Key Insights

The European venture capital (VC) market is poised for significant expansion, propelled by dynamic industry growth. With a projected Compound Annual Growth Rate (CAGR) of 13.87%, the market is estimated to reach $8.74 billion by 2025. Key growth drivers include the robust performance of the fintech sector, driven by technological innovation and increased digital adoption. The pharmaceutical and biotechnology industries are also attracting substantial investment due to their high return potential in research and development. Furthermore, consistent investment flows into consumer goods, industrial/energy, and IT hardware and services sectors are contributing to market expansion. Leading VC firms like Atomico, Accel Partners, and BGF are active players, underscoring the maturity and appeal of the European VC ecosystem. Major investment hubs include the UK, Germany, and Finland, attracting capital across all investment stages, from early-stage seed funding to later-stage ventures.

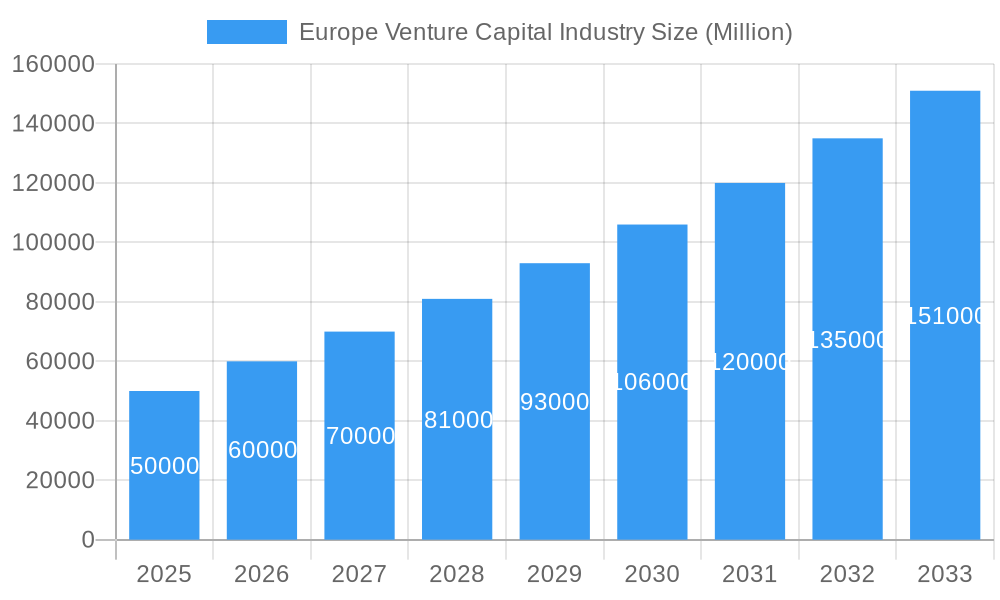

Europe Venture Capital Industry Market Size (In Billion)

Despite the positive outlook, potential market restraints such as regulatory challenges, geopolitical instability, and economic downturns could impact investor sentiment and funding availability. Industry and investment stage segmentation offers valuable insights into investment preferences and future growth areas. A granular analysis of sub-sectors, such as artificial intelligence within fintech and personalized medicine within pharma/biotech, can refine investment strategies and pinpoint emerging opportunities. The ongoing success of European startups, supported by favorable government policies in select regions, indicates sustained long-term growth within this vibrant ecosystem. Understanding the competitive landscape among European VC firms is vital for developing effective investment strategies. Ultimately, the future trajectory of the European VC market depends on maintaining a conducive investment climate, fostering innovation, and adapting to evolving market dynamics.

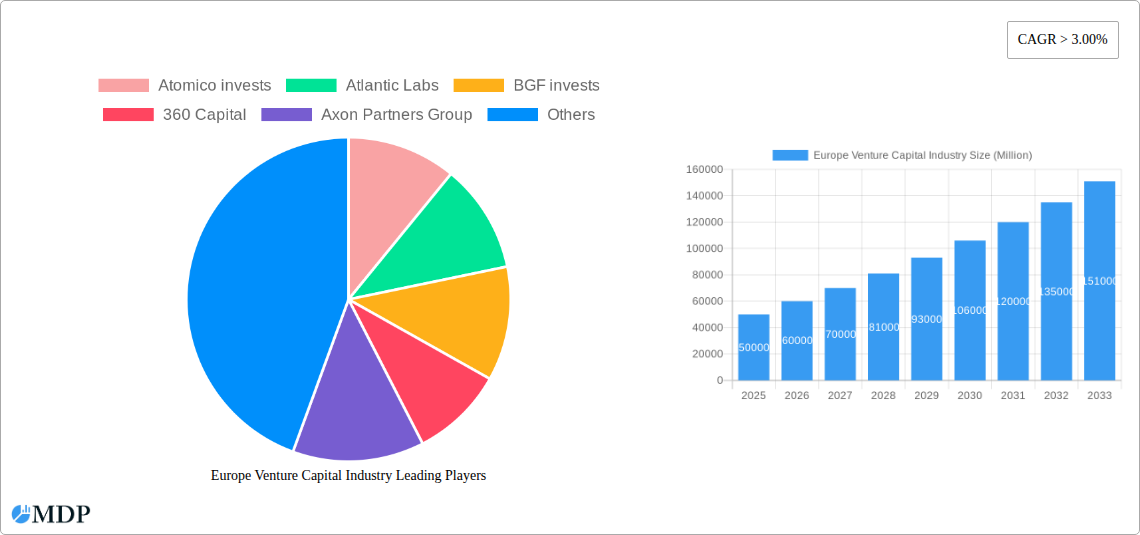

Europe Venture Capital Industry Company Market Share

Europe Venture Capital Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European Venture Capital industry, covering market dynamics, leading players, investment trends, and future growth prospects. From analyzing historical data (2019-2024) and the base year (2025) to forecasting market trends through 2033, this report offers crucial insights for investors, entrepreneurs, and industry stakeholders. With a focus on key segments like Fintech, Pharma & Biotech, and specific countries like the UK and Germany, this report is an essential resource for navigating the dynamic landscape of European venture capital.

Keywords: Europe Venture Capital, Venture Capital Investment, European Startup Funding, Fintech Investment Europe, Pharma Biotech Investment Europe, VC Market Analysis, European VC Trends, M&A in European VC, Angel Investment Europe, Seed Funding Europe, Early-Stage Investment Europe, Later-Stage Investment Europe, UK Venture Capital, German Venture Capital

Europe Venture Capital Industry Market Dynamics & Concentration

The European Venture Capital market exhibits a moderately concentrated landscape, with a handful of dominant players commanding significant market share. However, the entry of new players and increased competition are constantly reshaping this dynamic. Innovation drivers include technological advancements (AI, blockchain, etc.), supportive regulatory frameworks in certain regions, and strong entrepreneurial activity. Product substitutes include private equity and angel investors, though venture capital's focus on high-growth, early-stage companies creates a distinct niche. End-user trends reveal a growing preference for sustainable and tech-driven solutions. The M&A landscape is active, with strategic acquisitions driving consolidation and expansion within the sector.

- Market Concentration: Top 5 firms hold approximately xx% of the market share in 2025. (Estimated)

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024, with a projected xx% increase in 2025. (Estimated)

- Regulatory Environment: Variations across European nations impact investment strategies and regulatory compliance.

Europe Venture Capital Industry Industry Trends & Analysis

The European Venture Capital industry is experiencing robust growth, fueled by a confluence of factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033. Technological disruptions, especially in AI and fintech, are driving significant investment. Consumer preferences are shifting towards digitally native experiences and sustainable products, influencing investment priorities. Competitive dynamics are intense, with established players facing challenges from both new entrants and increased competition for promising startups. Market penetration for VC funding continues to grow across various sectors, with a particular focus on early-stage investments.

Leading Markets & Segments in Europe Venture Capital Industry

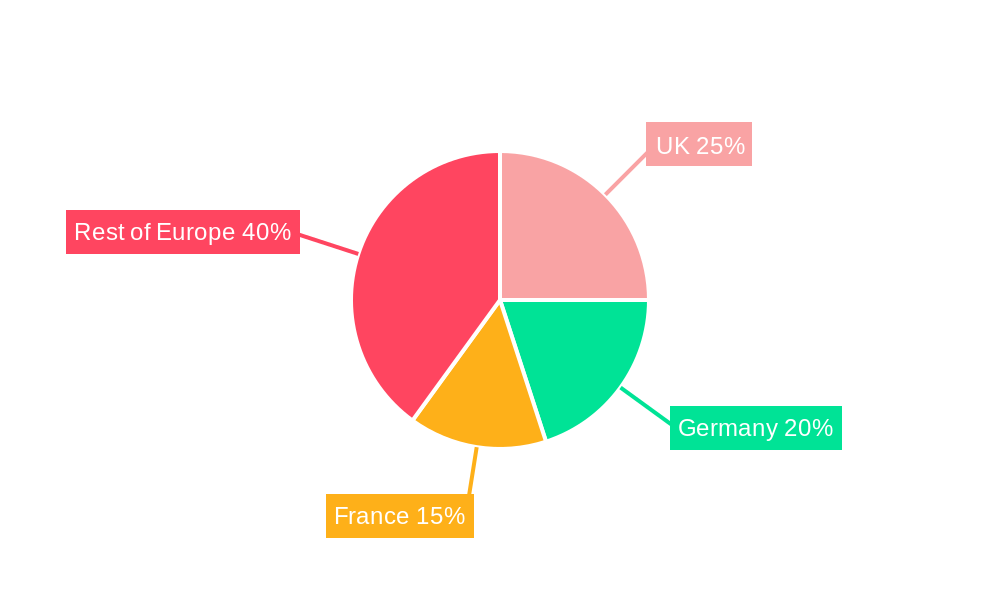

The UK remains a leading market for European Venture Capital, followed by Germany and France. Within industry segments, Fintech and Pharma/Biotech attract the lion's share of investment due to significant growth potential and technological advancements.

By Industry of Investment:

- Fintech: This sector consistently attracts the largest investments due to high growth potential and digital transformation.

- Pharma and Biotech: Significant investment driven by technological advancements and the need for new therapies.

- Consumer Goods: Growing investment in companies focused on sustainable and digitally-native products.

- Industrial/Energy: Investment focused on innovation in renewable energy and sustainable practices.

- IT Hardware and Services: Continued investment in cloud computing, data analytics, and cybersecurity solutions.

- Other Industries of Investment: A diverse range of sectors receive venture capital funding, representing a wide investment landscape.

Investments - By Country:

- UK: Strong entrepreneurial ecosystem and access to talent drives significant VC investments.

- Germany: A robust manufacturing base and increasing focus on digitalization attract significant investment.

- Finland: A strong technology cluster, particularly in mobile technology and gaming.

- Spain: Growing startup scene and government support boost VC activity.

- Others: Numerous other European countries are attracting increasing venture capital investment.

Deal Size - By Stage of Investment:

- Angel/Seed Investing: Early-stage funding focusing on high-growth potential.

- Early-stage Investing: Funding for companies developing and testing their products/services.

- Later-stage Investing: Significant investments in established companies seeking expansion.

Key Drivers:

- Favorable economic policies: Government initiatives supporting entrepreneurship and innovation.

- Developed infrastructure: Access to skilled labor and technological resources.

- Strong regulatory framework: Creating a stable and predictable investment environment.

Europe Venture Capital Industry Product Developments

Product innovation within the venture capital industry itself centers around improving deal sourcing, due diligence processes, and portfolio management through AI and data analytics. The focus is on streamlining operations, enhancing efficiency, and increasing returns for investors. The competitive advantage lies in leveraging advanced analytics to identify high-growth potential companies and mitigating investment risk.

Key Drivers of Europe Venture Capital Industry Growth

Technological advancements, particularly in AI, fintech, and biotech, are prime drivers. Favorable economic policies in many European countries, such as tax incentives for investments, boost the sector. A supportive regulatory environment, particularly in certain countries, fosters innovation and attracts investment.

Challenges in the Europe Venture Capital Industry Market

Regulatory hurdles vary across European countries, creating complexities for investors. Supply chain disruptions have impacted funding for certain startups. Increased competition among venture capitalists puts pressure on deal terms and returns. The total projected impact of these issues on investment amounts to xx Million in losses for 2025 (Estimated).

Emerging Opportunities in Europe Venture Capital Industry

Technological breakthroughs in areas like AI, quantum computing, and sustainable energy present significant investment opportunities. Strategic partnerships between established corporations and startups are driving innovation and market penetration. Expansion into new markets, particularly within developing regions of Europe, presents significant potential for growth.

Leading Players in the Europe Venture Capital Industry Sector

- Atomico

- Atlantic Labs

- BGF invests

- 360 Capital

- Axon Partners Group

- Acton Capital

- Bonsai Venture Capita

- Accel Partners

- Active Venture

- AAC Capital

- Adara Ventures

Key Milestones in Europe Venture Capital Industry Industry

- Oct 2021: Sequoia Capital shifts to a singular, permanent fund structure, altering the industry landscape.

- Feb 2022: France announces a new fund aiming to create 10 tech companies worth over €100 Billion by 2030.

Strategic Outlook for Europe Venture Capital Industry Market

The European Venture Capital market is poised for continued strong growth, driven by technological innovation, supportive government policies, and a vibrant startup ecosystem. Strategic opportunities lie in identifying and investing in companies leveraging emerging technologies and addressing pressing societal needs. The focus will be on sustainable and impactful investments that create long-term value.

Europe Venture Capital Industry Segmentation

-

1. Deal Size - Stage of Investment

- 1.1. Angel/Seed Investing

- 1.2. Early-stage Investing

- 1.3. Later-stage Investing

-

2. Industry of Investment

- 2.1. Fintech

- 2.2. Pharma and Biotech

- 2.3. Consumer Goods

- 2.4. Industrial/Energy

- 2.5. IT Hardware and Services

- 2.6. Other Industries of Investment

Europe Venture Capital Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Venture Capital Industry Regional Market Share

Geographic Coverage of Europe Venture Capital Industry

Europe Venture Capital Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. United States' role in VC rounds in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Venture Capital Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deal Size - Stage of Investment

- 5.1.1. Angel/Seed Investing

- 5.1.2. Early-stage Investing

- 5.1.3. Later-stage Investing

- 5.2. Market Analysis, Insights and Forecast - by Industry of Investment

- 5.2.1. Fintech

- 5.2.2. Pharma and Biotech

- 5.2.3. Consumer Goods

- 5.2.4. Industrial/Energy

- 5.2.5. IT Hardware and Services

- 5.2.6. Other Industries of Investment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Deal Size - Stage of Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Atomico invests

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Atlantic Labs

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BGF invests

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 360 Capital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axon Partners Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acton Capital

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bonsai Venture Capita

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accel Partners

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Active Venture

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AAC Capital

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Adara Ventures

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Atomico invests

List of Figures

- Figure 1: Europe Venture Capital Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Venture Capital Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Venture Capital Industry Revenue billion Forecast, by Deal Size - Stage of Investment 2020 & 2033

- Table 2: Europe Venture Capital Industry Revenue billion Forecast, by Industry of Investment 2020 & 2033

- Table 3: Europe Venture Capital Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Venture Capital Industry Revenue billion Forecast, by Deal Size - Stage of Investment 2020 & 2033

- Table 5: Europe Venture Capital Industry Revenue billion Forecast, by Industry of Investment 2020 & 2033

- Table 6: Europe Venture Capital Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Venture Capital Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Venture Capital Industry?

The projected CAGR is approximately 13.87%.

2. Which companies are prominent players in the Europe Venture Capital Industry?

Key companies in the market include Atomico invests, Atlantic Labs, BGF invests, 360 Capital, Axon Partners Group, Acton Capital, Bonsai Venture Capita, Accel Partners, Active Venture, AAC Capital, Adara Ventures.

3. What are the main segments of the Europe Venture Capital Industry?

The market segments include Deal Size - Stage of Investment, Industry of Investment.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

United States' role in VC rounds in Europe.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

February 2022: France's Prime Minister, Bruno Le Maire, announced the plans of creating a new fund to boost the technological sector in Europe. The target of the fund is to establish 10 technological companies having a net worth of more than Euro 100 billion by the end of 2030. Moreover, the fund will be publicly funded to finance new technological startups emerging in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Venture Capital Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Venture Capital Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Venture Capital Industry?

To stay informed about further developments, trends, and reports in the Europe Venture Capital Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence