Key Insights

The French Pay Later Solutions market is poised for significant expansion, driven by escalating e-commerce penetration, heightened consumer demand for flexible payment methods, and a thriving digital economy. With a projected Compound Annual Growth Rate (CAGR) of 11.3%, the market is expected to reach 12.68 billion by 2025, from a base year of 2025. Key growth catalysts include the widespread adoption of online shopping, particularly among younger demographics, who actively embrace Buy Now, Pay Later (BNPL) services. The inherent convenience, accessibility, and promotional integration of these solutions at checkout significantly boost their market adoption. The competitive environment, featuring established providers like Klarna and PayPal, alongside innovative newcomers such as Uplift and Splitit, fuels continuous innovation and enhances consumer value. Segmentation analysis highlights robust adoption across consumer electronics, fashion and personal care, and healthcare sectors. The digital channel's dominance underscores the integral role of BNPL in the online retail experience.

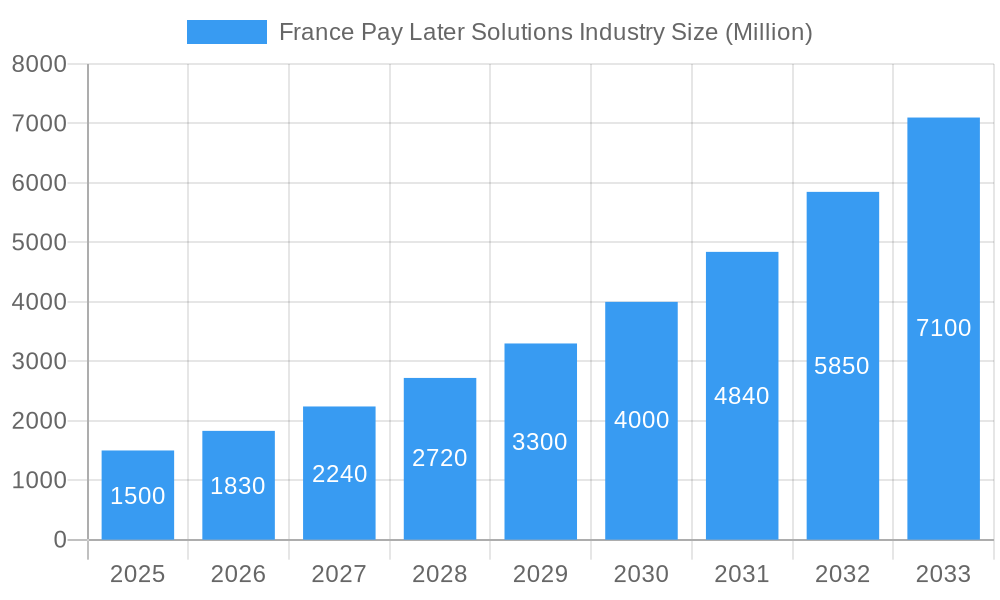

France Pay Later Solutions Industry Market Size (In Billion)

Despite positive growth trends, the market faces regulatory scrutiny concerning consumer protection and potential debt accumulation, posing a significant restraint. Intense competition among providers necessitates ongoing innovation in product development, customer service, and technological integration to sustain market share. Geographical adoption is expected to be concentrated in urban centers, with lower penetration in rural areas. To maximize market potential, providers must address these challenges through advanced risk management systems and targeted marketing strategies. The sustained success of the French Pay Later Solutions market depends on balancing aggressive expansion with responsible lending and effective risk mitigation.

France Pay Later Solutions Industry Company Market Share

France Pay Later Solutions Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the France Pay Later Solutions industry, covering market dynamics, trends, leading players, and future outlook. With a focus on the period 2019-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand and capitalize on the growth opportunities within this dynamic sector. The report utilizes data from 2019-2024 (Historical Period) as a basis for estimating the market in 2025 (Base and Estimated Year) and forecasting to 2033 (Forecast Period). Expected market value is in Millions.

France Pay Later Solutions Industry Market Dynamics & Concentration

The French Pay Later Solutions market, valued at xx Million in 2025, is characterized by a moderately concentrated landscape. Key players like Klarna, PayPal, and Alma hold significant market share, though the presence of numerous smaller players fosters competition and innovation. Market concentration is expected to evolve with M&A activity and the entry of new players. Innovation is driven by technological advancements, particularly in AI-powered risk assessment and seamless integration with e-commerce platforms. The regulatory framework, while still evolving, is increasingly focused on consumer protection and responsible lending practices. Substitute payment methods such as traditional credit cards and bank loans exert competitive pressure. However, the increasing popularity of BNPL amongst younger demographics, who prioritize convenience and flexible payment options, is a significant growth driver. M&A activity in the period 2019-2024 saw approximately xx deals, contributing to market consolidation.

- Market Share (2025): Klarna (xx%), PayPal (xx%), Alma (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: AI-powered risk assessment, improved mobile integration.

- Regulatory Focus: Consumer protection, responsible lending.

France Pay Later Solutions Industry Industry Trends & Analysis

The France Pay Later Solutions market is experiencing a period of dynamic expansion, with a projected Compound Annual Growth Rate (CAGR) of approximately 25-30% between 2025 and 2033. This significant upswing is propelled by a confluence of powerful drivers. The relentless surge in e-commerce penetration and the widespread adoption of seamless mobile payment solutions have cultivated an exceptionally fertile ground for Buy Now, Pay Later (BNPL) services. Concurrently, rapid technological advancements, including the sophisticated development of advanced fraud detection algorithms, enhanced user experience through intuitive interfaces, and the integration of AI for personalized offers, are significantly boosting customer trust and convenience, thereby accelerating wider market acceptance. Consumer behavior is visibly gravitating towards flexible, transparent payment alternatives that empower better personal financial management, positioning BNPL as a compelling substitute for traditional credit facilities. The competitive landscape is a vibrant ecosystem, characterized by the strategic presence of well-established financial institutions and nimble, innovative fintech startups, fostering an environment of continuous innovation, feature enhancements, and competitive pricing strategies. Market penetration is anticipated to climb to an impressive 40-50% by 2033, primarily fueled by sustained e-commerce growth, amplified consumer awareness, and the increasing integration of BNPL options across a broader spectrum of merchants.

Leading Markets & Segments in France Pay Later Solutions Industry

The online channel dominates the France Pay Later Solutions market, accounting for xx% of the total market value in 2025. This is largely attributable to the seamless integration of BNPL services within e-commerce platforms. The Fashion and Personal Care segment holds the largest share within product categories, reflecting strong consumer demand for flexible payment options in discretionary spending areas.

- Dominant Channel: Online

- Key Drivers: E-commerce growth, ease of integration.

- Dominant Product Category: Fashion and Personal Care

- Key Drivers: High discretionary spending, impulsive purchases.

The POS segment is growing steadily, with increasing merchant adoption driving expansion. Consumer electronics and other product categories also show significant promise, presenting lucrative opportunities for market expansion. Paris and other major urban centers exhibit higher adoption rates due to factors such as higher internet penetration and greater consumer awareness.

France Pay Later Solutions Industry Product Developments

Recent product developments focus on enhancing user experience and risk mitigation. New features include improved mobile interfaces, personalized payment plans, and sophisticated fraud prevention technologies. These innovations aim to improve customer satisfaction and reduce the risk of defaults, bolstering market acceptance and expansion. The market is witnessing the integration of BNPL services with loyalty programs and other customer engagement tools, further strengthening the value proposition.

Key Drivers of France Pay Later Solutions Industry Growth

Several factors drive growth in the France Pay Later Solutions market. Technological advancements are making BNPL solutions more accessible and user-friendly. Favorable economic conditions, characterized by increasing disposable incomes and consumer confidence, enhance spending power and increase demand for flexible payment options. Regulatory developments that support innovation while protecting consumers are also crucial. Strategic partnerships between BNPL providers and merchants expand market reach and build brand awareness.

Challenges in the France Pay Later Solutions Industry Market

The France Pay Later Solutions industry faces several challenges. Stringent regulatory compliance requirements can impose significant costs and administrative burdens. Supply chain disruptions can impact the availability of goods and services, potentially affecting BNPL transactions. Intense competition among various BNPL providers and other payment methods exerts pressure on pricing and profit margins. The risk of defaults and chargebacks represents a significant financial challenge for BNPL providers.

Emerging Opportunities in France Pay Later Solutions Industry

The long-term trajectory of the France Pay Later Solutions market is significantly influenced by a range of compelling emerging opportunities. Technological innovation continues to be a paramount catalyst, with advancements in areas like AI-driven credit scoring models that offer more nuanced risk assessments and the potential integration of blockchain technology for enhanced transaction security and transparency, promising to further optimize operational efficiencies. Strategic alliances and partnerships with traditional banks, established e-commerce platforms, and other financial service providers are poised to unlock access to extensive consumer bases, bolster funding capabilities, and integrate BNPL seamlessly into existing financial ecosystems. Furthermore, there is substantial untapped potential in expanding BNPL services into underserved market segments and developing specialized, industry-specific solutions tailored to meet unique consumer needs in sectors such as healthcare financing, educational expenses, and even sustainable purchasing initiatives. The ongoing evolution of regulatory frameworks also presents an opportunity for proactive players to lead in compliance and build consumer trust through responsible lending practices.

Key Milestones in France Pay Later Solutions Industry Industry

- July 2021: Air Tahiti strategically partnered with Uplift, enabling travelers to access BNPL options for their bookings. This collaboration significantly broadened Uplift's market presence and underscored the growing acceptance and utility of BNPL solutions within the travel and tourism sector.

- November 2021: Younited Credit, a prominent French BNPL player, extended its reach by partnering with Bankable and LiftForward to successfully launch a BNPL product in the Italian market. This strategic move highlights the international expansion ambitions of French BNPL firms and their capability to adapt and thrive in new geographical territories.

Strategic Outlook for France Pay Later Solutions Industry Market

The France Pay Later Solutions market is poised for continued and substantial growth, presenting a wealth of strategic opportunities for market participants. Key strategic imperatives for long-term success include a dedicated focus on leveraging cutting-edge technological innovation, cultivating robust strategic partnerships with diverse stakeholders, and strategically expanding into untapped market segments and emerging consumer demographics. Prioritizing an exceptional customer experience through intuitive onboarding processes, transparent terms, and responsive support will be paramount. Furthermore, effectively managing financial risks through sophisticated credit assessment and robust fraud prevention measures, while diligently adhering to and anticipating evolving regulatory frameworks, will be critical for sustainable growth and building enduring consumer trust. The future outlook for the French BNPL market is exceptionally promising, with significant expansion anticipated, driven by increasing consumer adoption, deepening merchant integration, and continuous advancements in payment technologies and financial services.

France Pay Later Solutions Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS

-

2. Product Category

- 2.1. Consumer Electronics

- 2.2. Fashion and Personal Care

- 2.3. Health Care

- 2.4. Other Products

France Pay Later Solutions Industry Segmentation By Geography

- 1. France

France Pay Later Solutions Industry Regional Market Share

Geographic Coverage of France Pay Later Solutions Industry

France Pay Later Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Affordable and Convenient Payment Service of Buy Now Pay Later Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Pay Later Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Consumer Electronics

- 5.2.2. Fashion and Personal Care

- 5.2.3. Health Care

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Uplift

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Splitit

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Clearpay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scalapay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Younited Credit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Klarna

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alma

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thunes**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Paypal

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sezzle

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Uplift

List of Figures

- Figure 1: France Pay Later Solutions Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Pay Later Solutions Industry Share (%) by Company 2025

List of Tables

- Table 1: France Pay Later Solutions Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 2: France Pay Later Solutions Industry Revenue billion Forecast, by Product Category 2020 & 2033

- Table 3: France Pay Later Solutions Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Pay Later Solutions Industry Revenue billion Forecast, by Channel 2020 & 2033

- Table 5: France Pay Later Solutions Industry Revenue billion Forecast, by Product Category 2020 & 2033

- Table 6: France Pay Later Solutions Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Pay Later Solutions Industry?

The projected CAGR is approximately 11.3%.

2. Which companies are prominent players in the France Pay Later Solutions Industry?

Key companies in the market include Uplift, Splitit, Clearpay, Scalapay, Younited Credit, Klarna, Alma, Thunes**List Not Exhaustive, Paypal, Sezzle.

3. What are the main segments of the France Pay Later Solutions Industry?

The market segments include Channel, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Affordable and Convenient Payment Service of Buy Now Pay Later Platforms.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

July 2021: Air Tahiti entered into a strategic partnership with Fly Now Pay Later provider, Uplift. Under the collaboration, travelers booking Air Tahiti can pay in installments using the BNPL payment method offered by Uplift. Notably, Uplift has partnered with over 200 airlines to offer its BNPL payment method to travelers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Pay Later Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Pay Later Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Pay Later Solutions Industry?

To stay informed about further developments, trends, and reports in the France Pay Later Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence