Key Insights

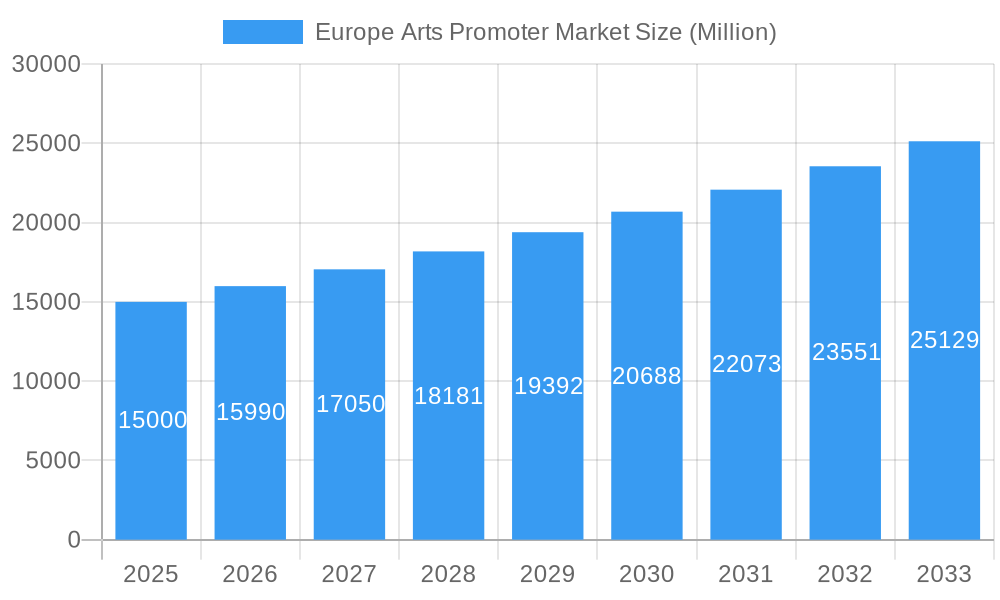

The European arts promoter market, valued at approximately €15 billion in 2025, is experiencing robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing affluence of high-net-worth individuals coupled with a rising appreciation for art and culture is significantly boosting demand for art promotion services. Secondly, technological advancements, particularly in digital marketing and online art platforms, are creating new avenues for reaching wider audiences and enhancing market reach for promoters. The growth of art tourism also plays a crucial role, driving demand for curated experiences and exhibitions, which arts promoters facilitate. Furthermore, the emergence of new art forms and creative expression further expands the market, necessitating specialized promotional strategies. Competitive rivalry amongst established players like Sotheby's and Christie's alongside innovative startups like MTArtAgency is also contributing to the dynamic nature of the market.

Europe Arts Promoter Market Market Size (In Billion)

However, the market faces certain restraints. Economic fluctuations can impact the disposable income of high-net-worth individuals, potentially reducing spending on art. Geopolitical instability and regulatory changes can also affect the international art trade, impacting the reach and profitability of arts promoters. Additionally, maintaining authenticity and originality in the increasingly digitized art world presents ongoing challenges for the sector. Segmentation within the market reveals a diverse landscape, including promotional services for contemporary art, classical art, digital art, and various associated events. The success of individual promoters hinges on their ability to adapt to these evolving trends, effectively leverage digital channels, and curate unique and compelling experiences that resonate with discerning collectors and art enthusiasts across Europe.

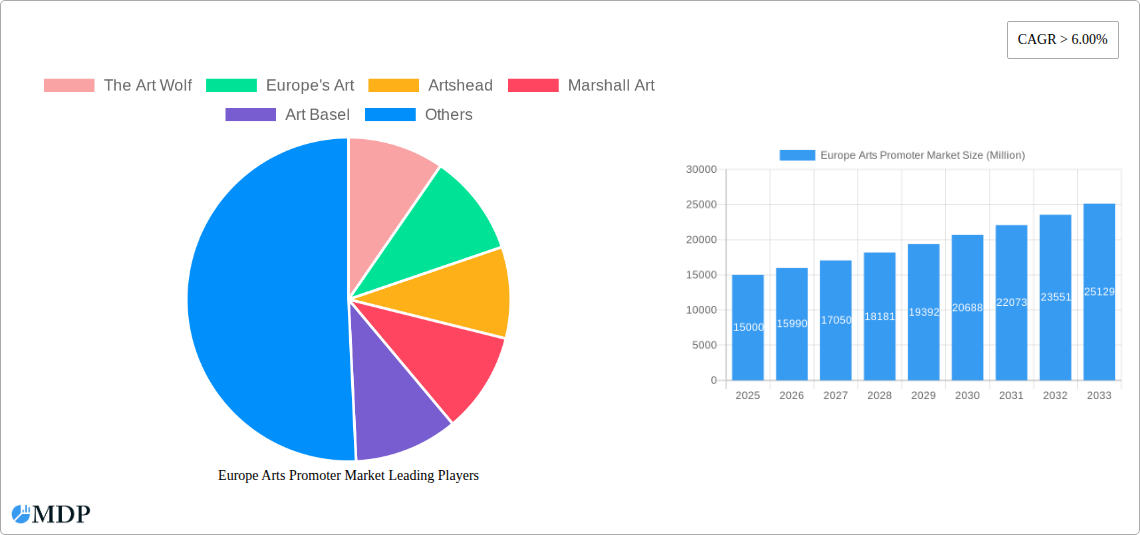

Europe Arts Promoter Market Company Market Share

Europe Arts Promoter Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Arts Promoter Market, covering market dynamics, industry trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report utilizes data from the historical period of 2019-2024 and incorporates key market events to provide valuable insights for industry stakeholders. This report is crucial for art promoters, investors, and anyone seeking a deeper understanding of this dynamic market. Expected market value in 2025 is predicted at xx Million.

Europe Arts Promoter Market Market Dynamics & Concentration

The European arts promoter market is characterized by a complex interplay of factors influencing its growth and concentration. Market concentration is currently moderate, with a few large players like Sotheby's and Christie's holding significant market share, alongside numerous smaller, specialized promoters. However, the market is witnessing increasing consolidation through mergers and acquisitions (M&A) activities. In 2024, approximately xx M&A deals were recorded, contributing to a shift towards larger, more diversified players. This trend is driven by several factors:

- Innovation: Technological advancements in online art sales platforms and digital marketing strategies are disrupting traditional promotional methods, creating new avenues for growth and attracting tech-savvy players.

- Regulatory Frameworks: Evolving regulations concerning art authentication, taxation, and cross-border trade impact market dynamics and create opportunities for specialized service providers.

- Product Substitutes: The rise of direct-to-consumer sales channels and online marketplaces presents challenges to traditional art promoters, forcing adaptation and diversification of services.

- End-User Trends: Changing consumer preferences toward experiential art engagement and the growing demand for online art experiences are impacting market demand and require adaptation by promoters.

- M&A Activities: The observed increase in M&A activity points towards consolidation and a possible future shift towards higher market concentration. Key players are seeking synergies to expand their reach and capabilities, driving market consolidation.

Europe Arts Promoter Market Industry Trends & Analysis

The European Arts Promoter Market is experiencing significant transformation, driven by a confluence of factors impacting its growth trajectory. The market demonstrates a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

- Market Growth Drivers: Increasing disposable income in key European markets, coupled with a growing appreciation for art and collectibles, is boosting demand for art promotion services. The rise of art as an investment asset further stimulates market growth. Market penetration in niche segments like digital art promotion is still relatively low, presenting significant expansion opportunities.

- Technological Disruptions: Digital platforms and online auction houses are reshaping the market landscape, allowing broader reach and access to potential buyers. This trend also presents new challenges for traditional promoters requiring digital transformation.

- Consumer Preferences: Younger generations increasingly engage with art through digital channels, demanding innovative promotional strategies that embrace technology. Personalized experiences and curated content are gaining traction.

- Competitive Dynamics: The market is characterized by both fierce competition and collaborative partnerships. Promoters are exploring strategic alliances to enhance their reach and service offerings.

Leading Markets & Segments in Europe Arts Promoter Market

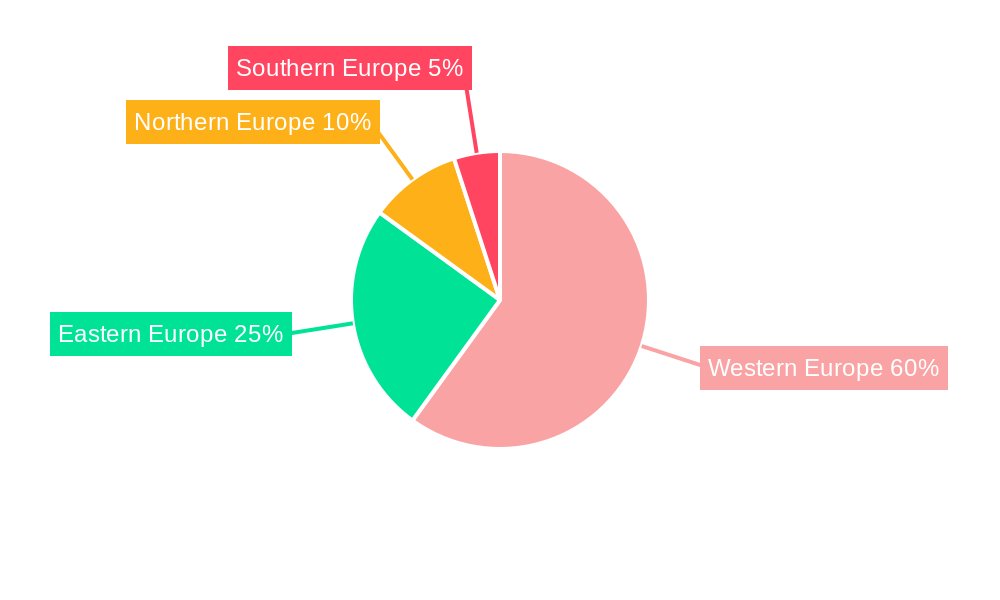

While the entire European region presents opportunities, certain markets and segments exhibit dominant positions. The United Kingdom and France consistently show the highest market share due to established art scenes, significant wealth concentration, and robust infrastructure. Germany and Italy are also important markets with growth potential.

Key Drivers for Leading Markets:

- Strong Economic Conditions: High disposable income levels and a developed art collector base drive high demand for promotion services.

- Established Art Infrastructure: Presence of prominent auction houses, galleries, and art fairs fosters a vibrant market.

- Supportive Government Policies: Policies supporting the arts and cultural heritage can positively influence market growth.

Dominance Analysis: The UK and France benefit from historical prominence in the global art world, a dense network of art professionals, and a well-developed art infrastructure, allowing for greater reach and influence.

Europe Arts Promoter Market Product Developments

Recent product innovations within the European art promotion market encompass new digital marketing strategies, AI-driven art valuation tools, and specialized services catering to specific art segments (e.g., digital art, NFTs). These innovations enhance efficiency, expand reach, and improve client services, offering competitive advantages to adopters. The market is witnessing a rapid evolution towards data-driven personalization and targeted marketing campaigns, maximizing engagement and sales.

Key Drivers of Europe Arts Promoter Market Growth

Several key factors are driving the growth of the European Arts Promoter Market:

- Technological advancements: Digitalization and the use of online platforms are expanding reach and efficiency.

- Economic growth: Increased disposable income in many European countries fuels greater art investment.

- Favorable regulatory environments: Government policies supporting arts and culture stimulate growth.

Challenges in the Europe Arts Promoter Market Market

The European Arts Promoter Market faces several key challenges:

- Intense Competition: A large number of players, including established giants and emerging firms, create a highly competitive landscape.

- Economic Downturns: Economic instability can significantly impact art spending, affecting market demand.

- Regulatory Uncertainty: Changes in taxation and cross-border regulations can create uncertainty.

Emerging Opportunities in Europe Arts Promoter Market

Significant opportunities exist for growth within the European Arts Promoter Market. The increasing adoption of NFTs and digital art creates new avenues for promotion. Strategic partnerships with technology companies can offer innovative solutions and expand reach. The expansion into underserved markets and the development of specialized services tailored to specific art segments present further growth potential.

Leading Players in the Europe Arts Promoter Market Sector

- The Art Wolf

- Europe's Art

- Artshead

- Marshall Art

- Art Basel

- Perrotin

- Sothebys

- MTArtAgency

- David Wade Fine Art

- Christies List Not Exhaustive

Key Milestones in Europe Arts Promoter Market Industry

- June 2023: Maestro Arts and Sullivan Sweetland merge, forming a mid-sized artist management company, significantly increasing their capacity and artist roster.

- June 2023: Sotheby's sells a Gustav Klimt masterpiece for USD 108.4 Million, setting a new European auction record, demonstrating the market's potential for high-value transactions.

Strategic Outlook for Europe Arts Promoter Market Market

The future of the European Arts Promoter Market looks promising. Continued technological advancements, strategic partnerships, and expansion into new markets will drive significant growth. Focusing on personalized experiences, embracing digital technologies, and adapting to evolving consumer preferences will be crucial for success in this dynamic sector. The market is poised for continued expansion driven by sustained economic growth and rising interest in art as both an investment and cultural experience.

Europe Arts Promoter Market Segmentation

-

1. Type

- 1.1. Sculpture

- 1.2. Painting

- 1.3. Visual Art

- 1.4. Fine Arts

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsoring

Europe Arts Promoter Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Arts Promoter Market Regional Market Share

Geographic Coverage of Europe Arts Promoter Market

Europe Arts Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 United Kingdom

- 3.2.2 France and Germany Driving the Market

- 3.3. Market Restrains

- 3.3.1 United Kingdom

- 3.3.2 France and Germany Driving the Market

- 3.4. Market Trends

- 3.4.1. Rising High Net Worth Individuals In Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Arts Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sculpture

- 5.1.2. Painting

- 5.1.3. Visual Art

- 5.1.4. Fine Arts

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Art Wolf

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Europe's Art

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Artshead

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marshall Art

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Art Basel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Perrotin

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sothebys

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MTArtAgency

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 David Wade Fine Art

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Christies**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Art Wolf

List of Figures

- Figure 1: Europe Arts Promoter Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Arts Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 3: Europe Arts Promoter Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Europe Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 6: Europe Arts Promoter Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Arts Promoter Market?

The projected CAGR is approximately 6.62%.

2. Which companies are prominent players in the Europe Arts Promoter Market?

Key companies in the market include The Art Wolf, Europe's Art, Artshead, Marshall Art, Art Basel, Perrotin, Sothebys, MTArtAgency, David Wade Fine Art, Christies**List Not Exhaustive.

3. What are the main segments of the Europe Arts Promoter Market?

The market segments include Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

United Kingdom. France and Germany Driving the Market.

6. What are the notable trends driving market growth?

Rising High Net Worth Individuals In Europe.

7. Are there any restraints impacting market growth?

United Kingdom. France and Germany Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Maestro Arts, a United Kingdom-based art promoter, joined forces with Sullivan Sweetland, resulting in the establishment of a mid-sized artist management company. This strategic merger enhanced their ability to support emerging artistic talent, execute ambitious projects, and significantly expand their roster of artists while increasing their project capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Arts Promoter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Arts Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Arts Promoter Market?

To stay informed about further developments, trends, and reports in the Europe Arts Promoter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence