Key Insights

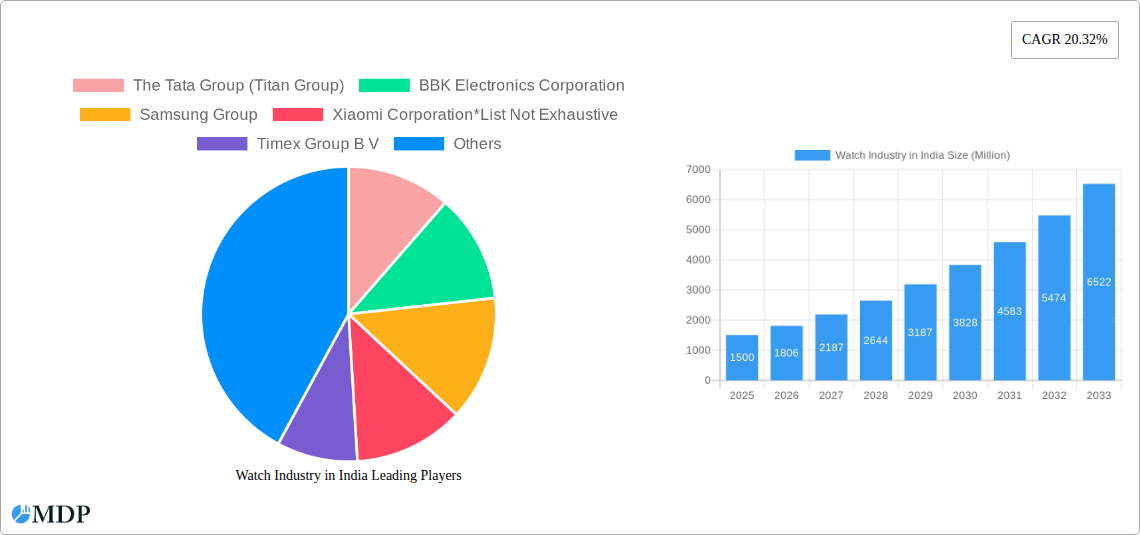

The Indian watch market is projected for substantial growth, exhibiting a CAGR of 10.79%. This expansion is fueled by rising disposable incomes, heightened fashion consciousness, and the increasing adoption of smartwatches. Key growth drivers include technological integration, with smartwatches leading the way, alongside sustained demand for quartz and digital timepieces across all price segments. The online retail channel is rapidly expanding due to improved e-commerce infrastructure and widespread internet access. Challenges include the prevalence of counterfeit products and gold price volatility impacting premium watch pricing. Established brands like Titan (The Tata Group) demonstrate the significance of brand equity and distribution. Emerging brands are gaining traction through innovative designs and competitive pricing. The forecast period (2025-2033) anticipates continuous expansion, with smartwatches expected to dominate due to increasing smartphone penetration and advanced feature integration. Market segmentation by product type (quartz, digital, smart), distribution channel (online, offline), and end-users (men, women, unisex) offers opportunities for targeted strategies. Regional market dynamics within India will necessitate customized approaches.

Watch Industry in India Market Size (In Billion)

The competitive environment features a blend of global and domestic players. Leading companies leverage their established distribution and brand recognition, while newer entrants are disrupting the market with cost-effective, stylish options and advanced technologies. The growing preference for smartwatches, especially among younger demographics, indicates a trend towards tech-integrated timepieces. This necessitates a focus on smartwatch innovation, including features for health monitoring, connectivity, and payments. Comprehensive research into consumer preferences across demographic segments is vital for refining product offerings and marketing efforts. The consistent growth projections highlight the Indian watch market's potential for sustained expansion and profitability. The current market size is valued at 4.19 billion.

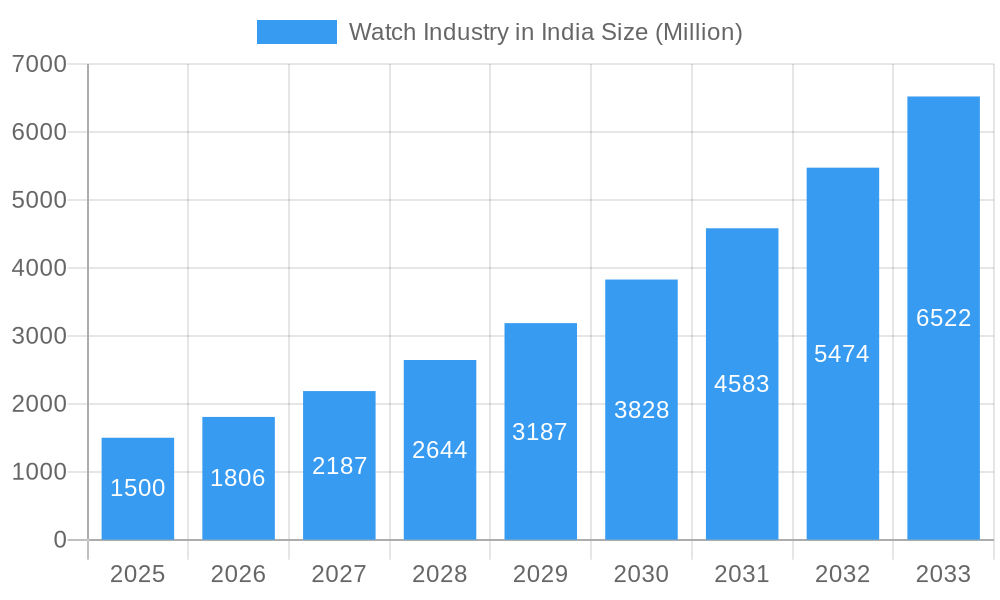

Watch Industry in India Company Market Share

India Watch Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Indian watch industry, offering invaluable insights for businesses, investors, and stakeholders. Covering the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report meticulously examines market dynamics, trends, leading players, and future growth prospects. With a focus on key segments (Quartz Watches, Digital Watches, Smartwatches), distribution channels (Online & Offline Retail), and end-users (Men, Women, Unisex), this report is an essential resource for navigating the complexities of this dynamic market. The report projects a market valued at xx Million by 2033, showcasing significant growth potential.

Watch Industry in India Market Dynamics & Concentration

The Indian watch market exhibits a dynamic interplay of factors influencing its concentration and growth. The market is characterized by a mix of established international players and rapidly growing domestic brands. Market concentration is moderate, with a few dominant players holding significant shares, but a substantial presence of smaller players fostering competition. Innovation is a key driver, fueled by advancements in technology, particularly in the smartwatch segment. The regulatory landscape, while generally favorable, faces evolving challenges concerning import duties and standards. Product substitutes, primarily mobile phones with time-telling capabilities, pose a competitive challenge. End-user trends lean towards stylish, functional, and technologically advanced watches, mirroring global preferences. Mergers and Acquisitions (M&A) activity has been moderate, with strategic acquisitions aimed at expanding product portfolios and market reach. Over the historical period (2019-2024), the M&A deal count averaged approximately xx per year, with a xx% increase in deals involving the smartwatch segment. Market share data for 2024 indicates Titan Group holding an estimated xx% share, followed by xx% for BBK Electronics, and the remaining xx% distributed across other players.

Watch Industry in India Industry Trends & Analysis

The Indian watch industry demonstrates robust growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for fashion accessories. Technological advancements, especially in smartwatches, are transforming the market landscape. Consumer preferences are evolving towards feature-rich, stylish, and connected watches. The market is experiencing a significant shift toward smartwatches, which are gaining traction among younger demographics. The increasing adoption of e-commerce platforms is further propelling growth in the online retail segment. Competitive dynamics are intensifying, with both domestic and international players vying for market share. The industry is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. This growth is further supported by increasing consumer awareness regarding health and fitness tracking features integrated into smartwatches.

Leading Markets & Segments in Watch Industry in India

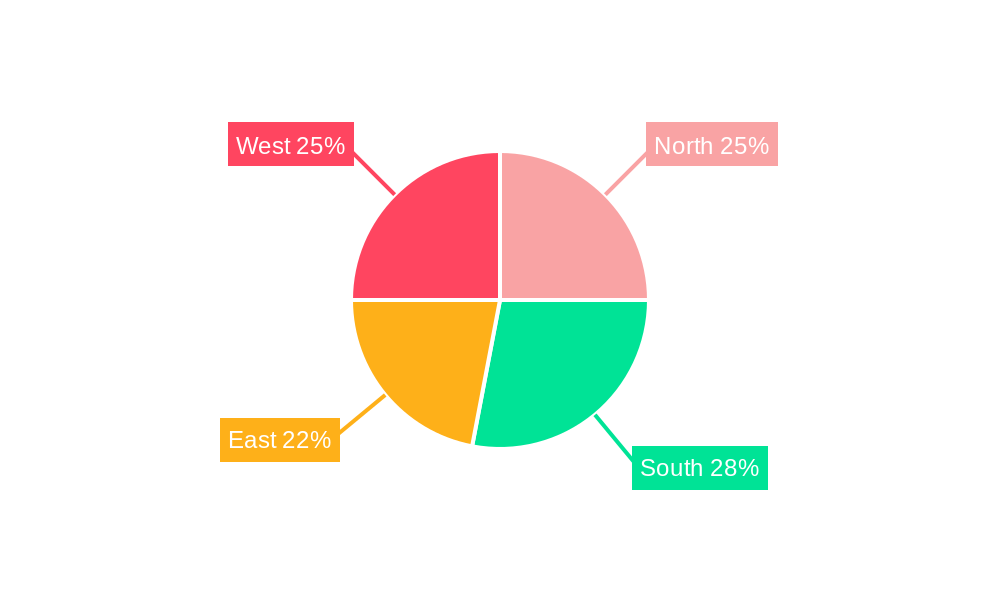

Dominant Regions: Urban centers like Mumbai, Delhi, Bangalore, and Chennai lead the market, driven by higher disposable incomes and greater brand awareness.

Dominant Product Type: Smartwatches are emerging as the fastest-growing segment, propelled by technological advancements and increasing demand for fitness trackers. Quartz watches continue to hold a substantial market share due to their affordability and reliability. Digital watches maintain a niche market.

Dominant Distribution Channel: Offline retail stores still dominate, but online retail stores are rapidly expanding, catering to younger demographics and offering wider choices.

Dominant End-User: Men and unisex watches hold the largest market share due to high demand for smartwatches among men and general-purpose timekeeping needs for unisex watches.

Key Drivers:

- Economic Growth: Rising disposable incomes are boosting consumer spending on premium and technologically advanced watches.

- Technological Advancements: Smartwatches with features like health monitoring and seamless smartphone connectivity are fueling market growth.

- Favorable Government Policies: Supportive government policies towards domestic manufacturing and e-commerce are encouraging industry growth.

- Evolving Consumer Preferences: Changing lifestyles and fashion trends drive the preference for stylish and functional timepieces.

Watch Industry in India Product Developments

Product innovation is a critical factor shaping the competitive landscape. The focus is on integrating smart features, advanced sensors, and enhanced user interfaces. Competition centers around superior battery life, sleek designs, and value-added features like health monitoring, contactless payment systems, and advanced fitness tracking capabilities. Smartwatches with robust operating systems and app ecosystems are gaining popularity, while traditional watchmakers are incorporating smart features into their classic designs to cater to evolving consumer needs.

Key Drivers of Watch Industry in India Growth

Several factors contribute to the Indian watch industry's growth. Technological advancements, especially in the smartwatch segment, are creating new opportunities. The rising disposable incomes of the burgeoning middle class fuel demand for both affordable and premium watches. Favorable government policies, such as "Make in India" initiatives, are promoting domestic manufacturing. Furthermore, the increasing penetration of e-commerce platforms offers wider market access.

Challenges in the Watch Industry in India Market

The industry faces challenges such as intense competition, fluctuating raw material prices, and the need to adapt to changing consumer preferences. Counterfeit products pose a significant threat, impacting brand reputation and sales. Supply chain disruptions and import duty fluctuations add to operational costs and affect profitability. Furthermore, the increasing prevalence of smartphones that offer basic timekeeping functions creates competition for the lower-end segments of the market.

Emerging Opportunities in Watch Industry in India

The Indian watch industry presents lucrative opportunities. Growth is driven by technological innovations, including the integration of Artificial Intelligence and the Internet of Things (IoT) in smartwatches. Strategic partnerships between established brands and emerging technology firms can open new avenues for market expansion. Further penetration into tier-2 and tier-3 cities presents substantial growth potential. Focus on sustainable and eco-friendly materials also offers significant opportunities.

Leading Players in the Watch Industry in India Sector

- The Tata Group (Titan Group)

- BBK Electronics Corporation

- Samsung Group

- Xiaomi Corporation

- Timex Group B V

- Citizen Watch Co ltd

- The Swatch Group Ltd

- Seiko Holding Corporation

- Casio Computer Co Ltd

- Fossil Group Inc

- Apple Inc

Key Milestones in Watch Industry in India Industry

- December 2021: Titan launched its new smartwatch series, marking a significant entry into the smartwatch market.

- September 2022: OnePlus (BBK Electronics subsidiary) launched its Nord smartwatch series, expanding the affordable smartwatch segment.

- September 2022: Realme (BBK Electronics subsidiary) launched the Realme Watch 3 Pro, strengthening its position in the budget smartwatch market.

Strategic Outlook for Watch Industry in India Market

The Indian watch industry holds immense future potential. Continued innovation in smartwatches, expansion into underserved markets, and strategic partnerships will drive growth. Focus on affordability, style, and technological advancements will be key to capturing market share. The integration of advanced health and fitness features, coupled with attractive pricing strategies, will be crucial in securing the long-term success of the Indian watch market.

Watch Industry in India Segmentation

-

1. Product Type

- 1.1. Quartz Watch

- 1.2. Digital Watch

- 1.3. Smart Watch

-

2. Distribution Channel

- 2.1. Online Retail Stores

-

2.2. Offline Retail Stores

- 2.2.1. Specialty Stores

- 2.2.2. Supermarkets/Hypermarkets

- 2.2.3. Other Offline Retail Stores

-

3. End Users

- 3.1. Women

- 3.2. Men

- 3.3. Unisex

Watch Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Watch Industry in India Regional Market Share

Geographic Coverage of Watch Industry in India

Watch Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus

- 3.4. Market Trends

- 3.4.1. Consumer Inclination Toward Luxury Watches

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Quartz Watch

- 5.1.2. Digital Watch

- 5.1.3. Smart Watch

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Retail Stores

- 5.2.2. Offline Retail Stores

- 5.2.2.1. Specialty Stores

- 5.2.2.2. Supermarkets/Hypermarkets

- 5.2.2.3. Other Offline Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Women

- 5.3.2. Men

- 5.3.3. Unisex

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Quartz Watch

- 6.1.2. Digital Watch

- 6.1.3. Smart Watch

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Retail Stores

- 6.2.2. Offline Retail Stores

- 6.2.2.1. Specialty Stores

- 6.2.2.2. Supermarkets/Hypermarkets

- 6.2.2.3. Other Offline Retail Stores

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Women

- 6.3.2. Men

- 6.3.3. Unisex

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Quartz Watch

- 7.1.2. Digital Watch

- 7.1.3. Smart Watch

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Retail Stores

- 7.2.2. Offline Retail Stores

- 7.2.2.1. Specialty Stores

- 7.2.2.2. Supermarkets/Hypermarkets

- 7.2.2.3. Other Offline Retail Stores

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Women

- 7.3.2. Men

- 7.3.3. Unisex

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Quartz Watch

- 8.1.2. Digital Watch

- 8.1.3. Smart Watch

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Retail Stores

- 8.2.2. Offline Retail Stores

- 8.2.2.1. Specialty Stores

- 8.2.2.2. Supermarkets/Hypermarkets

- 8.2.2.3. Other Offline Retail Stores

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Women

- 8.3.2. Men

- 8.3.3. Unisex

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Quartz Watch

- 9.1.2. Digital Watch

- 9.1.3. Smart Watch

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Retail Stores

- 9.2.2. Offline Retail Stores

- 9.2.2.1. Specialty Stores

- 9.2.2.2. Supermarkets/Hypermarkets

- 9.2.2.3. Other Offline Retail Stores

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Women

- 9.3.2. Men

- 9.3.3. Unisex

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Quartz Watch

- 10.1.2. Digital Watch

- 10.1.3. Smart Watch

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Retail Stores

- 10.2.2. Offline Retail Stores

- 10.2.2.1. Specialty Stores

- 10.2.2.2. Supermarkets/Hypermarkets

- 10.2.2.3. Other Offline Retail Stores

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Women

- 10.3.2. Men

- 10.3.3. Unisex

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Tata Group (Titan Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BBK Electronics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samsung Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xiaomi Corporation*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Timex Group B V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Citizen Watch Co ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Swatch Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seiko Holding Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Casio Computer Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fossil Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 The Tata Group (Titan Group)

List of Figures

- Figure 1: Global Watch Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 7: North America Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 8: North America Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Watch Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: South America Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 15: South America Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 16: South America Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Watch Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Europe Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 23: Europe Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Europe Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Watch Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 31: Middle East & Africa Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 32: Middle East & Africa Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Watch Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 39: Asia Pacific Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 40: Asia Pacific Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Watch Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: Global Watch Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 15: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 22: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 35: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 45: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Watch Industry in India?

The projected CAGR is approximately 10.79%.

2. Which companies are prominent players in the Watch Industry in India?

Key companies in the market include The Tata Group (Titan Group), BBK Electronics Corporation, Samsung Group, Xiaomi Corporation*List Not Exhaustive, Timex Group B V, Citizen Watch Co ltd, The Swatch Group Ltd, Seiko Holding Corporation, Casio Computer Co Ltd, Fossil Group Inc, Apple Inc.

3. What are the main segments of the Watch Industry in India?

The market segments include Product Type, Distribution Channel, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors.

6. What are the notable trends driving market growth?

Consumer Inclination Toward Luxury Watches.

7. Are there any restraints impacting market growth?

Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus.

8. Can you provide examples of recent developments in the market?

In September 2022, BBK Electronics Corporation subsidiary OnePlus announced the launch of its smartwatch series 'Nord' in India. The OnePlus Nord Watch has a 1.78-inch AMOLED display with a refresh rate of 60Hz. It boasts a peak brightness of 500 nits. The smartwatch features 105 different sports modes. The device's key features are monitoring blood level, stress, and heart rate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Watch Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Watch Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Watch Industry in India?

To stay informed about further developments, trends, and reports in the Watch Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence