Key Insights

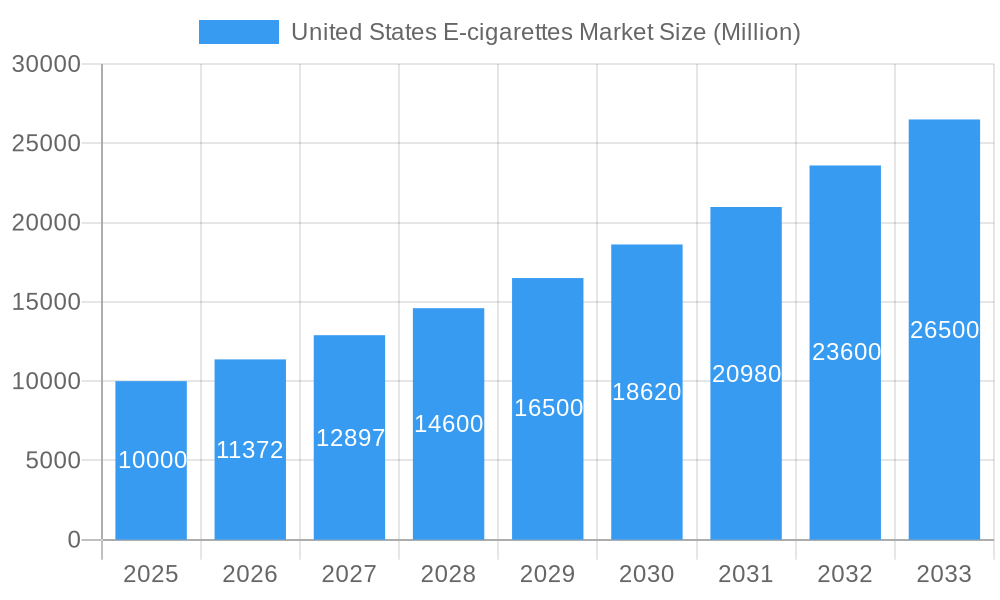

The United States e-cigarette market, a significant segment of the global market, is experiencing robust growth. With a global market size of $34.49 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 13.72%, the US market is projected to follow a similar trajectory, albeit potentially at a slightly adjusted rate due to specific regulatory factors and consumer preferences. Considering the global CAGR and the significant size of the US market within the global landscape, we can reasonably estimate the US e-cigarette market size in 2025 to be approximately $10 billion. Key growth drivers include the increasing prevalence of vaping among adult smokers seeking alternatives to traditional cigarettes, the continuous innovation in product design and functionality (such as advancements in disposable vapes and personalized vaporizers), and the expanding availability through both online and offline retail channels. However, stringent regulations regarding nicotine content, flavor restrictions, and marketing limitations pose significant restraints on market expansion. The market is segmented by product type (completely disposable models leading the way due to convenience, followed by rechargeable but disposable cartomizers), battery mode (automatic e-cigarettes currently dominating, with manual models holding a niche market share), and distribution channel (online retail experiencing rapid growth alongside established offline retail presence). Major players such as JUUL Labs, Philip Morris International, and British American Tobacco are engaged in a competitive landscape, constantly striving to innovate and capture market share.

United States E-cigarettes Market Market Size (In Billion)

The forecast period of 2025-2033 presents both opportunities and challenges for the US e-cigarette market. Continued innovation focusing on safer and healthier alternatives, coupled with effective marketing strategies that comply with regulations, are vital for sustained growth. The evolving regulatory landscape remains a crucial factor, requiring companies to adapt their strategies to navigate evolving legal frameworks. Furthermore, consumer perception and the ongoing debate surrounding the health effects of vaping will significantly influence market trends. Understanding these dynamics is essential for businesses to succeed in this competitive and rapidly evolving market. The market is expected to witness a shift towards higher-quality, longer-lasting devices, potentially slowing down the rapid growth observed with single-use vapes in recent years.

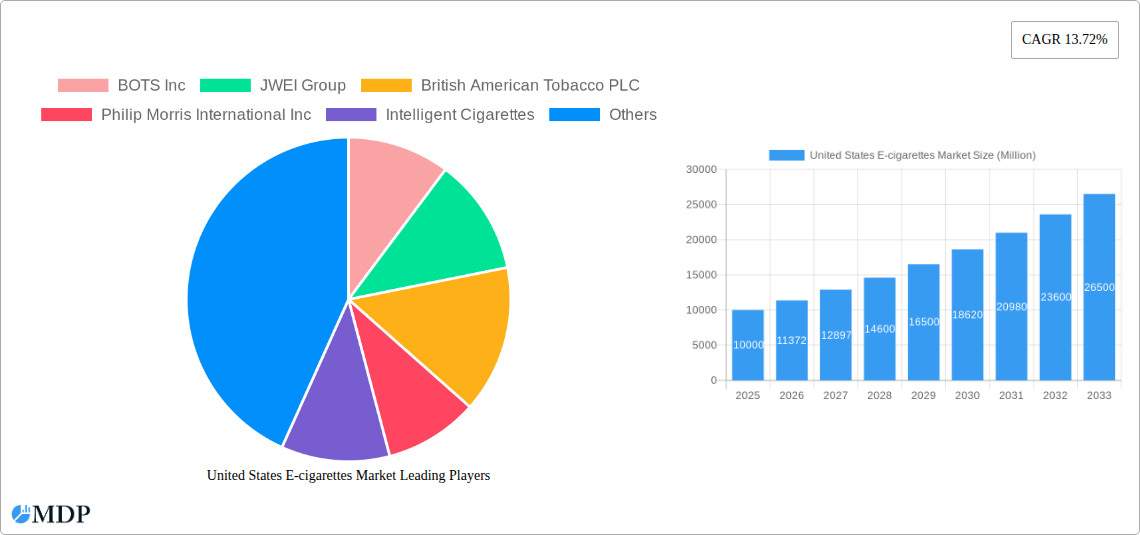

United States E-cigarettes Market Company Market Share

United States E-cigarettes Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States e-cigarettes market, encompassing market dynamics, industry trends, leading segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving landscape. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United States E-cigarettes Market Market Dynamics & Concentration

The United States e-cigarette market is characterized by intense competition, rapid innovation, and evolving regulatory landscapes. Market concentration is moderate, with several major players holding significant shares, while numerous smaller companies compete in niche segments. Innovation is driven by the continuous development of new product types, battery technologies, and flavor profiles, catering to diverse consumer preferences. The regulatory framework, however, remains a significant influence, with ongoing debates and changes impacting market access and product development. Product substitutes, such as traditional cigarettes and nicotine patches, exert competitive pressure. End-user trends show a shift towards healthier alternatives and personalized vaping experiences.

- Market Share: The top 5 players account for approximately xx% of the market share in 2025.

- M&A Activities: The historical period (2019-2024) witnessed xx mergers and acquisitions, indicating a trend of consolidation within the industry. The forecast period is expected to see a further xx M&A deals.

United States E-cigarettes Market Industry Trends & Analysis

The US e-cigarette market exhibits robust growth driven by factors such as increasing consumer awareness of potential health benefits compared to traditional cigarettes, the expanding range of product options catering to diverse preferences, and the growing adoption of online retail channels. Technological disruptions, including advancements in battery technology, e-liquid formulations, and device aesthetics, are constantly shaping market dynamics. Consumer preferences are shifting towards devices that offer greater customization, enhanced flavor profiles, and improved user experience. Competitive dynamics are intense, with major players engaging in aggressive marketing campaigns, product innovations, and strategic partnerships to gain market share.

Leading Markets & Segments in United States E-cigarettes Market

While data on regional dominance is unavailable at this time, analysis shows the following segment leadership:

- Product Type: The completely disposable model holds the largest market share, driven by its affordability and convenience.

- Battery Mode: Automatic e-cigarettes dominate the market due to ease of use.

- Distribution Channel: Offline retail continues to be the primary distribution channel due to established infrastructure and customer reach, though online retail is experiencing strong growth and captures a significant segment.

Key Drivers:

- Economic Factors: Disposable income levels and consumer spending habits.

- Technological Advancements: Innovations in battery technology, e-liquid formulations, and device design.

- Regulatory Landscape: Changes in FDA regulations and state-level laws significantly affect market growth.

United States E-cigarettes Market Product Developments

Recent product developments focus on improved battery life, enhanced flavor delivery systems, and more sophisticated temperature control mechanisms. Manufacturers are increasingly emphasizing user-friendly designs and personalized vaping experiences. Technological trends indicate a move towards closed-system devices for better safety and regulatory compliance, as well as the exploration of alternative nicotine delivery methods. The market fit for these innovations depends largely on regulatory changes and evolving consumer preferences.

Key Drivers of United States E-cigarettes Market Growth

The growth of the US e-cigarette market is fueled by several factors: the increasing number of smokers seeking alternatives to traditional cigarettes, technological advancements leading to more sophisticated and user-friendly devices, and the growing acceptance of e-cigarettes as a harm reduction tool. The favorable economic conditions in certain regions further enhance market expansion. Furthermore, evolving regulatory frameworks, while posing challenges, are also shaping the market by encouraging safer product development and responsible marketing practices.

Challenges in the United States E-cigarettes Market Market

The US e-cigarette market faces significant challenges, primarily driven by stringent regulations on nicotine and advertising, supply chain disruptions affecting the availability of components and raw materials, and intense competition among established players and emerging brands. These challenges often lead to price fluctuations and limit market accessibility. The exact quantifiable impact of these factors varies depending on the specific segment and regulatory changes.

Emerging Opportunities in United States E-cigarettes Market

Emerging opportunities lie in the development of innovative nicotine delivery systems, personalized vaping experiences tailored to individual preferences, and expansion into new market segments, such as those seeking cessation tools. Strategic partnerships with technology companies and healthcare providers can further enhance market growth. Advancements in battery technology and e-liquid formulations will offer potential cost reductions and improved safety features, creating additional opportunities.

Leading Players in the United States E-cigarettes Market Sector

- BOTS Inc

- JWEI Group

- British American Tobacco PLC

- Philip Morris International Inc

- Intelligent Cigarettes

- Nicoventures Trading Limited

- Japan Tobacco Inc

- NJOY Inc

- Imperial Brands PLC

- Juul Labs Inc

Key Milestones in United States E-cigarettes Market Industry

- June 2022: Japan Tobacco Inc. publishes a patent application for a flavor inhaler smoking system.

- November 2022: R.J. Reynolds Tobacco Company patents composite tobacco-containing materials for smokeless tobacco consumption.

- November 2022: Philip Morris acquires 93% of Swedish Match, aiming to expand its presence in the US e-cigarette market.

Strategic Outlook for United States E-cigarettes Market Market

The US e-cigarette market presents significant long-term growth potential, driven by ongoing innovation, evolving consumer preferences, and strategic partnerships. Companies that focus on developing safer, more user-friendly products, and those that effectively navigate regulatory complexities will be well-positioned to capture market share. Strategic investments in research and development, coupled with targeted marketing campaigns, are crucial for success in this dynamic sector.

United States E-cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-cigarettes

- 2.2. Manual E-cigarettes

-

3. Distribution Channel

- 3.1. Offline Retail

- 3.2. Online Retail

United States E-cigarettes Market Segmentation By Geography

- 1. United States

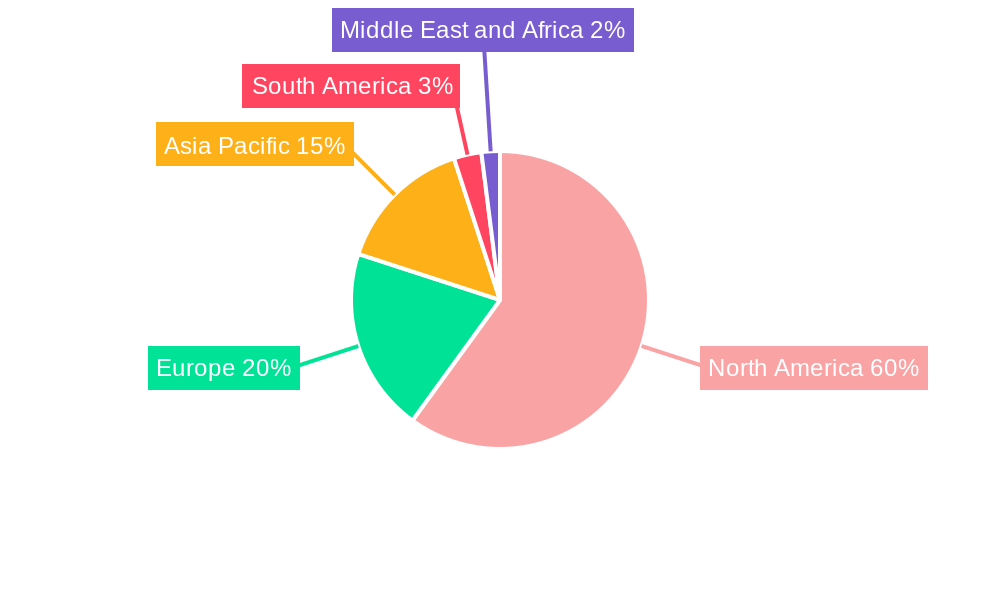

United States E-cigarettes Market Regional Market Share

Geographic Coverage of United States E-cigarettes Market

United States E-cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism

- 3.3. Market Restrains

- 3.3.1. Presence of counterfeit products

- 3.4. Market Trends

- 3.4.1. Increasing Health Concern Among Smoking Population Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States E-cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-cigarettes

- 5.2.2. Manual E-cigarettes

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail

- 5.3.2. Online Retail

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BOTS Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JWEI Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 British American Tobacco PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Philip Morris International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Intelligent Cigarettes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nicoventures Trading Limited*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Japan Tobacco Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NJOY Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Imperial Brands PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Juul Labs Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BOTS Inc

List of Figures

- Figure 1: United States E-cigarettes Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States E-cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: United States E-cigarettes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States E-cigarettes Market Revenue Million Forecast, by Battery Mode 2020 & 2033

- Table 3: United States E-cigarettes Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States E-cigarettes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States E-cigarettes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United States E-cigarettes Market Revenue Million Forecast, by Battery Mode 2020 & 2033

- Table 7: United States E-cigarettes Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United States E-cigarettes Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States E-cigarettes Market?

The projected CAGR is approximately 13.72%.

2. Which companies are prominent players in the United States E-cigarettes Market?

Key companies in the market include BOTS Inc, JWEI Group, British American Tobacco PLC, Philip Morris International Inc, Intelligent Cigarettes, Nicoventures Trading Limited*List Not Exhaustive, Japan Tobacco Inc, NJOY Inc, Imperial Brands PLC, Juul Labs Inc.

3. What are the main segments of the United States E-cigarettes Market?

The market segments include Product Type, Battery Mode, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism.

6. What are the notable trends driving market growth?

Increasing Health Concern Among Smoking Population Drives the Market.

7. Are there any restraints impacting market growth?

Presence of counterfeit products.

8. Can you provide examples of recent developments in the market?

November 2022: A patent for composite tobacco-containing materials from R.J. Reynolds Tobacco Company shows that tobacco can be consumed in a reportedly "smokeless" form. The use of smokeless tobacco products often involves placing processed tobacco or a formulation containing tobacco in the user's mouth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States E-cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States E-cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States E-cigarettes Market?

To stay informed about further developments, trends, and reports in the United States E-cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence