Key Insights

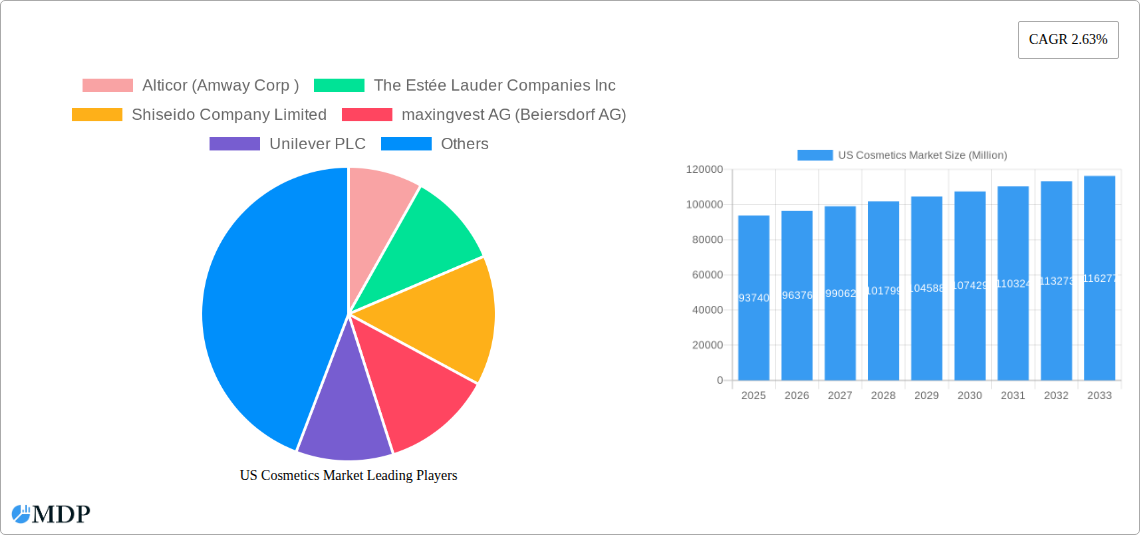

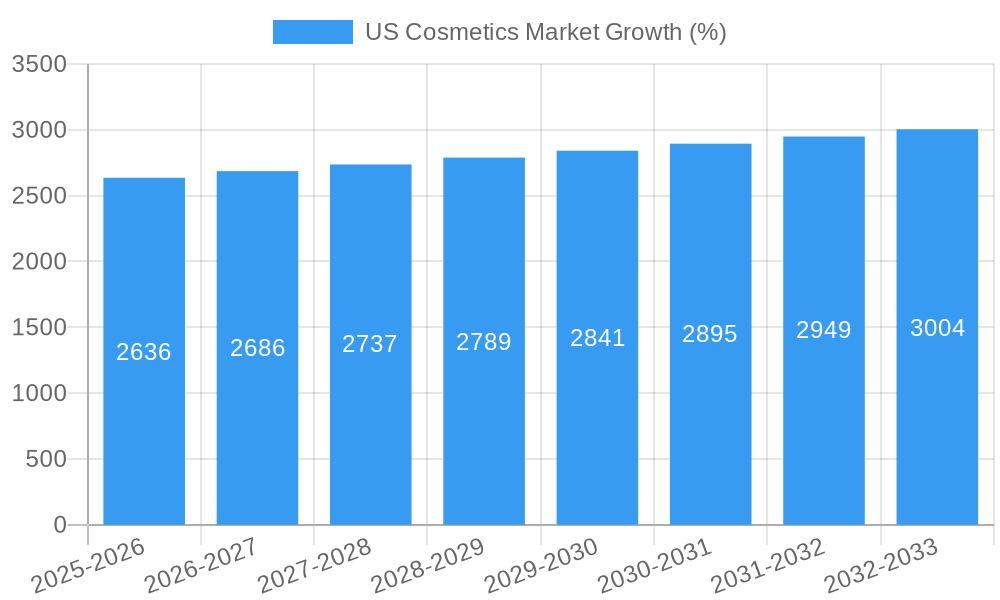

The US cosmetics market, valued at approximately $93.74 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.63% from 2025 to 2033. This growth is driven by several key factors. Firstly, increasing disposable incomes and a growing awareness of personal care among consumers fuel demand for premium and mass cosmetics products. Secondly, the expanding e-commerce sector offers convenient access to a wider range of brands and products, boosting market penetration. The rise of social media influencers and beauty bloggers further propels market growth by shaping consumer preferences and driving product discovery. Finally, continuous innovation in product formulations, focusing on natural ingredients, sustainable packaging, and personalized skincare solutions, caters to evolving consumer demands and preferences.

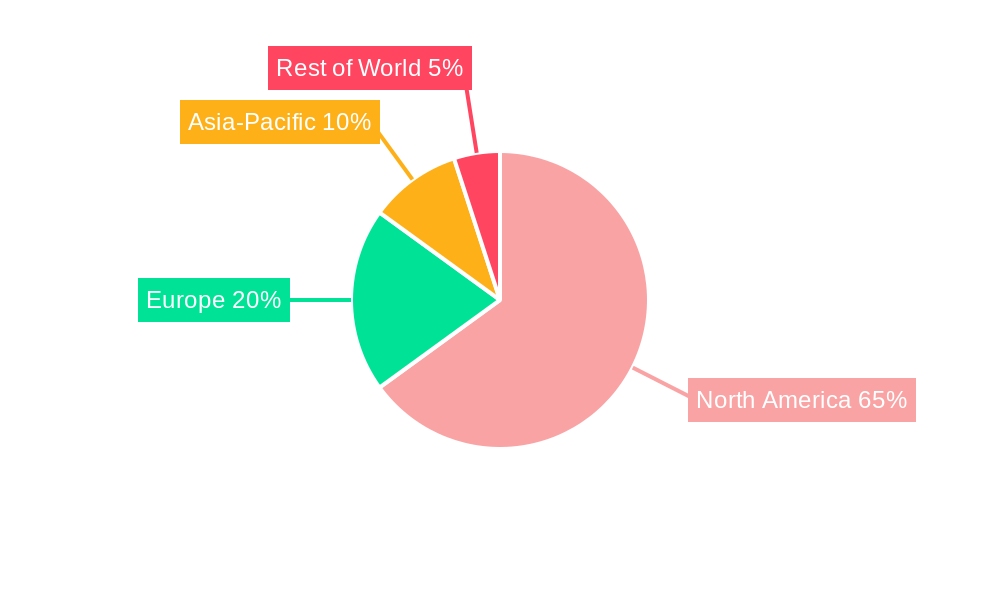

However, certain restraints may influence market growth. Fluctuations in raw material costs and economic downturns can impact consumer spending on non-essential goods like cosmetics. Furthermore, increasing regulatory scrutiny and evolving consumer expectations regarding product safety and transparency necessitate consistent adherence to ethical and sustainable practices by manufacturers. Market segmentation reveals strong performance across product types (skincare, makeup, fragrances, hair care), distribution channels (retail stores, e-commerce, direct-to-consumer), and product categories (premium and mass). Key players, including L'Oréal, Estée Lauder, Unilever, and Procter & Gamble, leverage their strong brand equity and extensive distribution networks to maintain market share. The US market's dominance within North America is expected to continue, driven by high consumer spending and a mature beauty industry. Future growth will be influenced by adapting to evolving consumer preferences, embracing technological advancements, and maintaining responsible business practices.

US Cosmetics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Cosmetics Market, encompassing market dynamics, industry trends, leading segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

US Cosmetics Market Market Dynamics & Concentration

The US cosmetics market is characterized by high competition and significant consolidation, driven by a multitude of factors. Market concentration is evident with a few major players commanding significant market share. For instance, L'Oréal S.A., Estée Lauder, and Procter & Gamble collectively hold a substantial portion (estimated at xx%) of the overall market, while several other players compete fiercely for smaller segments. Innovation plays a crucial role, with companies continuously introducing new products and formulations catering to evolving consumer preferences. Stringent regulatory frameworks governing ingredients, labeling, and safety standards influence market dynamics. The rise of natural and organic cosmetics has presented a compelling product substitute, challenging the traditional market leaders. End-user trends towards personalized beauty routines and the increasing use of online channels contribute significantly to the market's evolution. M&A activity is prevalent, with large companies acquiring smaller brands to expand their product portfolios and market reach. Over the period 2019-2024, an estimated xx M&A deals occurred in the US cosmetics market.

- Market Share: L'Oréal S.A. (xx%), Estée Lauder (xx%), Procter & Gamble (xx%), Others (xx%).

- M&A Activity: High level of activity focused on expansion into premium segments and digital channels.

- Innovation Drivers: Consumer demand for personalized, natural, and sustainable products.

- Regulatory Landscape: Stringent FDA regulations on ingredient safety and labeling.

- End-User Trends: Growing preference for online purchasing, personalized beauty routines, and clean beauty products.

US Cosmetics Market Industry Trends & Analysis

The US cosmetics market is experiencing robust growth, propelled by several key factors. The increasing disposable income of consumers fuels demand for premium and luxury products, contributing to a significant expansion in the market. Technological advancements, specifically in areas like personalized skincare, augmented reality (AR) makeup try-on tools, and advanced formulations, have disrupted traditional market dynamics, allowing for more targeted product development and customer engagement. Consumer preferences are shifting towards natural, organic, and sustainable products, pushing companies to reformulate and improve their offerings. Competitive dynamics are intensifying, with both large multinational corporations and smaller niche brands competing aggressively for market share. The market's growth is further spurred by a rise in social media influencers and marketing trends that drive consumer interest and product awareness.

- CAGR: xx% (2025-2033)

- Market Penetration: xx% (for key product categories)

- Growth Drivers: Rising disposable income, technological advancements, shifting consumer preferences, and aggressive marketing strategies.

- Competitive Dynamics: Intense competition between established brands and emerging players.

Leading Markets & Segments in US Cosmetics Market

The US cosmetics market is segmented by product type (skincare, makeup, fragrances, hair care), distribution channel (retail stores, e-commerce, direct-to-consumer), and product category (premium, mass). The skincare segment consistently dominates the market, driven by increasing awareness of skincare's importance among consumers. Online channels have experienced significant growth in recent years, overtaking traditional retail stores in some segments. Premium products maintain a substantial portion of the market due to consumers' willingness to spend on high-quality cosmetics.

- Dominant Segment: Skincare (by product type); E-commerce (by distribution channel); Premium (by category)

- Key Drivers (Skincare): Aging population, increased awareness of skin health, and availability of advanced formulations.

- Key Drivers (E-commerce): Convenience, wider product selection, and targeted marketing.

- Key Drivers (Premium): Willingness of consumers to spend on high-quality and luxury products.

US Cosmetics Market Product Developments

Recent product developments focus on personalized skincare solutions, natural and sustainable ingredients, and innovative packaging. Technological advancements have allowed the creation of products offering targeted solutions to specific skin concerns. Many companies are incorporating AI and machine learning to develop customized skincare routines, while the shift towards sustainability is driving the use of eco-friendly ingredients and packaging. This trend is enhancing the market competitiveness by catering to health-conscious consumers.

Key Drivers of US Cosmetics Market Growth

Several key factors drive growth in the US cosmetics market. Technological advancements, particularly in product formulations and personalized beauty solutions, are a major factor. The rising disposable income of consumers allows for increased spending on beauty products, while shifting consumer preferences towards natural, organic, and ethically sourced cosmetics are influencing product development. Favorable economic conditions and government policies also contribute positively to market growth.

Challenges in the US Cosmetics Market

The US cosmetics market faces certain challenges. Stringent regulations governing product ingredients and labeling pose compliance hurdles, impacting product development and marketing strategies. Supply chain disruptions, particularly those experienced in recent years, can impact the availability of raw materials and finished goods, impacting production and sales. The intense competitive landscape necessitates significant investment in innovation and marketing to maintain market share.

Emerging Opportunities in US Cosmetics Market

The long-term growth of the US cosmetics market is supported by several opportunities. Technological breakthroughs in personalized beauty solutions, such as customized skincare products tailored to an individual's genetic makeup and skin conditions, are opening new avenues for growth. Strategic partnerships between established cosmetics companies and technology firms can foster innovation and accelerate market expansion. The expansion of e-commerce channels and the growth of the direct-to-consumer (DTC) model present significant opportunities for market penetration and sales growth.

Leading Players in the US Cosmetics Market Sector

- Alticor (Amway Corp)

- The Estée Lauder Companies Inc

- Shiseido Company Limited

- maxingvest AG (Beiersdorf AG)

- Unilever PLC

- Colgate-Palmolive Company

- L'Oréal S A

- Johnson & Johnson Services Inc

- Revlon Inc

- Natura & Co

- Procter & Gamble Company

Key Milestones in US Cosmetics Market Industry

- July 2021: Unilever acquired Paula's Choice, a digital skincare brand known for innovation and cruelty-free products, expanding its presence in the digital skincare market and enhancing its sustainability profile.

- February 2022: Beiersdorf acquired Chantecaille Beauté Inc., strengthening its premium skincare portfolio and market position.

- March 2022: Procter & Gamble launched Crest Densify, a premium toothpaste focusing on enamel remineralization, expanding its premium product offerings and addressing a growing consumer need for advanced oral health solutions.

Strategic Outlook for US Cosmetics Market Market

The future of the US cosmetics market is promising. Continued innovation in personalized beauty, sustainable and ethically sourced ingredients, and technological advancements will drive market growth. Strategic partnerships and mergers and acquisitions will reshape the competitive landscape. Expansion into new markets and segments will create further growth opportunities. Companies that adapt to changing consumer preferences and embrace digital strategies will be best positioned for success.

US Cosmetics Market Segmentation

-

1. Product Type

-

1.1. Personal Care

-

1.1.1. Hair Care

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioner

- 1.1.1.3. Hair Oil

- 1.1.1.4. Hair Styling and Coloring Products

- 1.1.1.5. Other Hair Care Products

-

1.1.2. Skin Care

- 1.1.2.1. Facial Care

- 1.1.2.2. Body Care

- 1.1.2.3. Lip Care

-

1.1.3. Bath and Shower

- 1.1.3.1. Soaps

- 1.1.3.2. Shower Gels

- 1.1.3.3. Bath Salts

- 1.1.3.4. Bathing Accessories

- 1.1.3.5. Other Bath and Shower Products

-

1.1.4. Oral Care

- 1.1.4.1. Toothbrushes and Replacements

- 1.1.4.2. Toothpastes

- 1.1.4.3. Mouthwashes and Rinses

- 1.1.4.4. Other Oral Care Products

- 1.1.5. Men's Grooming

- 1.1.6. Deodrants and Antiperspirants

-

1.1.1. Hair Care

-

1.2. Beauty and Make-up/Cosmetics Market

-

1.2.1. Color Cosmetics

- 1.2.1.1. Facial Make-up Products

- 1.2.1.2. Eye Make-up Products

- 1.2.1.3. Lip and Nail Make-up Products

-

1.2.1. Color Cosmetics

-

1.1. Personal Care

-

2. Category

- 2.1. Premium Products

- 2.2. Mass Products

-

3. Distribution Channel

- 3.1. Specialist Retail Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience Stores

- 3.4. Pharmacies/Drug Stores

- 3.5. Online Retail Stores

- 3.6. Other Distribution Channels

US Cosmetics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Cosmetics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription

- 3.3. Market Restrains

- 3.3.1. High Cost of Rented Apparel Maintenance

- 3.4. Market Trends

- 3.4.1 Growing Inclination Toward Organic

- 3.4.2 Natural

- 3.4.3 and Cruelty-Free Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care

- 5.1.1.1. Hair Care

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioner

- 5.1.1.1.3. Hair Oil

- 5.1.1.1.4. Hair Styling and Coloring Products

- 5.1.1.1.5. Other Hair Care Products

- 5.1.1.2. Skin Care

- 5.1.1.2.1. Facial Care

- 5.1.1.2.2. Body Care

- 5.1.1.2.3. Lip Care

- 5.1.1.3. Bath and Shower

- 5.1.1.3.1. Soaps

- 5.1.1.3.2. Shower Gels

- 5.1.1.3.3. Bath Salts

- 5.1.1.3.4. Bathing Accessories

- 5.1.1.3.5. Other Bath and Shower Products

- 5.1.1.4. Oral Care

- 5.1.1.4.1. Toothbrushes and Replacements

- 5.1.1.4.2. Toothpastes

- 5.1.1.4.3. Mouthwashes and Rinses

- 5.1.1.4.4. Other Oral Care Products

- 5.1.1.5. Men's Grooming

- 5.1.1.6. Deodrants and Antiperspirants

- 5.1.1.1. Hair Care

- 5.1.2. Beauty and Make-up/Cosmetics Market

- 5.1.2.1. Color Cosmetics

- 5.1.2.1.1. Facial Make-up Products

- 5.1.2.1.2. Eye Make-up Products

- 5.1.2.1.3. Lip and Nail Make-up Products

- 5.1.2.1. Color Cosmetics

- 5.1.1. Personal Care

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Premium Products

- 5.2.2. Mass Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialist Retail Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience Stores

- 5.3.4. Pharmacies/Drug Stores

- 5.3.5. Online Retail Stores

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Personal Care

- 6.1.1.1. Hair Care

- 6.1.1.1.1. Shampoo

- 6.1.1.1.2. Conditioner

- 6.1.1.1.3. Hair Oil

- 6.1.1.1.4. Hair Styling and Coloring Products

- 6.1.1.1.5. Other Hair Care Products

- 6.1.1.2. Skin Care

- 6.1.1.2.1. Facial Care

- 6.1.1.2.2. Body Care

- 6.1.1.2.3. Lip Care

- 6.1.1.3. Bath and Shower

- 6.1.1.3.1. Soaps

- 6.1.1.3.2. Shower Gels

- 6.1.1.3.3. Bath Salts

- 6.1.1.3.4. Bathing Accessories

- 6.1.1.3.5. Other Bath and Shower Products

- 6.1.1.4. Oral Care

- 6.1.1.4.1. Toothbrushes and Replacements

- 6.1.1.4.2. Toothpastes

- 6.1.1.4.3. Mouthwashes and Rinses

- 6.1.1.4.4. Other Oral Care Products

- 6.1.1.5. Men's Grooming

- 6.1.1.6. Deodrants and Antiperspirants

- 6.1.1.1. Hair Care

- 6.1.2. Beauty and Make-up/Cosmetics Market

- 6.1.2.1. Color Cosmetics

- 6.1.2.1.1. Facial Make-up Products

- 6.1.2.1.2. Eye Make-up Products

- 6.1.2.1.3. Lip and Nail Make-up Products

- 6.1.2.1. Color Cosmetics

- 6.1.1. Personal Care

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Premium Products

- 6.2.2. Mass Products

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Specialist Retail Stores

- 6.3.2. Supermarkets/Hypermarkets

- 6.3.3. Convenience Stores

- 6.3.4. Pharmacies/Drug Stores

- 6.3.5. Online Retail Stores

- 6.3.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Personal Care

- 7.1.1.1. Hair Care

- 7.1.1.1.1. Shampoo

- 7.1.1.1.2. Conditioner

- 7.1.1.1.3. Hair Oil

- 7.1.1.1.4. Hair Styling and Coloring Products

- 7.1.1.1.5. Other Hair Care Products

- 7.1.1.2. Skin Care

- 7.1.1.2.1. Facial Care

- 7.1.1.2.2. Body Care

- 7.1.1.2.3. Lip Care

- 7.1.1.3. Bath and Shower

- 7.1.1.3.1. Soaps

- 7.1.1.3.2. Shower Gels

- 7.1.1.3.3. Bath Salts

- 7.1.1.3.4. Bathing Accessories

- 7.1.1.3.5. Other Bath and Shower Products

- 7.1.1.4. Oral Care

- 7.1.1.4.1. Toothbrushes and Replacements

- 7.1.1.4.2. Toothpastes

- 7.1.1.4.3. Mouthwashes and Rinses

- 7.1.1.4.4. Other Oral Care Products

- 7.1.1.5. Men's Grooming

- 7.1.1.6. Deodrants and Antiperspirants

- 7.1.1.1. Hair Care

- 7.1.2. Beauty and Make-up/Cosmetics Market

- 7.1.2.1. Color Cosmetics

- 7.1.2.1.1. Facial Make-up Products

- 7.1.2.1.2. Eye Make-up Products

- 7.1.2.1.3. Lip and Nail Make-up Products

- 7.1.2.1. Color Cosmetics

- 7.1.1. Personal Care

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Premium Products

- 7.2.2. Mass Products

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Specialist Retail Stores

- 7.3.2. Supermarkets/Hypermarkets

- 7.3.3. Convenience Stores

- 7.3.4. Pharmacies/Drug Stores

- 7.3.5. Online Retail Stores

- 7.3.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Personal Care

- 8.1.1.1. Hair Care

- 8.1.1.1.1. Shampoo

- 8.1.1.1.2. Conditioner

- 8.1.1.1.3. Hair Oil

- 8.1.1.1.4. Hair Styling and Coloring Products

- 8.1.1.1.5. Other Hair Care Products

- 8.1.1.2. Skin Care

- 8.1.1.2.1. Facial Care

- 8.1.1.2.2. Body Care

- 8.1.1.2.3. Lip Care

- 8.1.1.3. Bath and Shower

- 8.1.1.3.1. Soaps

- 8.1.1.3.2. Shower Gels

- 8.1.1.3.3. Bath Salts

- 8.1.1.3.4. Bathing Accessories

- 8.1.1.3.5. Other Bath and Shower Products

- 8.1.1.4. Oral Care

- 8.1.1.4.1. Toothbrushes and Replacements

- 8.1.1.4.2. Toothpastes

- 8.1.1.4.3. Mouthwashes and Rinses

- 8.1.1.4.4. Other Oral Care Products

- 8.1.1.5. Men's Grooming

- 8.1.1.6. Deodrants and Antiperspirants

- 8.1.1.1. Hair Care

- 8.1.2. Beauty and Make-up/Cosmetics Market

- 8.1.2.1. Color Cosmetics

- 8.1.2.1.1. Facial Make-up Products

- 8.1.2.1.2. Eye Make-up Products

- 8.1.2.1.3. Lip and Nail Make-up Products

- 8.1.2.1. Color Cosmetics

- 8.1.1. Personal Care

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Premium Products

- 8.2.2. Mass Products

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Specialist Retail Stores

- 8.3.2. Supermarkets/Hypermarkets

- 8.3.3. Convenience Stores

- 8.3.4. Pharmacies/Drug Stores

- 8.3.5. Online Retail Stores

- 8.3.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Personal Care

- 9.1.1.1. Hair Care

- 9.1.1.1.1. Shampoo

- 9.1.1.1.2. Conditioner

- 9.1.1.1.3. Hair Oil

- 9.1.1.1.4. Hair Styling and Coloring Products

- 9.1.1.1.5. Other Hair Care Products

- 9.1.1.2. Skin Care

- 9.1.1.2.1. Facial Care

- 9.1.1.2.2. Body Care

- 9.1.1.2.3. Lip Care

- 9.1.1.3. Bath and Shower

- 9.1.1.3.1. Soaps

- 9.1.1.3.2. Shower Gels

- 9.1.1.3.3. Bath Salts

- 9.1.1.3.4. Bathing Accessories

- 9.1.1.3.5. Other Bath and Shower Products

- 9.1.1.4. Oral Care

- 9.1.1.4.1. Toothbrushes and Replacements

- 9.1.1.4.2. Toothpastes

- 9.1.1.4.3. Mouthwashes and Rinses

- 9.1.1.4.4. Other Oral Care Products

- 9.1.1.5. Men's Grooming

- 9.1.1.6. Deodrants and Antiperspirants

- 9.1.1.1. Hair Care

- 9.1.2. Beauty and Make-up/Cosmetics Market

- 9.1.2.1. Color Cosmetics

- 9.1.2.1.1. Facial Make-up Products

- 9.1.2.1.2. Eye Make-up Products

- 9.1.2.1.3. Lip and Nail Make-up Products

- 9.1.2.1. Color Cosmetics

- 9.1.1. Personal Care

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Premium Products

- 9.2.2. Mass Products

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Specialist Retail Stores

- 9.3.2. Supermarkets/Hypermarkets

- 9.3.3. Convenience Stores

- 9.3.4. Pharmacies/Drug Stores

- 9.3.5. Online Retail Stores

- 9.3.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Personal Care

- 10.1.1.1. Hair Care

- 10.1.1.1.1. Shampoo

- 10.1.1.1.2. Conditioner

- 10.1.1.1.3. Hair Oil

- 10.1.1.1.4. Hair Styling and Coloring Products

- 10.1.1.1.5. Other Hair Care Products

- 10.1.1.2. Skin Care

- 10.1.1.2.1. Facial Care

- 10.1.1.2.2. Body Care

- 10.1.1.2.3. Lip Care

- 10.1.1.3. Bath and Shower

- 10.1.1.3.1. Soaps

- 10.1.1.3.2. Shower Gels

- 10.1.1.3.3. Bath Salts

- 10.1.1.3.4. Bathing Accessories

- 10.1.1.3.5. Other Bath and Shower Products

- 10.1.1.4. Oral Care

- 10.1.1.4.1. Toothbrushes and Replacements

- 10.1.1.4.2. Toothpastes

- 10.1.1.4.3. Mouthwashes and Rinses

- 10.1.1.4.4. Other Oral Care Products

- 10.1.1.5. Men's Grooming

- 10.1.1.6. Deodrants and Antiperspirants

- 10.1.1.1. Hair Care

- 10.1.2. Beauty and Make-up/Cosmetics Market

- 10.1.2.1. Color Cosmetics

- 10.1.2.1.1. Facial Make-up Products

- 10.1.2.1.2. Eye Make-up Products

- 10.1.2.1.3. Lip and Nail Make-up Products

- 10.1.2.1. Color Cosmetics

- 10.1.1. Personal Care

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Premium Products

- 10.2.2. Mass Products

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Specialist Retail Stores

- 10.3.2. Supermarkets/Hypermarkets

- 10.3.3. Convenience Stores

- 10.3.4. Pharmacies/Drug Stores

- 10.3.5. Online Retail Stores

- 10.3.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. United States US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 12. Canada US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 13. Mexico US Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Alticor (Amway Corp )

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 The Estée Lauder Companies Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Shiseido Company Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 maxingvest AG (Beiersdorf AG)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Unilever PLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Colgate-Palmolive Company

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 L'Oréal S A

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Johnson & Johnson Services Inc *List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Revlon Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Natura & Co

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Procter & Gamble Company

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Alticor (Amway Corp )

List of Figures

- Figure 1: Global US Cosmetics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America US Cosmetics Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America US Cosmetics Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Cosmetics Market Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America US Cosmetics Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America US Cosmetics Market Revenue (Million), by Category 2024 & 2032

- Figure 7: North America US Cosmetics Market Revenue Share (%), by Category 2024 & 2032

- Figure 8: North America US Cosmetics Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America US Cosmetics Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America US Cosmetics Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America US Cosmetics Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America US Cosmetics Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: South America US Cosmetics Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: South America US Cosmetics Market Revenue (Million), by Category 2024 & 2032

- Figure 15: South America US Cosmetics Market Revenue Share (%), by Category 2024 & 2032

- Figure 16: South America US Cosmetics Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South America US Cosmetics Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South America US Cosmetics Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America US Cosmetics Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe US Cosmetics Market Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe US Cosmetics Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe US Cosmetics Market Revenue (Million), by Category 2024 & 2032

- Figure 23: Europe US Cosmetics Market Revenue Share (%), by Category 2024 & 2032

- Figure 24: Europe US Cosmetics Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe US Cosmetics Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe US Cosmetics Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe US Cosmetics Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa US Cosmetics Market Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Middle East & Africa US Cosmetics Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Middle East & Africa US Cosmetics Market Revenue (Million), by Category 2024 & 2032

- Figure 31: Middle East & Africa US Cosmetics Market Revenue Share (%), by Category 2024 & 2032

- Figure 32: Middle East & Africa US Cosmetics Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa US Cosmetics Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa US Cosmetics Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa US Cosmetics Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific US Cosmetics Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Asia Pacific US Cosmetics Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Asia Pacific US Cosmetics Market Revenue (Million), by Category 2024 & 2032

- Figure 39: Asia Pacific US Cosmetics Market Revenue Share (%), by Category 2024 & 2032

- Figure 40: Asia Pacific US Cosmetics Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific US Cosmetics Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific US Cosmetics Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific US Cosmetics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Cosmetics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Cosmetics Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global US Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Global US Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global US Cosmetics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global US Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global US Cosmetics Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Global US Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 12: Global US Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global US Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global US Cosmetics Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Global US Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 19: Global US Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global US Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global US Cosmetics Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global US Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 26: Global US Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Global US Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global US Cosmetics Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global US Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 39: Global US Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global US Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Turkey US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Israel US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: GCC US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: North Africa US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Africa US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East & Africa US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global US Cosmetics Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 48: Global US Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 49: Global US Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 50: Global US Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: ASEAN US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Oceania US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific US Cosmetics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Cosmetics Market?

The projected CAGR is approximately 2.63%.

2. Which companies are prominent players in the US Cosmetics Market?

Key companies in the market include Alticor (Amway Corp ), The Estée Lauder Companies Inc, Shiseido Company Limited, maxingvest AG (Beiersdorf AG), Unilever PLC, Colgate-Palmolive Company, L'Oréal S A, Johnson & Johnson Services Inc *List Not Exhaustive, Revlon Inc, Natura & Co, Procter & Gamble Company.

3. What are the main segments of the US Cosmetics Market?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription.

6. What are the notable trends driving market growth?

Growing Inclination Toward Organic. Natural. and Cruelty-Free Products.

7. Are there any restraints impacting market growth?

High Cost of Rented Apparel Maintenance.

8. Can you provide examples of recent developments in the market?

March 2022: Crest, a Procter & Gamble Company brand, launched Crest Densify, a premium toothpaste that actively rebuilds tooth density by remineralizing enamel. The toothpaste claims to strengthen the teeth and protect them from future decay.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Cosmetics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Cosmetics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Cosmetics Market?

To stay informed about further developments, trends, and reports in the US Cosmetics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence