Key Insights

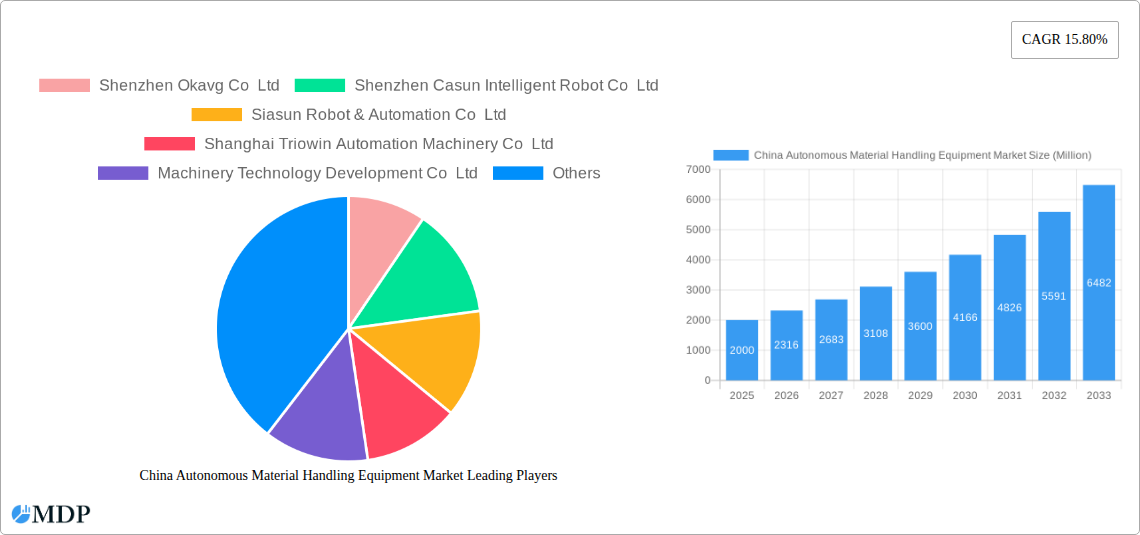

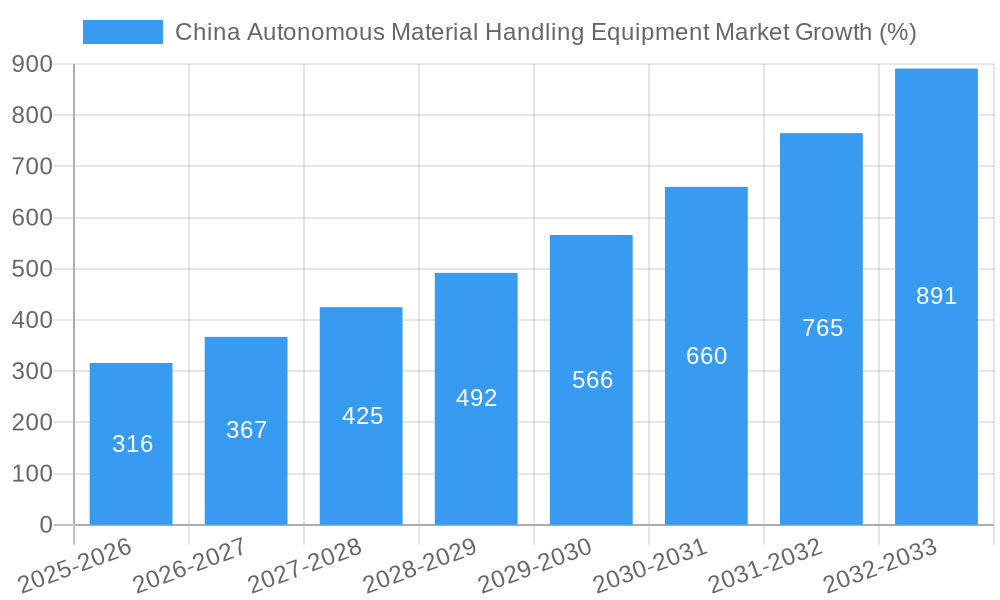

The China autonomous material handling equipment market exhibits robust growth, driven by the nation's expanding e-commerce sector, increasing automation needs across various industries, and government initiatives promoting technological advancements. The market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is projected to experience a Compound Annual Growth Rate (CAGR) of 15.80% from 2025 to 2033. Key growth drivers include the rising demand for efficient warehousing and logistics solutions in rapidly expanding industries like e-commerce and manufacturing, coupled with a growing need to improve worker safety and productivity. Furthermore, the adoption of Industry 4.0 principles and smart factories is fueling the demand for sophisticated autonomous material handling systems. Significant market segments include automated guided vehicles (AGVs), automated storage and retrieval systems (ASRS), and mobile robots, each contributing substantially to the overall market value. The strong presence of established domestic players like Shenzhen Okavg Co Ltd, Shenzhen Casun Intelligent Robot Co Ltd, and Siasun Robot & Automation Co Ltd, along with continuous technological innovations, further contributes to the market’s positive trajectory.

The market segmentation reveals significant opportunities across various end-user verticals. The e-commerce boom is driving significant growth in the retail/warehousing/distribution centers segment, requiring highly efficient and automated material handling solutions. Similarly, the pharmaceutical and food and beverage industries are increasingly adopting automation for improved hygiene, traceability, and efficiency. The preference for specific equipment types varies across sectors; for instance, the automotive sector might favor AGVs and robotic systems, while warehouses might prioritize ASRS and mobile robots. Challenges include the high initial investment costs associated with implementing autonomous systems and the need for skilled workforce training. Despite these challenges, the long-term benefits of improved efficiency, reduced labor costs, and enhanced safety are expected to propel market growth, making China a strategically vital market for autonomous material handling equipment providers.

China Autonomous Material Handling Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning China Autonomous Material Handling Equipment market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, technological advancements, and future growth opportunities. The market is segmented by end-user vertical (Airport, Automotive, Food & Beverage, Retail/Warehousing/Distribution Centers/Logistic Centers, General Manufacturing, Pharmaceuticals, Post & Parcel, Other End-Users), product type (Hardware, Software, Services), and equipment type (Mobile Robots, AGVs, Laser Guided Vehicles, ASRS, Vertical Lift Modules, Automated Conveyors, Overhead Palletizers, Robotic Sortation Systems). The report forecasts a market value of xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

China Autonomous Material Handling Equipment Market Market Dynamics & Concentration

The China Autonomous Material Handling Equipment market is experiencing significant growth, driven by a confluence of factors. Market concentration is currently moderate, with several key players holding substantial shares, but the market remains dynamic with ongoing mergers and acquisitions (M&A) activities. Innovation is a key driver, with continuous advancements in robotics, AI, and automation technologies. The regulatory framework, while evolving, is generally supportive of technological advancements in the logistics and manufacturing sectors. Product substitutes, such as traditional manual handling equipment, are gradually being replaced due to efficiency gains and cost savings offered by autonomous solutions. End-user trends show a strong preference for automated solutions due to increasing labor costs, rising demand for faster delivery times, and the need for enhanced operational efficiency.

- Market Share: The top 5 players account for approximately xx% of the market share in 2025.

- M&A Activity: A total of xx M&A deals were recorded between 2019 and 2024. This is expected to increase in the coming years.

- Innovation Drivers: Advancements in AI, machine learning, and sensor technologies are driving innovation.

- Regulatory Landscape: Government initiatives promoting automation and digitalization are creating favorable conditions.

China Autonomous Material Handling Equipment Market Industry Trends & Analysis

The China Autonomous Material Handling Equipment market is characterized by rapid growth, fueled by several key factors. The increasing adoption of e-commerce, coupled with the expansion of logistics networks and the demand for efficient supply chain solutions, significantly boosts market demand. Technological disruptions, such as the introduction of 5G technology and the development of sophisticated AI algorithms, are enhancing the capabilities and efficiency of autonomous material handling equipment. Consumer preferences are shifting towards faster and more reliable delivery services, further driving the adoption of automation. Competitive dynamics are intense, with both established players and emerging startups vying for market share through innovation and strategic partnerships. The market penetration rate is expected to reach xx% by 2033. The CAGR for the period 2025-2033 is projected at xx%.

Leading Markets & Segments in China Autonomous Material Handling Equipment Market

The Retail/Warehousing/Distribution Centers/Logistic Centers segment dominates the end-user vertical, driven by the explosive growth of e-commerce and the need for efficient order fulfillment. The Hardware segment leads the product type category, representing the core component of these systems. Within equipment types, AGVs (particularly Automated Forklifts and Automated Tow/Tractor/Tugs) and Mobile Robots hold the largest market shares due to their widespread applicability across various industries.

- Key Drivers (Retail/Warehousing/Distribution Centers/Logistic Centers):

- Rapid growth of e-commerce.

- Increasing demand for faster delivery.

- Expansion of logistics networks.

- Government initiatives promoting efficient logistics.

- Dominance Analysis: The substantial growth in e-commerce and the ongoing expansion of logistics infrastructure within China contribute significantly to the dominance of the Retail/Warehousing/Distribution Centers/Logistic Centers segment. The high demand for efficient material handling solutions within these sectors propels the adoption of autonomous equipment.

China Autonomous Material Handling Equipment Market Product Developments

Recent product developments focus on improving the efficiency, safety, and intelligence of autonomous material handling equipment. This includes advancements in navigation technologies, such as SLAM (Simultaneous Localization and Mapping) and sensor fusion, which enhance the precision and reliability of these systems. Integration of AI capabilities enables more sophisticated decision-making and adaptive behaviors. New applications are constantly emerging, such as the use of autonomous robots in last-mile delivery and in-warehouse automation.

Key Drivers of China Autonomous Material Handling Equipment Market Growth

The market's expansion is driven by several factors: increasing labor costs necessitate automation; the expanding e-commerce sector demands enhanced logistics efficiency; government policies promoting technological advancements and industrial automation further boost adoption; finally, technological improvements lead to more sophisticated and cost-effective autonomous solutions.

Challenges in the China Autonomous Material Handling Equipment Market Market

Challenges include the high initial investment costs associated with implementing autonomous systems, the need for robust and reliable infrastructure to support operations, and the potential for cybersecurity vulnerabilities. Furthermore, the competition is fierce, with both domestic and international players vying for market share.

Emerging Opportunities in China Autonomous Material Handling Equipment Market

Emerging opportunities lie in the development of more sophisticated AI-powered systems, the integration of autonomous equipment into broader IoT ecosystems, and the expansion into new application areas such as smart factories and automated healthcare facilities. Strategic partnerships and collaborations between technology providers and end-users will play a crucial role in driving market growth.

Leading Players in the China Autonomous Material Handling Equipment Market Sector

- Shenzhen Okavg Co Ltd

- Shenzhen Casun Intelligent Robot Co Ltd

- Siasun Robot & Automation Co Ltd

- Shanghai Triowin Automation Machinery Co Ltd

- Machinery Technology Development Co Ltd

- Guangzhou Sinorobot Technology Co Ltd

- Zhejiang Guozi Robot Technology Co Ltd

- Noblelift Intelligent Equipment Co Ltd

Key Milestones in China Autonomous Material Handling Equipment Market Industry

- November 2020: Alibaba's warehouse achieves a 300% production increase using Quicktron robots.

- January 2021: Yaskawa Electric invests heavily in a new robot component manufacturing plant in Changzhou.

Strategic Outlook for China Autonomous Material Handling Equipment Market Market

The China Autonomous Material Handling Equipment market holds immense long-term potential, driven by sustained growth in e-commerce, advancements in automation technology, and supportive government policies. Strategic opportunities for players include focusing on innovation, forging strategic partnerships, and expanding into underserved market segments. The market is poised for continued robust expansion in the coming years.

China Autonomous Material Handling Equipment Market Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Equipment Type

-

2.1. Mobile Robots

-

2.1.1. Automated Guided Vehicle (AGV)

- 2.1.1.1. Automated Forklift

- 2.1.1.2. Automated Tow/Tractor/Tug

- 2.1.1.3. Unit Load

- 2.1.1.4. Assembly Line

- 2.1.1.5. Special Purpose

- 2.1.2. Autonomous Mobile Robots (AMR)

- 2.1.3. Laser Guided Vehicle

-

2.1.1. Automated Guided Vehicle (AGV)

-

2.2. Automated Storage and Retrieval System (ASRS)

- 2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 2.2.3. Vertical Lift Module

-

2.3. Automated Conveyor

- 2.3.1. Belt

- 2.3.2. Roller

- 2.3.3. Pallet

- 2.3.4. Overhead

-

2.4. Palletizer

- 2.4.1. Conventional (High Level + Low Level)

- 2.4.2. Robotic

- 2.5. Sortation System

-

2.1. Mobile Robots

-

3. End-user Vertical

- 3.1. Airport

- 3.2. Automotive

- 3.3. Food and Beverage

- 3.4. Retail/W

- 3.5. General Manufacturing

- 3.6. Pharmaceuticals

- 3.7. Post and Parcel

- 3.8. Other End-Users

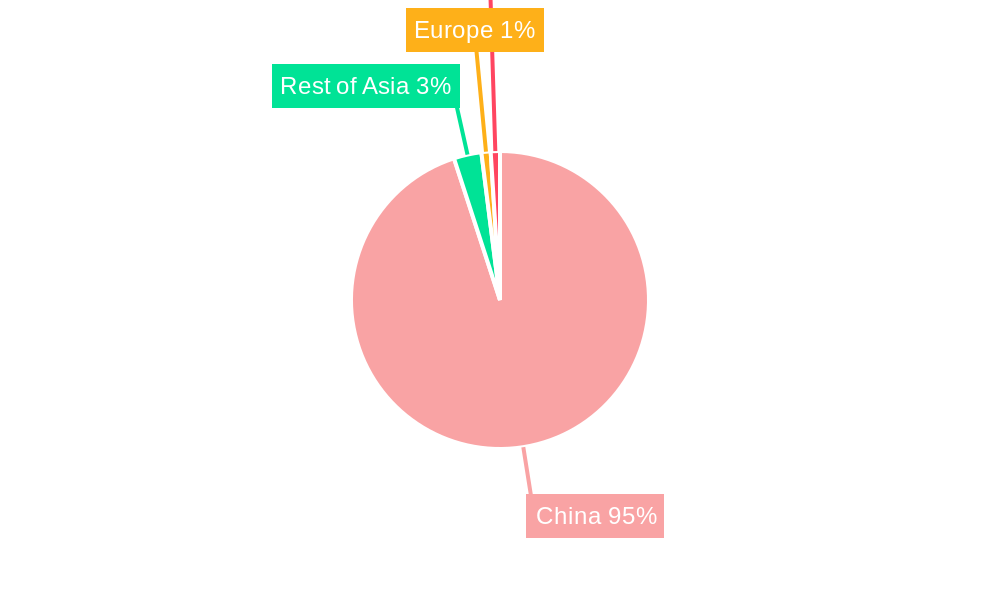

China Autonomous Material Handling Equipment Market Segmentation By Geography

- 1. China

China Autonomous Material Handling Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing technological advancements aiding market growth; Industry 4.0 investments driving the demand for automation and material handling; Rapid growth of Smart manufacturing

- 3.3. Market Restrains

- 3.3.1. Unavailability for skilled workforce

- 3.4. Market Trends

- 3.4.1. AGV to Register Highest CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Autonomous Material Handling Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Mobile Robots

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.1.1.1. Automated Forklift

- 5.2.1.1.2. Automated Tow/Tractor/Tug

- 5.2.1.1.3. Unit Load

- 5.2.1.1.4. Assembly Line

- 5.2.1.1.5. Special Purpose

- 5.2.1.2. Autonomous Mobile Robots (AMR)

- 5.2.1.3. Laser Guided Vehicle

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.2. Automated Storage and Retrieval System (ASRS)

- 5.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3. Vertical Lift Module

- 5.2.3. Automated Conveyor

- 5.2.3.1. Belt

- 5.2.3.2. Roller

- 5.2.3.3. Pallet

- 5.2.3.4. Overhead

- 5.2.4. Palletizer

- 5.2.4.1. Conventional (High Level + Low Level)

- 5.2.4.2. Robotic

- 5.2.5. Sortation System

- 5.2.1. Mobile Robots

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Airport

- 5.3.2. Automotive

- 5.3.3. Food and Beverage

- 5.3.4. Retail/W

- 5.3.5. General Manufacturing

- 5.3.6. Pharmaceuticals

- 5.3.7. Post and Parcel

- 5.3.8. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shenzhen Okavg Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shenzhen Casun Intelligent Robot Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siasun Robot & Automation Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shanghai Triowin Automation Machinery Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Machinery Technology Development Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Guangzhou Sinorobot Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Guozi Robot Technology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Noblelift Intelligent Equipment Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Shenzhen Okavg Co Ltd

List of Figures

- Figure 1: China Autonomous Material Handling Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Autonomous Material Handling Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 9: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 10: China Autonomous Material Handling Equipment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Autonomous Material Handling Equipment Market?

The projected CAGR is approximately 15.80%.

2. Which companies are prominent players in the China Autonomous Material Handling Equipment Market?

Key companies in the market include Shenzhen Okavg Co Ltd, Shenzhen Casun Intelligent Robot Co Ltd, Siasun Robot & Automation Co Ltd, Shanghai Triowin Automation Machinery Co Ltd, Machinery Technology Development Co Ltd, Guangzhou Sinorobot Technology Co Ltd, Zhejiang Guozi Robot Technology Co Ltd, Noblelift Intelligent Equipment Co Ltd.

3. What are the main segments of the China Autonomous Material Handling Equipment Market?

The market segments include Product Type, Equipment Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing technological advancements aiding market growth; Industry 4.0 investments driving the demand for automation and material handling; Rapid growth of Smart manufacturing.

6. What are the notable trends driving market growth?

AGV to Register Highest CAGR.

7. Are there any restraints impacting market growth?

Unavailability for skilled workforce.

8. Can you provide examples of recent developments in the market?

November 2020 - A Chinese 32,000-square-foot warehouse belonging to e-commerce giant Alibaba successfully increased its production rate by 300 percent by incorporating robots into the workflow. These artificially intelligent indoor driving robots were made by Quicktron, a Shanghai-based startup founded in 2014.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Autonomous Material Handling Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Autonomous Material Handling Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Autonomous Material Handling Equipment Market?

To stay informed about further developments, trends, and reports in the China Autonomous Material Handling Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence