Key Insights

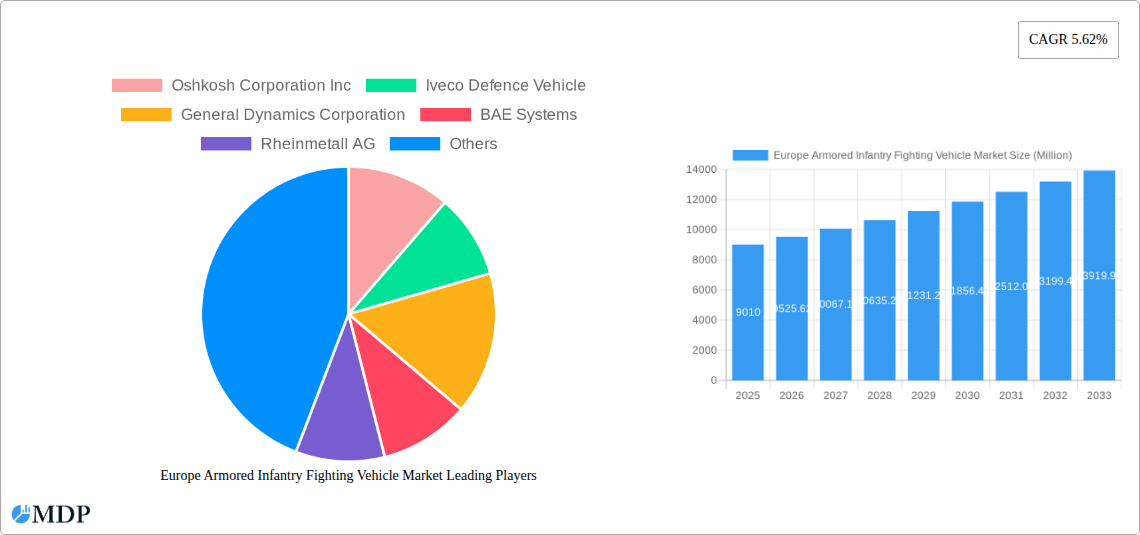

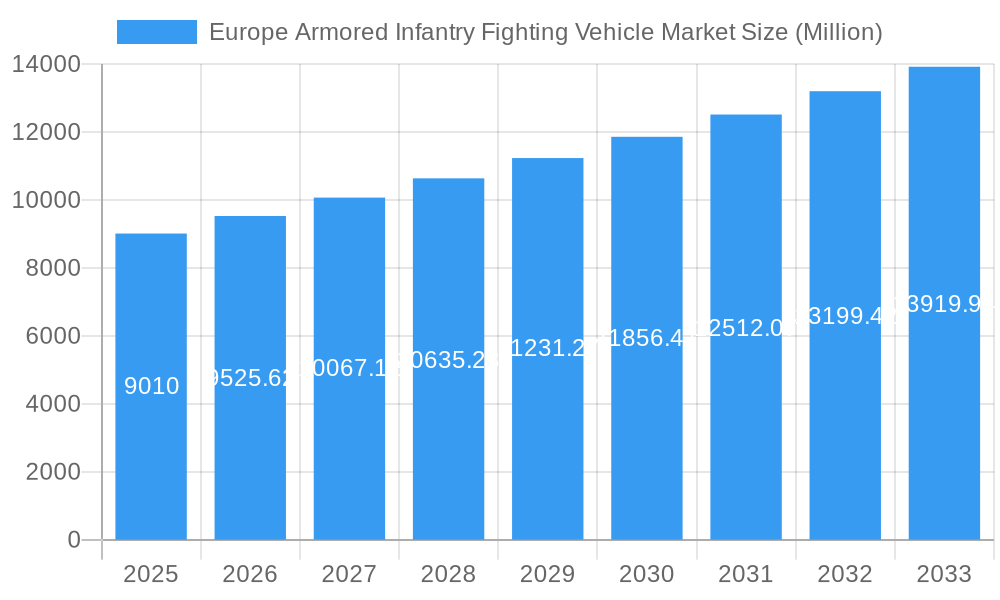

The European Armored Infantry Fighting Vehicle (IFV) market, valued at €9.01 billion in 2025, is projected to experience robust growth, driven by increasing geopolitical instability and modernization efforts across European nations. A Compound Annual Growth Rate (CAGR) of 5.62% from 2025 to 2033 indicates a significant expansion of this market. Key drivers include the need for enhanced battlefield mobility and protection, rising defense budgets in several European countries (particularly in response to the ongoing conflict in Ukraine), and technological advancements in IFV design incorporating advanced weaponry, improved armor protection, and enhanced situational awareness systems. Germany, the United Kingdom, France, and Russia represent the largest national markets, accounting for a significant share of the overall demand. The market segmentation, encompassing various IFV types (Armored Personnel Carriers, Infantry Fighting Vehicles, Main Battle Tanks, and other specialized vehicles), reflects the diverse operational requirements of European armed forces. Competition among key players like Oshkosh Corporation, Iveco Defence Vehicles, General Dynamics, BAE Systems, and Rheinmetall AG fuels innovation and drives down costs. However, market restraints include budgetary constraints in some countries, the complexity and high cost associated with developing and maintaining advanced IFV technology, and the potential for technological obsolescence. The continuing evolution of warfare doctrines and the increasing focus on asymmetric threats will also significantly influence technological development and market demand.

Europe Armored Infantry Fighting Vehicle Market Market Size (In Billion)

The forecast period (2025-2033) suggests sustained growth, driven primarily by continued modernization initiatives across Europe. The increasing emphasis on network-centric warfare, the integration of advanced sensor and communication systems, and the ongoing development of hybrid and electric propulsion systems will be critical factors shaping market trends. While the Rest of Europe segment shows potential for growth, the mature markets of Germany, France, and the UK will continue to be dominant due to their substantial defense budgets and sophisticated technological capabilities. The market's future trajectory depends on the geopolitical landscape and the continued commitment of European nations to maintaining robust defense capabilities, thereby securing the long-term health of the European Armored Infantry Fighting Vehicle market.

Europe Armored Infantry Fighting Vehicle Market Company Market Share

Europe Armored Infantry Fighting Vehicle Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Armored Infantry Fighting Vehicle (AIFV) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. The market is segmented by type (Armored Personal Carrier (APC), Infantry Fighting Vehicle (IFV), Main Battle Tank (MBT), and Other Types) and country (Germany, United Kingdom, France, Russia, Spain, and Rest of Europe). Key players analyzed include Oshkosh Corporation Inc, Iveco Defence Vehicle, General Dynamics Corporation, BAE Systems, Rheinmetall AG, ARQUUS Defense, KNDS N V, Patria, Supacat Limited (SC Group), and Military Industrial Company. The report's value exceeds xx Million.

Europe Armored Infantry Fighting Vehicle Market Market Dynamics & Concentration

The European AIFV market is characterized by moderate concentration, with a few major players holding significant market share. While precise market share figures for individual companies are proprietary data within the full report, Rheinmetall AG and BAE Systems are recognized as major players, contributing substantially to the overall market value. Innovation in areas like advanced armor protection, integrated sensor systems, and autonomous capabilities is a key growth driver. Stringent regulatory frameworks governing defense procurement, including export controls and environmental regulations, shape the market landscape. The presence of substitute technologies, although limited, necessitates continuous innovation to maintain a competitive edge. End-user preferences are shifting towards enhanced mobility, survivability, and lethality. The market has witnessed a modest level of M&A activity in recent years, with approximately xx M&A deals in the historical period. This activity is anticipated to slightly increase towards the forecast period.

- Market Concentration: Moderate, with key players holding significant shares.

- Innovation Drivers: Advanced armor, sensor integration, autonomous capabilities.

- Regulatory Frameworks: Stringent defense procurement regulations and export controls.

- Product Substitutes: Limited but represent an ongoing competitive challenge.

- End-User Trends: Demand for enhanced mobility, survivability, and lethality.

- M&A Activity: xx deals in the historical period (2019-2024), with projected increase in forecast period.

Europe Armored Infantry Fighting Vehicle Market Industry Trends & Analysis

The European AIFV market exhibits a steady growth trajectory, driven by factors such as escalating geopolitical tensions, increasing defense budgets across several European nations, and the modernization of armed forces. Technological advancements contribute to improved vehicle performance and capabilities, further stimulating market growth. The estimated market size in 2025 is xx Million, and this market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced technologies like active protection systems remains relatively low, though the adoption rate is expected to increase during the forecast period. Competitive dynamics are intense, with companies focusing on differentiation through technological advancements and strategic partnerships.

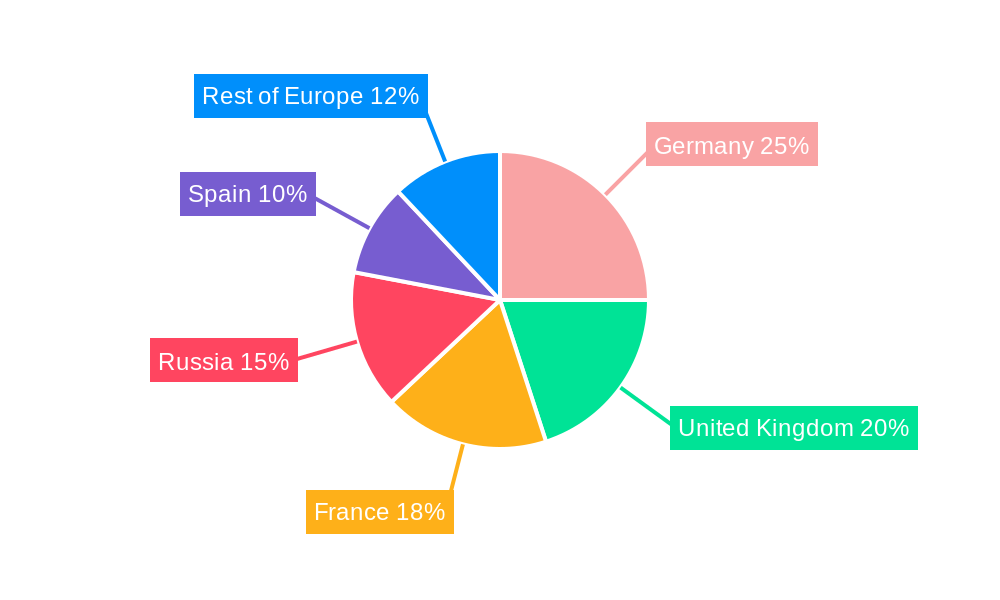

Leading Markets & Segments in Europe Armored Infantry Fighting Vehicle Market

Germany, the United Kingdom, and France represent the leading markets for AIFVs in Europe, driven by robust defense budgets and ongoing military modernization programs. These countries also dominate the IFV segment, due to the continuous need to upgrade their armored forces.

- Germany: Strong defense spending, advanced technological capabilities, and a well-established defense industry are key drivers.

- United Kingdom: Significant investments in defense modernization, participation in international coalitions, and strategic partnerships contribute to its dominance.

- France: Focus on national defense, strategic alliances, and exports of AIFVs.

- Russia: The domestic market largely relies on indigenous production. Exports are limited due to geopolitical factors.

- Spain: Moderate defense spending and regional security concerns contribute to a smaller but developing market.

- Rest of Europe: A mixed landscape with varying levels of defense expenditure and modernization initiatives.

The IFV segment holds the largest market share due to its versatile capabilities across diverse operational environments.

Europe Armored Infantry Fighting Vehicle Market Product Developments

Recent product innovations focus on enhancing survivability through advanced armor and active protection systems. Integration of sophisticated sensor and communication technologies enhances situational awareness and battlefield effectiveness. The trend is towards greater levels of automation and the incorporation of artificial intelligence to optimize operational efficiency. These advancements increase the market value and improve the overall combat readiness of AIFVs.

Key Drivers of Europe Armored Infantry Fighting Vehicle Market Growth

The market is driven by several factors: increased geopolitical instability and rising defense budgets across Europe, modernization of existing fleets with technologically advanced vehicles, the continuous demand for enhanced vehicle protection, and the growth of advanced technologies. The adoption of these technologies is further boosted by government initiatives focused on strengthening defense capabilities.

Challenges in the Europe Armored Infantry Fighting Vehicle Market Market

High procurement costs and limited defense budgets, particularly in some of the smaller European nations, represent key challenges. Supply chain disruptions and the complexities of integrating advanced technologies pose significant obstacles. Intense competition among major players, leading to price pressure and profit margin reduction also impact the market.

Emerging Opportunities in Europe Armored Infantry Fighting Vehicle Market

The emergence of hybrid and electric propulsion systems, advancements in artificial intelligence and autonomous capabilities, and increased focus on interoperability between different AIFV systems present substantial long-term opportunities. Collaborative development programs and strategic partnerships among companies are also creating avenues for market expansion.

Leading Players in the Europe Armored Infantry Fighting Vehicle Market Sector

- Oshkosh Corporation Inc

- Iveco Defence Vehicle

- General Dynamics Corporation

- BAE Systems

- Rheinmetall AG

- ARQUUS Defense

- KNDS N V

- Patria

- Supacat Limited (SC Group)

- Military Industrial Company

Key Milestones in Europe Armored Infantry Fighting Vehicle Market Industry

- 2021: Launch of the Boxer IFV by ARTEC GmbH (Germany/Netherlands)

- 2022: Rheinmetall AG secures major contract for AIFV upgrades in multiple European countries

- 2023: BAE Systems unveils new generation of IFV with advanced protection systems.

- 2024: Significant increase in defense spending announced by several European governments.

Strategic Outlook for Europe Armored Infantry Fighting Vehicle Market Market

The European AIFV market is poised for continued growth, driven by technological innovation and evolving geopolitical landscapes. Companies adopting strategic partnerships, focusing on R&D, and prioritizing the development of advanced technologies are best positioned to capitalize on the emerging opportunities. The market is projected to reach xx Million by 2033, reflecting substantial growth potential.

Europe Armored Infantry Fighting Vehicle Market Segmentation

-

1. Type

- 1.1. Armored Personal Carrier (APC)

- 1.2. Infantry Fighting Vehicle (IFV)

- 1.3. Main Battle Tank (MBT)

- 1.4. Other Types

Europe Armored Infantry Fighting Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Armored Infantry Fighting Vehicle Market Regional Market Share

Geographic Coverage of Europe Armored Infantry Fighting Vehicle Market

Europe Armored Infantry Fighting Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Armored Personal Carrier (APC)

- 5.1.2. Infantry Fighting Vehicle (IFV)

- 5.1.3. Main Battle Tank (MBT)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oshkosh Corporation Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Iveco Defence Vehicle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Dynamics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BAE Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rheinmetall AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ARQUUS Defense

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KNDS N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Patria

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supacat Limited (SC Group)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Military Industrial Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Oshkosh Corporation Inc

List of Figures

- Figure 1: Europe Armored Infantry Fighting Vehicle Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Armored Infantry Fighting Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Armored Infantry Fighting Vehicle Market?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the Europe Armored Infantry Fighting Vehicle Market?

Key companies in the market include Oshkosh Corporation Inc, Iveco Defence Vehicle, General Dynamics Corporation, BAE Systems, Rheinmetall AG, ARQUUS Defense, KNDS N V, Patria, Supacat Limited (SC Group), Military Industrial Company.

3. What are the main segments of the Europe Armored Infantry Fighting Vehicle Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Armored Infantry Fighting Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Armored Infantry Fighting Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Armored Infantry Fighting Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Armored Infantry Fighting Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence