure and ongoing exploration & production activities driving substantial demand. Geographically, North America and Asia Pacific dominate the market, owing to robust industrial activity and significant investments in energy and chemical projects.

By Type:

- Valves: The valves segment holds the largest market share, driven by diverse applications across all end-user industries. Technological advancements, such as the development of low-emission valves, further fuel growth.

- Pressure Relief Equipment (Furnaces/Boilers): This segment witnesses steady growth, fuelled by increased safety regulations and demand from power generation and process industries.

- Heat Exchangers: Growing emphasis on energy efficiency and heat recovery drives consistent demand.

- Pressure Vessels: The pressure vessels segment experiences moderate growth, driven by demand from the chemical and petrochemical industries.

By End-user Industry:

- Oil and Gas: Dominant segment driven by exploration and production activities.

- Power Generation: Steady growth fueled by investments in renewable and conventional power plants.

- Chemicals and Petrochemicals: Significant demand driven by large-scale industrial processes.

- Water and Wastewater: Moderate growth driven by infrastructure development and treatment upgrades.

- Other Process Industries: This segment demonstrates consistent growth driven by diverse industrial activities.

Key Drivers (by region):

- North America: Robust industrial activity, stringent environmental regulations.

- Asia Pacific: Rapid industrialization, substantial infrastructure investments.

- Europe: Focus on energy efficiency, stringent emission norms.

Industrial Static Equipment Market Product Developments

Recent innovations focus on enhancing efficiency, safety, and sustainability. Emerson's launch of the ASCO Series 084 solenoid valve highlights advancements in precision flow control for critical applications. Similarly, Emerson's H2 Valve Series and Flowserve's Durco G4XZ valve demonstrate a commitment to improving safety and complying with stringent emission standards in high-pressure hydrogen and industrial process applications. These developments emphasize the trend towards compact designs, higher flow rates, and improved leak prevention. The increasing adoption of smart technologies like sensors and data analytics is improving equipment performance and predictive maintenance capabilities.

Key Drivers of Industrial Static Equipment Market Growth

The market's growth is propelled by several key factors. First, the increasing demand for energy across various sectors fuels the need for efficient and reliable industrial static equipment. Second, stringent environmental regulations worldwide push the adoption of low-emission and energy-efficient technologies. Third, the growing complexity of industrial processes requires advanced equipment capable of handling demanding operational conditions. Finally, technological advancements in materials science and automation technologies continuously improve equipment performance and reduce operational costs.

Challenges in the Industrial Static Equipment Market Market

Several factors pose challenges to market growth. Fluctuations in commodity prices, particularly for raw materials like steel and specialized alloys, impact production costs and profitability. Supply chain disruptions can cause delays in project execution and affect overall market performance. The intensity of competition within the market necessitates continuous investment in Research and Development to maintain a competitive edge and ensure compliance with ever-evolving safety and environmental regulations, adding further cost and complexity. Stringent safety standards and certification requirements also increase the cost of product development and deployment.

Emerging Opportunities in Industrial Static Equipment Market

Significant long-term growth is anticipated from the expansion of renewable energy sources, such as solar and wind power, that require sophisticated static equipment for efficient energy conversion. The development of hydrogen-based economies will generate substantial demand for high-pressure hydrogen handling equipment. Strategic partnerships between equipment manufacturers and end-user industries allow tailored solutions and foster collaborative innovation. Furthermore, the penetration into emerging markets presents significant growth potential as industrialization expands in these regions.

Leading Players in the Industrial Static Equipment Market Sector

- API Heat Transfer

- AVK Group

- Doosan Mecatec (Doosan Corporation)

- HRS Heat Exchangers

- Lennox International Inc

- Japan Steel Works Ltd

- Emerson Electric CO

- Hitachi Zosen Corporation

- EG Valves

- Leser GMBH & CO KG

- The Fulton Companies

- Worcester Bosch Group (the Bosch Group)

- Ideal Boilers (ideal Heating)

- Shanghai Electric Group Company Limited

- Baxi (BDR Thermea Group)

- IHI Power Services Corp (IHI Corporation)

- Baker Hughes Company

- Danfoss A/S

- AKO Armaturen & Separationstecchink GMBH

- General Electric Company

- Schlumberger Limited

- Viessmann Group

- Burnham Commercial Boiler

- Hisaka Works Ltd

- Alfa Laval AB

- Mitsubishi Heavy Industries Ltd

Key Milestones in Industrial Static Equipment Market Industry

- September 2022: Emerson launched the ASCO Series 084 solenoid valve, improving precision flow control in critical applications.

- July 2022: Emerson launched the H2 Valve Series for hydrogen applications, enhancing safety and reducing emissions.

- March 2022: Flowserve engineered the Durco G4XZ low-emission plug valve, ensuring compliance with stringent emission standards.

Strategic Outlook for Industrial Static Equipment Market Market

The future of the Industrial Static Equipment Market is promising, driven by ongoing industrialization, investments in renewable energy, and the need for sustainable solutions. Companies focused on innovation, strategic partnerships, and expansion into emerging markets are poised for significant growth. The focus on developing energy-efficient, low-emission equipment will be paramount. Those who leverage technological advancements and adapt to evolving regulatory landscapes are best positioned for long-term success.

Industrial Static Equipment Market Segmentation

-

1. Type

-

1.1. Valves

- 1.1.1. Gate, Globe, and Check

- 1.1.2. Ball Valves

- 1.1.3. Butterfly

- 1.1.4. Plug

- 1.1.5. Pressure Relief

- 1.2. Furnaces/Boilers

- 1.3. Heat Exchangers

- 1.4. Pressure Vessels

-

1.1. Valves

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Chemicals and Petrochemicals

- 2.4. Water and Wastewater

- 2.5. Other Process Industries

- 2.6. Other Discrete Industries

Industrial Static Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Industrial Static Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Industrialization; Increasing Oil and Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. High Investment Cost and Shift Toward Renewable Energy Generation Sources

- 3.4. Market Trends

- 3.4.1. Rapid Industrialization Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Valves

- 5.1.1.1. Gate, Globe, and Check

- 5.1.1.2. Ball Valves

- 5.1.1.3. Butterfly

- 5.1.1.4. Plug

- 5.1.1.5. Pressure Relief

- 5.1.2. Furnaces/Boilers

- 5.1.3. Heat Exchangers

- 5.1.4. Pressure Vessels

- 5.1.1. Valves

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Chemicals and Petrochemicals

- 5.2.4. Water and Wastewater

- 5.2.5. Other Process Industries

- 5.2.6. Other Discrete Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Valves

- 6.1.1.1. Gate, Globe, and Check

- 6.1.1.2. Ball Valves

- 6.1.1.3. Butterfly

- 6.1.1.4. Plug

- 6.1.1.5. Pressure Relief

- 6.1.2. Furnaces/Boilers

- 6.1.3. Heat Exchangers

- 6.1.4. Pressure Vessels

- 6.1.1. Valves

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Power Generation

- 6.2.3. Chemicals and Petrochemicals

- 6.2.4. Water and Wastewater

- 6.2.5. Other Process Industries

- 6.2.6. Other Discrete Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Valves

- 7.1.1.1. Gate, Globe, and Check

- 7.1.1.2. Ball Valves

- 7.1.1.3. Butterfly

- 7.1.1.4. Plug

- 7.1.1.5. Pressure Relief

- 7.1.2. Furnaces/Boilers

- 7.1.3. Heat Exchangers

- 7.1.4. Pressure Vessels

- 7.1.1. Valves

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Power Generation

- 7.2.3. Chemicals and Petrochemicals

- 7.2.4. Water and Wastewater

- 7.2.5. Other Process Industries

- 7.2.6. Other Discrete Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Valves

- 8.1.1.1. Gate, Globe, and Check

- 8.1.1.2. Ball Valves

- 8.1.1.3. Butterfly

- 8.1.1.4. Plug

- 8.1.1.5. Pressure Relief

- 8.1.2. Furnaces/Boilers

- 8.1.3. Heat Exchangers

- 8.1.4. Pressure Vessels

- 8.1.1. Valves

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Power Generation

- 8.2.3. Chemicals and Petrochemicals

- 8.2.4. Water and Wastewater

- 8.2.5. Other Process Industries

- 8.2.6. Other Discrete Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Valves

- 9.1.1.1. Gate, Globe, and Check

- 9.1.1.2. Ball Valves

- 9.1.1.3. Butterfly

- 9.1.1.4. Plug

- 9.1.1.5. Pressure Relief

- 9.1.2. Furnaces/Boilers

- 9.1.3. Heat Exchangers

- 9.1.4. Pressure Vessels

- 9.1.1. Valves

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Power Generation

- 9.2.3. Chemicals and Petrochemicals

- 9.2.4. Water and Wastewater

- 9.2.5. Other Process Industries

- 9.2.6. Other Discrete Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Valves

- 10.1.1.1. Gate, Globe, and Check

- 10.1.1.2. Ball Valves

- 10.1.1.3. Butterfly

- 10.1.1.4. Plug

- 10.1.1.5. Pressure Relief

- 10.1.2. Furnaces/Boilers

- 10.1.3. Heat Exchangers

- 10.1.4. Pressure Vessels

- 10.1.1. Valves

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Power Generation

- 10.2.3. Chemicals and Petrochemicals

- 10.2.4. Water and Wastewater

- 10.2.5. Other Process Industries

- 10.2.6. Other Discrete Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Industrial Static Equipment Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 API Heat Transfer

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 AVK Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Doosan Mecatec (Doosan Corporation)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 HRS Heat Exchangers

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lennox International Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Japan Steel Works Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Emerson Electric CO

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Hitachi Zosen Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 EG Valves

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Leser GMBH & CO KG

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 The Fulton Companies

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Worcester Bosch Group (the Bosch Group)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Ideal Boilers (ideal Heating)

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Shanghai Electric Group Company Limited

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Baxi (BDR Thermea Group)

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 IHI Power Services Corp (IHI Corporation)

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Baker Hughes Company

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 Danfoss A/S

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.19 AKO Armaturen & Separationstecchink GMBH

- 16.2.19.1. Overview

- 16.2.19.2. Products

- 16.2.19.3. SWOT Analysis

- 16.2.19.4. Recent Developments

- 16.2.19.5. Financials (Based on Availability)

- 16.2.20 General Electric Company

- 16.2.20.1. Overview

- 16.2.20.2. Products

- 16.2.20.3. SWOT Analysis

- 16.2.20.4. Recent Developments

- 16.2.20.5. Financials (Based on Availability)

- 16.2.21 Schlumberger Limited

- 16.2.21.1. Overview

- 16.2.21.2. Products

- 16.2.21.3. SWOT Analysis

- 16.2.21.4. Recent Developments

- 16.2.21.5. Financials (Based on Availability)

- 16.2.22 Viessmann Group

- 16.2.22.1. Overview

- 16.2.22.2. Products

- 16.2.22.3. SWOT Analysis

- 16.2.22.4. Recent Developments

- 16.2.22.5. Financials (Based on Availability)

- 16.2.23 Burnham Commercial Boiler

- 16.2.23.1. Overview

- 16.2.23.2. Products

- 16.2.23.3. SWOT Analysis

- 16.2.23.4. Recent Developments

- 16.2.23.5. Financials (Based on Availability)

- 16.2.24 Hisaka Works Ltd

- 16.2.24.1. Overview

- 16.2.24.2. Products

- 16.2.24.3. SWOT Analysis

- 16.2.24.4. Recent Developments

- 16.2.24.5. Financials (Based on Availability)

- 16.2.25 Alfa Laval AB

- 16.2.25.1. Overview

- 16.2.25.2. Products

- 16.2.25.3. SWOT Analysis

- 16.2.25.4. Recent Developments

- 16.2.25.5. Financials (Based on Availability)

- 16.2.26 Mitsubishi Heavy Industries Ltd

- 16.2.26.1. Overview

- 16.2.26.2. Products

- 16.2.26.3. SWOT Analysis

- 16.2.26.4. Recent Developments

- 16.2.26.5. Financials (Based on Availability)

- 16.2.1 API Heat Transfer

List of Figures

- Figure 1: Global Industrial Static Equipment Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Industrial Static Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Industrial Static Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Industrial Static Equipment Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Industrial Static Equipment Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Industrial Static Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Industrial Static Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Industrial Static Equipment Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Industrial Static Equipment Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Industrial Static Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Industrial Static Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Industrial Static Equipment Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Industrial Static Equipment Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Industrial Static Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Industrial Static Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Industrial Static Equipment Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Industrial Static Equipment Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Industrial Static Equipment Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Industrial Static Equipment Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Industrial Static Equipment Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Industrial Static Equipment Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Industrial Static Equipment Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Industrial Static Equipment Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Static Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Static Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Industrial Static Equipment Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Industrial Static Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Industrial Static Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Industrial Static Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Industrial Static Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Industrial Static Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Industrial Static Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Industrial Static Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Industrial Static Equipment Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Industrial Static Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Industrial Static Equipment Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Industrial Static Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Industrial Static Equipment Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Industrial Static Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Industrial Static Equipment Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Industrial Static Equipment Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Industrial Static Equipment Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Industrial Static Equipment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Static Equipment Market?

The projected CAGR is approximately 4.44%.

2. Which companies are prominent players in the Industrial Static Equipment Market?

Key companies in the market include API Heat Transfer, AVK Group, Doosan Mecatec (Doosan Corporation), HRS Heat Exchangers, Lennox International Inc, Japan Steel Works Ltd, Emerson Electric CO, Hitachi Zosen Corporation, EG Valves, Leser GMBH & CO KG, The Fulton Companies, Worcester Bosch Group (the Bosch Group), Ideal Boilers (ideal Heating), Shanghai Electric Group Company Limited, Baxi (BDR Thermea Group), IHI Power Services Corp (IHI Corporation), Baker Hughes Company, Danfoss A/S, AKO Armaturen & Separationstecchink GMBH, General Electric Company, Schlumberger Limited, Viessmann Group, Burnham Commercial Boiler, Hisaka Works Ltd, Alfa Laval AB, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Industrial Static Equipment Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 171.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Industrialization; Increasing Oil and Gas Exploration Activities.

6. What are the notable trends driving market growth?

Rapid Industrialization Drives the Market Growth.

7. Are there any restraints impacting market growth?

High Investment Cost and Shift Toward Renewable Energy Generation Sources.

8. Can you provide examples of recent developments in the market?

September 2022 - Emerson launched the ASCO Series 084, a new, miniature, cartridge-style solenoid valve that precisely controls the flow rates of gases in a range of critical applications, including oxygen therapy and powered patient support surfaces. It will be able to handle more than 140 liters per minute at 20 pounds per square inch. The Series 084 is rated to operate reliably at some of the highest flow rates of any solenoid valve in the health care industry, all in a portable, easy-to-install package.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Static Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Static Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Static Equipment Market?

To stay informed about further developments, trends, and reports in the Industrial Static Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence