Key Insights

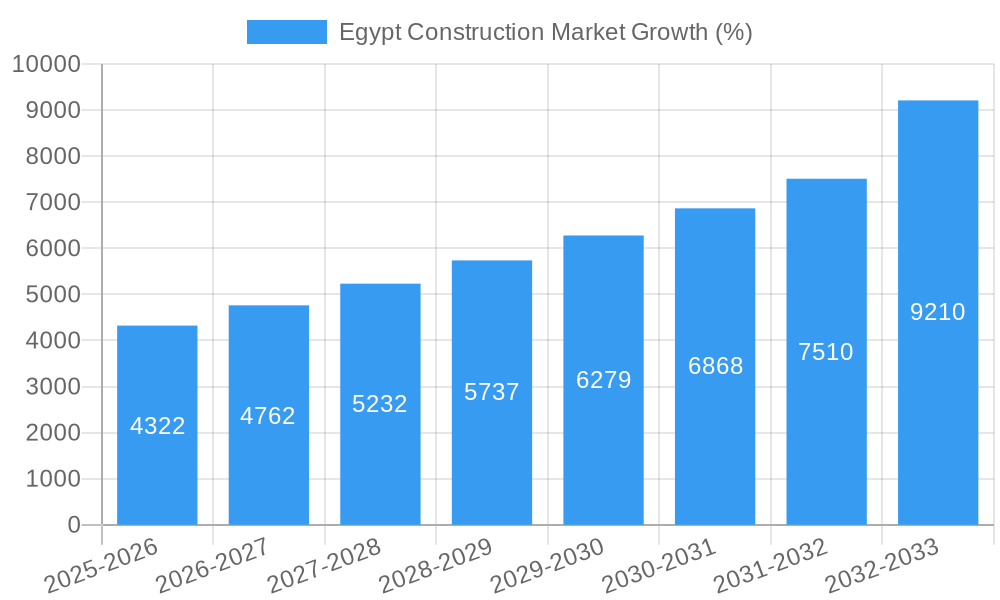

The Egypt construction market, valued at $50.78 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 8.39% from 2025 to 2033. This expansion is fueled by several key drivers. Significant government investments in infrastructure development, particularly in residential, commercial, and transportation sectors, are a major catalyst. The ongoing urbanization trend in Egypt, coupled with a growing population and rising disposable incomes, is boosting demand for new housing and commercial spaces. Furthermore, the Egyptian government's focus on large-scale projects, such as new cities and industrial zones, is creating substantial opportunities for construction companies. However, challenges such as fluctuating material prices, potential supply chain disruptions, and the need for skilled labor could moderate growth. The market is segmented across residential, commercial, industrial, transportation infrastructure, and energy and utilities sectors, with residential construction likely dominating market share due to population growth and urbanization. Key players like RAYA Holdings, Osman Group, Palm Hills Developments, and others are actively shaping the market landscape through large-scale projects and strategic partnerships.

The forecast period (2025-2033) anticipates continued growth, driven by sustained government investment and private sector participation. The market's resilience is expected to be tested by global economic uncertainties, but the long-term outlook remains positive. The diversification of projects across different sectors ensures resilience against localized economic downturns. While challenges exist, the substantial investment pipeline, coupled with the government's commitment to infrastructure development, positions the Egyptian construction market for continued expansion in the coming years. The competition among major players is fostering innovation and efficiency improvements, leading to better quality and cost-effectiveness in construction projects.

Egypt Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Egypt construction market, offering invaluable insights for investors, stakeholders, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market dynamics, trends, leading players, and future opportunities. This report is crucial for navigating the complexities of this dynamic sector and making informed strategic decisions.

Egypt Construction Market Market Dynamics & Concentration

The Egypt construction market, valued at xx Million in 2024, is characterized by moderate concentration, with several major players holding significant market share. The market's dynamics are shaped by a complex interplay of factors, including:

Market Concentration: While precise market share data for individual players is unavailable, key players like RAYA Holdings, Osman Group, Palm Hills Developments, and AL-AHLY Development command substantial portions. The level of concentration is estimated to be moderate, with a Herfindahl-Hirschman Index (HHI) of approximately xx.

Innovation Drivers: The recent partnership between Orascom Construction and COBOD to introduce 3D printing technology signifies a growing focus on innovation to improve efficiency and reduce costs. Government initiatives promoting sustainable construction practices also drive innovation.

Regulatory Frameworks: Government regulations concerning building codes, environmental standards, and licensing procedures significantly impact market operations. Recent amendments and their impact on market activities are analyzed within the full report.

Product Substitutes: While limited direct substitutes exist for traditional construction materials, the increasing adoption of prefabricated components and sustainable materials presents some level of substitution.

End-User Trends: A rising population, urbanization, and government infrastructure projects fuel strong demand across residential, commercial, and infrastructure segments. Changing preferences towards sustainable and smart buildings are also influencing market trends.

M&A Activities: The number of M&A deals within the Egyptian construction sector in the historical period (2019-2024) averaged xx deals annually. The report analyzes the impact of key mergers and acquisitions on market concentration and competitive dynamics.

Egypt Construction Market Industry Trends & Analysis

The Egypt construction market exhibits a robust growth trajectory, driven by sustained government investment in infrastructure, a burgeoning population, and a thriving real estate sector. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at xx%, exceeding the global average. This growth is further fueled by:

Market Growth Drivers: Significant government spending on mega-projects, including new cities and transportation networks, is a primary driver. The expansion of the tourism sector also contributes significantly to construction activity.

Technological Disruptions: The adoption of Building Information Modeling (BIM), advanced construction materials, and, as evidenced by the Orascom/COBOD partnership, 3D printing technology are revolutionizing construction practices, enhancing efficiency, and improving project outcomes.

Consumer Preferences: Growing demand for sustainable buildings, smart homes, and improved living standards are reshaping construction trends, driving demand for energy-efficient and technologically advanced buildings.

Competitive Dynamics: The market is characterized by both intense competition among large established firms and the emergence of smaller, specialized contractors. This competitive landscape fosters innovation and drives down costs, benefiting end-users. Market penetration by key players is analyzed in detail within the full report.

Leading Markets & Segments in Egypt Construction Market

The Egyptian construction market shows considerable strength across multiple segments, with the residential sector dominating.

Dominant Segments:

Residential: This sector remains the largest, driven by population growth, urbanization, and increased demand for affordable and luxury housing. Key drivers include government initiatives promoting affordable housing and the expansion of new urban developments.

Commercial: Growth in this segment is propelled by increasing foreign investment, expansion of the tourism sector, and the development of modern office spaces and retail complexes.

Industrial: This sector experiences moderate growth tied to industrial zone developments and manufacturing expansion.

Transportation Infrastructure: Massive government investments in road, rail, and airport infrastructure projects are key drivers in this sector.

Energy and Utilities: The growing energy demands fuel development in power plants, renewable energy projects, and related infrastructure.

The full report provides a granular analysis of each segment, detailing market size, growth drivers, and future prospects.

Egypt Construction Market Product Developments

Significant innovations are shaping the Egyptian construction landscape. The introduction of 3D printing technology offers the potential to drastically accelerate construction timelines and reduce costs. The adoption of sustainable materials, prefabricated components, and digital construction technologies are improving project efficiency and sustainability, enhancing the appeal of Egypt's construction market.

Key Drivers of Egypt Construction Market Growth

Several factors fuel the growth of the Egyptian construction market:

Government Infrastructure Spending: Massive investments in infrastructure projects drive substantial demand across various sectors.

Population Growth and Urbanization: A rising population and continued urbanization create a strong need for new housing and infrastructure.

Foreign Investment: Increased foreign direct investment further fuels construction activity, particularly in the commercial and tourism sectors.

Technological Advancements: The adoption of new technologies enhances efficiency and productivity, promoting market growth.

Challenges in the Egypt Construction Market Market

Despite its growth potential, the Egyptian construction market faces several challenges:

Regulatory Hurdles: Bureaucratic procedures and licensing processes can create delays and increase project costs.

Supply Chain Issues: Fluctuations in material prices and potential supply chain disruptions can affect project timelines and profitability.

Competitive Pressures: Intense competition, particularly in the residential sector, can pressure profit margins.

Emerging Opportunities in Egypt Construction Market

The Egyptian construction market presents several attractive long-term opportunities:

Green Building Technologies: Growing demand for sustainable buildings creates significant opportunities for companies specializing in green construction technologies.

Strategic Partnerships: Collaborations between international and local firms can leverage expertise and technology, fostering rapid market expansion.

Expansion into New Cities: The development of new administrative capitals and urban centers presents substantial growth potential.

Leading Players in the Egypt Construction Market Sector

- RAYA Holdings

- Osman Group

- Palm Hills Developments

- AL-AHLY Development

- GAMA Constructions

- DORRA Group

- The Arab Contractors

- Construction & Reconstruction Engineering Company

- Energya- PTS

- H A Construction (H A C)

Key Milestones in Egypt Construction Market Industry

October 2022: ERG Developments commences construction of the Ri8 residential complex in the New Administrative Capital (NAC), a 3.5 Billion Egyptian pounds investment encompassing 1,063 units.

November 2022: Orascom Construction PLC partners with COBOD to introduce 3D printing construction technology to Egypt, marking a significant technological advancement in the sector.

Strategic Outlook for Egypt Construction Market Market

The Egypt construction market is poised for sustained growth over the forecast period. Strategic investments in infrastructure, technological advancements, and the pursuit of sustainable construction practices will be key factors driving long-term market expansion. Opportunities abound for companies that adapt to evolving market trends and adopt innovative technologies to improve efficiency and reduce costs.

Egypt Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Transportation Infrastructure

- 1.5. Energy and Utilities

Egypt Construction Market Segmentation By Geography

- 1. Egypt

Egypt Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Increased investment in residential segment by government driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Transportation Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 RAYA Holdings**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Osman Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Palm Hills Developments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AL-AHLY Development

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GAMA Constructions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DORRA Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Arab Contractors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Construction & Reconstruction Engineering Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Energya- PTS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H A Construction (H A C)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 RAYA Holdings**List Not Exhaustive

List of Figures

- Figure 1: Egypt Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Egypt Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Egypt Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Egypt Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Egypt Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Construction Market?

The projected CAGR is approximately 8.39%.

2. Which companies are prominent players in the Egypt Construction Market?

Key companies in the market include RAYA Holdings**List Not Exhaustive, Osman Group, Palm Hills Developments, AL-AHLY Development, GAMA Constructions, DORRA Group, The Arab Contractors, Construction & Reconstruction Engineering Company, Energya- PTS, H A Construction (H A C).

3. What are the main segments of the Egypt Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.78 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Increased investment in residential segment by government driving the market.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

October 2022: ERG Developments in the New Administrative Capital (NAC) has begun construction on the residential complex Ri8 for an estimated 3.5 billion Egyptian pounds. The 25-acre Ri8 Compound is part of Zawya Projects, which was to be built in three phases and includes 34 residential structures with 1,063 units.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Construction Market?

To stay informed about further developments, trends, and reports in the Egypt Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence