Key Insights

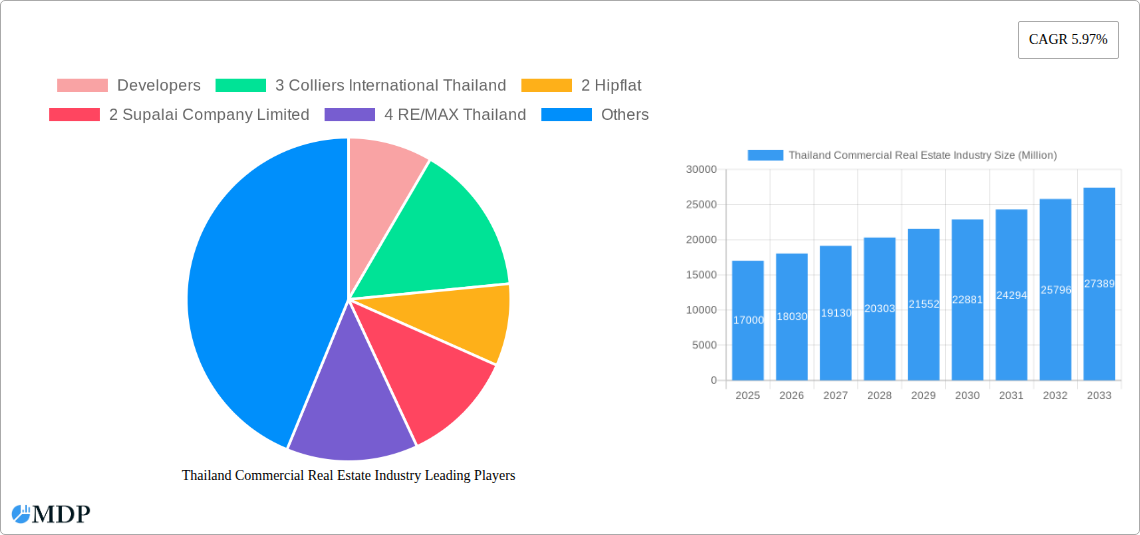

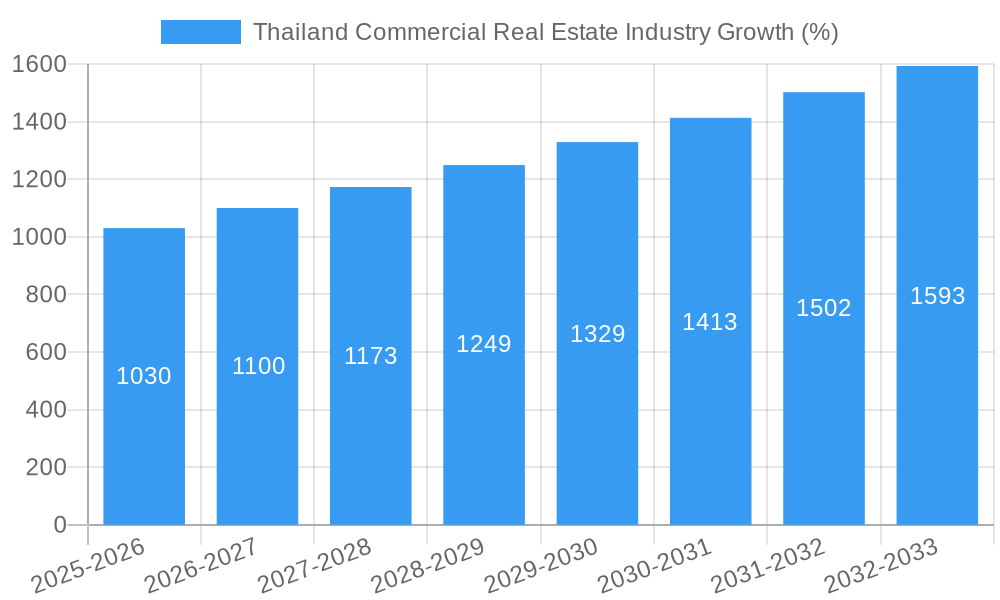

The Thailand commercial real estate market, valued at approximately 17 million USD in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 5.97% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing foreign direct investment (FDI) and a burgeoning tourism sector, particularly in major cities like Bangkok, Chiang Mai, and Hua Hin, fuel demand for office, retail, and hospitality spaces. Secondly, the rise of e-commerce and logistics necessitates the expansion of industrial and logistics facilities across the country. Furthermore, ongoing infrastructure development and government initiatives aimed at improving urban planning and connectivity contribute to a positive investment climate. However, challenges remain. Economic fluctuations, potential interest rate hikes, and competition from neighboring Southeast Asian countries could exert pressure on the market. The segmentation of the market, with notable players like Central Pattana PLC, Supalai Company Limited, and international firms like CBRE and JLL Thailand vying for market share, indicates a dynamic and competitive landscape. The diverse range of property types, encompassing office spaces, retail centers, industrial parks, and hospitality establishments across various cities, suggests a market ripe for strategic investment opportunities tailored to specific sectors and geographical locations. The historical period (2019-2024) likely reflects a period of growth preceding the pandemic, and post-pandemic recovery is contributing to the projected expansion.

The forecast period (2025-2033) reveals significant potential for sustained growth, albeit with some level of market volatility. The key to success lies in identifying and capitalizing on niche market opportunities, focusing on sustainable development practices, and adapting to changing economic conditions. A focus on strategic partnerships and collaborations will be crucial for navigating this competitive yet potentially lucrative market. The continued growth in tourism and the rise of e-commerce are long-term drivers that will sustain demand across various property types within the commercial sector. Understanding the nuances of different city markets and aligning investment strategies accordingly is crucial for realizing profitable returns within the Thailand commercial real estate industry.

Thailand Commercial Real Estate Industry: 2019-2033 Forecast Report

Dive deep into the dynamic Thailand commercial real estate market with this comprehensive report, providing actionable insights for investors, developers, and industry stakeholders. This in-depth analysis covers the period from 2019 to 2033, with a focus on the 2025 market and projections extending to 2033. Expect detailed breakdowns of market segments, leading players, and key trends shaping the future of Thailand's commercial real estate landscape.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Thailand Commercial Real Estate Industry Market Dynamics & Concentration

The Thai commercial real estate market displays a moderately concentrated landscape, with a few major players dominating certain segments. Market share is influenced by factors like brand recognition, established networks, and access to capital. Innovation is driven by technological advancements in property management, data analytics for investment decisions, and sustainable building practices. The regulatory framework, while generally supportive of investment, faces ongoing adjustments to adapt to evolving market needs. Substitute products (e.g., co-working spaces affecting traditional office demand) exert pressure on specific segments. End-user trends, including increasing demand for flexible workspaces and sustainable buildings, are reshaping the market. M&A activity remains significant, with an estimated xx number of deals in the historical period (2019-2024), contributing to market consolidation.

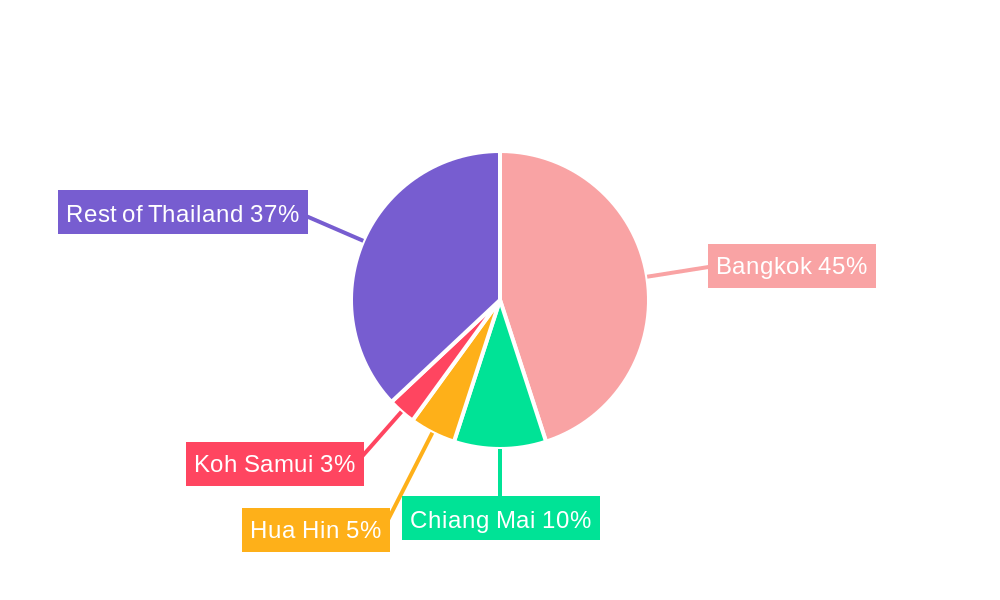

- Market Share: Bangkok holds the largest share (estimated xx%), followed by other key cities like Chiang Mai and Hua Hin. The office segment dominates the market by value (estimated xx Million USD), with retail and industrial and logistics sectors closely following.

- M&A Activity: The number of M&A transactions is predicted to increase over the forecast period, driven by expansion strategies and consolidation among developers and property managers. Estimated xx Million USD was invested in M&A activities from 2019-2024.

- Innovation Drivers: Technological advancements (proptech), sustainable development initiatives, and evolving consumer preferences are key factors driving innovation in the sector.

Thailand Commercial Real Estate Industry Industry Trends & Analysis

The Thai commercial real estate market is projected to experience a CAGR of xx% from 2025 to 2033, driven by robust economic growth, increasing urbanization, and rising foreign investment. Technological disruption is evident in property management technologies (smart buildings), online real estate platforms (like Hipflat and Dot Property), and data-driven decision-making for investors. Consumer preferences show a growing demand for flexible workspaces, sustainable properties, and integrated retail and entertainment experiences. Competitive dynamics are characterized by intense competition among large developers, increasing participation of international firms, and the emergence of innovative start-ups. Market penetration of green building technologies remains relatively low but is increasing steadily.

Leading Markets & Segments in Thailand Commercial Real Estate Industry

Bangkok remains the dominant market, accounting for the largest share of commercial real estate activity in terms of both value and volume. Other key cities like Chiang Mai and Hua Hin are witnessing increasing activity driven by tourism and regional economic growth.

By Type:

- Office: High demand driven by expanding businesses, particularly in Bangkok's central business districts.

- Retail: Strong growth spurred by the expansion of both international and local retail brands, particularly in tourist destinations.

- Industrial & Logistics: Significant growth potential due to rising e-commerce and expanding manufacturing sectors, particularly within the Eastern Economic Corridor (EEC).

- Hospitality: Growth linked to tourism, particularly in popular destinations such as Phuket and Koh Samui.

By Key Cities:

- Bangkok: Dominant market due to established infrastructure, strong economy, and high concentration of businesses. Key drivers include infrastructure development projects (Mass Transit System), ongoing economic growth, and expansion of businesses in the city.

- Chiang Mai: Growing market fueled by tourism, education and regional economic expansion.

- Hua Hin: A significant coastal market driven mainly by tourism and high-end residential properties.

- Koh Samui: A strong tourism-driven market featuring high-end hospitality and residential properties.

- Rest of Thailand: Emerging markets in secondary cities driven by regional growth and infrastructure investment.

Thailand Commercial Real Estate Industry Product Developments

Product innovations focus on smart building technologies, sustainable design, and flexible workspace configurations to meet evolving consumer demands. These innovations are providing competitive advantages through improved efficiency, reduced operating costs, and enhanced tenant satisfaction. The integration of technology into property management systems and the rise of proptech startups are transforming how spaces are managed and marketed. A strong focus on sustainability is becoming a key differentiator in attracting tenants and investors.

Key Drivers of Thailand Commercial Real Estate Industry Growth

Several key factors drive the growth of Thailand's commercial real estate sector. These include sustained economic growth, increasing urbanization leading to higher demand for commercial spaces, government initiatives promoting infrastructure development (particularly in the Eastern Economic Corridor), and foreign direct investment. The tourism sector's resilience also boosts the hospitality segment.

Challenges in the Thailand Commercial Real Estate Industry Market

Challenges include the ongoing impact of the global economic situation, land scarcity in prime locations leading to high land costs, and intense competition, particularly in major cities like Bangkok. Regulatory hurdles, while generally streamlined, can still pose delays for projects. Fluctuations in tourism and the potential impact of climate change on coastal properties pose some risk. Supply chain disruptions also present a continued challenge, especially in the construction and renovation of buildings.

Emerging Opportunities in Thailand Commercial Real Estate Industry

Significant opportunities lie in sustainable development projects, tech-enabled property management, and expanding into secondary markets with strong growth potential. Strategic partnerships between developers, technology firms, and investors will play a critical role in capturing these opportunities. The focus on integrated mixed-use developments that combine retail, office, and residential spaces also presents a potential area of growth.

Leading Players in the Thailand Commercial Real Estate Industry Sector

- Developers: Supalai Company Limited, Pace Development Corporation PLC, Raimon Land PCL (and others)

- Colliers International Thailand

- Hipflat

- Central Pattana PLC

- RE/MAX Thailand

- Savills

- Dot Property

- Knight Frank Thailand*

- CBRE Thailand

- Other Companies (Start-ups and Associations): xx

- JLL Thailand

- Property Perfect

- Blink Design Group*

- DDProperty

Key Milestones in Thailand Commercial Real Estate Industry Industry

- December 2023: FitFlop expands retail presence in Thailand, showcasing a revamped retail design. This signifies a growing interest in upgrading retail spaces to attract consumers.

- February 2024: Central Retail Corporation allocates USD 613 to USD 669 Million for expansion, demonstrating strong investor confidence and potential for increased retail development.

Strategic Outlook for Thailand Commercial Real Estate Industry Market

The future of Thailand's commercial real estate market appears bright, driven by continued economic growth and increased foreign investment. Opportunities exist in sustainable development, technology integration, and expansion into secondary markets. Strategic partnerships and innovative approaches to property development and management will be crucial for success in this dynamic market. The focus on ESG (environmental, social, and governance) factors will be increasingly important for attracting investors and tenants.

Thailand Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

- 1.5. Others

-

2. Key Cities

- 2.1. Bangkok

- 2.2. Chiang Mai

- 2.3. Hua Hin

- 2.4. Koh Samui

- 2.5. Rest of Thailand

Thailand Commercial Real Estate Industry Segmentation By Geography

- 1. Thailand

Thailand Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Overall economic growth driving the market; The growth of business and industries driving the market

- 3.3. Market Restrains

- 3.3.1. Fluctuating economic conditions hindering the growth of the market; Difficulty in landownership and leasing rights affecting the market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Retail Spaces in Thailand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Bangkok

- 5.2.2. Chiang Mai

- 5.2.3. Hua Hin

- 5.2.4. Koh Samui

- 5.2.5. Rest of Thailand

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Developers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 Colliers International Thailand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 2 Hipflat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Supalai Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 4 RE/MAX Thailand

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 1 Central Pattana PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 2 Savills

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4 Dot Property**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 6 Knight Frank Thailand*

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 CBRE Thailand

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Other Companies (Start-ups Associations)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 5 JLL Thailand

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 3 Pace Development Corporation PLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Real Estate Agencies

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 1 Property Perfect

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 5 Blink Design Group*

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 4 Raimon Land PCL

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 3 DDProperty

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Developers

List of Figures

- Figure 1: Thailand Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Commercial Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Commercial Real Estate Industry?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Thailand Commercial Real Estate Industry?

Key companies in the market include Developers, 3 Colliers International Thailand, 2 Hipflat, 2 Supalai Company Limited, 4 RE/MAX Thailand, 1 Central Pattana PLC, 2 Savills, 4 Dot Property**List Not Exhaustive, 6 Knight Frank Thailand*, 1 CBRE Thailand, Other Companies (Start-ups Associations), 5 JLL Thailand, 3 Pace Development Corporation PLC, Real Estate Agencies, 1 Property Perfect, 5 Blink Design Group*, 4 Raimon Land PCL, 3 DDProperty.

3. What are the main segments of the Thailand Commercial Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 17 Million as of 2022.

5. What are some drivers contributing to market growth?

Overall economic growth driving the market; The growth of business and industries driving the market.

6. What are the notable trends driving market growth?

Growing Demand for Retail Spaces in Thailand.

7. Are there any restraints impacting market growth?

Fluctuating economic conditions hindering the growth of the market; Difficulty in landownership and leasing rights affecting the market.

8. Can you provide examples of recent developments in the market?

February 2024: Central Retail Corporation, Thailand's leading retailer, set aside THB 22 to 24 billion (USD 613 to USD 669 million) for expansion in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Thailand Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence