Key Insights

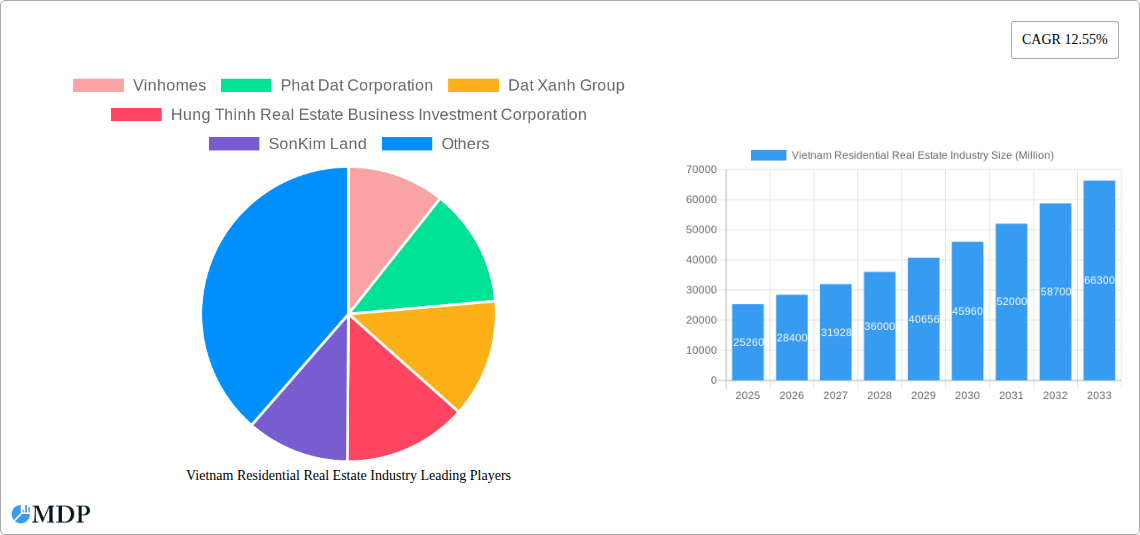

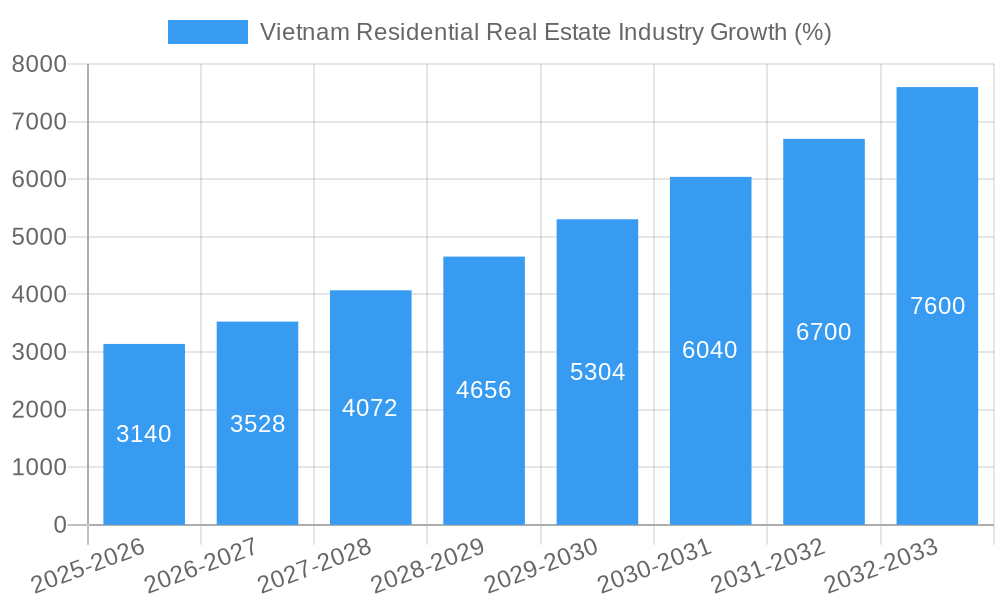

The Vietnam residential real estate market exhibits robust growth potential, projected to reach a market size of $25.26 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.55% from 2025 to 2033. This expansion is driven by several key factors. A burgeoning middle class with increasing disposable incomes fuels demand for improved housing, particularly in rapidly developing urban centers like Ho Chi Minh City, Hanoi, and Da Nang. Furthermore, government initiatives aimed at infrastructure development and economic diversification are creating a favorable investment climate. The market is segmented by property type, with apartments and condominiums dominating the market share, followed by villas and landed houses catering to higher-end segments. Leading developers such as Vinhomes, Phat Dat Corporation, and Novaland Group are key players shaping the market landscape, constantly innovating and adapting to evolving consumer preferences. However, challenges remain, including potential fluctuations in the global economy and the need for sustainable urban planning to manage rapid urbanization and ensure affordable housing options for all income brackets.

Looking ahead, the market is expected to experience further growth through 2033. Sustained economic growth in Vietnam, coupled with ongoing infrastructure improvements, will likely continue to attract both domestic and international investment. The increasing popularity of eco-friendly and smart home features will also influence future developments. The sector will likely see further diversification, with an increased focus on affordable housing projects to address the growing need for housing among lower and middle-income groups. Competition among developers will intensify, leading to innovative projects and improved service offerings to attract buyers. Effective regulatory measures and sustainable development practices will be crucial to ensure the long-term health and stability of the Vietnam residential real estate market.

Vietnam Residential Real Estate Industry: 2019-2033 Market Report

Unlocking Vietnam's Booming Real Estate Market: A Comprehensive Analysis from 2019-2033

This comprehensive report provides an in-depth analysis of Vietnam's dynamic residential real estate market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, leading players, emerging trends, and future opportunities. We analyze key segments including apartments, condominiums, villas, and landed houses across major cities like Ho Chi Minh City, Hanoi, and Da Nang. With data-driven projections and expert analysis, this report is your essential guide to navigating the complexities and capitalizing on the immense potential of the Vietnamese residential real estate sector. The report utilizes data from sources such as [Insert data sources here if applicable. If not available, remove this sentence.].

Vietnam Residential Real Estate Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of Vietnam's residential real estate market from 2019-2033, examining market concentration, innovation, regulatory influences, and mergers & acquisitions (M&A) activity.

Market Concentration: The market exhibits a moderately concentrated structure, with a few large players like Vinhomes, Novaland Group, and Phat Dat Corporation holding significant market share. However, a considerable number of smaller developers also contribute to the market's dynamism. We estimate the top 5 players control approximately xx% of the market in 2025.

Innovation Drivers: Technological advancements, including PropTech solutions and sustainable building practices, are driving innovation. Government initiatives promoting green building standards also play a crucial role.

Regulatory Frameworks: Government regulations, including building codes, land-use policies, and foreign investment regulations, significantly impact market dynamics. Changes in these regulations can lead to shifts in market activity and investment flows.

Product Substitutes: While limited, rental markets and alternative housing solutions represent potential substitutes for homeownership, particularly for younger demographics.

End-User Trends: Growing urbanization, rising disposable incomes, and changing lifestyle preferences are driving demand for modern, high-quality residential properties.

M&A Activity: The number of M&A deals in the sector has increased in recent years, driven by strategic consolidation and expansion ambitions of major players. We project xx M&A deals annually in 2025-2033.

Vietnam Residential Real Estate Industry Industry Trends & Analysis

This section provides a comprehensive overview of the key trends shaping Vietnam's residential real estate market. We analyze market growth drivers, technological disruptions, evolving consumer preferences, and intense competitive pressures.

[Insert 600 words of analysis here, incorporating metrics like CAGR and market penetration. Consider addressing factors such as rising urban populations, government initiatives, economic growth, infrastructure development, and the impact of global events. Ensure clear, concise paragraphs supporting the analysis.]

Leading Markets & Segments in Vietnam Residential Real Estate Industry

This section identifies the dominant regions and property types within Vietnam's residential real estate market.

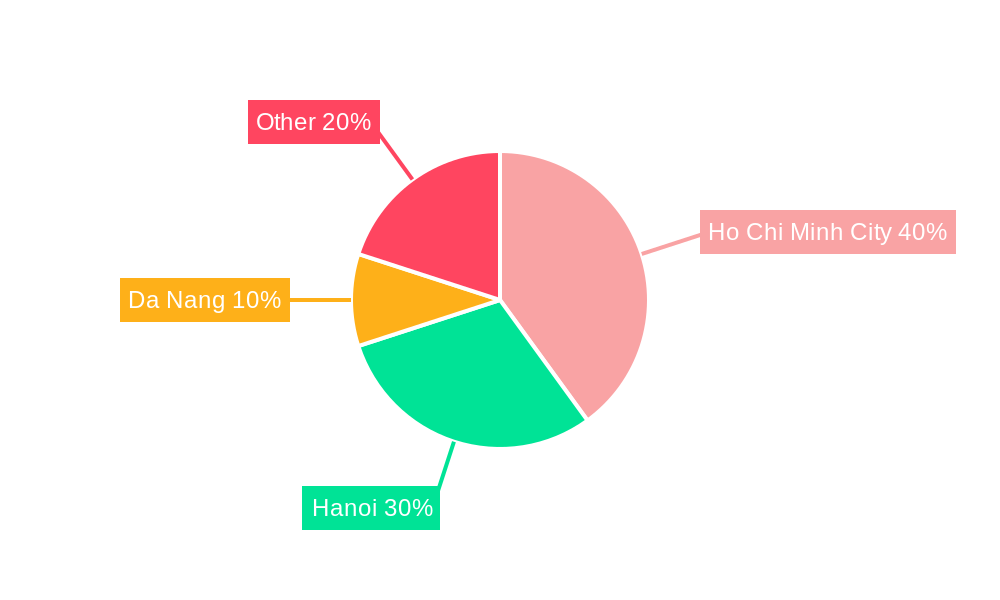

By Key Cities:

Ho Chi Minh City: Remains the leading market, driven by strong economic activity, significant foreign investment, and robust infrastructure development. High demand for luxury apartments and condominiums contributes to its dominance.

Hanoi: A rapidly expanding market, fueled by a growing population, government initiatives, and improving infrastructure. Demand for both apartments and villas is high.

Da Nang: A significant but smaller market compared to Ho Chi Minh City and Hanoi, benefitting from tourism and its coastal location. Demand for luxury villas and beachfront properties is strong.

By Type:

Apartments and Condominiums: This segment accounts for the largest share of the market, driven by affordability and convenience, particularly in urban areas.

Villas and Landed Houses: This segment appeals to a more affluent clientele, with demand particularly high in suburban areas and near major cities. [Insert 600 words of detailed analysis here using paragraphs and bullet points. This section needs a strong argument, supporting the dominant regions and types with hard data, market analysis, and reasoning.]

Vietnam Residential Real Estate Industry Product Developments

Recent innovations in residential real estate focus on smart home technology, sustainable building materials, and enhanced design aesthetics to cater to evolving consumer preferences. The integration of technology to improve energy efficiency and enhance security features is gaining traction, while there is increased focus on community design and recreational facilities. This improves market fit and fosters a competitive advantage among developers.

Key Drivers of Vietnam Residential Real Estate Industry Growth

Several factors drive the growth of Vietnam's residential real estate sector. These include:

Rapid Urbanization: The ongoing migration from rural to urban areas fuels significant demand for housing.

Economic Growth: Vietnam's sustained economic growth improves affordability and increases purchasing power, driving demand for residential properties.

Government Support: Government initiatives, including infrastructure development and investment incentives, contribute to market expansion.

Challenges in the Vietnam Residential Real Estate Industry Market

The industry faces several challenges:

Land Scarcity: Limited land availability in urban areas pushes up prices and restricts supply.

Regulatory Hurdles: Complex approval processes and bureaucratic delays can hinder project timelines.

Competitive Pressure: The highly competitive market necessitates innovative strategies to attract and retain market share.

Emerging Opportunities in Vietnam Residential Real Estate Industry

Long-term growth opportunities arise from several factors:

Sustainable Development: Growing demand for green buildings and environmentally friendly housing presents a significant opportunity.

Strategic Partnerships: Collaborations between local and foreign developers can lead to innovative projects and market expansion.

Expansion into Emerging Markets: Development in secondary cities and provinces holds significant potential.

Leading Players in the Vietnam Residential Real Estate Industry Sector

- Vinhomes

- Phat Dat Corporation

- Dat Xanh Group

- Hung Thinh Real Estate Business Investment Corporation

- SonKim Land

- Sun Group

- Capital and Limited

- FLC Group

- Rever

- Phu My Hung Development Corporation

- Novaland Group

Key Milestones in Vietnam Residential Real Estate Industry Industry

October 2023: Phat Dat's investment project exceeding 10,000 billion VND in Binh Duong receives planning approval. This signals a significant boost to the supply of residential units and potential growth in the Binh Duong region.

November 2023: Phat Dat Real Estate and MB Bank sign a cooperation agreement for financial sponsorship of Phat Dat projects, including the Thuan An 1&2 complex (investment exceeding 10,800 billion VND). This partnership enhances affordability and market access.

Strategic Outlook for Vietnam Residential Real Estate Industry Market

The Vietnam residential real estate market is poised for continued growth, driven by urbanization, economic expansion, and rising disposable incomes. Strategic opportunities lie in sustainable development, technological integration, and strategic partnerships to capitalize on the immense potential of this dynamic market. The focus should be on adapting to evolving consumer preferences and navigating the challenges of land scarcity and regulatory frameworks.

Vietnam Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Ho Chi Minh City

- 2.2. Hanoi

- 2.3. Danang

Vietnam Residential Real Estate Industry Segmentation By Geography

- 1. Vietnam

Vietnam Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land Availability4.; Economic Uncertainties

- 3.4. Market Trends

- 3.4.1. Rising Government Initiatives and Social Housing Development Policies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Ho Chi Minh City

- 5.2.2. Hanoi

- 5.2.3. Danang

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vinhomes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Phat Dat Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dat Xanh Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hung Thinh Real Estate Business Investment Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SonKim Land

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sun Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Capital and Limited**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FLC Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rever

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Phu My Hung Development Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novaland Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Vinhomes

List of Figures

- Figure 1: Vietnam Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Vietnam Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Residential Real Estate Industry?

The projected CAGR is approximately 12.55%.

2. Which companies are prominent players in the Vietnam Residential Real Estate Industry?

Key companies in the market include Vinhomes, Phat Dat Corporation, Dat Xanh Group, Hung Thinh Real Estate Business Investment Corporation, SonKim Land, Sun Group, Capital and Limited**List Not Exhaustive, FLC Group, Rever, Phu My Hung Development Corporation, Novaland Group.

3. What are the main segments of the Vietnam Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.26 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy.

6. What are the notable trends driving market growth?

Rising Government Initiatives and Social Housing Development Policies.

7. Are there any restraints impacting market growth?

4.; Limited Land Availability4.; Economic Uncertainties.

8. Can you provide examples of recent developments in the market?

November 2023: Phat Dat Real Estate Development Joint Stock Company and Military Commercial Joint Stock Bank (MB Bank) signed a comprehensive cooperation agreement with the purpose of financial sponsorship for investors and customers. Products at Phat Dat projects. The sponsored project is the Thuan An 1&2 high-rise housing complex with a scale of 4.47 hectares, located in a prime location right in the central area of Thuan An City, connected to many large industrial clusters in Binh Duong. The project has completed its legality with an investment of more than 10,800 billion VND, including apartment products, shophouses, and townhouses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Vietnam Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence