Key Insights

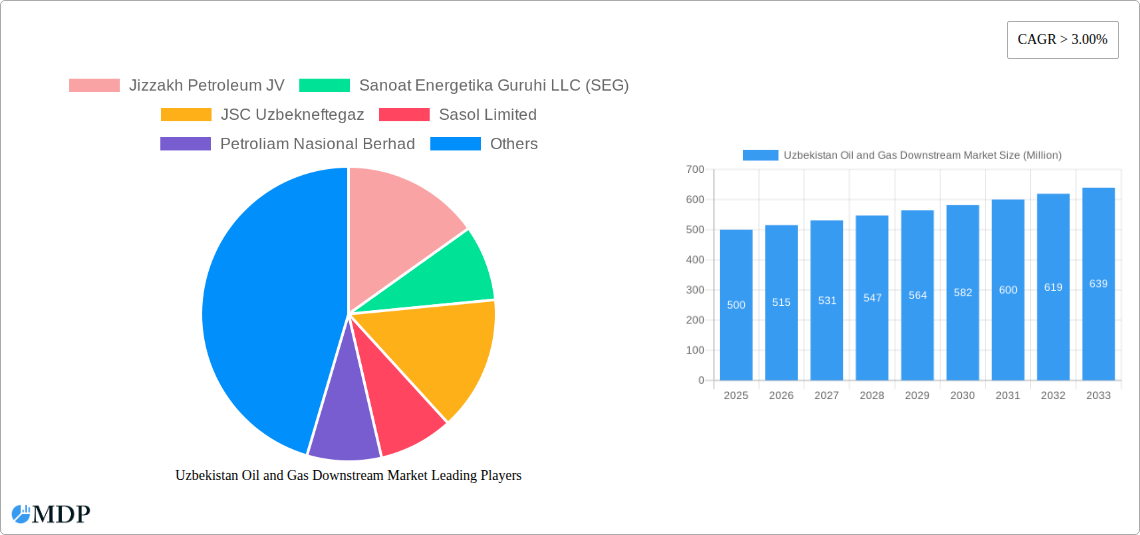

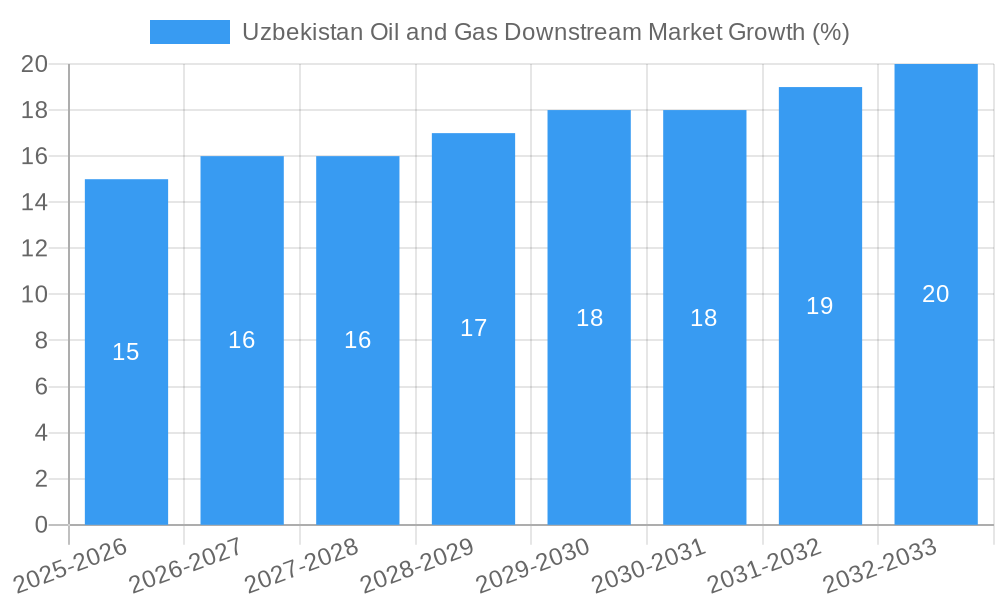

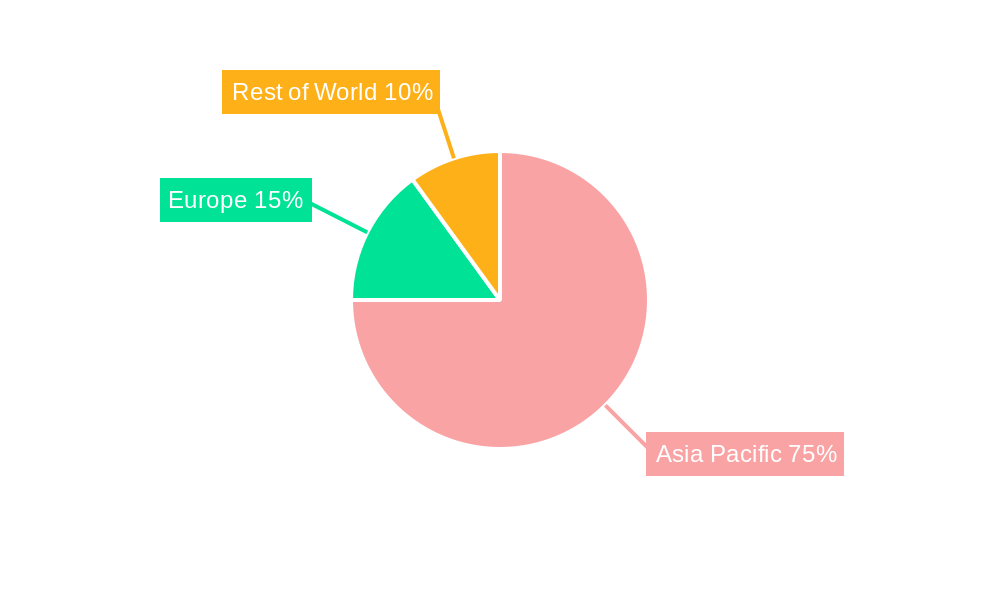

The Uzbekistan Oil and Gas Downstream Market, encompassing gasoline, diesel, jet fuel, LPG, and CNG, is experiencing robust growth, projected to maintain a CAGR exceeding 3% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing urbanization and motorization within Uzbekistan fuel demand for gasoline and diesel, primarily within the transportation sector. Secondly, industrial growth and expansion of power generation capabilities are significantly boosting demand for various oil and gas products. While the market faces challenges such as infrastructure limitations and potential price volatility linked to global energy markets, these are being mitigated through government investments and strategic partnerships with international energy companies like Sasol Limited, TotalEnergies SE, and Gazprom. The market's segmentation, encompassing diverse end-use sectors like transportation, industrial applications, and power generation, ensures resilience against economic fluctuations. The Asia-Pacific region, particularly countries like China and India, serves as a significant trading partner, influencing the pricing and supply dynamics within the Uzbekistan market.

The competitive landscape features a mix of state-owned enterprises such as JSC Uzbekneftegaz and Jizzakh Petroleum JV, alongside international players. This blend fosters both domestic production enhancement and the inflow of advanced technologies and operational expertise. Looking ahead, the market's trajectory indicates continued growth driven by sustained economic expansion and strategic government initiatives aimed at modernizing the energy sector. While precise figures for market size in 2025 are unavailable, a logical estimation based on available data and the provided CAGR would suggest a significant market value in the hundreds of millions of USD, demonstrating the considerable investment potential and growth opportunity in this sector. Further growth will hinge upon consistent investment in infrastructure, technological advancements in refining processes, and successful navigation of global energy market fluctuations.

Uzbekistan Oil & Gas Downstream Market Report: 2019-2033

Dive deep into the dynamic Uzbekistan oil and gas downstream market with this comprehensive report, providing invaluable insights for strategic decision-making. This in-depth analysis covers the period from 2019 to 2033, with a focus on 2025, offering a detailed understanding of market dynamics, industry trends, leading players, and future opportunities. This report is essential for investors, industry professionals, and anyone seeking to navigate this rapidly evolving market.

Uzbekistan Oil and Gas Downstream Market Market Dynamics & Concentration

This section analyzes the competitive landscape, regulatory environment, and market trends impacting the Uzbekistan oil and gas downstream sector. The market is characterized by a mix of both domestic and international players, with varying degrees of market concentration across different segments.

Market Concentration: While JSC Uzbekneftegaz holds a significant market share, the presence of international players like PJSC Gazprom, TotalEnergies SE, and others indicates a moderately concentrated market. Precise market share figures for each company are unavailable for the current report, but future reports will track this. We estimate the top 5 players control approximately xx% of the market.

Innovation Drivers: The industry is witnessing increasing innovation driven by the need for improved efficiency, environmental sustainability, and technological advancements. This is reflected in the growing adoption of digital technologies and the focus on cleaner fuels.

Regulatory Framework: Government regulations play a crucial role in shaping the market, impacting investment decisions and operational strategies. Recent regulatory changes related to fuel quality and environmental standards are likely to drive further changes.

Product Substitutes: The availability of substitute fuels and renewable energy sources creates competitive pressure, necessitating continuous innovation and adaptation by industry players.

End-User Trends: The rising demand from the transportation sector continues to be a major growth driver, while industrial and power generation sectors also contribute significantly. Shifts in transportation habits toward more fuel-efficient vehicles could potentially moderate growth.

M&A Activities: The number of mergers and acquisitions in the sector during the historical period (2019-2024) was xx, reflecting a moderate level of consolidation. Future M&A activity is expected to remain robust.

Uzbekistan Oil and Gas Downstream Market Industry Trends & Analysis

This section offers a detailed analysis of market growth drivers, technological disruptions, consumer preferences, and competitive dynamics within the Uzbekistan oil and gas downstream market.

The Uzbekistan oil and gas downstream market experienced a CAGR of xx% during the historical period (2019-2024). This growth is attributed to factors such as increasing energy consumption, particularly in the transportation sector, supported by economic growth and expanding infrastructure. Technological advancements, such as the adoption of cleaner fuels and improved refining techniques, have further facilitated market expansion. However, the market faces challenges from fluctuating global oil prices and the ongoing transition towards renewable energy sources. Consumer preferences are shifting towards cleaner fuels. Intense competition among players is driving innovation and efficiency improvements. The market penetration of CNG and LPG remains relatively low compared to gasoline and diesel, presenting opportunities for growth. We project a CAGR of xx% for the forecast period (2025-2033).

Leading Markets & Segments in Uzbekistan Oil and Gas Downstream Market

This section identifies the dominant regions, countries, and segments within the Uzbekistan oil and gas downstream market.

Dominant Segments:

Product: Gasoline and diesel fuel continue to dominate the product segment, accounting for the largest market share due to their widespread use in the transportation sector. LPG and CNG show potential for growth, but their market penetration remains comparatively low. Jet fuel constitutes a smaller but significant segment catering to the aviation sector.

End-Use: The transportation sector remains the largest end-use segment, followed by industrial and power generation sectors.

Key Drivers:

- Economic Policies: Government policies related to energy subsidies, taxation, and infrastructure development significantly influence market growth.

- Infrastructure: The availability and quality of infrastructure, including pipelines, refineries, and storage facilities, are crucial for efficient market operations.

Detailed Dominance Analysis: The Tashkent region and surrounding areas are expected to dominate the market due to high population density and economic activity. This is further supported by favorable infrastructure.

Uzbekistan Oil and Gas Downstream Market Product Developments

Recent product developments focus on improving fuel quality to meet international standards and reduce emissions. The increasing adoption of cleaner fuels, like LPG and CNG, indicates a gradual shift towards environmentally friendly options. Technological advancements in refinery processes are leading to increased efficiency and reduced production costs. The focus is on enhancing the quality of gasoline and diesel to meet stricter emission norms, and developing better-quality LPG and CNG solutions for increased acceptance in the transport sector. This market is driven by increasing environmental consciousness and fuel-efficiency standards.

Key Drivers of Uzbekistan Oil and Gas Downstream Market Growth

The growth of the Uzbekistan oil and gas downstream market is primarily driven by:

- Increasing Energy Demand: Growing industrialization and rising living standards fuel energy consumption, driving demand for oil and gas products.

- Economic Growth: The nation’s overall economic growth directly correlates with energy consumption, especially in the transportation and industrial sectors.

- Government Initiatives: Government investments in infrastructure projects and support for cleaner fuel adoption create further momentum for growth.

- Foreign Direct Investment (FDI): Foreign investment plays a crucial role in modernizing the sector and increasing capacity.

Challenges in the Uzbekistan Oil and Gas Downstream Market Market

Several factors hinder the growth of the Uzbekistan oil and gas downstream market:

- Price Volatility: Fluctuations in global oil prices impact profitability and investment decisions.

- Infrastructure Constraints: Limited refining capacity and insufficient pipeline networks in certain regions create bottlenecks.

- Regulatory Hurdles: Complex regulatory processes can slow down investment and expansion plans.

- Competition: The presence of both domestic and international players creates a competitive environment that pressures margins and profitability.

Emerging Opportunities in Uzbekistan Oil and Gas Downstream Market

The Uzbekistan oil and gas downstream market presents several long-term growth opportunities:

- Expansion of CNG and LPG infrastructure: Increasing the availability of CNG and LPG filling stations will encourage wider adoption of these cleaner fuels.

- Technological advancements: Implementing advanced refining technologies to enhance efficiency and reduce emissions will provide a competitive edge.

- Strategic partnerships: Collaborations between domestic and international companies can attract further investment and expertise.

- Government support: Continued government initiatives to modernize the sector and attract foreign investment will boost growth.

Leading Players in the Uzbekistan Oil and Gas Downstream Market Sector

- Jizzakh Petroleum JV

- Sanoat Energetika Guruhi LLC (SEG)

- JSC Uzbekneftegaz

- Sasol Limited

- Petroliam Nasional Berhad

- PJSC Gazprom

- TotalEnergies SE

Key Milestones in Uzbekistan Oil and Gas Downstream Market Industry

- August 2022: Wood Plc signed a contract to provide engineering and procurement assistance to the MTO gas-chemical complex, showcasing a move towards advanced technologies and digitalization.

- November 2022: Enter Engineering Pte Ltd secured a USD 3 billion contract for the MTO Gas Chemical Complex, signaling significant investment and expansion in the petrochemical sector, indirectly impacting the downstream market by creating demand for feedstock.

Strategic Outlook for Uzbekistan Oil and Gas Downstream Market Market

The Uzbekistan oil and gas downstream market holds significant long-term growth potential. Strategic investments in upgrading refining capacities, expanding infrastructure for cleaner fuels, and fostering strategic partnerships are key to unlocking this potential. The focus on improving fuel quality and environmental sustainability will play a vital role in shaping the market’s future. The government's continued support and the inflow of foreign investment will be crucial in driving the market's expansion and modernization. The successful implementation of large-scale projects like the MTO complex will play a significant role in transforming the sector and driving future growth.

Uzbekistan Oil and Gas Downstream Market Segmentation

- 1. Refineries

- 2. Petrochemical Pants

Uzbekistan Oil and Gas Downstream Market Segmentation By Geography

- 1. Uzbekistan

Uzbekistan Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Refineries to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical Pants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uzbekistan

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. China Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 8. India Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Uzbekistan Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Jizzakh Petroleum JV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sanoat Energetika Guruhi LLC (SEG)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 JSC Uzbekneftegaz

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sasol Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Petroliam Nasional Berhad

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PJSC Gazprom

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 TotalEnergies SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 Jizzakh Petroleum JV

List of Figures

- Figure 1: Uzbekistan Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uzbekistan Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemical Pants 2019 & 2032

- Table 4: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Uzbekistan Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 14: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemical Pants 2019 & 2032

- Table 15: Uzbekistan Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uzbekistan Oil and Gas Downstream Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Uzbekistan Oil and Gas Downstream Market?

Key companies in the market include Jizzakh Petroleum JV, Sanoat Energetika Guruhi LLC (SEG), JSC Uzbekneftegaz, Sasol Limited, Petroliam Nasional Berhad, PJSC Gazprom, TotalEnergies SE.

3. What are the main segments of the Uzbekistan Oil and Gas Downstream Market?

The market segments include Refineries, Petrochemical Pants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Refineries to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

November 2022: Enter Engineering Pte Ltd has been selected as the EPC contractor for Uzbekistan's MTO (Methanol to Olefin) Gas Chemical Complex Central Asia LLC. The USD 3-billion contract includes design, purchase of equipment, construction of facilities, and essential infrastructure for the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uzbekistan Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uzbekistan Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uzbekistan Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Uzbekistan Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence