Key Insights

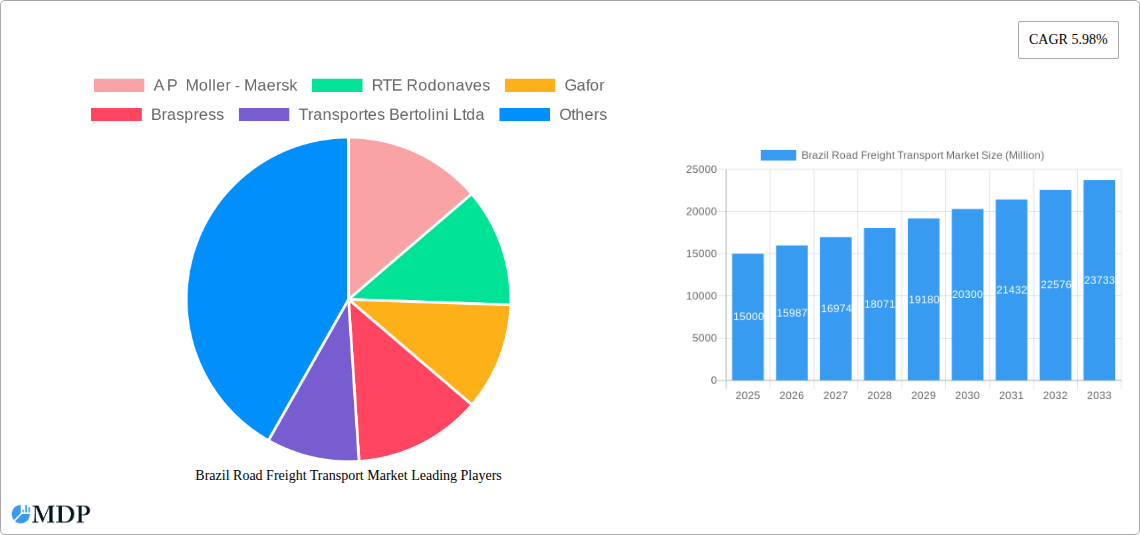

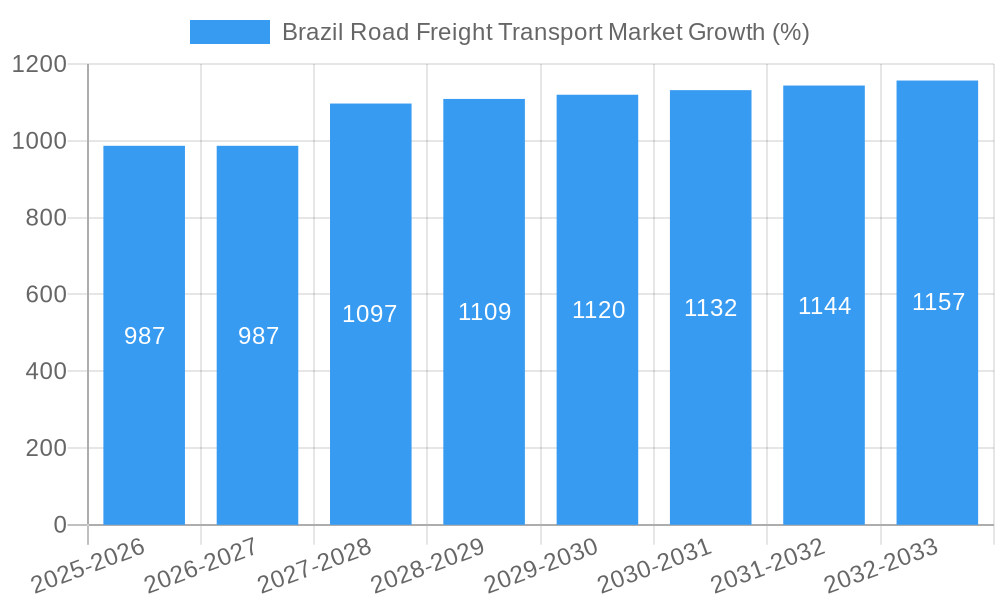

The Brazil road freight transport market, a significant component of the nation's logistics infrastructure, is experiencing robust growth. Driven by a burgeoning e-commerce sector, expanding industrial production, and increasing domestic consumption, the market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. The market's segmentation reveals a strong reliance on full-truckload (FTL) shipments, particularly for long-haul transportation of solid goods within the domestic market. Key end-user industries include manufacturing, construction, and agriculture, with significant contributions from the oil and gas sector. While the market benefits from expanding infrastructure development, challenges remain, including fluctuating fuel prices, driver shortages, and the need for improved road networks, especially in more remote regions. These restraints, however, are not expected to significantly impede the overall positive growth trajectory.

The competitive landscape is characterized by a mix of large multinational corporations and domestically established players. Companies like A.P. Moller-Maersk, DHL Group, and several prominent Brazilian logistics firms compete fiercely, offering a range of services catering to diverse client needs. Future growth will likely be shaped by technological advancements, including the adoption of telematics, route optimization software, and improved fleet management systems. A sustained focus on sustainable practices, such as the integration of alternative fuel vehicles and eco-friendly logistics solutions, will also be crucial for long-term market success. The expansion of e-commerce will continue to fuel demand for efficient last-mile delivery solutions, creating opportunities for specialized players within the LTL and temperature-controlled segments. The continued growth of Brazil's economy and its expanding middle class are expected to further stimulate the demand for road freight transport services in the coming years.

Brazil Road Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil road freight transport market, covering market dynamics, industry trends, leading segments, key players, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand the complexities and opportunities within this dynamic market. The report reveals crucial insights into market size, growth drivers, and challenges, providing actionable intelligence for strategic decision-making.

Brazil Road Freight Transport Market Market Dynamics & Concentration

The Brazilian road freight transport market is characterized by a moderately concentrated landscape with several large players vying for market share. A P Moller - Maersk, RTE Rodonaves, and DHL Group represent significant portions of the market. However, a large number of smaller, regional operators also contribute significantly to the overall volume. The market's dynamics are influenced by several factors:

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating moderate concentration. This is expected to slightly decrease to xx% by 2033 due to increased competition from smaller players and new entrants.

- Innovation Drivers: Technological advancements such as telematics, GPS tracking, and route optimization software are driving efficiency improvements and cost reductions. The adoption of electric and alternative fuel vehicles is also a key innovation driver, particularly in response to growing environmental concerns.

- Regulatory Frameworks: Government regulations concerning road safety, driver hours, and emissions standards significantly impact operational costs and strategies. Changes in regulations directly affect market entry and expansion plans for companies.

- Product Substitutes: While road transport remains the dominant mode for freight movement in Brazil, competition from rail and waterway transport is increasing, particularly for long-haul shipments. This competition is forcing road freight companies to innovate and offer competitive pricing and services.

- End-User Trends: The growing e-commerce sector and increasing demand for faster delivery times are driving growth in the less-than-truckload (LTL) segment. Furthermore, specific end-user industries, such as manufacturing and retail, significantly influence overall market demand.

- M&A Activities: The number of mergers and acquisitions in the sector has been moderate in recent years (xx deals between 2019-2024). Consolidation is expected to continue as larger players seek to expand their market share and service offerings.

Brazil Road Freight Transport Market Industry Trends & Analysis

The Brazilian road freight transport market exhibits robust growth, primarily driven by the expansion of the country's economy and increasing industrialization. The market is experiencing a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is influenced by various factors:

- Market Growth Drivers: Brazil's expanding economy, growth in manufacturing and e-commerce, improvements in infrastructure (albeit still limited in some regions), and increased cross-border trade contribute to the market's growth trajectory. Government initiatives to improve logistics infrastructure are also playing a positive role. The market penetration of advanced logistics technologies is increasing steadily.

- Technological Disruptions: The adoption of telematics, IoT devices, and AI-powered solutions is revolutionizing fleet management, improving efficiency and reducing operational costs. The increasing adoption of electric vehicles is also reshaping the landscape, though this segment is still nascent in the Brazilian context.

- Consumer Preferences: Consumers are demanding faster and more reliable delivery services, prompting logistics companies to invest in advanced technologies and optimized delivery routes. This increased demand for faster, more reliable service fuels the growth of LTL and specialized temperature-controlled services.

- Competitive Dynamics: The market is marked by intense competition, with established players facing challenges from both smaller regional companies and new entrants leveraging technological innovations to disrupt traditional operations. Price competition and service differentiation are key aspects of the competitive landscape.

Leading Markets & Segments in Brazil Road Freight Transport Market

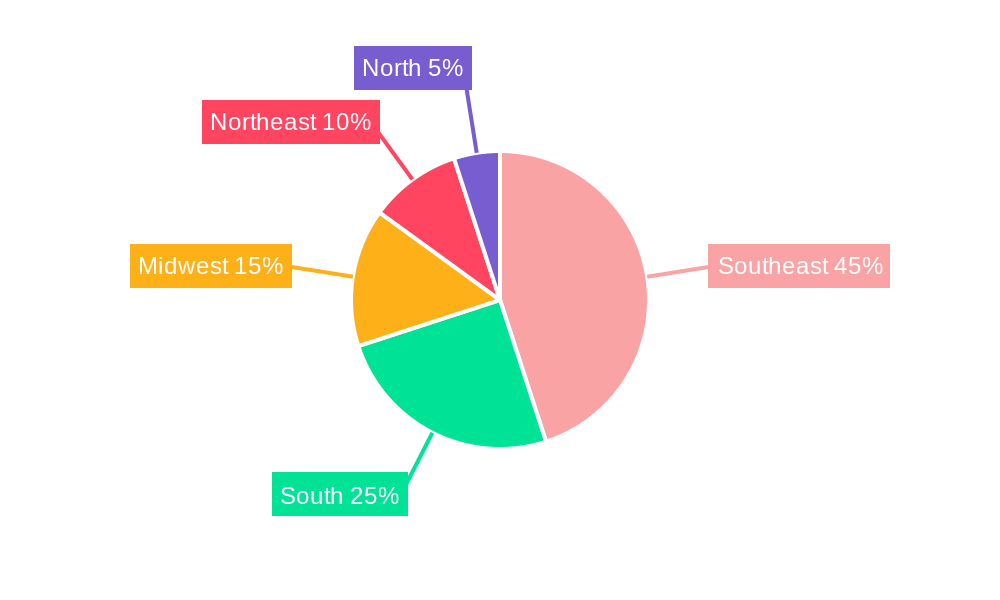

The Brazilian road freight transport market is geographically diverse, with the Southeast region demonstrating the highest market volume due to its concentration of industrial and commercial activity. Specific segments also show stronger growth:

Key Drivers (By Segment):

- End-User Industry: Manufacturing and wholesale and retail trade are the largest end-user segments, driven by robust domestic consumption and industrial production.

- Destination: Domestic transportation constitutes the majority of market volume, while international transport is expanding slowly due to infrastructure constraints and cross-border regulations.

- Truckload Specification: FTL remains the dominant mode of transport, although LTL is experiencing relatively faster growth driven by e-commerce.

- Containerization: Non-containerized transportation dominates the market, though containerized shipments are growing along with increased intermodal transport.

- Distance: Long-haul transportation represents a substantial share of the market, followed by short-haul transportation.

- Goods Configuration: Solid goods dominate, with fluid goods representing a smaller yet growing share.

- Temperature Control: Non-temperature-controlled transportation is the largest segment; however, temperature-controlled transportation is gaining traction due to growth in the food and pharmaceutical sectors.

Dominance Analysis: The Southeast region's dominance stems from its robust industrial infrastructure and high population density. The manufacturing and wholesale/retail trade sectors benefit from efficient road networks (though with capacity constraints) and a large consumer base. The FTL segment's leading role reflects the prevalence of bulk shipments, particularly for raw materials and manufactured goods.

Brazil Road Freight Transport Market Product Developments

Recent product developments focus on enhancing efficiency and sustainability. The integration of telematics and GPS tracking systems optimizes routes, improves fleet management, and reduces fuel consumption. The emergence of electric and alternative fuel vehicles addresses environmental concerns and offers potential cost savings in the long term. These technological advancements are shaping a more efficient and environmentally conscious road freight sector.

Key Drivers of Brazil Road Freight Transport Market Growth

Several factors fuel the market's growth: increased industrial production, the expansion of the e-commerce sector, government investments in infrastructure (though incremental), and the ongoing modernization of logistics operations through technology adoption. These factors collectively contribute to a positive growth outlook for the Brazilian road freight market.

Challenges in the Brazil Road Freight Transport Market Market

Significant challenges persist: inadequate road infrastructure in certain regions leads to increased transportation costs and delivery times. High fuel prices and driver shortages further impact profitability. Bureaucratic hurdles and regulatory complexities create operational challenges. The overall impact of these factors is an estimated xx% reduction in potential market growth annually.

Emerging Opportunities in Brazil Road Freight Transport Market

The increasing adoption of technology, specifically AI-driven route optimization and predictive maintenance, presents significant opportunities. Strategic partnerships between logistics providers and technology companies offer potential for innovation and growth. Expansion into underserved regions through improved infrastructure and government support presents long-term opportunities for market expansion.

Leading Players in the Brazil Road Freight Transport Market Sector

- A P Moller - Maersk

- RTE Rodonaves

- Gafor

- Braspress

- Transportes Bertolini Ltda

- DHL Group

- JSL SA

- Expresso Nepomuceno

- Fadel Transportes e Logística

- HU Transporte Rodoviario

- Transben Transportes

- Transpanorama Transportes LTDA

- VIX Logístic

Key Milestones in Brazil Road Freight Transport Market Industry

- August 2023: DHL Supply Chain and Mondelez integrate four refrigerated electric vehicles into their distribution network, demonstrating a commitment to sustainable practices and aligning with growing ESG concerns.

- September 2023: Maersk conducts electric truck pilots, signifying a move toward decarbonization and showcasing a proactive approach to adopting sustainable transportation technologies.

- January 2024: Polar (DHL Group) adds five multi-temperature trucks to its fleet, expanding its capabilities in the specialized healthcare logistics sector and highlighting a growing niche market.

Strategic Outlook for Brazil Road Freight Transport Market Market

The Brazilian road freight transport market offers strong growth potential driven by continued economic expansion and technological advancements. Strategic investments in infrastructure, the adoption of sustainable practices, and leveraging technological innovations will be key to success. Companies that effectively adapt to changing regulations and consumer preferences will capture significant market share in the coming years.

Brazil Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Brazil Road Freight Transport Market Segmentation By Geography

- 1. Brazil

Brazil Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RTE Rodonaves

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gafor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Braspress

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Transportes Bertolini Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JSL SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Expresso Nepomuceno

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fadel Transportes e Logística

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HU Transporte Rodoviario

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Transben Transportes

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Transpanorama Transportes LTDA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VIX Logístic

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Brazil Road Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Road Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Brazil Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Brazil Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Brazil Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Brazil Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Brazil Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Brazil Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Brazil Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Brazil Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 13: Brazil Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 14: Brazil Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 15: Brazil Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 16: Brazil Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 17: Brazil Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 18: Brazil Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Road Freight Transport Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Brazil Road Freight Transport Market?

Key companies in the market include A P Moller - Maersk, RTE Rodonaves, Gafor, Braspress, Transportes Bertolini Ltda, DHL Group, JSL SA, Expresso Nepomuceno, Fadel Transportes e Logística, HU Transporte Rodoviario, Transben Transportes, Transpanorama Transportes LTDA, VIX Logístic.

3. What are the main segments of the Brazil Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

January 2024: Polar, a DHL Group company specialized in the transportation of medicines, vaccines and other medical and hospital supplies, has included in its fleet currently composed of more than 350 vehicles, 5 multi-temperature trucks, in an investment of more than R$ 5 million. The new vehicle profile makes it possible to deliver products that require different temperature ranges, something that is still uncommon in the health logistics market in Brazil.September 2023: Supporting initiatives to decarbonize its customers' supply chains Maersk conducted two pilots to provide electric truck capabilities to customers in Brazil. The pilots were done with heavy-duty tractor units. The two-week pilots were carried out with two different EV truck manufacturers in Brazil.August 2023: DHL Supply Chain and Mondele have taken another step in their ESG agenda. They have included four refrigerated electric vehicles in their distribution network, adding to the two traditional electric models that already made up their fleet. The new dedicated vehicles will transport chocolates from Mondelez's wide range, which require maintaining temperatures along the route between 10º and 20º C. The initiative is part of the commitment that the two companies have to zero emissions in their operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Brazil Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence