Key Insights

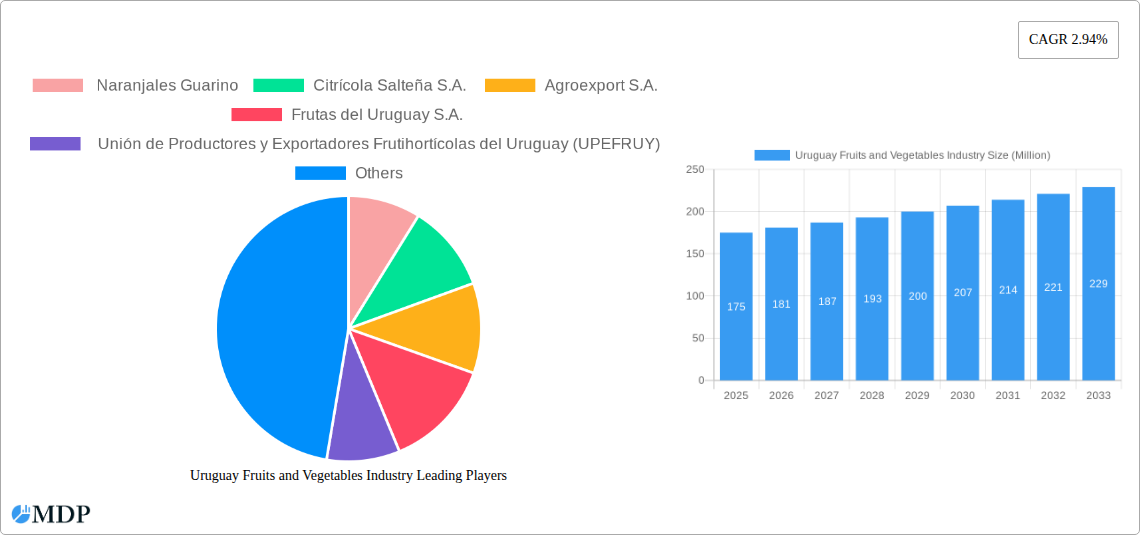

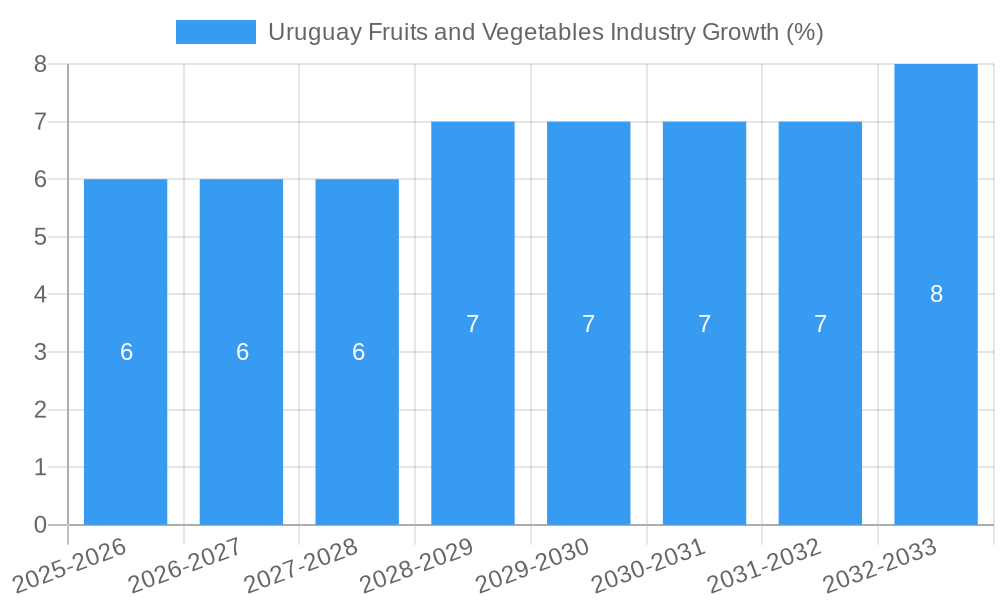

The Uruguayan fruits and vegetables industry, while smaller in scale compared to global giants, presents a dynamic market with significant growth potential. The industry's 2.94% CAGR from 2019-2024 indicates steady expansion, driven by factors such as increasing domestic consumption fueled by a growing population and rising disposable incomes. Furthermore, the burgeoning export market, particularly to neighboring South American countries, provides a key avenue for growth. Strong regional demand for high-quality, fresh produce, coupled with Uruguay's favorable climate and agricultural infrastructure, contribute to this expansion. Key segments within the industry include organic and conventional production types, with fruits and vegetables representing the core product categories. While precise market size figures for 2025 are unavailable, extrapolating from the historical CAGR and considering the consistent growth trajectory, a reasonable estimation for the total market value in 2025 would fall within the range of $150-200 million USD. Leading companies like Naranjales Guarino, Citrícola Salteña S.A., and Agroexport S.A. play crucial roles in production and export, shaping industry dynamics. The presence of cooperative organizations such as UPEFRUY further underscores the collaborative nature of the sector.

However, challenges exist. While export opportunities are promising, dependence on international markets can create vulnerabilities to global economic fluctuations and trade policies. Furthermore, competition from larger, more established fruit and vegetable producers in other South American countries presents a hurdle. Addressing these challenges requires a strategic focus on value-added processing, branding, and diversification of export markets. Investment in sustainable agricultural practices and efficient supply chains is also crucial to maintain competitiveness and ensure long-term sustainability of the Uruguayan fruits and vegetables industry. This growth, however, may be hampered by factors like climate change impacts and fluctuating international prices for agricultural products. Addressing these restraints through sustainable farming practices and strategic market diversification will be key to long-term success.

Uruguay Fruits and Vegetables Industry: 2019-2033 Market Report

Dive deep into the dynamic Uruguayan fruits and vegetables industry with this comprehensive market analysis, projecting growth from 2019 to 2033. This report provides crucial insights into market size, leading players, emerging trends, and future opportunities, empowering stakeholders to make informed decisions. The study covers the historical period (2019-2024), the base year (2025), and forecasts until 2033. The report values are expressed in Millions.

High-traffic keywords: Uruguay fruits, Uruguay vegetables, Uruguayan agriculture, fruit export Uruguay, vegetable export Uruguay, organic produce Uruguay, Uruguay food industry, citrus industry Uruguay, blueberry industry Uruguay, Naranjales Guarino, Citrícola Salteña S.A., Agroexport S.A., Frutas del Uruguay S.A., UPEFRUY, Conaprole, Bardanca S.A.

Uruguay Fruits and Vegetables Industry Market Dynamics & Concentration

The Uruguayan fruits and vegetables industry exhibits a moderately concentrated market structure, with several large players and numerous smaller producers. Market share data for 2024 indicates that the top five companies hold approximately xx% of the total market. Innovation is driven by investments in new technologies, particularly in areas such as precision agriculture and post-harvest handling. The regulatory framework is relatively stable, with a focus on food safety and export standards. Product substitutes, such as imported fruits and vegetables, exert some competitive pressure, especially in price-sensitive segments. End-user trends reveal a growing preference for organic and sustainably produced products, presenting both challenges and opportunities for producers. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Top 5 companies hold approximately xx% market share (2024).

- Innovation Drivers: Precision agriculture, post-harvest technologies, organic farming.

- Regulatory Framework: Focus on food safety and export standards.

- M&A Activity: xx deals between 2019-2024.

Uruguay Fruits and Vegetables Industry Industry Trends & Analysis

The Uruguayan fruits and vegetables industry is experiencing steady growth, driven by factors such as increasing domestic consumption, expanding export markets, and favorable climatic conditions. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was estimated at xx%, and a forecast CAGR of xx% is projected for 2025-2033. Technological disruptions, such as the adoption of data-driven farming practices and improved logistics, are enhancing efficiency and productivity. Consumer preferences are shifting towards healthier, more convenient options, with a growing demand for organic and ready-to-eat products. Competitive dynamics are shaped by factors such as price competition, product differentiation, and brand loyalty. Market penetration of organic produce is steadily increasing, with an estimated xx% of the market in 2024, projected to reach xx% by 2033.

Leading Markets & Segments in Uruguay Fruits and Vegetables Industry

The leading segment within the Uruguayan fruits and vegetables industry is conventional fruit production, driven by strong export demand, established infrastructure, and economies of scale. While the organic segment is expanding rapidly, it still represents a smaller portion of the overall market. The dominant region for fruit and vegetable production is the coastal areas due to their favorable climate and proximity to ports.

Key Drivers for Conventional Fruit Production:

- Strong export demand: Particularly for citrus fruits and blueberries.

- Established infrastructure: Well-developed transportation networks and export facilities.

- Economies of scale: Large-scale production leads to cost efficiencies.

Key Drivers for Organic Production Growth:

- Growing consumer demand: Increasing awareness of health and sustainability.

- Premium pricing: Higher profit margins for organic products.

- Government support: Initiatives to promote sustainable agriculture.

Uruguay Fruits and Vegetables Industry Product Developments

Recent product innovations focus on developing higher-yielding, disease-resistant varieties, and improving post-harvest handling techniques to extend shelf life. The introduction of new citrus varieties and the expansion of blueberry production to new markets demonstrate a commitment to product differentiation and meeting evolving consumer preferences. These developments highlight technological trends and market adaptation within the industry.

Key Drivers of Uruguay Fruits and Vegetables Industry Growth

Several factors contribute to the growth of the Uruguayan fruits and vegetables industry. Favorable climatic conditions, government support for agricultural development, and increasing investment in technology are key drivers. The expansion into new export markets, particularly for high-value products like blueberries, also contributes to growth.

Challenges in the Uruguay Fruits and Vegetables Industry Market

The industry faces challenges including climate change impacts on production, competition from other exporting countries, and fluctuations in global prices. Supply chain inefficiencies and the high cost of labor also pose significant obstacles. The impact of these challenges results in reduced profitability and export competitiveness, requiring further investments in sustainable agricultural practices and supply chain modernization.

Emerging Opportunities in Uruguay Fruits and Vegetables Industry

The industry sees significant opportunities in expanding organic production, developing value-added products, and entering new niche markets. Strategic partnerships with international companies, along with investment in technology, could further enhance competitiveness and drive long-term growth. The increasing global demand for healthy and sustainably sourced food products presents significant market expansion potential.

Leading Players in the Uruguay Fruits and Vegetables Industry Sector

- Naranjales Guarino (If a website exists, replace this with the correct link. Otherwise, remove the link.)

- Citrícola Salteña S.A.

- Agroexport S.A.

- Frutas del Uruguay S.A.

- Unión de Productores y Exportadores Frutihortícolas del Uruguay (UPEFRUY)

- Cooperativa Nacional de Productores de Leche (Conaprole)

- Bardanca S.A.

Key Milestones in Uruguay Fruits and Vegetables Industry Industry

- June 2022: New market access for Uruguayan blueberries in Israel. This significantly expanded export opportunities and increased revenue potential.

- December 2022: Launch of six new citrus varieties through Uruguay's Citrus Breeding Program. This enhances competitiveness through product differentiation and improved yields.

Strategic Outlook for Uruguay Fruits and Vegetables Industry Market

The Uruguayan fruits and vegetables industry is poised for continued growth, driven by strong export potential, increasing domestic demand, and opportunities in value-added products and organic farming. Strategic investments in technology, sustainability, and brand building will be crucial for maximizing future market potential. Further expansion into new markets and the development of strong export relationships will be vital for sustained success.

Uruguay Fruits and Vegetables Industry Segmentation

- 1. Vegetables

- 2. Fruits

- 3. Vegetables

- 4. Fruits

Uruguay Fruits and Vegetables Industry Segmentation By Geography

- 1. Uruguay

Uruguay Fruits and Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Adoption of Strategies to Increase Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uruguay Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vegetables

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.4. Market Analysis, Insights and Forecast - by Fruits

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Uruguay

- 5.1. Market Analysis, Insights and Forecast - by Vegetables

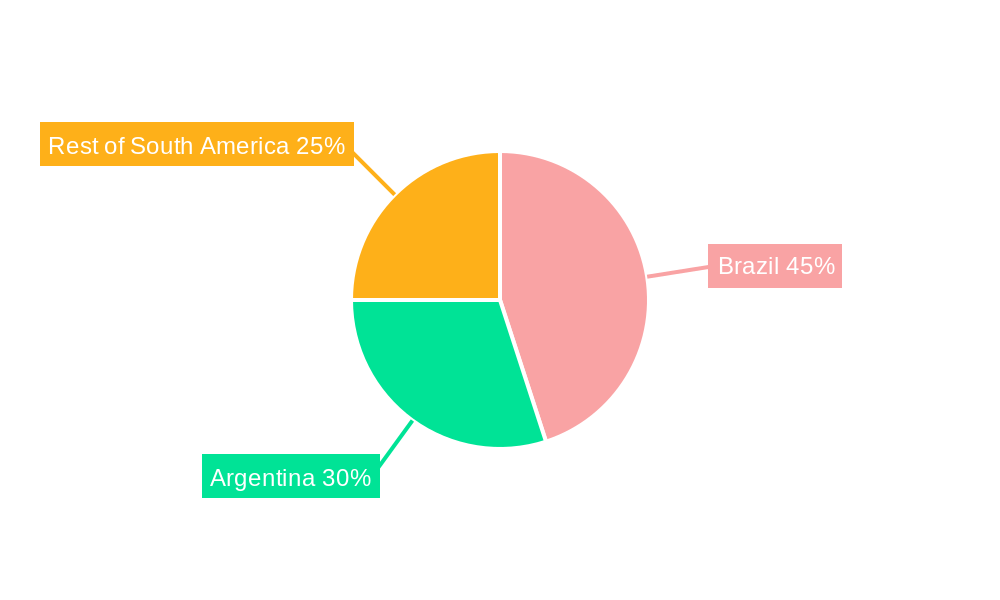

- 6. Brazil Uruguay Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Uruguay Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Uruguay Fruits and Vegetables Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Naranjales Guarino

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Citrícola Salteña S.A.

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Agroexport S.A.

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Frutas del Uruguay S.A.

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Unión de Productores y Exportadores Frutihortícolas del Uruguay (UPEFRUY)

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cooperativa Nacional de Productores de Leche (Conaprole)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Bardanca S.A.

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Naranjales Guarino

List of Figures

- Figure 1: Uruguay Fruits and Vegetables Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uruguay Fruits and Vegetables Industry Share (%) by Company 2024

List of Tables

- Table 1: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 4: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 5: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 6: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 7: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 8: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 9: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 10: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 11: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 13: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 15: Brazil Uruguay Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Brazil Uruguay Fruits and Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 17: Argentina Uruguay Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Uruguay Fruits and Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America Uruguay Fruits and Vegetables Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America Uruguay Fruits and Vegetables Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 22: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 23: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 24: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 25: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 26: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Vegetables 2019 & 2032

- Table 27: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2019 & 2032

- Table 28: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Fruits 2019 & 2032

- Table 29: Uruguay Fruits and Vegetables Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Uruguay Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uruguay Fruits and Vegetables Industry?

The projected CAGR is approximately 2.94%.

2. Which companies are prominent players in the Uruguay Fruits and Vegetables Industry?

Key companies in the market include Naranjales Guarino, Citrícola Salteña S.A. , Agroexport S.A. , Frutas del Uruguay S.A. , Unión de Productores y Exportadores Frutihortícolas del Uruguay (UPEFRUY) , Cooperativa Nacional de Productores de Leche (Conaprole), Bardanca S.A. .

3. What are the main segments of the Uruguay Fruits and Vegetables Industry?

The market segments include Vegetables, Fruits, Vegetables, Fruits.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Adoption of Strategies to Increase Productivity.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

December 2022: Uruguay's Citrus Breeding Program launched six new citrus varieties. These cultivars will be available for growers through an international licensing call until February 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uruguay Fruits and Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uruguay Fruits and Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uruguay Fruits and Vegetables Industry?

To stay informed about further developments, trends, and reports in the Uruguay Fruits and Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence