Key Insights

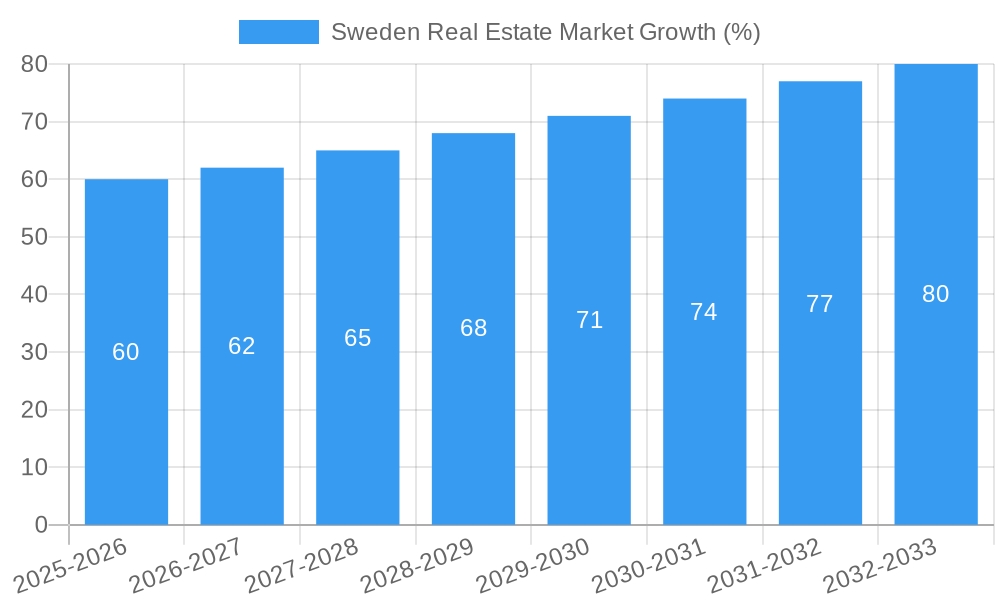

The Swedish real estate market, specifically the luxury segment encompassing apartments, condominiums, landed houses, and villas, presents a robust investment opportunity. Driven by a consistently strong economy, increasing urbanization particularly in major cities like Stockholm and Malmö, and a growing preference for high-end properties, the market exhibits a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2019 to 2033. This growth is fueled by factors such as rising disposable incomes among affluent Swedes, an influx of international high-net-worth individuals, and limited supply of luxury properties in prime locations. While potential regulatory changes or economic downturns could act as restraints, the overall outlook remains positive, supported by the ongoing appeal of Sweden as a desirable place to live and invest.

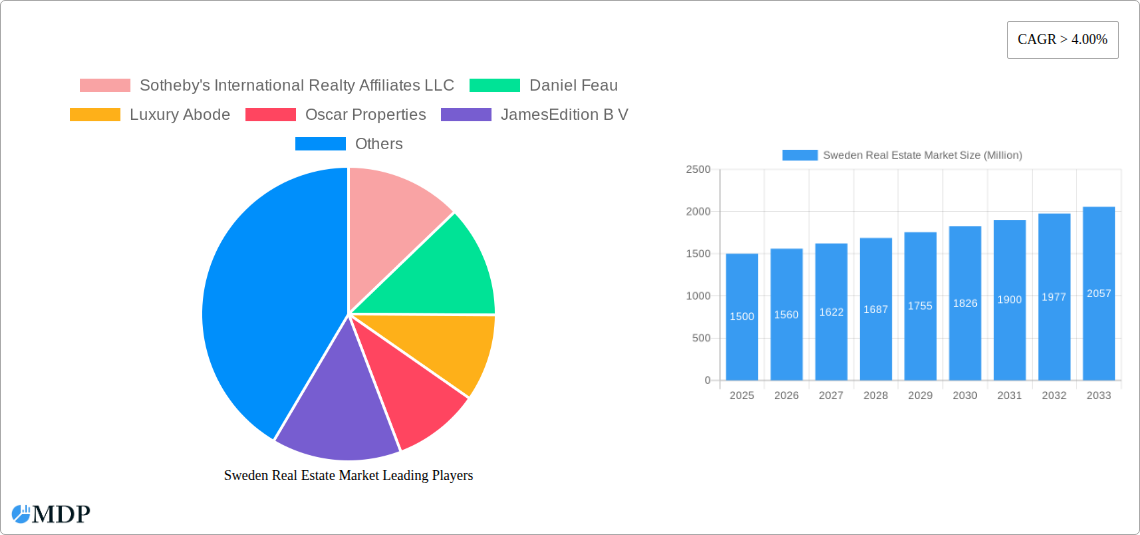

The segment analysis reveals a significant share held by apartments and condominiums in major cities, driven by their convenience and accessibility. However, landed houses and villas in affluent suburbs and rural areas are also experiencing substantial growth, catering to buyers seeking privacy and larger living spaces. Key players like Sotheby's International Realty, Luxury Abode, and Fantastic Frank are capitalizing on this market, indicating strong competition and significant investor interest. The forecast period (2025-2033) projects continued expansion, particularly in Stockholm and Malmö, due to their robust economic activity and desirability. The market's resilience even amidst potential global economic fluctuations stems from the strong fundamentals of the Swedish economy and the sustained demand for high-quality living spaces. Strategic investments in property development and marketing targeting both domestic and international buyers are expected to further enhance market growth throughout the forecast period.

Sweden Real Estate Market Report: 2019-2033 Forecast

Uncover lucrative investment opportunities and navigate the dynamic Swedish real estate landscape with this comprehensive market analysis. This in-depth report provides a detailed examination of the Swedish real estate market from 2019 to 2033, offering crucial insights for investors, developers, and industry stakeholders. The report analyzes market trends, leading players, and future growth prospects, focusing on key segments like apartments, condominiums, landed houses, and villas across major cities including Stockholm and Malmö. With a base year of 2025 and a forecast period spanning 2025-2033, this report is your essential guide to understanding and capitalizing on the opportunities within the Swedish real estate sector. The total market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Sweden Real Estate Market Dynamics & Concentration

This section analyzes the concentration of the Swedish real estate market, identifying key players and their market shares. We explore the driving forces behind innovation, the regulatory landscape, the presence of substitute products, evolving end-user preferences, and the impact of mergers and acquisitions (M&A) activities. The historical period (2019-2024) reveals a fluctuating market influenced by economic cycles and regulatory changes.

Market Concentration: The Swedish real estate market exhibits a moderately concentrated structure, with a few large players commanding significant market share. For example, Sotheby's International Realty Affiliates LLC and Fantastic Frank hold an estimated combined market share of xx% in the luxury segment in 2024. However, a significant portion of the market is occupied by smaller, regional players.

Innovation Drivers: Technological advancements, particularly in online property platforms and PropTech solutions, are driving innovation, leading to increased transparency and efficiency in transactions.

Regulatory Framework: The Swedish government’s policies concerning mortgages, taxation, and building permits have a considerable impact on market dynamics. Recent changes have aimed to increase housing supply and affordability.

Product Substitutes: The presence of alternative housing options, such as co-living spaces and rental apartments, influences the demand for traditional property types.

End-User Trends: Increasing demand for sustainable and energy-efficient homes is reshaping the market, influencing both new constructions and renovations.

M&A Activities: The number of M&A deals in the Swedish real estate sector has fluctuated between xx and xx per year during the historical period. Larger firms are consolidating market share through strategic acquisitions.

Sweden Real Estate Market Industry Trends & Analysis

This section delves into the key industry trends shaping the Swedish real estate market, providing a comprehensive overview of market growth drivers, technological disruptions, evolving consumer preferences, and the competitive landscape. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, driven primarily by increasing urbanization and population growth. Market penetration of PropTech solutions is also expected to increase significantly.

This in-depth analysis covers aspects like the impact of rising interest rates, shifts in consumer demand (e.g., towards sustainable housing), and the increased competition from both established and new players. We explore the penetration of digital technologies within the sector and their impact on the overall efficiency and transparency of transactions. The impact of government regulations on market dynamics are also carefully considered, contributing to a holistic understanding of market behavior and trends.

Leading Markets & Segments in Sweden Real Estate Market

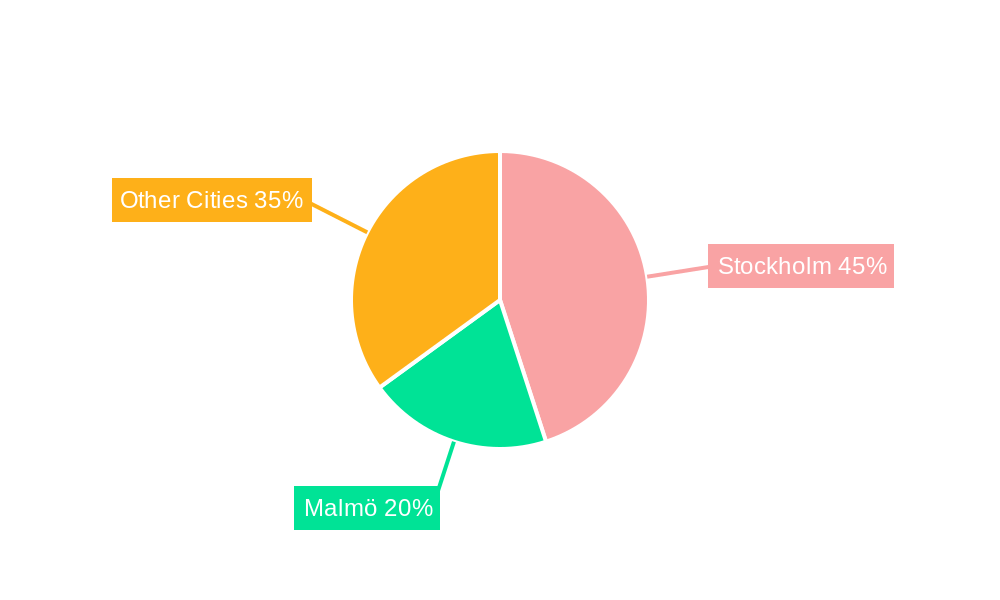

This section identifies the dominant segments within the Swedish real estate market by type (apartments, condominiums, landed houses, villas) and key cities (Stockholm, Malmö, Other Cities). It provides a detailed analysis of the factors contributing to the dominance of specific segments and locations.

By Type:

Apartments and Condominiums: This segment remains the most dominant, driven by affordability and proximity to urban amenities. The share of apartments and condominiums in 2025 is estimated at xx%.

Landed Houses and Villas: This segment caters to a higher-income bracket and commands premium prices, particularly in prime locations within Stockholm. Their share is projected at xx% in 2025.

By Key Cities:

Stockholm: Stockholm holds the largest share of the market owing to its robust economy and high concentration of employment opportunities.

Malmö: Malmö is experiencing strong growth, driven by affordability relative to Stockholm and ongoing infrastructural developments.

Other Cities: The remaining cities contribute a significant but smaller share to the overall market, characterized by regional variations in demand and prices.

Key Drivers:

- Economic Policies: Government incentives and tax regulations influence affordability and investment decisions.

- Infrastructure: Investment in public transportation and urban development positively impacts property values.

- Demographics: Population growth and shifting demographic patterns (e.g., urbanization) drive housing demand.

Sweden Real Estate Market Product Developments

The Swedish real estate market witnesses continuous evolution in product offerings, with increased emphasis on sustainable and technologically advanced solutions. Developers are incorporating smart home technologies, energy-efficient designs, and eco-friendly materials to meet the demands of environmentally conscious buyers. This shift towards sustainable development is driven by evolving consumer preferences and government regulations promoting greener building practices. This innovation leads to a competitive advantage for developers offering superior and more attractive properties in the market.

Key Drivers of Sweden Real Estate Market Growth

Several factors contribute to the growth of the Swedish real estate market. Strong economic growth, coupled with low-interest rates (historically), fueled substantial demand. Government initiatives promoting housing development and infrastructure projects also played a crucial role. Technological advancements, such as online platforms and PropTech solutions, enhance market efficiency and transparency, further stimulating growth.

Challenges in the Sweden Real Estate Market

The Swedish real estate market faces certain challenges. Housing shortages in major cities, particularly Stockholm, drive up prices and limit affordability. Stricter lending regulations may impact market liquidity. Increasing construction costs and labor shortages add to development difficulties. The sensitivity of the market to interest rate changes and global economic fluctuations is another notable challenge. These factors represent significant headwinds that can curb growth momentum.

Emerging Opportunities in Sweden Real Estate Market

Despite challenges, several opportunities exist. The growing demand for sustainable and energy-efficient housing presents a significant opportunity for developers. PropTech advancements can revolutionize the market's efficiency and transparency. The expansion into new markets and the strategic partnerships among stakeholders can further unlock growth. The focus on affordable housing solutions will be crucial in addressing the existing housing shortage.

Leading Players in the Sweden Real Estate Market Sector

- Sotheby's International Realty Affiliates LLC

- Daniel Feau

- Luxury Abode

- Oscar Properties

- JamesEdition B V

- Bolaget Fastighetsformedling

- Per Jansson Fastighetsformedling AB

- MANSION GLOBAL

- Fantastic Frank

- Christies International Real Estate

- LuxuryEstate

Key Milestones in Sweden Real Estate Market Industry

- 2020-2021: Increased government focus on affordable housing initiatives.

- 2022: Several major PropTech companies secured significant funding rounds.

- 2023: Increased consolidation in the market through mergers and acquisitions.

- 2024: Introduction of new regulations impacting sustainable building practices.

Strategic Outlook for Sweden Real Estate Market Market

The Swedish real estate market exhibits strong long-term growth potential, driven by population growth, economic stability, and increasing demand for modern, sustainable housing. Strategic partnerships, technological adoption, and a focus on meeting evolving consumer preferences will be crucial for success. Opportunities exist for developers and investors who can navigate the challenges and adapt to the ever-changing market dynamics.

Sweden Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Stockholm

- 2.2. Malmo

- 2.3. Other Cities

Sweden Real Estate Market Segmentation By Geography

- 1. Sweden

Sweden Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and population growth; Government policies and Foreign Investnents

- 3.3. Market Restrains

- 3.3.1. Skilled Labor Shortage; Material Price Fluctuations

- 3.4. Market Trends

- 3.4.1. Rise in Construction of New Dwellings Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Stockholm

- 5.2.2. Malmo

- 5.2.3. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sotheby's International Realty Affiliates LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daniel Feau

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Luxury Abode

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oscar Properties

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JamesEdition B V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bolaget Fastighetsformedling

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Per Jansson Fastighetsformedling AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MANSION GLOBAL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fantastic Frank*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Christies International Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LuxuryEstate

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sotheby's International Realty Affiliates LLC

List of Figures

- Figure 1: Sweden Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Sweden Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Sweden Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Sweden Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Sweden Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Sweden Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Sweden Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Real Estate Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Sweden Real Estate Market?

Key companies in the market include Sotheby's International Realty Affiliates LLC, Daniel Feau, Luxury Abode, Oscar Properties, JamesEdition B V, Bolaget Fastighetsformedling, Per Jansson Fastighetsformedling AB, MANSION GLOBAL, Fantastic Frank*List Not Exhaustive, Christies International Real Estate, LuxuryEstate.

3. What are the main segments of the Sweden Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and population growth; Government policies and Foreign Investnents.

6. What are the notable trends driving market growth?

Rise in Construction of New Dwellings Driving the Market.

7. Are there any restraints impacting market growth?

Skilled Labor Shortage; Material Price Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Real Estate Market?

To stay informed about further developments, trends, and reports in the Sweden Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence