Key Insights

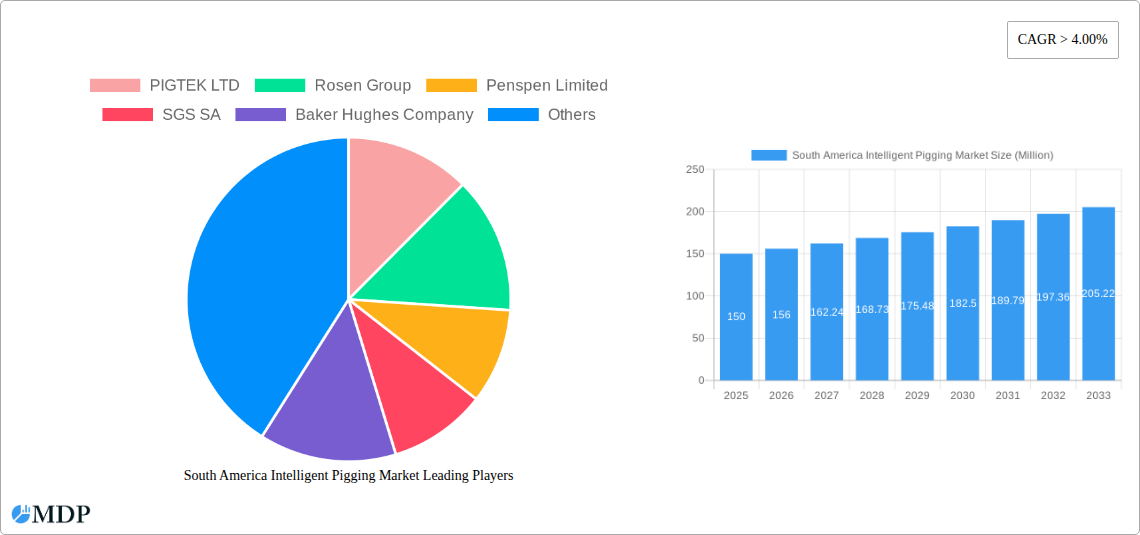

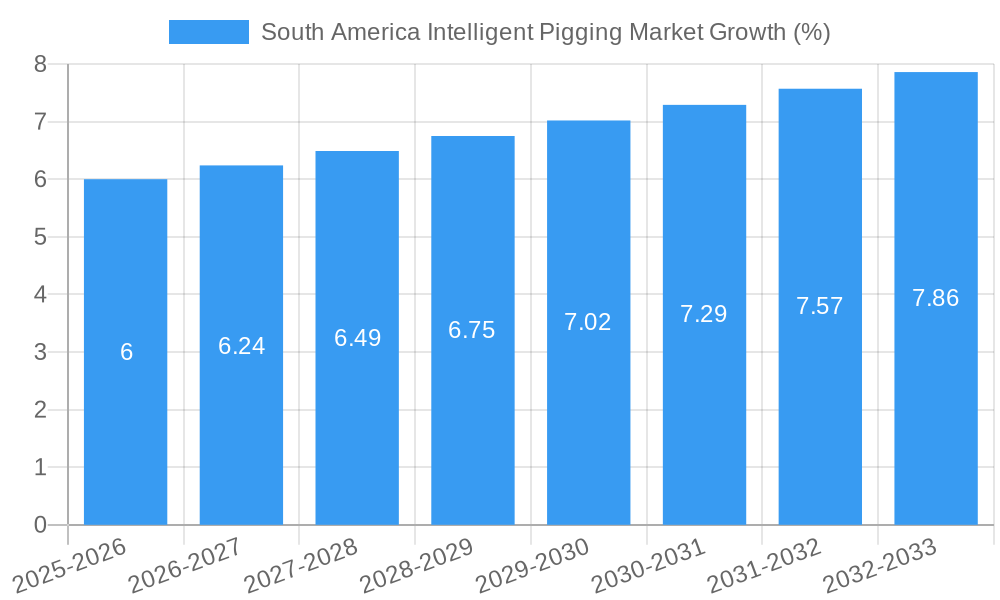

The South American Intelligent Pigging market, encompassing technologies like magnetic flux leakage, capillary, and ultrasonic pigs for pipeline inspection, is experiencing robust growth. Driven by increasing oil and gas production and aging pipeline infrastructure requiring regular maintenance, the market is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. The demand for crack and leakage detection, metal loss/corrosion detection, and geometry/bend detection services is particularly strong, fueled by stringent safety regulations and the need to minimize environmental risks associated with pipeline failures. Brazil and Argentina represent the largest market segments within South America, reflecting their significant oil and gas reserves and established pipeline networks. However, the market's expansion is also influenced by factors like the ongoing investment in new pipeline infrastructure across the region and the adoption of advanced inspection techniques for enhanced operational efficiency. Challenges include the high initial investment cost associated with intelligent pigging technologies and a potential shortage of skilled personnel for deployment and data interpretation. Despite these constraints, the market's growth trajectory remains positive, driven by increasing operational efficiency demands and regulatory pressures. The presence of established players like PIGTEK LTD, Rosen Group, and Baker Hughes, alongside regional service providers, indicates a competitive yet dynamic landscape.

The growth in the South American intelligent pigging market is expected to be further propelled by technological advancements leading to more sophisticated and cost-effective inspection tools. The increasing focus on predictive maintenance strategies among pipeline operators will further drive demand. Moreover, government initiatives aimed at improving pipeline safety and environmental regulations will continue to provide significant impetus to market expansion. While the market size for 2025 is not specified, assuming a modest starting point and applying the provided CAGR, we can expect significant growth over the forecast period. Specific applications like crack and leakage detection will likely maintain a significant market share due to their crucial role in preventing costly and hazardous pipeline failures. The continued investment in oil and gas exploration and production, coupled with the inherent need for effective pipeline integrity management, ensures the long-term viability and expansion of the South American intelligent pigging market.

South America Intelligent Pigging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South America Intelligent Pigging Market, offering actionable insights for industry stakeholders. With a focus on market dynamics, key players, and future trends, this report is essential for businesses operating in or planning to enter this dynamic sector. Covering the period 2019-2033, with a base year of 2025, this report projects significant growth opportunities. The report meticulously examines market segmentation by application (Crack & Leakage Detection, Metal Loss/Corrosion Detection, Geometry Measurement & Bend Detection, Other Applications), technology (Magnetic Flux Leakage Pigs, Capiler Pigs, Ultrasonic Pigs), and pipeline fluid type (Oil, Gas). Leading companies like PIGTEK LTD, Rosen Group, Penspen Limited, SGS SA, Baker Hughes Company, Dacon Inspection Technologies, and NDT global services ltd are profiled, providing a competitive landscape analysis.

South America Intelligent Pigging Market Market Dynamics & Concentration

The South America Intelligent Pigging market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. The market share distribution amongst the leading companies is estimated to be xx% in 2025, with a projected xx% change by 2033. This dynamic is driven by continuous innovation in pigging technologies, stringent regulatory frameworks mandating pipeline integrity management, and increasing demand for efficient pipeline inspection and maintenance. The market is witnessing a rise in mergers and acquisitions (M&A) activities, with xx deals recorded in the last five years, primarily aimed at expanding market reach and technological capabilities. The substitution of traditional inspection methods with intelligent pigging technologies is another key driver. End-user trends indicate a growing preference for advanced pigging solutions offering real-time data analysis and improved accuracy.

- Market Concentration: Moderately concentrated, with key players holding xx% market share in 2025.

- Innovation Drivers: Demand for advanced technologies, real-time data analysis, and improved accuracy.

- Regulatory Frameworks: Stringent pipeline integrity management regulations drive adoption.

- Product Substitutes: Traditional inspection methods face increasing competition from intelligent pigging.

- End-User Trends: Preference for advanced, data-driven solutions.

- M&A Activities: xx deals in the last five years, fueling market consolidation.

South America Intelligent Pigging Market Industry Trends & Analysis

The South America Intelligent Pigging market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the expansion of oil and gas infrastructure across the region, coupled with increasing investments in pipeline modernization and maintenance. Technological advancements, particularly in the development of more efficient and reliable pigging technologies, are further bolstering market expansion. Market penetration for intelligent pigging is currently at xx% and is expected to reach xx% by 2033. However, competitive dynamics are intensifying as new players enter the market, leading to price pressures and the need for continuous innovation. Consumer preferences are shifting towards solutions offering enhanced data analytics and remote monitoring capabilities.

Leading Markets & Segments in South America Intelligent Pigging Market

The Brazilian and Argentinian markets currently dominate the South America Intelligent Pigging market, driven by robust oil and gas production and extensive pipeline networks. Within applications, Crack & Leakage Detection holds the largest market share, followed by Metal Loss/Corrosion Detection. Magnetic Flux Leakage Pigs are the most prevalent technology, given their cost-effectiveness and reliability. Oil pipelines constitute a larger segment than gas pipelines, but both exhibit considerable growth potential.

- Key Drivers in Brazil: Extensive oil and gas infrastructure, supportive government policies.

- Key Drivers in Argentina: Expansion of Vaca Muerta shale gas production, new pipeline projects (e.g., the 563-km natural gas pipeline project).

- Dominant Application: Crack & Leakage Detection (xx% market share in 2025).

- Dominant Technology: Magnetic Flux Leakage Pigs (xx% market share in 2025).

- Dominant Pipeline Fluid: Oil (xx% market share in 2025).

South America Intelligent Pigging Market Product Developments

Recent product innovations focus on enhancing pigging technology efficiency, incorporating advanced sensors for data acquisition, and integrating real-time data analytics for improved decision-making. This is driven by the demand for reduced inspection time, improved accuracy, and remote monitoring capabilities. These advancements cater to the increasing need for reliable and cost-effective pipeline integrity management. The market is witnessing a growing adoption of intelligent pigging solutions equipped with advanced sensors for various applications.

Key Drivers of South America Intelligent Pigging Market Growth

The South American Intelligent Pigging market’s growth is driven by several factors: the expansion of oil and gas infrastructure, particularly in regions with significant reserves like Vaca Muerta in Argentina; increasing government regulations emphasizing pipeline safety and integrity; and the ongoing technological advancements in pigging technology leading to enhanced efficiency and accuracy. Furthermore, the growing adoption of data analytics in pipeline management further propels the market's growth trajectory.

Challenges in the South America Intelligent Pigging Market Market

The South America Intelligent Pigging market faces challenges like the high initial investment costs associated with implementing intelligent pigging technologies, which can deter smaller operators. Supply chain disruptions can also impact the availability of specialized pigging equipment and services. Furthermore, intense competition among established players and new entrants can create pressure on pricing. These factors can negatively impact market growth, leading to a slower adoption rate than projected.

Emerging Opportunities in South America Intelligent Pigging Market

Significant long-term growth is anticipated due to technological breakthroughs enabling remote operation and predictive maintenance. Strategic partnerships between technology providers and pipeline operators are likely to drive market expansion. Moreover, expansion into underserved regions with limited pipeline infrastructure and growing energy demand represents a considerable opportunity for market players. The integration of IoT (Internet of Things) and AI (Artificial Intelligence) into intelligent pigging technology offers tremendous scope for future advancements.

Leading Players in the South America Intelligent Pigging Market Sector

- PIGTEK LTD

- Rosen Group (Rosen Group)

- Penspen Limited (Penspen Limited)

- SGS SA (SGS SA)

- Baker Hughes Company (Baker Hughes Company)

- Dacon Inspection Technologies

- NDT global services ltd

Key Milestones in South America Intelligent Pigging Market Industry

- June 2022: Argentina launches a tender for a new 563-km natural gas pipeline, boosting demand for pipeline inspection services. This significantly impacts the market by creating a need for extensive pipeline integrity management, including intelligent pigging services.

- May 2022: Enbridge Inc.'s USD 6.6 Million investment in SmartpipeTechnologies highlights the growing focus on innovative pipeline technologies, including advanced leak detection methods and enhanced monitoring capabilities, which directly impacts the intelligent pigging market's growth by fostering technological innovation and driving demand for improved solutions.

Strategic Outlook for South America Intelligent Pigging Market Market

The South America Intelligent Pigging market is poised for substantial growth, fueled by increasing investments in pipeline infrastructure, technological advancements, and stringent regulatory requirements. Strategic partnerships, focused R&D, and expansion into new markets will be crucial for success. Companies that effectively leverage data analytics and develop innovative solutions will gain a competitive edge in this dynamic market. The market is expected to witness a surge in demand for advanced intelligent pigging technologies, emphasizing the need for continuous innovation and adaptation to evolving industry demands.

South America Intelligent Pigging Market Segmentation

-

1. Technology

- 1.1. Magnetic Flux Leakage Pigs

- 1.2. Capiler Pigs

- 1.3. Ultrasonic Pigs

-

2. Pipeline fluid type

- 2.1. Oil

- 2.2. Gas

-

3. Application

- 3.1. Crack & Leakage Detection

- 3.2. Metal Loss/Corrosion Detection

- 3.3. Geometry Measurement & Bend Detection

- 3.4. Other Applications

-

4. Geography

- 4.1. Venezuela

- 4.2. Argentina

- 4.3. Brazil

- 4.4. Rest of South America

South America Intelligent Pigging Market Segmentation By Geography

- 1. Venezuela

- 2. Argentina

- 3. Brazil

- 4. Rest of South America

South America Intelligent Pigging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Amount of Waste Generation

- 3.2.2 Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living4.; Increasing Focus on Non-fossil Fuel Sources of Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Expensive Nature of Incinerators

- 3.4. Market Trends

- 3.4.1. Oil Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Intelligent Pigging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Magnetic Flux Leakage Pigs

- 5.1.2. Capiler Pigs

- 5.1.3. Ultrasonic Pigs

- 5.2. Market Analysis, Insights and Forecast - by Pipeline fluid type

- 5.2.1. Oil

- 5.2.2. Gas

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Crack & Leakage Detection

- 5.3.2. Metal Loss/Corrosion Detection

- 5.3.3. Geometry Measurement & Bend Detection

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Venezuela

- 5.4.2. Argentina

- 5.4.3. Brazil

- 5.4.4. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Venezuela

- 5.5.2. Argentina

- 5.5.3. Brazil

- 5.5.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Venezuela South America Intelligent Pigging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Magnetic Flux Leakage Pigs

- 6.1.2. Capiler Pigs

- 6.1.3. Ultrasonic Pigs

- 6.2. Market Analysis, Insights and Forecast - by Pipeline fluid type

- 6.2.1. Oil

- 6.2.2. Gas

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Crack & Leakage Detection

- 6.3.2. Metal Loss/Corrosion Detection

- 6.3.3. Geometry Measurement & Bend Detection

- 6.3.4. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Venezuela

- 6.4.2. Argentina

- 6.4.3. Brazil

- 6.4.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Argentina South America Intelligent Pigging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Magnetic Flux Leakage Pigs

- 7.1.2. Capiler Pigs

- 7.1.3. Ultrasonic Pigs

- 7.2. Market Analysis, Insights and Forecast - by Pipeline fluid type

- 7.2.1. Oil

- 7.2.2. Gas

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Crack & Leakage Detection

- 7.3.2. Metal Loss/Corrosion Detection

- 7.3.3. Geometry Measurement & Bend Detection

- 7.3.4. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Venezuela

- 7.4.2. Argentina

- 7.4.3. Brazil

- 7.4.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Brazil South America Intelligent Pigging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Magnetic Flux Leakage Pigs

- 8.1.2. Capiler Pigs

- 8.1.3. Ultrasonic Pigs

- 8.2. Market Analysis, Insights and Forecast - by Pipeline fluid type

- 8.2.1. Oil

- 8.2.2. Gas

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Crack & Leakage Detection

- 8.3.2. Metal Loss/Corrosion Detection

- 8.3.3. Geometry Measurement & Bend Detection

- 8.3.4. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Venezuela

- 8.4.2. Argentina

- 8.4.3. Brazil

- 8.4.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of South America South America Intelligent Pigging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Magnetic Flux Leakage Pigs

- 9.1.2. Capiler Pigs

- 9.1.3. Ultrasonic Pigs

- 9.2. Market Analysis, Insights and Forecast - by Pipeline fluid type

- 9.2.1. Oil

- 9.2.2. Gas

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Crack & Leakage Detection

- 9.3.2. Metal Loss/Corrosion Detection

- 9.3.3. Geometry Measurement & Bend Detection

- 9.3.4. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Venezuela

- 9.4.2. Argentina

- 9.4.3. Brazil

- 9.4.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Brazil South America Intelligent Pigging Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Intelligent Pigging Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Intelligent Pigging Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 PIGTEK LTD

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Rosen Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Penspen Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SGS SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Baker Hughes Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Dacon Inspection Technologies

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 NDT global services ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 PIGTEK LTD

List of Figures

- Figure 1: South America Intelligent Pigging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Intelligent Pigging Market Share (%) by Company 2024

List of Tables

- Table 1: South America Intelligent Pigging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Intelligent Pigging Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: South America Intelligent Pigging Market Revenue Million Forecast, by Pipeline fluid type 2019 & 2032

- Table 4: South America Intelligent Pigging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: South America Intelligent Pigging Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Intelligent Pigging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South America Intelligent Pigging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil South America Intelligent Pigging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina South America Intelligent Pigging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of South America South America Intelligent Pigging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South America Intelligent Pigging Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 12: South America Intelligent Pigging Market Revenue Million Forecast, by Pipeline fluid type 2019 & 2032

- Table 13: South America Intelligent Pigging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: South America Intelligent Pigging Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: South America Intelligent Pigging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South America Intelligent Pigging Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: South America Intelligent Pigging Market Revenue Million Forecast, by Pipeline fluid type 2019 & 2032

- Table 18: South America Intelligent Pigging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: South America Intelligent Pigging Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Intelligent Pigging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: South America Intelligent Pigging Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: South America Intelligent Pigging Market Revenue Million Forecast, by Pipeline fluid type 2019 & 2032

- Table 23: South America Intelligent Pigging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: South America Intelligent Pigging Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: South America Intelligent Pigging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Intelligent Pigging Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 27: South America Intelligent Pigging Market Revenue Million Forecast, by Pipeline fluid type 2019 & 2032

- Table 28: South America Intelligent Pigging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: South America Intelligent Pigging Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: South America Intelligent Pigging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Intelligent Pigging Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the South America Intelligent Pigging Market?

Key companies in the market include PIGTEK LTD, Rosen Group, Penspen Limited, SGS SA, Baker Hughes Company, Dacon Inspection Technologies, NDT global services ltd.

3. What are the main segments of the South America Intelligent Pigging Market?

The market segments include Technology, Pipeline fluid type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Amount of Waste Generation. Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living4.; Increasing Focus on Non-fossil Fuel Sources of Energy.

6. What are the notable trends driving market growth?

Oil Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Expensive Nature of Incinerators.

8. Can you provide examples of recent developments in the market?

June 2022: Argentina officially launched a tender to construct a new 563-km natural gas pipeline to transport gas from the country's massive Vaca Muerta shale formation. The channel connects the town of Tratayen in the Neuquen province with Salliquelo, west of Buenos Aires. The pipeline is anticipated to transport 24 million cubic meters per day (m3/d) of gas, expanding Argentina's natural gas transport capacity by 25%. The Vaca Muerta shale formation is the world's fourth-largest shale oil reserve and the second-largest for shale gas. The estimated project cost is about USD 1.5 billion, and it would take about 18 months to complete construction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Intelligent Pigging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Intelligent Pigging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Intelligent Pigging Market?

To stay informed about further developments, trends, and reports in the South America Intelligent Pigging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence