Key Insights

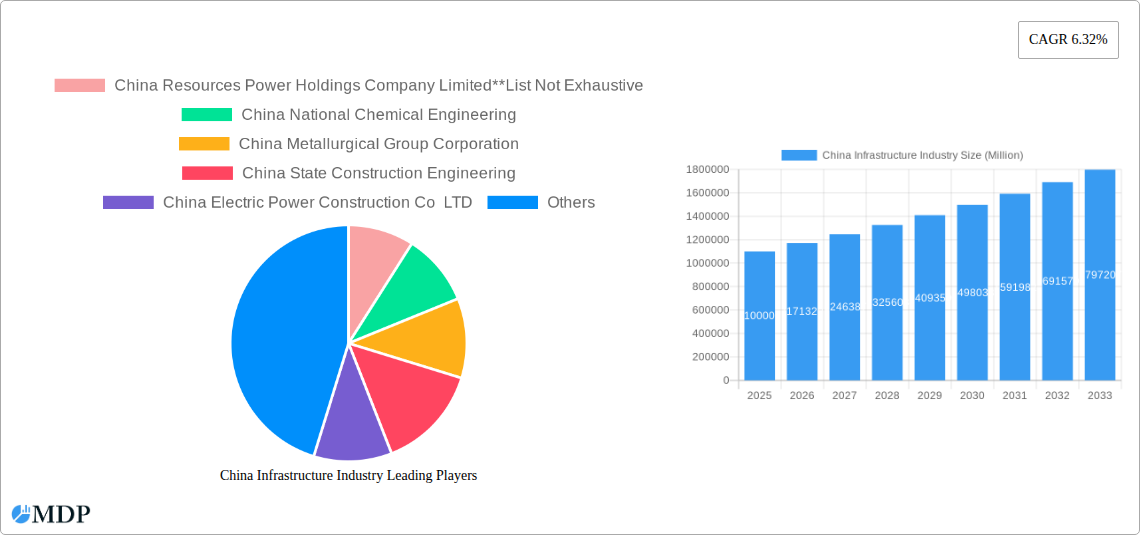

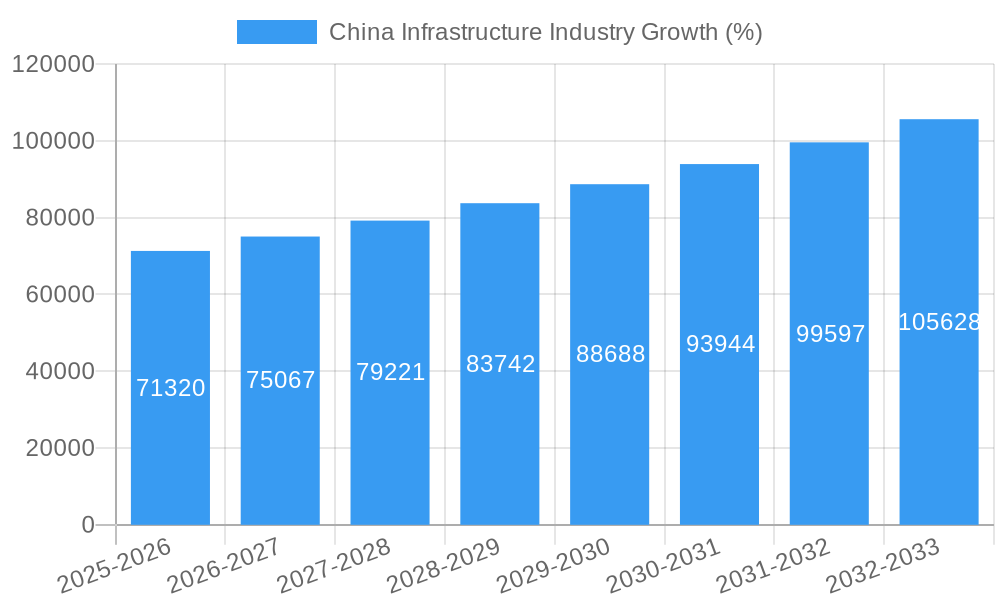

The China infrastructure market, valued at $1.10 trillion in 2025, is projected to experience robust growth, driven by sustained government investment in social infrastructure projects like transportation networks, water management systems, and telecommunications. The 6.32% CAGR indicates a significant expansion over the forecast period (2025-2033). Key drivers include urbanization, industrialization, and the government's ongoing commitment to modernization and improving living standards. This translates into considerable opportunities for both domestic and international companies involved in construction, engineering, and materials supply. The market is segmented by infrastructure type (social infrastructure encompassing transportation, waterways, telecoms, and manufacturing infrastructure) and key cities (Shanghai, Beijing, Shenzhen), reflecting regional variations in project pipelines and investment intensity. While specific restraints aren't detailed, factors like potential economic fluctuations, environmental regulations, and resource availability could influence market growth trajectory. Competition among major players like China Resources Power Holdings, China National Chemical Engineering, and China State Construction Engineering is intense, driving innovation and efficiency improvements. The continued focus on high-speed rail expansion, smart city initiatives, and renewable energy infrastructure projects will further shape market dynamics in the coming years. This market showcases substantial long-term potential, underpinned by China's strategic economic development plans.

The dominance of state-owned enterprises within the Chinese infrastructure sector underscores the importance of government policy and regulatory frameworks. Analyzing the specific projects undertaken by these companies provides a granular view of sector performance. The focus on specific key cities like Shanghai, Beijing, and Shenzhen highlights the concentration of investment in major urban centers, reflecting ongoing urbanization and the need for improved infrastructure to support these rapidly growing populations. Further research into specific sub-segments, like high-speed rail or renewable energy projects, can provide a more nuanced understanding of investment trends and opportunities. The data suggests the market's sustained growth is likely to attract significant foreign investment, fostering collaboration and technology transfer. Ongoing monitoring of macroeconomic indicators and policy changes is crucial for accurate forecasting and effective strategic decision-making in this dynamic market.

China Infrastructure Industry Report: 2019-2033 Forecast

Uncover the lucrative opportunities and challenges shaping China's multi-trillion dollar infrastructure market. This comprehensive report provides an in-depth analysis of the China infrastructure industry, covering market dynamics, leading players, technological advancements, and future growth prospects. With a forecast period spanning 2025-2033 and a base year of 2025, this report is an essential resource for investors, industry professionals, and strategic decision-makers. The study period covers 2019-2024, providing valuable historical context. The report leverages data from 2025 to project future market trends.

China Infrastructure Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of China's infrastructure industry, examining market concentration, innovation, regulatory influences, and M&A activity. The market is highly concentrated, with several state-owned enterprises holding significant market share. In 2025, the top 5 companies are estimated to hold xx% of the market.

Market Concentration: The top 10 players account for an estimated xx% of the total market revenue in 2025. This high concentration is driven by the dominance of state-owned enterprises and large-scale project requirements. The Herfindahl-Hirschman Index (HHI) is projected to be xx in 2025, indicating a highly concentrated market.

Innovation Drivers: Government initiatives promoting technological advancement and sustainable infrastructure development are key innovation drivers. Increased adoption of BIM (Building Information Modeling), AI-powered project management, and sustainable materials are shaping the industry.

Regulatory Frameworks: Government regulations concerning environmental protection, safety standards, and land acquisition play a critical role in shaping market dynamics. Recent policy changes focusing on greener infrastructure have led to increased investments in renewable energy projects.

Product Substitutes: The emergence of advanced construction materials and techniques is creating some level of substitution, but overall, the demand for traditional infrastructure remains robust.

End-User Trends: Growing urbanization, industrial expansion, and improving living standards are driving demand for diverse infrastructure projects.

M&A Activity: The number of M&A deals in the Chinese infrastructure sector was xx in 2024, projected to increase to xx in 2025. These deals are primarily driven by companies seeking to expand their geographic reach, enhance technological capabilities, and consolidate market share.

China Infrastructure Industry Industry Trends & Analysis

This section explores the key trends driving the growth and evolution of the Chinese infrastructure industry. The industry is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fuelled by significant investments in transportation, energy, and telecommunications infrastructure. Market penetration of new technologies such as 5G and smart city solutions is expected to reach xx% by 2033. This trend is further enhanced by government support for technological upgrades and efficiency improvements across the industry. Consumer preferences are shifting towards higher quality, sustainable, and technologically advanced infrastructure solutions, driving innovation and competition.

Leading Markets & Segments in China Infrastructure Industry

This section highlights the leading markets and segments within the Chinese infrastructure industry.

By Type:

Transportation Infrastructure: This remains the largest segment, driven by extensive expansion of high-speed rail networks, highways, and urban transit systems. Key drivers include government initiatives to improve connectivity, support economic development, and enhance logistics efficiency.

Social Infrastructure: This segment encompasses hospitals, schools, and other public facilities, experiencing significant growth driven by government spending on improving social welfare and public services.

Waterways: Investments in port facilities, waterways, and water management systems are substantial, supported by the country's strategic focus on maritime trade and water resource management.

Extraction Infrastructure: This segment focuses on mining and resource extraction, showing growth due to increasing demand for raw materials.

By Key Cities:

Shanghai: As a major economic hub, Shanghai continues to lead in infrastructure development, attracting substantial investment in transportation, energy, and communications infrastructure.

Beijing: Significant government investment in infrastructure projects keeps Beijing a key market.

Shenzhen: Shenzhen's rapid growth as a tech hub drives investment in high-tech infrastructure, including data centers and advanced transportation systems.

China Infrastructure Industry Product Developments

The Chinese infrastructure industry is witnessing significant product innovations, driven by technological advancements and the need for improved efficiency and sustainability. New materials such as high-strength concrete and advanced composites are being increasingly adopted, while automation and robotics are transforming construction processes. Smart city initiatives are further driving the development of integrated infrastructure solutions, incorporating intelligent transportation systems, energy-efficient buildings, and advanced data analytics. The market is seeing increased adoption of prefabricated construction methods to speed up construction times and enhance efficiency.

Key Drivers of China Infrastructure Industry Growth

Several factors contribute to the sustained growth of China's infrastructure industry.

Government Investment: Massive government investment in infrastructure projects remains the primary growth driver. The “Belt and Road” initiative further fuels growth through international projects.

Urbanization: Rapid urbanization necessitates continuous expansion of transportation, housing, and utility infrastructure.

Technological Advancements: Adoption of innovative technologies boosts efficiency and reduces costs.

Challenges in the China Infrastructure Industry Market

Despite the significant growth, the industry faces challenges.

Funding Constraints: While overall investment is significant, securing funding for large-scale projects can be complex.

Environmental Concerns: Balancing infrastructure development with environmental protection remains a major challenge.

Supply Chain Disruptions: Global supply chain issues can impact project timelines and costs.

Emerging Opportunities in China Infrastructure Industry

The Chinese infrastructure industry presents significant long-term opportunities. Expanding into rural areas, developing resilient infrastructure, and increasing private sector participation will create new avenues for growth. Furthermore, the integration of renewable energy sources into infrastructure projects and the development of smart cities are key growth areas.

Leading Players in the China Infrastructure Industry Sector

- China Resources Power Holdings Company Limited

- China National Chemical Engineering

- China Metallurgical Group Corporation

- China State Construction Engineering

- China Electric Power Construction Co LTD

- China Communications Construction Company

- China Energy Engineering Corporation

- Shanghai Construction Group

- China Railway Group Limited

- China Power International Development Limited

- China Railway Construction Corporation

Key Milestones in China Infrastructure Industry Industry

- 2020: Launch of several key infrastructure projects under the “Belt and Road” Initiative.

- 2022: Increased focus on green and sustainable infrastructure initiatives by the government.

- 2024: Significant investments in 5G network infrastructure.

Strategic Outlook for China Infrastructure Industry Market

The long-term outlook for the Chinese infrastructure industry remains positive, fueled by continued government investment, urbanization, and technological advancements. Strategic partnerships, expansion into new markets, and focusing on sustainable and resilient infrastructure solutions will shape the industry's future. The market's potential is vast, with opportunities for both domestic and international players.

China Infrastructure Industry Segmentation

-

1. Type

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Other Social Infrastructures

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission and Distribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

- 1.4.5. Other Manufacturing Infrastructures

-

1.1. Social Infrastructure

-

2. Key Cities

- 2.1. Shanghai

- 2.2. Beijing

- 2.3. Shenzhen

China Infrastructure Industry Segmentation By Geography

- 1. China

China Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population

- 3.2.2 along with a rising middle class

- 3.3. Market Restrains

- 3.3.1. Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs

- 3.4. Market Trends

- 3.4.1. Transportation Infrastructure is Witnessing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Infrastructure Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Other Social Infrastructures

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission and Distribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.4.5. Other Manufacturing Infrastructures

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Shanghai

- 5.2.2. Beijing

- 5.2.3. Shenzhen

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China Resources Power Holdings Company Limited**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China National Chemical Engineering

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Metallurgical Group Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China State Construction Engineering

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Electric Power Construction Co LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Communications Construction Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Energy Engineering Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Construction Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Railway Group Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Power International Development Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 China Railway Construction Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 China Resources Power Holdings Company Limited**List Not Exhaustive

List of Figures

- Figure 1: China Infrastructure Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Infrastructure Industry Share (%) by Company 2024

List of Tables

- Table 1: China Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: China Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: China Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: China Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: China Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Infrastructure Industry?

The projected CAGR is approximately 6.32%.

2. Which companies are prominent players in the China Infrastructure Industry?

Key companies in the market include China Resources Power Holdings Company Limited**List Not Exhaustive, China National Chemical Engineering, China Metallurgical Group Corporation, China State Construction Engineering, China Electric Power Construction Co LTD, China Communications Construction Company, China Energy Engineering Corporation, Shanghai Construction Group, China Railway Group Limited, China Power International Development Limited, China Railway Construction Corporation.

3. What are the main segments of the China Infrastructure Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population. along with a rising middle class.

6. What are the notable trends driving market growth?

Transportation Infrastructure is Witnessing Significant Growth.

7. Are there any restraints impacting market growth?

Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Infrastructure Industry?

To stay informed about further developments, trends, and reports in the China Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence