Key Insights

The Egypt power EPC (Engineering, Procurement, and Construction) industry is experiencing robust growth, driven by increasing electricity demand fueled by a growing population and expanding industrial sector. A compound annual growth rate (CAGR) exceeding 2.5% suggests a significant market expansion over the forecast period (2025-2033). Key drivers include government initiatives promoting renewable energy sources like solar and wind power, alongside continued investment in conventional thermal power plants to ensure energy security. The market is segmented by technology (renewable and conventional), project type (EPC and EPC+O&M), and end-user (utilities, independent power producers, and industrial consumers). While the exact market size in 2025 is unavailable, based on the provided CAGR and a reasonable assumption of a 2024 market size (estimated based on regional trends and industry reports), a 2025 market size of approximately $1.5 billion (USD) is plausible. This projection is further supported by strong involvement from major EPC players like El Sewedy Electric, Mitsubishi Hitachi Power Systems, Orascom Construction, Elsewedy Power, and Siemens Energy. These companies are strategically positioned to benefit from both government-led projects and the increasing private sector investment in Egypt’s energy infrastructure. The regional focus is primarily on Egypt, with potential spillover effects into other Middle East and African nations. Growth restraints may include potential financial limitations in certain projects, regulatory hurdles, and fluctuations in global energy prices.

The dominance of established players highlights the high barriers to entry, while the segment breakdown allows for targeted investment strategies. The increasing emphasis on renewable energy integration will likely reshape the market landscape, demanding specialized expertise and technologies. Consequently, companies specializing in renewable energy EPC projects are poised for significant growth. The incorporation of O&M (Operation and Maintenance) contracts into EPC projects is a positive trend, signifying a shift toward long-term partnerships and improved project lifecycle management, impacting profitability and enhancing market stability. Future growth will hinge on the government's commitment to energy infrastructure development, the successful implementation of renewable energy targets, and the ability of EPC companies to adapt to technological advancements and changing regulatory frameworks.

Egypt Power EPC Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Egypt Power EPC industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a focus on the period 2019-2033, including a base year of 2025 and forecast extending to 2033, this report delivers crucial data and actionable intelligence. The study covers key segments, leading players, and emerging trends, equipping readers with the knowledge necessary to make informed business decisions. The report analyzes a market valued at xx Million USD in 2025, poised for significant growth in the coming years.

Egypt Power EPC Industry Market Dynamics & Concentration

The Egyptian Power EPC market exhibits a moderately concentrated landscape, with key players like El Sewedy Electric, Mitsubishi Hitachi Power Systems, Orascom Construction, Elsewedy Power, and Siemens Energy vying for market share. Market concentration is influenced by factors such as government regulations, project size, and technological expertise. Innovation drivers include the increasing adoption of renewable energy technologies and the government's push for energy diversification. Regulatory frameworks, while supportive of investment, sometimes present bureaucratic hurdles. Product substitutes are limited, primarily focusing on alternative energy sources, while M&A activity remains relatively moderate, with xx major deals recorded between 2019 and 2024.

- Market Share: El Sewedy Electric holds an estimated xx% market share, followed by Orascom Construction at xx% and Siemens Energy at xx%.

- M&A Activity: An average of xx M&A deals per year were recorded during the historical period (2019-2024). Consolidation is expected to increase slightly in the forecast period.

- End-User Trends: Utilities remain the dominant end-user segment, followed by Independent Power Producers (IPPs) and, increasingly, industrial consumers.

Egypt Power EPC Industry Industry Trends & Analysis

The Egypt Power EPC industry is experiencing robust growth, driven by the government's ambitious energy sector expansion plans and a growing demand for electricity. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033. Technological disruptions, particularly in renewable energy, are reshaping the market landscape, with solar and wind power witnessing significant penetration. Consumer preferences are shifting towards cleaner and more sustainable energy sources. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, particularly in the renewable energy segment. Market penetration of renewable energy technologies continues to rise at an estimated rate of xx% annually.

Leading Markets & Segments in Egypt Power EPC Industry

The Egyptian Power EPC market is dominated by the utilities sector, particularly state-owned entities driving large-scale projects. The renewable energy segment, specifically solar and wind power, is witnessing the most rapid expansion, fuelled by government incentives and falling technology costs. EPC projects constitute the majority of the market share compared to EPC+O&M contracts.

By Technology:

- Renewable Energy: High growth driven by government targets for renewable energy integration, abundant solar and wind resources.

- Conventional Thermal Power: Still significant, but growth is slowing as the focus shifts to cleaner alternatives.

- Nuclear Power: Significant investment, particularly with the El Dabaa NPP project, providing substantial growth opportunities.

By Project Type: EPC projects hold the larger market share, though EPC+O&M contracts are increasing.

By End-User: Utilities are the leading end-users.

Key Drivers:

- Government Policies: Supportive policies and investment in infrastructure development.

- Economic Growth: Rising electricity demand associated with population growth and industrialization.

- Foreign Investment: Attracting significant foreign investment in the energy sector.

Egypt Power EPC Industry Product Developments

Product innovation is focused on enhancing efficiency, reducing costs, and improving sustainability. This includes advancements in solar PV technology, wind turbine design, and smart grid integration. Companies are also focusing on optimizing EPC processes to reduce project timelines and improve project delivery. These developments are driving market fit by enabling faster deployment of renewable energy projects and improving overall grid reliability.

Key Drivers of Egypt Power EPC Industry Growth

The Egypt Power EPC industry’s growth is primarily driven by:

- Government Initiatives: Ambitious plans to expand electricity generation capacity, coupled with significant investments in renewable energy.

- Technological Advancements: Cost reductions in renewable energy technologies, making them increasingly competitive with conventional sources.

- Economic Expansion: Egypt's growing economy is boosting electricity demand, driving investments in new power generation and transmission infrastructure.

Challenges in the Egypt Power EPC Industry Market

Challenges include:

- Regulatory Hurdles: Navigating bureaucratic processes and obtaining necessary permits can delay projects and increase costs.

- Supply Chain Issues: Global supply chain disruptions can impact project timelines and material costs, especially for specialized equipment.

- Financing Constraints: Securing project financing can be challenging, particularly for large-scale renewable energy projects.

Emerging Opportunities in Egypt Power EPC Industry

Emerging opportunities lie in:

- Renewable Energy Expansion: Significant potential for growth in solar, wind, and other renewable energy sources.

- Smart Grid Development: Investing in smart grid technologies to optimize electricity distribution and improve grid reliability.

- Strategic Partnerships: Collaboration between domestic and international players to leverage expertise and access funding.

Leading Players in the Egypt Power EPC Industry Sector

- El Sewedy Electric

- Mitsubishi Hitachi Power Systems

- Orascom Construction

- Elsewedy Power

- Siemens Energy

Key Milestones in Egypt Power EPC Industry Industry

- November 2022: Doosan Enerbility secured a USD 1.2 billion contract for the El Dabaa Nuclear Power Plant, boosting nuclear power segment growth.

- April 2021: Belectric and CCC awarded a contract for a 50MW solar plant, signifying the growing importance of renewable energy projects.

Strategic Outlook for Egypt Power EPC Industry Market

The Egypt Power EPC market presents significant long-term growth potential, driven by the nation's energy diversification strategy and increasing electricity demand. Strategic opportunities exist for companies that can successfully navigate regulatory hurdles, leverage technological advancements, and secure project financing. The focus on renewable energy will continue to shape the market, creating opportunities for companies specializing in solar, wind, and other clean energy technologies.

Egypt Power EPC Industry Segmentation

-

1. Technology

- 1.1. Renewable Energy (Solar, Wind)

- 1.2. Conventional Thermal Power (Gas, Coal)

- 1.3. Nuclear Power

-

2. Project Type

- 2.1. EPC

- 2.2. EPC+O&M

-

3. End-User

- 3.1. Utilities

- 3.2. Independent Power Producers

- 3.3. Industrial Consumers

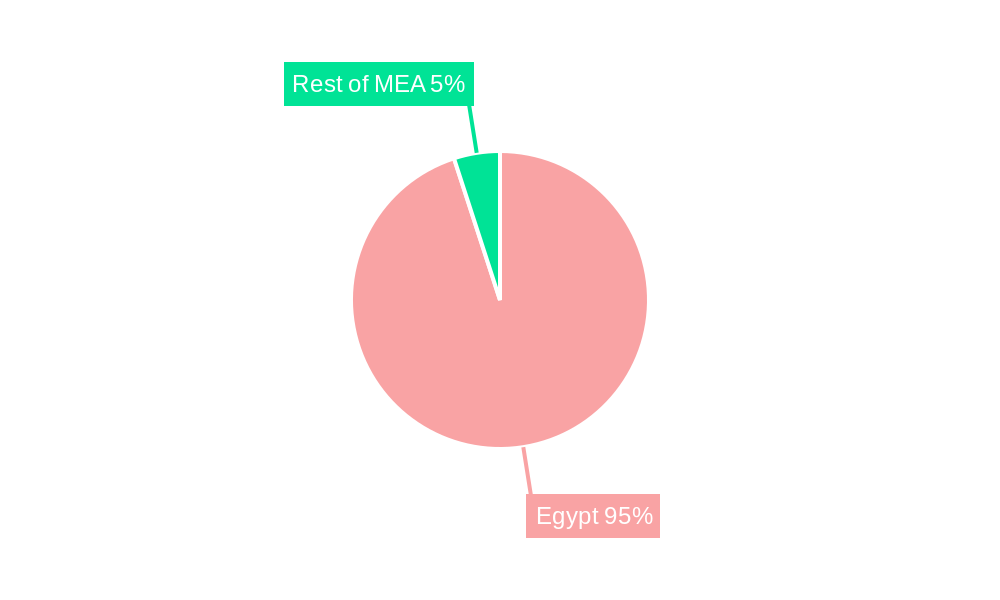

Egypt Power EPC Industry Segmentation By Geography

- 1. Egypt

Egypt Power EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Renewable Energy (Solar, Wind)

- 5.1.2. Conventional Thermal Power (Gas, Coal)

- 5.1.3. Nuclear Power

- 5.2. Market Analysis, Insights and Forecast - by Project Type

- 5.2.1. EPC

- 5.2.2. EPC+O&M

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Utilities

- 5.3.2. Independent Power Producers

- 5.3.3. Industrial Consumers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. UAE Egypt Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Egypt Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Egypt Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Egypt Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 El Sewedy Electric

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mitsubishi Hitachi Power Systems

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Orascom Construction

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Elsewedy Power

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens Energy

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 El Sewedy Electric

List of Figures

- Figure 1: Egypt Power EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Power EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: Egypt Power EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Power EPC Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Egypt Power EPC Industry Revenue Million Forecast, by Project Type 2019 & 2032

- Table 4: Egypt Power EPC Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Egypt Power EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Egypt Power EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Egypt Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Egypt Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Egypt Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Egypt Power EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Egypt Power EPC Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 12: Egypt Power EPC Industry Revenue Million Forecast, by Project Type 2019 & 2032

- Table 13: Egypt Power EPC Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 14: Egypt Power EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Power EPC Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Egypt Power EPC Industry?

Key companies in the market include El Sewedy Electric , Mitsubishi Hitachi Power Systems, Orascom Construction , Elsewedy Power , Siemens Energy .

3. What are the main segments of the Egypt Power EPC Industry?

The market segments include Technology, Project Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Conventional Thermal Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Doosan Enerbility secured a KRW 1.6 trillion (USD 1.2 billion) contract from Korea Hydro and Nuclear Power (KHNP) to build a turbine island at the El Dabaa Nuclear Power Plant (NPP) in Egypt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Power EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Power EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Power EPC Industry?

To stay informed about further developments, trends, and reports in the Egypt Power EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence