Key Insights

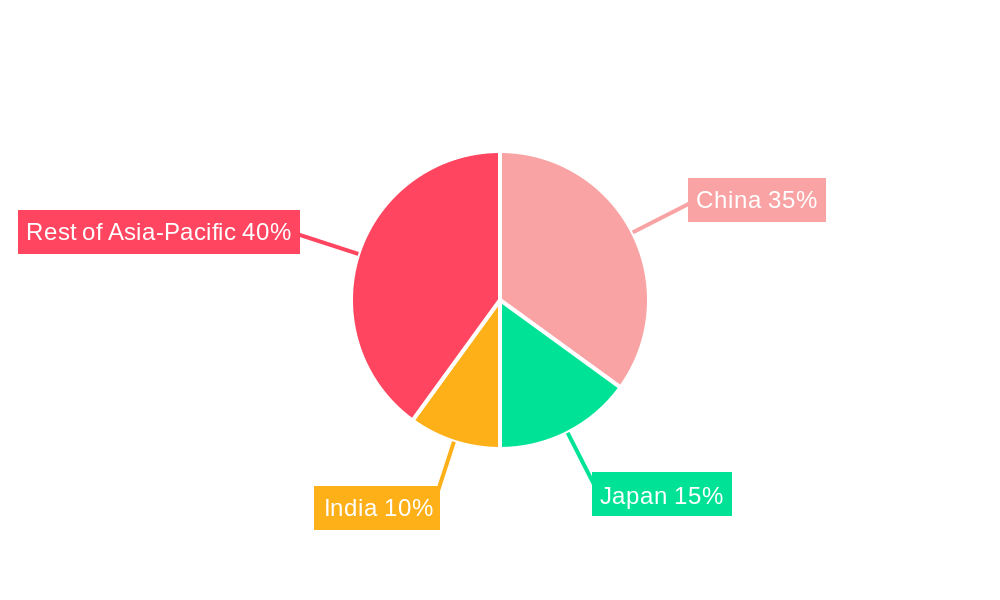

The Central Asia oil and gas market, encompassing upstream, midstream, and downstream sectors, presents a compelling investment landscape characterized by steady growth and significant regional influence. Driven by increasing energy demand from rapidly developing economies within the region and beyond, coupled with substantial reserves of natural gas and oil, the market exhibits a Compound Annual Growth Rate (CAGR) exceeding 2.00%. Major players like KazMunayGas, KazTransOil, Shell, and Gazprom are actively engaged, shaping the competitive dynamics. However, geopolitical factors and infrastructure limitations represent key constraints. Growth is projected to be strongest in the downstream sector, fueled by rising domestic consumption and export opportunities. The upstream sector, while possessing abundant resources, faces challenges in maximizing production efficiency due to complex geological conditions and technological advancements needed for efficient extraction. Midstream activities, critical for transportation and storage, are likely to witness moderate growth, primarily driven by the need to enhance connectivity with international markets. The Asia-Pacific region, particularly China, Japan, and India, serves as a crucial export destination for Central Asian energy resources, creating further growth opportunities and influencing market trends. Over the forecast period (2025-2033), the market is poised for sustained expansion, albeit with fluctuating growth rates depending on global energy prices, geopolitical stability, and infrastructure developments.

The market's evolution hinges on several crucial factors. Government policies promoting energy sector investments and infrastructure development play a significant role. Technological advancements, particularly in enhanced oil recovery and efficient pipeline infrastructure, are essential to unlocking the full potential of the region’s resources. Furthermore, international collaborations and foreign direct investments are instrumental in supporting large-scale projects and promoting technological transfer. Addressing environmental concerns and embracing sustainable practices will also be paramount in ensuring long-term growth and responsible development of the Central Asian oil and gas sector. The competitive landscape is characterized by both state-owned enterprises and international oil and gas giants, fostering both cooperation and competition in the pursuit of market share and resource exploitation.

Central Asia Oil & Gas Market Report: 2019-2033

Uncover lucrative investment opportunities and navigate the complexities of the Central Asian oil and gas sector with our comprehensive market analysis. This in-depth report provides a detailed examination of the Central Asia oil and gas market, covering the period 2019-2033, with a focus on market dynamics, key players, and future growth prospects. The report meticulously analyzes upstream, midstream, and downstream segments, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a base year of 2025 and a forecast period extending to 2033, this report equips you with the data-driven intelligence you need to thrive in this dynamic market.

Central Asia Oil & Gas Market Market Dynamics & Concentration

The Central Asian oil and gas market exhibits a complex interplay of factors influencing its concentration and dynamics. Market share is largely concentrated among national oil companies (NOCs) like National Company JSC (KazMunayGas) and KazTransOil JSC, alongside international energy giants such as Shell PLC, Gazprom International Limited, and PJSC Lukoil Oil Company. However, the market is not static; the increasing involvement of companies like Chevron Corporation and Sinopec Oilfield Service Corporation signals a shift towards greater diversification.

- Market Concentration: NOCs hold a significant market share, estimated at approximately xx% in 2024, with international players contributing xx%.

- Innovation Drivers: Technological advancements in exploration and extraction, particularly in enhanced oil recovery (EOR) techniques, are driving market innovation.

- Regulatory Frameworks: Varying regulatory landscapes across Central Asian nations influence investment decisions and operational efficiency. Streamlining regulations and promoting transparency are crucial for sustained growth.

- Product Substitutes: The increasing global focus on renewable energy sources presents a long-term challenge, though the region's vast reserves still offer significant appeal.

- End-User Trends: Growing domestic demand and increasing regional energy exports shape market dynamics.

- M&A Activities: The number of M&A deals in the Central Asian oil and gas sector has fluctuated over the past five years, averaging approximately xx deals annually, with larger deals tending to involve NOCs and international players.

Central Asia Oil & Gas Market Industry Trends & Analysis

The Central Asia oil and gas market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including consistent exploration and development activities, rising domestic energy consumption, and increasing regional energy trade. However, the market faces challenges like geopolitical instability and price volatility. Technological disruptions, particularly in the areas of digitalization and automation, are transforming operational efficiency and cost structures. Consumer preferences are shifting towards cleaner energy sources, placing pressure on the sector to adopt sustainable practices. The competitive landscape remains intense, with both NOCs and international companies vying for market share. Market penetration of new technologies remains relatively low, but is expected to see significant growth over the next decade.

Leading Markets & Segments in Central Asia Oil & Gas Market

Kazakhstan currently holds the leading position in the Central Asian oil and gas market, driven primarily by its substantial reserves and robust infrastructure. The Upstream segment dominates the market, accounting for approximately xx% of the total market value.

Key Drivers for Kazakhstan's Dominance:

- Extensive Reserves: Kazakhstan boasts significant proven oil and gas reserves, making it a key player in the global energy market.

- Well-Developed Infrastructure: A relatively established oil and gas infrastructure facilitates efficient exploration, production, and transportation.

- Government Support: Government policies supportive of the oil and gas sector, while undergoing change, have historically attracted substantial foreign investment.

Dominance Analysis: Kazakhstan's leadership stems from a combination of factors. Its substantial reserves provide a solid foundation, while government policies and infrastructure development have helped attract and maintain substantial foreign investment. The country's strategic location also aids exports to both east and west. However, ongoing geopolitical complexities and the global push for cleaner energy pose significant challenges. Other countries like Turkmenistan, Uzbekistan, and Kyrgyzstan possess considerable reserves, but their development lags behind Kazakhstan due to various factors, including infrastructure limitations and regulatory hurdles. The Upstream segment's dominance reflects the importance of exploration and production in the value chain.

Central Asia Oil & Gas Market Product Developments

Recent product developments in the Central Asian oil and gas market focus on improving efficiency and reducing environmental impact. This includes the adoption of advanced drilling technologies, enhanced oil recovery techniques, and pipeline modernization. The focus on CCUS technologies, as seen in the Chevron-KMG MoU, reflects the industry's response to increasing pressure for environmental sustainability. These developments aim to enhance operational efficiency, lower production costs, and improve environmental performance, ensuring the long-term viability and competitiveness of the industry.

Key Drivers of Central Asia Oil & Gas Market Growth

Several key factors are driving growth in the Central Asian oil and gas market:

- Growing Energy Demand: Increasing domestic energy consumption across the region, fueled by economic growth and population increase.

- Technological Advancements: Improvements in exploration and production technologies leading to increased efficiency and recovery rates.

- Strategic Investments: Significant investment in infrastructure upgrades, which enhances transportation capabilities and facilitates exports.

Challenges in the Central Asia Oil and Gas Market Market

Significant challenges hinder growth in the Central Asian oil and gas market:

- Geopolitical Instability: The region's volatile geopolitical climate creates uncertainty and can disrupt operations and investment flows.

- Infrastructure Limitations: Inadequate infrastructure in some areas restricts exploration, production, and transportation, especially in the case of gas.

- Environmental Concerns: Growing environmental awareness and stricter regulations regarding emissions put pressure on operators to adopt sustainable practices. The resulting investment in such technology presents a major hurdle.

Emerging Opportunities in Central Asia Oil and Gas Market

Despite the challenges, several promising opportunities are emerging, offering potential for significant long-term growth and development in the Central Asian oil and gas sector.

- Regional Cooperation and Integration: Increased cooperation among Central Asian nations, alongside collaboration with international partners, can facilitate the development of crucial energy infrastructure, enabling cross-border energy trade and fostering regional economic growth. Joint ventures and shared infrastructure projects can significantly reduce costs and risks.

- Technological Advancements and Efficiency Gains: The adoption of advanced technologies such as Enhanced Oil Recovery (EOR) techniques, digitalization of operations, and the implementation of smart technologies can dramatically improve efficiency, optimize production, and reduce operational costs. This includes leveraging data analytics and AI for better resource management and predictive maintenance.

- Growing Global Demand for Natural Gas: The increasing global demand for cleaner-burning natural gas presents a substantial opportunity for Central Asian nations to become major exporters, particularly to markets in Asia and Europe. This requires strategic infrastructure development and access to diverse export routes.

- Investment in Renewable Energy: While fossil fuels remain crucial, integrating renewable energy sources into the energy mix can enhance sustainability, reduce reliance on volatile fossil fuel markets, and attract environmentally conscious investors.

Leading Players in the Central Asia Oil & Gas Market Sector

- National Company JSC (KazMunayGas)

- KazTransOil JSC

- Shell PLC

- Intergas Central Asia JSC

- Gazprom International Limited

- PJSC Lukoil Oil Company

- Chevron Corporation

- JSC Turkmengaz

- National Company QazaqGaz JSC

- Sinopec Oilfield Service Corporation

Key Milestones in Central Asia Oil & Gas Market Industry

- August 2022: Kazakhstan announces plans to diversify its oil export routes via Azerbaijan, reducing reliance on Russia.

- August 2022: Turkmenistan's Turkmennebit SOE purchases drilling pipes from China for well overhauls, highlighting ongoing investment in domestic production capacity.

- June 2022: Chevron and KazMunayGas sign a MoU to explore lower-carbon business opportunities in Kazakhstan, signaling a shift towards sustainability.

Strategic Outlook for Central Asia Oil and Gas Market Market

The Central Asian oil and gas market presents significant long-term opportunities despite existing challenges. Continued investment in infrastructure, technological advancements, and strategic partnerships will be essential to unlock the region's vast energy potential. Focus on diversification of export routes and adopting cleaner energy solutions will be vital for ensuring the sustainability and long-term growth of the sector. The market's future hinges on effectively managing geopolitical risks and balancing economic development with environmental concerns.

Central Asia Oil and Gas Market Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Kazakhstan

- 2.2. Tajikistan

- 2.3. Turkmenistan

- 2.4. Rest of Central Asia

Central Asia Oil and Gas Market Segmentation By Geography

- 1. Kazakhstan

- 2. Tajikistan

- 3. Turkmenistan

- 4. Rest of Central Asia

Central Asia Oil and Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector to dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Kazakhstan

- 5.2.2. Tajikistan

- 5.2.3. Turkmenistan

- 5.2.4. Rest of Central Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kazakhstan

- 5.3.2. Tajikistan

- 5.3.3. Turkmenistan

- 5.3.4. Rest of Central Asia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Kazakhstan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Kazakhstan

- 6.2.2. Tajikistan

- 6.2.3. Turkmenistan

- 6.2.4. Rest of Central Asia

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Tajikistan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Kazakhstan

- 7.2.2. Tajikistan

- 7.2.3. Turkmenistan

- 7.2.4. Rest of Central Asia

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Turkmenistan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Kazakhstan

- 8.2.2. Tajikistan

- 8.2.3. Turkmenistan

- 8.2.4. Rest of Central Asia

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of Central Asia Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Kazakhstan

- 9.2.2. Tajikistan

- 9.2.3. Turkmenistan

- 9.2.4. Rest of Central Asia

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. China Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 12. India Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 National Company JSC (KazMunayGas)

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 KazTransOil JSC

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Shell PLC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Intergas Central Asia JSC

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Gazprom International Limited

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 PJSC Lukoil Oil Company

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Chevron Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 JSC Turkmengaz

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 National Company QazaqGaz JSC

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Sinopec Oilfield Service Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 National Company JSC (KazMunayGas)

List of Figures

- Figure 1: Central Asia Oil and Gas Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Central Asia Oil and Gas Market Share (%) by Company 2024

List of Tables

- Table 1: Central Asia Oil and Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Region 2019 & 2032

- Table 3: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 5: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 7: Central Asia Oil and Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Region 2019 & 2032

- Table 9: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 11: China Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 13: Japan Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 15: India Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 17: South Korea Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 21: Australia Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 25: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 26: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 27: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 29: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 31: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 32: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 33: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 35: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 37: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 38: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 39: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 41: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 43: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 44: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 45: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 47: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central Asia Oil and Gas Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Central Asia Oil and Gas Market?

Key companies in the market include National Company JSC (KazMunayGas), KazTransOil JSC, Shell PLC, Intergas Central Asia JSC, Gazprom International Limited, PJSC Lukoil Oil Company, Chevron Corporation, JSC Turkmengaz, National Company QazaqGaz JSC, Sinopec Oilfield Service Corporation.

3. What are the main segments of the Central Asia Oil and Gas Market?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Upstream Sector to dominate the market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In August 2022, Kazakhstan announced plans to sell some of its crude oil through Azerbaijan's most significant oil pipeline as the nation seeks alternatives to a route Russia threatened to shut. Kazakh oil exports account for more than 1 percent of world supplies, or roughly 1.4 million barrels per day (BPD).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tonns.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central Asia Oil and Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central Asia Oil and Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central Asia Oil and Gas Market?

To stay informed about further developments, trends, and reports in the Central Asia Oil and Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence