Key Insights

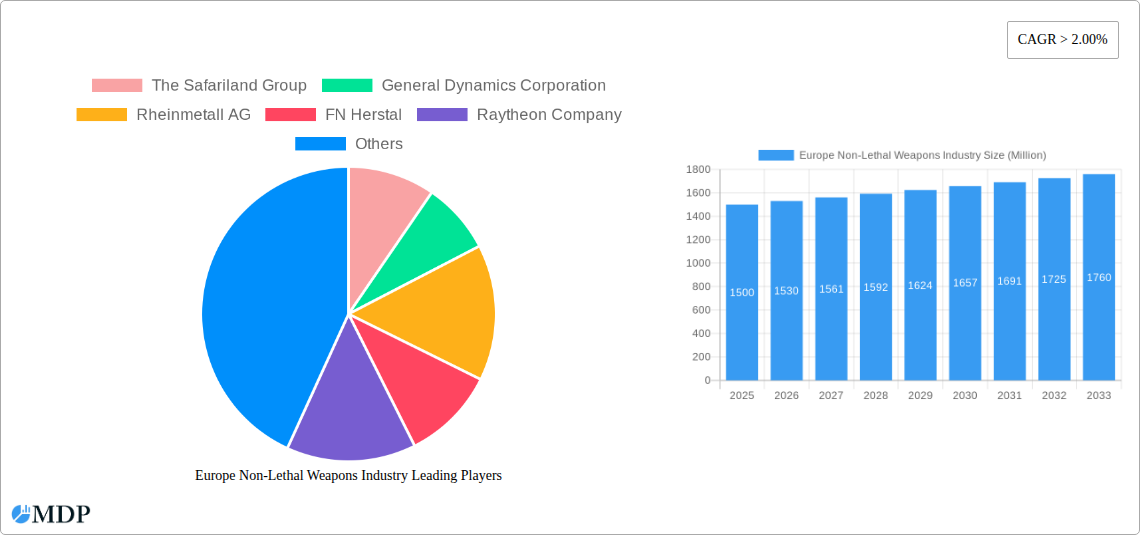

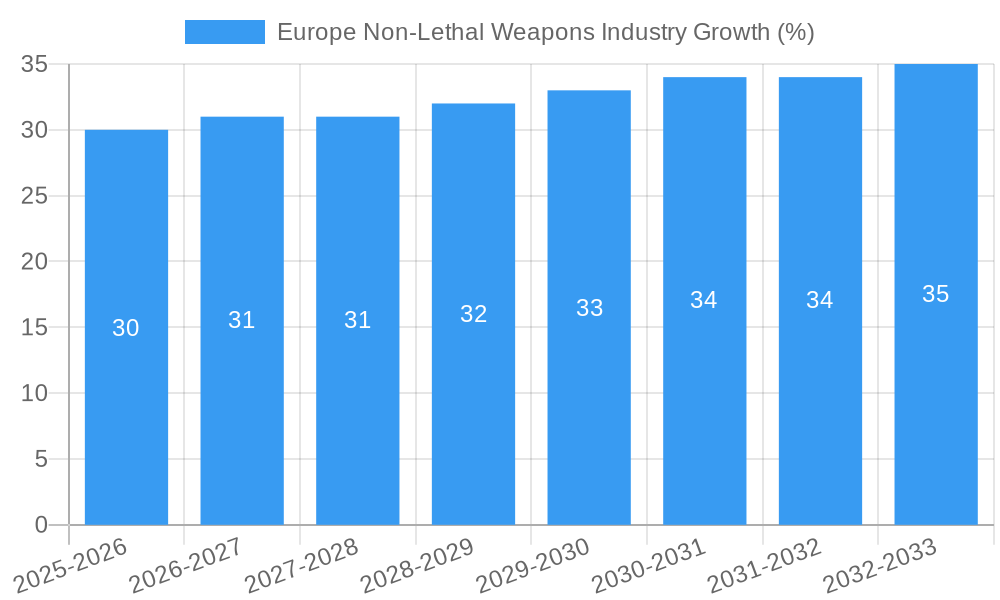

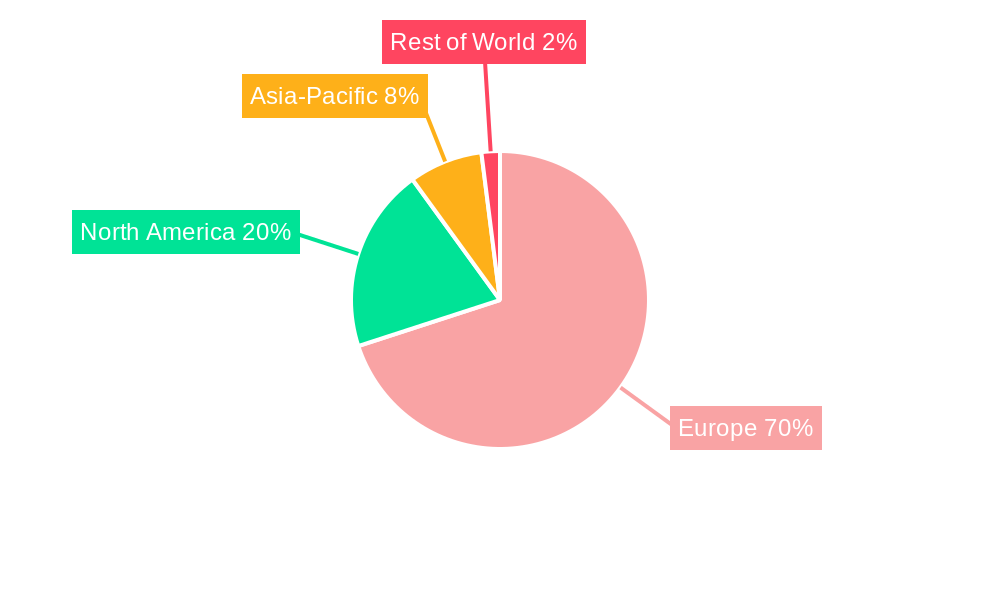

The European non-lethal weapons market, valued at approximately €1.5 billion in 2025, is projected to experience robust growth, driven by increasing demand from law enforcement agencies and militaries across the region. A Compound Annual Growth Rate (CAGR) exceeding 2% signifies a steady expansion through 2033, fueled by several key factors. Rising concerns about civil unrest and terrorism necessitate the adoption of less-lethal crowd control and de-escalation tools. Furthermore, technological advancements in directed energy weapons and electroshock devices are enhancing their effectiveness and accuracy, boosting market appeal. The segment dominated by area denial systems and ammunition, reflecting a continued reliance on traditional methods alongside the increasing adoption of newer technologies such as gas and spray based weapons. Germany, France, and the United Kingdom represent the largest national markets, benefiting from strong defense budgets and proactive security policies. However, regulatory hurdles related to the deployment and usage of certain non-lethal weapons, particularly those involving chemical agents, pose a significant constraint to market growth.

Despite the restraining factors, the market is expected to witness a steady increase in investment in R&D for advanced non-lethal technologies. This is particularly true for directed energy weapons, which show significant promise for precision and minimizing collateral damage. The market segmentation by application (law enforcement and military) indicates a balanced demand from both sectors, with the military segment potentially exhibiting slightly higher growth due to larger procurement budgets and the deployment of non-lethal weapons in peacekeeping and stability operations. Leading market players, including The Safariland Group, General Dynamics Corporation, and Rheinmetall AG, are strategically positioning themselves to capture market share through innovation, strategic partnerships, and focused regional expansion efforts across Europe. The continuing development and adoption of these technologies promise a more nuanced and effective approach to security challenges, albeit with ethical considerations remaining a prominent concern within this sector.

Europe Non-Lethal Weapons Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Non-Lethal Weapons industry, offering valuable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future growth opportunities. The report leverages extensive primary and secondary research to deliver actionable intelligence for strategic decision-making. Expect detailed analysis of key segments like Area Denial, Ammunition, Explosives, Gases and Sprays, Directed Energy Weapons, and Electroshock Weapons across Law Enforcement and Military applications. Discover the market’s potential, identify emerging trends, and gain a competitive edge with this essential market intelligence resource. The market is estimated to be worth xx Million in 2025 and projected to reach xx Million by 2033.

Europe Non-Lethal Weapons Industry Market Dynamics & Concentration

The European non-lethal weapons market exhibits a moderately concentrated landscape, with several key players holding significant market share. The market share distribution is influenced by factors such as technological innovation, robust R&D investments, and successful mergers and acquisitions (M&A) activities. Regulatory frameworks, varying across European nations, also play a pivotal role in shaping market dynamics. The availability of substitute products and evolving end-user preferences (particularly within law enforcement and military sectors) further contribute to the market's complexity.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025. This concentration is expected to remain relatively stable through 2033, though minor shifts may occur due to M&A activity and the emergence of innovative players.

- Innovation Drivers: Continuous advancements in directed energy weapons, electroshock technology, and less-lethal ammunition are driving significant innovation. The demand for more precise and effective non-lethal solutions fuels R&D investments.

- Regulatory Framework: Stringent regulations concerning the development, production, and deployment of non-lethal weapons vary significantly across European nations. This fragmented regulatory landscape presents both challenges and opportunities for market players.

- Product Substitutes: The availability of alternative crowd control and security methods, such as advanced surveillance technologies, presents a competitive challenge to non-lethal weapons manufacturers.

- End-User Trends: Increasing demand for non-lethal solutions from law enforcement agencies to mitigate civilian casualties and maintain public order significantly impacts market growth. Similarly, the military sector's adoption of less-lethal technologies for specific operations influences demand.

- M&A Activity: The number of M&A deals in the European non-lethal weapons sector averaged xx per year between 2019 and 2024, indicating moderate consolidation within the industry.

Europe Non-Lethal Weapons Industry Industry Trends & Analysis

The European non-lethal weapons market is experiencing steady growth, driven by increasing demand from both law enforcement and military sectors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological advancements, particularly in directed energy weapons and less-lethal ammunition, are major drivers of market expansion. Consumer preferences are shifting towards more precise, less harmful, and ethically sound non-lethal solutions. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and a focus on product differentiation. Market penetration of non-lethal weapons across various applications continues to rise. Government initiatives and funding programs supporting the development and deployment of less-lethal technologies further stimulate market growth. Emerging concerns regarding the ethical implications of certain non-lethal weapons are prompting innovation towards more humane solutions. The market is witnessing a gradual shift towards greater use of technology-driven solutions, including AI-powered systems for enhanced control and precision. The development and adoption of such solutions significantly impact the overall market expansion.

Leading Markets & Segments in Europe Non-Lethal Weapons Industry

Germany and France are currently the leading markets for non-lethal weapons in Europe. Their dominance is attributed to robust defense budgets, a strong law enforcement presence, and active participation in international peacekeeping operations. Within the product segments, Ammunition and Gases and Sprays hold the largest market share, followed by Electroshock Weapons and Area Denial systems.

- Key Drivers for Germany and France:

- Strong defense budgets and government procurement initiatives.

- Large and well-equipped law enforcement agencies.

- Significant involvement in international peacekeeping and security operations.

- Developed technological infrastructure supporting innovation and manufacturing.

- Dominance Analysis: Germany’s leadership stems from its established defense industry and strong technological capabilities. France’s dominance is reinforced by its significant military presence and proactive approach to internal security. The Ammunition segment's dominance is driven by consistent demand from law enforcement and military operations, while the widespread use of tear gas and pepper spray contributes to the significant market share of Gases and Sprays.

Europe Non-Lethal Weapons Industry Product Developments

Recent years have witnessed significant advancements in non-lethal weapon technology. This includes the development of more precise directed energy weapons, improved less-lethal ammunition with enhanced accuracy and reduced collateral damage potential, and more effective electroshock weapons. These innovations reflect a growing focus on minimizing unintended harm while maximizing effectiveness. The market is increasingly driven by a demand for adaptable solutions that cater to the specific needs of different operational environments and target profiles. Technological integration, such as the incorporation of smart sensors and data analytics, is enhancing the precision and efficacy of many non-lethal weapon systems.

Key Drivers of Europe Non-Lethal Weapons Industry Growth

Technological advancements in less-lethal technologies, such as directed energy weapons, are a primary driver of market growth. Increased government spending on defense and internal security, coupled with the growing need for effective crowd control measures, further fuel market expansion. Supportive regulatory environments in certain European countries foster the development and adoption of these technologies. The ongoing demand from both military and law enforcement sectors, alongside the development of more sophisticated and versatile non-lethal weaponry, propel market expansion.

Challenges in the Europe Non-Lethal Weapons Industry Market

The industry faces several challenges, including stringent regulations and licensing requirements that can hinder product development and market entry. Concerns surrounding the potential for misuse and ethical implications of certain non-lethal weapons also pose significant hurdles. Supply chain disruptions and fluctuations in raw material costs can negatively affect production and profitability, and intense competition among established players and emerging innovators creates a complex and challenging market environment. The varying regulatory landscape across European nations creates additional complexity for manufacturers seeking to operate across multiple countries.

Emerging Opportunities in Europe Non-Lethal Weapons Industry

The development of more precise and less harmful directed energy weapons presents significant growth opportunities. Strategic partnerships between technology providers and defense/law enforcement agencies are expected to drive innovation and market expansion. Growing adoption of non-lethal technologies by military and police forces across the globe presents a significant avenue for growth. Exploration of new applications, beyond law enforcement and military uses, offers further potential.

Leading Players in the Europe Non-Lethal Weapons Industry Sector

- The Safariland Group

- General Dynamics Corporation

- Rheinmetall AG

- FN Herstal

- Raytheon Company

- RUAG Group

- Fiocchi Munizioni SpA

- BAE Systems PLC

- AARDVAR

Key Milestones in Europe Non-Lethal Weapons Industry Industry

- 2020: Introduction of a new generation of less-lethal ammunition by Rheinmetall AG.

- 2021: Successful testing of a prototype directed energy weapon by a European defense contractor. (Contractor Name not specified)

- 2022: Merger between two smaller non-lethal weapons manufacturers in France. (Company names not specified)

- 2023: Launch of a new electroshock weapon with enhanced safety features by FN Herstal.

- 2024: Significant investment in R&D of non-lethal technologies by a major European defense company. (Company Name not specified)

Strategic Outlook for Europe Non-Lethal Weapons Industry Market

The European non-lethal weapons market is poised for continued growth, driven by technological advancements and increasing demand from both military and law enforcement sectors. Strategic partnerships, focused R&D initiatives, and expansion into new markets are key growth accelerators. The long-term outlook remains positive, with opportunities for innovation and market leadership for companies that can adapt to evolving consumer needs and regulatory landscapes. The market's future hinges on developing technologically superior, ethically sound, and cost-effective solutions.

Europe Non-Lethal Weapons Industry Segmentation

-

1. Type

- 1.1. Area Denial

- 1.2. Ammunition

- 1.3. Explosives

- 1.4. Gases and Sprays

- 1.5. Directed Energy Weapons

- 1.6. Electroshock Weapons

-

2. Application

- 2.1. Law Enforcement

- 2.2. Military

Europe Non-Lethal Weapons Industry Segmentation By Geography

-

1. By Country

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Non-Lethal Weapons Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Law Enforcement Segment is Expected to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Area Denial

- 5.1.2. Ammunition

- 5.1.3. Explosives

- 5.1.4. Gases and Sprays

- 5.1.5. Directed Energy Weapons

- 5.1.6. Electroshock Weapons

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Law Enforcement

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. By Country

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 The Safariland Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 General Dynamics Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Rheinmetall AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 FN Herstal

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Raytheon Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 RUAG Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fiocchi Munizioni SpA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BAE Systems PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AARDVAR

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 The Safariland Group

List of Figures

- Figure 1: Europe Non-Lethal Weapons Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Non-Lethal Weapons Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: France Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Non-Lethal Weapons Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Europe Non-Lethal Weapons Industry?

Key companies in the market include The Safariland Group, General Dynamics Corporation, Rheinmetall AG, FN Herstal, Raytheon Company, RUAG Group, Fiocchi Munizioni SpA, BAE Systems PLC, AARDVAR.

3. What are the main segments of the Europe Non-Lethal Weapons Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Law Enforcement Segment is Expected to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Non-Lethal Weapons Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Non-Lethal Weapons Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Non-Lethal Weapons Industry?

To stay informed about further developments, trends, and reports in the Europe Non-Lethal Weapons Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence