Key Insights

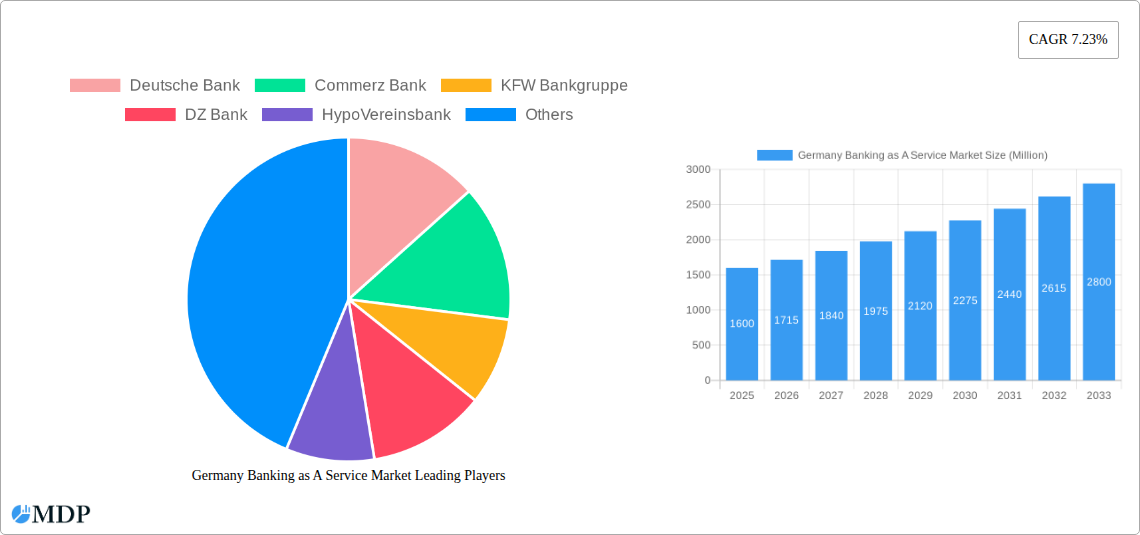

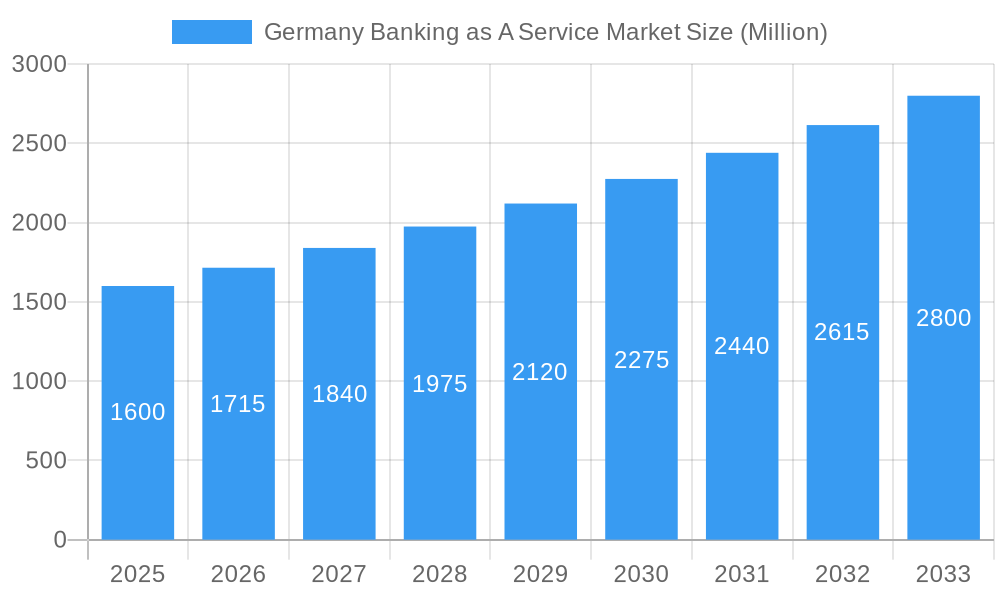

The German Banking-as-a-Service (BaaS) market, valued at €1.6 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.23% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing digitalization within the German financial sector is pushing traditional banks to adopt BaaS solutions to enhance efficiency, reduce operational costs, and offer innovative financial products. Furthermore, the rise of fintech companies and the growing demand for embedded finance are creating significant opportunities for BaaS providers. The regulatory environment, while evolving, is generally supportive of innovation in the financial technology sector, further contributing to market growth. Competition is intense, with established players like Deutsche Bank, Commerzbank, and KfW Bankgruppe alongside agile fintechs like SolarisBank, Mambu, and Bankable vying for market share. This competitive landscape fosters innovation and drives down prices, benefiting both banks and end-customers. Challenges include navigating evolving data privacy regulations (GDPR) and ensuring robust cybersecurity measures, as these are crucial for maintaining customer trust in the BaaS ecosystem.

Germany Banking as A Service Market Market Size (In Billion)

The market segmentation within German BaaS is likely diverse, encompassing various service offerings such as payment processing, lending platforms, and account management solutions. The regional distribution is anticipated to be concentrated in major urban centers and economically active regions of Germany, mirroring the overall distribution of financial activity. The forecast period (2025-2033) suggests continued market expansion, driven by sustained technological advancements and increased adoption of digital banking solutions by both consumers and businesses. The projected growth signifies a significant shift in the German banking landscape, with BaaS playing a pivotal role in shaping the future of financial services. Future growth will likely depend on successful navigation of regulatory hurdles and continuous innovation to meet the evolving needs of customers.

Germany Banking as A Service Market Company Market Share

Germany Banking as a Service (BaaS) Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Germany Banking as a Service (BaaS) market, offering invaluable insights for stakeholders, investors, and industry players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report reveals market size in Millions and analyzes key players, including Deutsche Bank, Commerzbank, KFW Bankgruppe, DZ Bank, HypoVereinsbank, SolarisBank, Bankable, Figo, Mambu, Crosscard, and Deposit Solutions (list not exhaustive).

Germany Banking as A Service Market Market Dynamics & Concentration

The German BaaS market is experiencing dynamic growth fueled by technological advancements, evolving regulatory frameworks, and shifting consumer preferences. Market concentration is currently moderate, with a few established players holding significant market share, while numerous fintech startups are emerging, fostering competition. The market's value in 2025 is estimated at €XX Million, with a projected CAGR of xx% from 2025 to 2033.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025. This is expected to decrease slightly by 2033 as new entrants gain traction.

- Innovation Drivers: Open banking initiatives, API-driven solutions, and the increasing adoption of cloud technologies are major innovation drivers.

- Regulatory Frameworks: The regulatory landscape is evolving, impacting market dynamics. Compliance with PSD2 and other regulations is crucial for BaaS providers.

- Product Substitutes: Traditional banking services and niche fintech solutions offer alternative choices, influencing the competitive landscape.

- End-User Trends: Growing demand for personalized financial services, seamless digital experiences, and embedded finance solutions drives BaaS adoption.

- M&A Activities: The number of M&A deals in the German BaaS market increased from xx in 2019 to xx in 2024, indicating a consolidating market.

Germany Banking as A Service Market Industry Trends & Analysis

The German BaaS market is characterized by robust growth driven by several key factors. The increasing demand for digital banking solutions, coupled with the rising adoption of embedded finance, significantly fuels market expansion. Technological disruptions, such as the proliferation of APIs and cloud-based infrastructure, have streamlined the development and deployment of BaaS offerings. Consumer preferences are shifting towards personalized and seamless financial experiences, leading to heightened demand for innovative BaaS solutions. The competitive landscape is dynamic, with both established banks and fintech companies vying for market share. The market is expected to reach €XX Million by 2033, exhibiting significant growth potential. Market penetration currently stands at xx% and is projected to reach xx% by 2033.

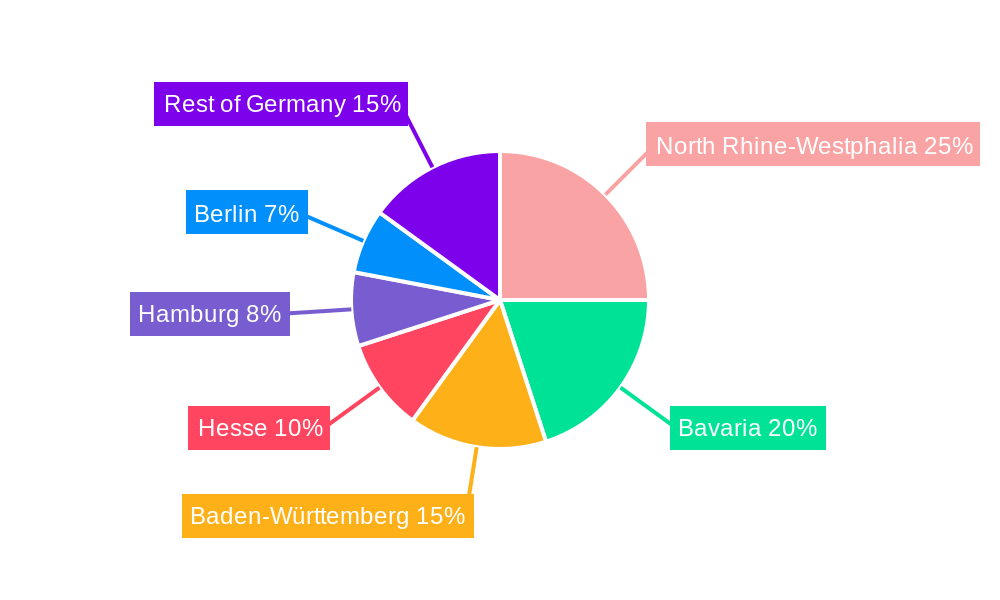

Leading Markets & Segments in Germany Banking as A Service Market

The German BaaS market is currently dominated by the major metropolitan areas due to higher digital literacy and fintech activity. Smaller cities and rural areas are expected to witness growth in the coming years with improved internet penetration. The SME segment is a significant driver of BaaS adoption, primarily due to cost efficiency and increased accessibility to financial services.

- Key Drivers for Dominance:

- Strong Digital Infrastructure: Germany boasts a well-developed digital infrastructure enabling seamless BaaS operations.

- Supportive Regulatory Environment: While evolving, the regulatory framework supports innovation in the financial technology sector.

- High Fintech Activity: Germany has a thriving fintech ecosystem contributing to BaaS market growth.

- SME Demand: Small and medium-sized enterprises are actively adopting BaaS solutions to streamline their financial operations.

Germany Banking as A Service Market Product Developments

Recent product developments in the German BaaS market have focused on enhancing user experience, improving security, and expanding the range of financial services offered. This includes innovative solutions like embedded finance, open banking APIs, and customizable white-label platforms. These developments aim to improve market fit by providing tailored solutions to specific industry needs. Technological trends such as AI and machine learning are being incorporated to enhance the efficiency and personalization of BaaS offerings.

Key Drivers of Germany Banking as a Service Market Growth

Several key factors fuel the growth of the German BaaS market:

- Technological Advancements: API-led connectivity, cloud computing, and AI/ML are key enablers.

- Regulatory Support: Open banking initiatives and supportive policies foster innovation.

- Increased Demand: SMEs and consumers seek digital financial solutions, driving BaaS adoption.

- Cost Efficiency: BaaS provides cost-effective alternatives to traditional banking infrastructure.

Challenges in the Germany Banking as A Service Market Market

Despite significant growth, the German BaaS market faces challenges:

- Regulatory Compliance: Navigating complex regulations requires significant investment and expertise.

- Data Security Concerns: Protecting sensitive customer data is paramount and demands robust security measures.

- Competition: Intense competition from established banks and emerging fintechs creates pressure.

- Integration Complexity: Seamless integration with existing banking systems can be challenging.

Emerging Opportunities in Germany Banking as a Service Market

Long-term growth will be driven by:

- Expansion into Underserved Markets: Reaching smaller cities and rural areas presents significant opportunities.

- Strategic Partnerships: Collaborations between banks and fintechs can unlock new market segments.

- Innovation in Embedded Finance: Integrating financial services into non-financial platforms offers substantial growth potential.

- Leveraging AI and Machine Learning: These technologies can enhance personalization and risk management.

Leading Players in the Germany Banking as a Service Market Sector

- Deutsche Bank

- Commerzbank

- KFW Bankgruppe

- DZ Bank

- HypoVereinsbank

- Solaris Bank

- Bankable

- Figo

- Mambu

- Crosscard

- Deposit Solutions

Key Milestones in Germany Banking as a Service Market Industry

- September 2023: Deutsche Bank launches DB Investment Partners (DBIP), expanding its private credit offerings. This signals a strategic move towards broadening its BaaS capabilities.

- November 2023: Commerzbank receives the Crypto Custody Licence, opening doors for innovative digital asset services within the BaaS space. This positions them as a leader in offering crypto-related banking services.

Strategic Outlook for Germany Banking as a Service Market Market

The German BaaS market is poised for continued growth, driven by technological advancements and evolving consumer preferences. Strategic partnerships, expansion into new market segments, and innovation in product offerings will be crucial for success. The focus on embedded finance and the integration of AI/ML will shape the future of the market, leading to more personalized, efficient, and secure financial solutions.

Germany Banking as A Service Market Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Type

- 2.1. API-based Bank-as-a-service

- 2.2. Cloud-based Bank-as-a-service

-

3. Enterprise Size

- 3.1. Large Enterprise

- 3.2. Small & Medium Enterprise

-

4. End-User

- 4.1. Banks

- 4.2. FinTech Corporations/NBFC

- 4.3. Other End-Users

Germany Banking as A Service Market Segmentation By Geography

- 1. Germany

Germany Banking as A Service Market Regional Market Share

Geographic Coverage of Germany Banking as A Service Market

Germany Banking as A Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitization and Open Banking Initiatives are Driving the Market; Fintech Growth is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Digitization and Open Banking Initiatives are Driving the Market; Fintech Growth is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Use of Digital Transformation Technology in Banks is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Banking as A Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. API-based Bank-as-a-service

- 5.2.2. Cloud-based Bank-as-a-service

- 5.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.3.1. Large Enterprise

- 5.3.2. Small & Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Banks

- 5.4.2. FinTech Corporations/NBFC

- 5.4.3. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deutsche Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Commerz Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KFW Bankgruppe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DZ Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HypoVereinsbank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Solaris Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bankable

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Figo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mambu

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Crosscard

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deposit Solutions**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Deutsche Bank

List of Figures

- Figure 1: Germany Banking as A Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Banking as A Service Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Banking as A Service Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Germany Banking as A Service Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Germany Banking as A Service Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Germany Banking as A Service Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Germany Banking as A Service Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 6: Germany Banking as A Service Market Volume Billion Forecast, by Enterprise Size 2020 & 2033

- Table 7: Germany Banking as A Service Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Germany Banking as A Service Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 9: Germany Banking as A Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Germany Banking as A Service Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Germany Banking as A Service Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Germany Banking as A Service Market Volume Billion Forecast, by Component 2020 & 2033

- Table 13: Germany Banking as A Service Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Germany Banking as A Service Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Germany Banking as A Service Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 16: Germany Banking as A Service Market Volume Billion Forecast, by Enterprise Size 2020 & 2033

- Table 17: Germany Banking as A Service Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Germany Banking as A Service Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 19: Germany Banking as A Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Germany Banking as A Service Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Banking as A Service Market?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the Germany Banking as A Service Market?

Key companies in the market include Deutsche Bank, Commerz Bank, KFW Bankgruppe, DZ Bank, HypoVereinsbank, Solaris Bank, Bankable, Figo, Mambu, Crosscard, Deposit Solutions**List Not Exhaustive.

3. What are the main segments of the Germany Banking as A Service Market?

The market segments include Component, Type, Enterprise Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitization and Open Banking Initiatives are Driving the Market; Fintech Growth is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Use of Digital Transformation Technology in Banks is Driving the Market.

7. Are there any restraints impacting market growth?

Digitization and Open Banking Initiatives are Driving the Market; Fintech Growth is Driving the Market.

8. Can you provide examples of recent developments in the market?

In September 2023, DEUTSCHE Bank announced the launch of DB Investment Partners (DBIP), a new investment manager focusing on private credit opportunities for institutional clients and high-net-worth investors. DBIP will target various private debt strategies, including corporate, real estate, asset-based, infrastructure, and renewable finance lending opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Banking as A Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Banking as A Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Banking as A Service Market?

To stay informed about further developments, trends, and reports in the Germany Banking as A Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence