Key Insights

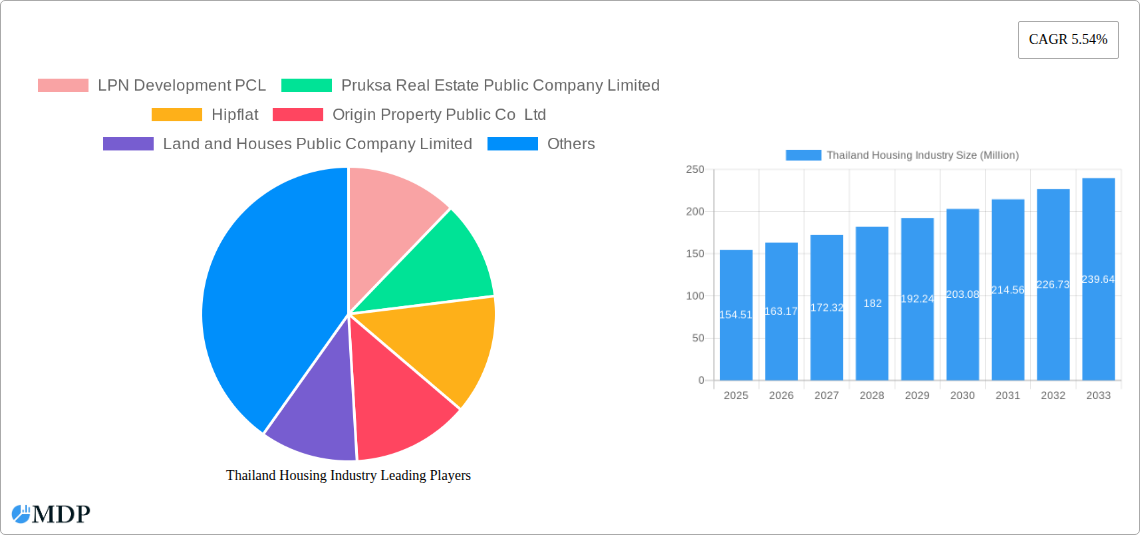

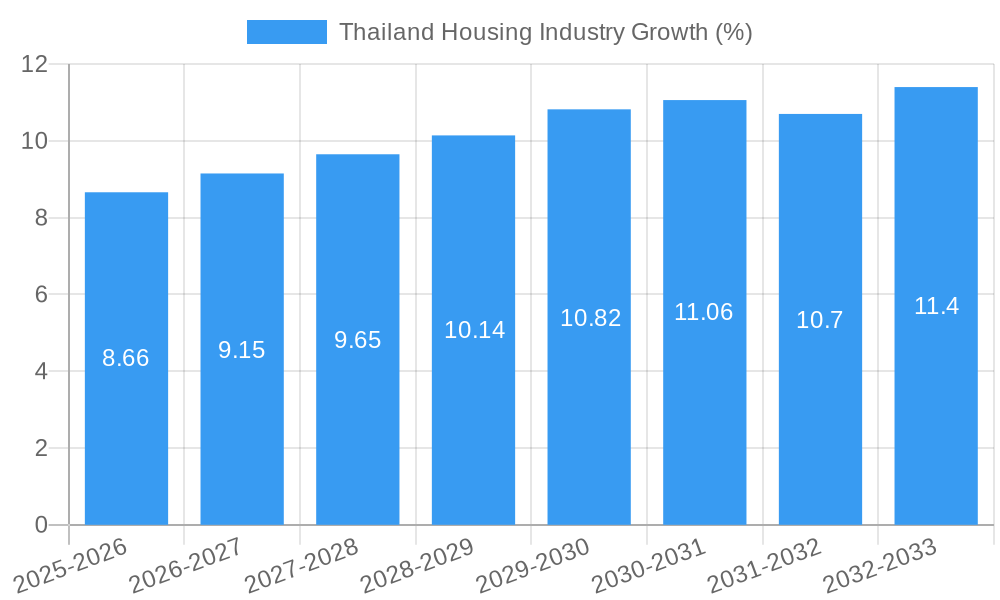

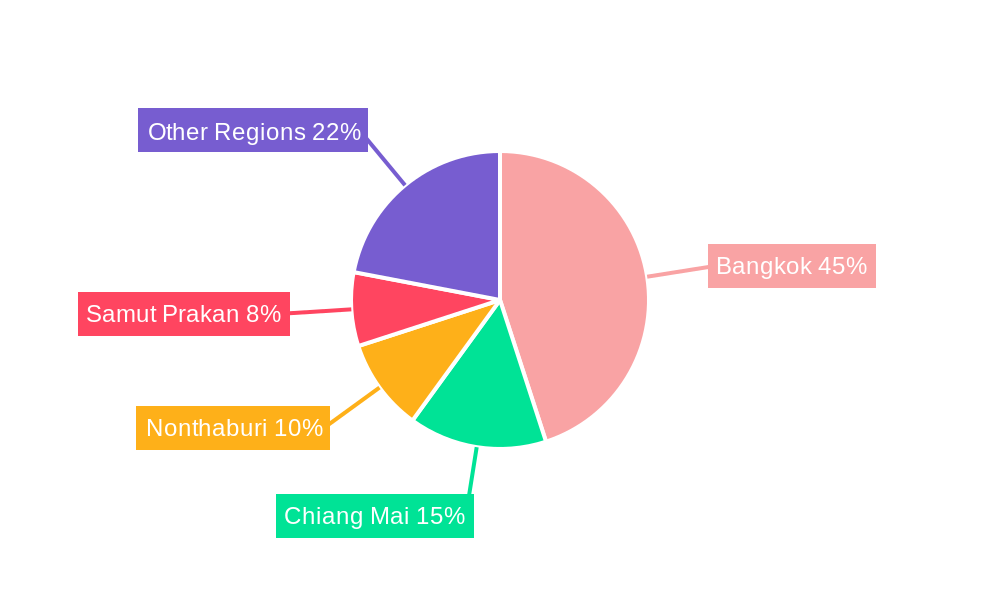

The Thailand housing market, valued at $154.51 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.54% from 2025 to 2033. This expansion is driven by several factors. Firstly, Thailand's steadily growing economy and increasing urbanization are fueling demand for residential properties, particularly in key cities like Bangkok, Chiang Mai, Nonthaburi, and Samut Prakan. Secondly, a burgeoning middle class with rising disposable incomes is increasingly seeking improved housing options. Furthermore, government initiatives aimed at improving infrastructure and boosting the property sector contribute to market dynamism. The market is segmented by property type (apartments & condominiums, landed houses & villas) catering to diverse consumer preferences and budgetary constraints. Leading developers such as LPN Development PCL, Pruksa Real Estate, and Sansiri Public Co Ltd are key players, driving innovation and shaping market trends. However, potential constraints include fluctuating interest rates, which can impact affordability, and land scarcity in prime urban locations. The forecast period (2025-2033) suggests consistent growth, with projected increases in both market size and the number of units transacted yearly.

The competitive landscape features both established large-scale developers and smaller, niche players. Competition is fierce, leading to innovation in design, amenities, and financing options to attract buyers. Future trends suggest a rising demand for sustainable and technologically advanced housing, encompassing smart-home features and eco-friendly designs. The government's focus on infrastructure development, particularly in transportation and utilities, is expected to unlock further growth potential in previously less-developed areas. The market's resilience to economic fluctuations and consistent demand for quality housing suggest a positive outlook for the long term, making Thailand an attractive destination for both domestic and international investors in the real estate sector.

Thailand Housing Industry: Market Analysis & Forecast (2019-2033)

Unlocking the Potential of Thailand's Thriving Real Estate Sector: A Comprehensive Market Report

This comprehensive report provides an in-depth analysis of Thailand's dynamic housing industry, offering valuable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers a detailed forecast, examining market trends, key players, and emerging opportunities. Expect granular data, insightful analysis, and actionable strategies to navigate this lucrative market. The report analyzes a market valued at xx Million USD in 2025 and projects xx Million USD by 2033.

Key Highlights:

- Market Size & Growth: Detailed analysis of market size (in Millions USD) for the historical period (2019-2024), base year (2025), and forecast period (2025-2033), including Compound Annual Growth Rate (CAGR).

- Market Segmentation: Comprehensive breakdown by property type (Apartments & Condominiums, Landed Houses & Villas) and key cities (Bangkok, Chiang Mai, Nonthaburi, Samut Prakan).

- Competitive Landscape: In-depth profiles of leading players including LPN Development PCL, Pruksa Real Estate Public Company Limited, Hipflat, Origin Property Public Co Ltd, Land and Houses Public Company Limited, Supalai Company Limited, Property Perfect Public Company Limited, Sansiri Public Co Ltd, AP (THAILAND) PUBLIC COMPANY LIMITED, Ananda Development Public Company Limited, Quality Houses Public Company Limited, Magnolia Quality Development Corp Co Ltd, and an assessment of their market share and M&A activities.

- Growth Drivers & Challenges: Identification of key growth catalysts (economic factors, technological advancements, government policies) and challenges (regulatory hurdles, supply chain disruptions).

- Future Outlook: Strategic recommendations and forecasts for long-term growth potential.

Thailand Housing Industry Market Dynamics & Concentration

Thailand's housing market, valued at xx Million USD in 2025, displays moderate concentration, with several large players dominating specific segments. Innovation is driven by technological advancements in construction and design, catering to evolving consumer preferences for smart homes and sustainable living. The regulatory framework, while generally supportive, faces ongoing adjustments to address affordability and transparency concerns. Product substitutes, such as renting and co-living spaces, exert pressure on the market, particularly in the condominium segment. End-user trends reflect a growing preference for suburban living and smaller, more efficient units, influenced by changing demographics and lifestyle choices. M&A activity has been relatively robust in recent years, with approximately xx deals recorded between 2019 and 2024, leading to increased market consolidation and expansion for some key players. Market share data reveals that the top 5 players collectively hold approximately xx% of the market.

- Market Share: Top 5 players holding approximately xx% in 2025.

- M&A Activity: Approximately xx deals between 2019-2024.

- Key Drivers: Technological advancements, evolving consumer preferences.

- Challenges: Regulatory adjustments, competition from substitutes.

Thailand Housing Industry Industry Trends & Analysis

The Thailand housing industry is experiencing robust growth, driven by several key factors. Urbanization continues to drive demand, particularly in Bangkok and surrounding provinces. Government initiatives to improve infrastructure and stimulate the economy further support market expansion. Technological disruptions are transforming construction methods, leading to increased efficiency and reduced costs. The adoption of Building Information Modeling (BIM) and prefabricated construction is gaining traction. Consumer preferences are shifting towards sustainable and smart homes, featuring energy-efficient designs and integrated technology. Competitive dynamics are characterized by increased consolidation, as larger developers acquire smaller firms to expand their market reach. The CAGR for the forecast period (2025-2033) is estimated at xx%, driven by robust demand and government support. Market penetration of smart home technology is expected to reach xx% by 2033.

Leading Markets & Segments in Thailand Housing Industry

Bangkok remains the dominant market, accounting for approximately xx% of the total housing market value in 2025, driven by strong economic activity, employment opportunities, and well-established infrastructure. The condominium segment is the largest by value, representing xx% of the market, fueled by high demand from young professionals and investors. However, the landed houses and villas segment show substantial growth potential driven by increasing disposable incomes and a preference for more spacious living options. Nonthaburi and Samut Prakan, benefiting from their proximity to Bangkok and improved infrastructure, also experience significant growth. Chiang Mai shows strong, albeit smaller, growth due to increasing tourism and retirement migration.

- Bangkok: Dominant market share (xx%), driven by economic activity and infrastructure.

- Condominiums: Largest segment by value (xx%), driven by demand from professionals and investors.

- Landed Houses & Villas: High growth potential due to rising disposable income and preferences.

- Nonthaburi & Samut Prakan: Significant growth due to proximity to Bangkok and infrastructural improvements.

Thailand Housing Industry Product Developments

Product innovation in the Thai housing sector is focused on incorporating smart home technology, sustainable materials, and energy-efficient designs. Developers are increasingly offering customizable units and flexible layouts catering to diverse lifestyle needs. The use of prefabricated construction methods is gaining traction to accelerate building times and reduce costs. These innovations enhance both the competitive advantage and the market fit of new projects, attracting tech-savvy and environmentally conscious buyers.

Key Drivers of Thailand Housing Industry Growth

Several factors contribute to the growth of Thailand's housing industry. Economic growth and rising disposable incomes drive demand, especially within the middle-class. Government initiatives to support infrastructure development and housing affordability play a crucial role. Technological advancements in construction and design enable the construction of more efficient and sustainable buildings. Favorable demographics, with a large and growing young population, also support sustained demand for housing.

Challenges in the Thailand Housing Industry Market

The Thailand housing market faces several challenges. Land scarcity in prime urban areas and associated high land costs impact affordability. Regulatory hurdles, including complex approval processes, can delay project timelines. Supply chain disruptions, particularly in the aftermath of global events, can impact construction costs and timelines. Intense competition among developers leads to price wars and reduces profit margins for some players. These factors collectively impact market stability and investor confidence.

Emerging Opportunities in Thailand Housing Industry

Long-term growth opportunities abound in the Thai housing sector. Government-led infrastructure development projects, particularly in public transportation and utilities, create new housing demand. Strategic partnerships between developers and technology firms promote the adoption of innovative construction and property management solutions. Expansion into secondary cities and provinces, leveraging growth in regional economies and tourism, promises significant potential. The rising popularity of co-living spaces and other alternative housing models represents a niche market waiting to be further explored.

Leading Players in the Thailand Housing Industry Sector

- LPN Development PCL

- Pruksa Real Estate Public Company Limited

- Hipflat

- Origin Property Public Co Ltd

- Land and Houses Public Company Limited

- Supalai Company Limited

- Property Perfect Public Company Limited

- Sansiri Public Co Ltd

- AP (THAILAND) PUBLIC COMPANY LIMITED

- Ananda Development Public Company Limited

- Quality Houses Public Company Limited

- Magnolia Quality Development Corp Co Ltd

Key Milestones in Thailand Housing Industry Industry

- 2020: Government launches a stimulus package to support the housing sector, including tax incentives for homebuyers.

- 2021: Several major developers announce significant investments in sustainable building technologies.

- 2022: Increased adoption of smart home technologies in new residential projects.

- 2023: Several mergers and acquisitions among smaller housing developers.

- 2024: Launch of several large-scale housing projects in suburban areas.

Strategic Outlook for Thailand Housing Industry Market

The future of Thailand's housing market is promising. Sustained economic growth, coupled with government support and ongoing technological innovation, will drive significant market expansion. Strategic opportunities exist in the development of affordable housing, sustainable communities, and smart city projects. Focusing on sustainable and technology-driven solutions, coupled with an understanding of evolving consumer preferences, will prove key to success in this dynamic market. The report provides valuable market insights and recommendations for both established players and new entrants to effectively navigate the complexities and capitalize on the immense potential of Thailand's housing industry.

Thailand Housing Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Bangkok

- 2.2. Chiang Mais

- 2.3. Nontha Buri

- 2.4. Samut Prakan

Thailand Housing Industry Segmentation By Geography

- 1. Thailand

Thailand Housing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government initiatives and huge investments driving the market4.; Vision 2030 and allied projects driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; High construction costs affecting the market4.; Limited land availability affecting the growth of the market

- 3.4. Market Trends

- 3.4.1. Bangkok and Vicinities Witnessing Growth in the Residential Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Housing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Bangkok

- 5.2.2. Chiang Mais

- 5.2.3. Nontha Buri

- 5.2.4. Samut Prakan

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 LPN Development PCL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pruksa Real Estate Public Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hipflat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Origin Property Public Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Land and Houses Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Supalai Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Property Perfect Public Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sansiri Public Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AP (THAILAND) PUBLIC COMPANY LIMITED

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ananda Development Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Quality Houses Public Company Limited*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Magnolia Quality Development Corp Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 LPN Development PCL

List of Figures

- Figure 1: Thailand Housing Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Housing Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Housing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Housing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Thailand Housing Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Thailand Housing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Housing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Thailand Housing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Thailand Housing Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Thailand Housing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Housing Industry?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the Thailand Housing Industry?

Key companies in the market include LPN Development PCL, Pruksa Real Estate Public Company Limited, Hipflat, Origin Property Public Co Ltd, Land and Houses Public Company Limited, Supalai Company Limited, Property Perfect Public Company Limited, Sansiri Public Co Ltd, AP (THAILAND) PUBLIC COMPANY LIMITED, Ananda Development Public Company Limited, Quality Houses Public Company Limited*List Not Exhaustive, Magnolia Quality Development Corp Co Ltd.

3. What are the main segments of the Thailand Housing Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.51 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government initiatives and huge investments driving the market4.; Vision 2030 and allied projects driving the market.

6. What are the notable trends driving market growth?

Bangkok and Vicinities Witnessing Growth in the Residential Sector.

7. Are there any restraints impacting market growth?

4.; High construction costs affecting the market4.; Limited land availability affecting the growth of the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Housing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Housing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Housing Industry?

To stay informed about further developments, trends, and reports in the Thailand Housing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence