Key Insights

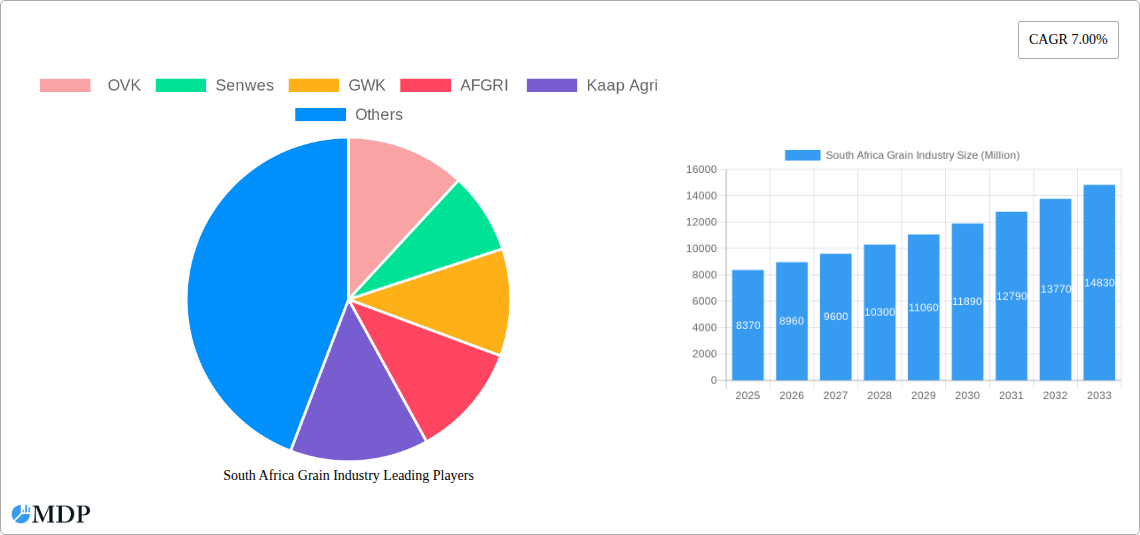

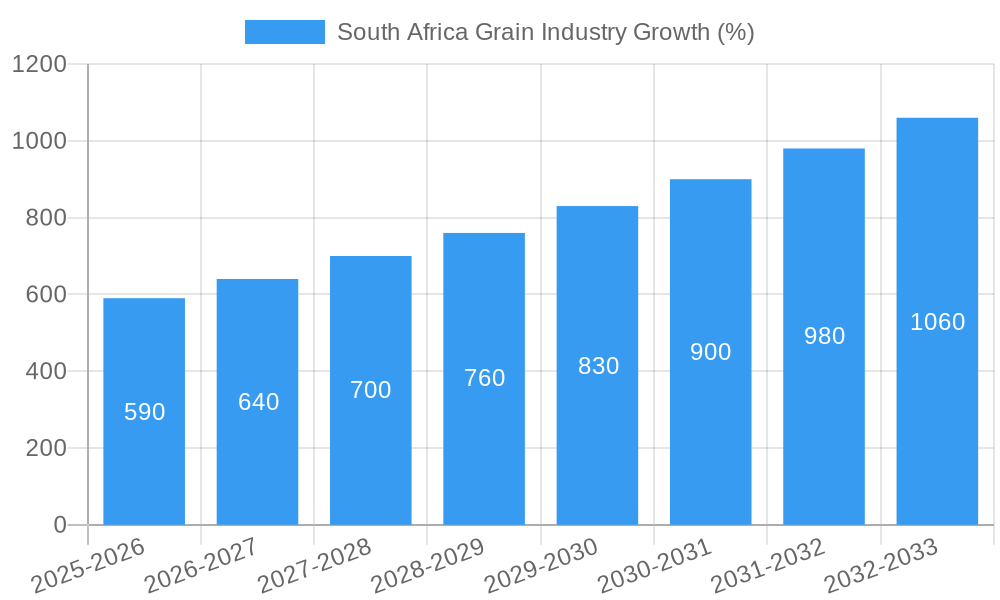

The South African grain industry, valued at $8.37 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is fueled by several key factors. Increasing domestic demand for food staples like maize and wheat, coupled with a growing livestock sector boosting animal feed consumption, significantly contributes to market expansion. Furthermore, the industrial utilization of grains in sectors such as brewing and biofuel production adds another layer of growth. South Africa's favorable climate and arable land provide a solid foundation for production, although challenges remain. Water scarcity and fluctuating weather patterns pose significant risks to crop yields, potentially impacting future growth trajectories. The industry's competitive landscape, characterized by major players like OVK, Senwes, GWK, AFGRI, Kaap Agri, Grain SA, and BKB Ltd., influences pricing and market share dynamics. The distribution channels – direct sales, wholesale, and retail – also play a critical role in determining market access and consumer reach. Strategic investments in agricultural technology and infrastructure are likely to play a crucial role in mitigating risks and fostering sustainable industry expansion.

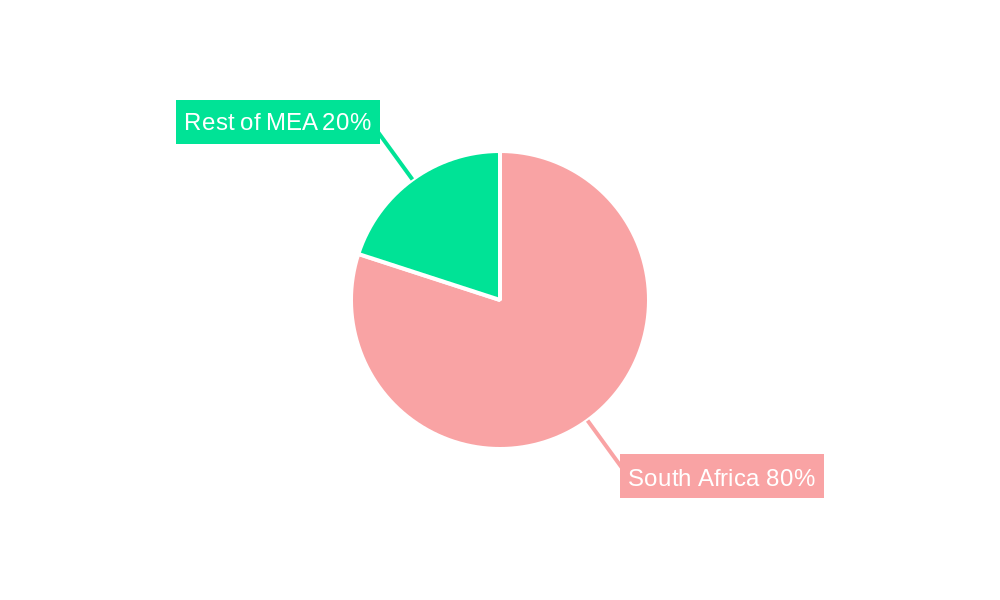

Focusing on the regional breakdown within South Africa itself, the diverse agricultural zones and varying climatic conditions across the country contribute to regional differences in grain production. While precise regional market share data for South Africa isn't provided, the Middle East and Africa (MEA) region, including South Africa, UAE, and Saudi Arabia, demonstrates significant potential for grain imports and trade, further fueling market expansion. The industry's ongoing efforts to enhance productivity, address logistical challenges, and adapt to climate change will significantly determine the future trajectory of this lucrative sector. The forecast period of 2025-2033 promises substantial growth opportunities within the South African grain industry. However, proactive strategies to overcome challenges associated with climate change and supply chain efficiencies will be crucial for realizing this potential.

South Africa Grain Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the South African grain industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study covers the period from 2019 to 2033, with a focus on 2025 as the base and estimated year. We project a robust market trajectory, driven by several key factors analyzed in depth. This report is essential for investors, industry professionals, and government agencies seeking to understand the current landscape and future prospects of the South African grain sector. Download now to gain a competitive edge!

South Africa Grain Industry Market Dynamics & Concentration

The South African grain industry exhibits a moderately concentrated market structure, with a handful of major players dominating various segments. These include OVK, Senwes, GWK, AFGRI, Kaap Agri, Grain SA, and BKB Ltd. Market share dynamics vary significantly across grain types and distribution channels. Maize, for example, accounts for the largest share of production and revenue, while wheat holds a significant position, though with less market dominance.

- Market Concentration: The top 5 players collectively hold an estimated xx% market share in 2025, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in farming practices, seed genetics, and storage infrastructure drive efficiency gains and productivity increases.

- Regulatory Frameworks: Government policies and regulations pertaining to agricultural subsidies, trade, and food safety significantly impact market dynamics. The recent xx regulations on xx have created xx opportunities/challenges.

- Product Substitutes: The industry faces competition from imported grains and alternative food sources, which influence pricing and demand.

- End-User Trends: The growing demand for processed food products and animal feed fuels the growth of certain grain segments, particularly maize and sorghum.

- M&A Activities: The past five years have witnessed xx mergers and acquisitions (M&A) deals within the sector, primarily focused on consolidation and expansion of value chains.

South Africa Grain Industry Industry Trends & Analysis

The South African grain industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by multiple factors. Market growth is largely propelled by increasing domestic consumption, expanding export markets, and improvements in agricultural technologies. However, challenges like climate change and water scarcity pose significant threats.

Technological disruptions, such as precision agriculture and data analytics, are transforming farming practices, resulting in improved yields and resource management. Consumer preferences increasingly favor sustainably produced grains, leading companies to adopt environmentally friendly practices. Competitive dynamics are shaped by price fluctuations, global trade policies, and the strategic alliances among key players. Market penetration of new technologies like xx is expected to reach xx% by 2033.

Leading Markets & Segments in South Africa Grain Industry

Maize consistently dominates the grain market in South Africa, accounting for the largest share of both production and consumption, primarily driven by its use in human consumption, animal feed, and industrial applications (e.g., starch production). The largest producing and consuming region is xx.

- By Grain Type:

- Maize: Key driver is strong demand from domestic consumption and exports, supported by favorable climatic conditions in certain regions.

- Wheat: Growth is constrained by xx, leading to xx.

- Barley, Sorghum, Oats, and Other Grains: These segments exhibit niche market characteristics, with growth driven by specific industrial applications and specialized food products.

- By End-User:

- Animal Feed: Significant growth driven by the expanding livestock industry, notably poultry and livestock farming, with xx% contribution to overall market.

- Human Consumption: Remains a dominant end-use segment with xx Million tons consumed annually.

- Industrial Uses: Growth is tied to the development of industries relying on grains for processing (e.g., biofuel, starch).

- By Distribution Channel:

- Wholesale: Dominates the grain market due to its extensive reach to end-users and established supply chains.

- Retail: Represents a significant portion, particularly for smaller scale farmers and direct-to-consumer sales.

- Direct Sales: Mostly concentrated in specific grain types or niche markets.

South Africa Grain Industry Product Developments

Recent innovations focus on improved seed varieties with enhanced yields and pest resistance, alongside advancements in post-harvest technologies for efficient grain storage and processing. These developments aim to enhance both profitability and sustainability, thus increasing market competitiveness. The adoption of new technologies such as xx is expected to boost efficiency by xx%.

Key Drivers of South Africa Grain Industry Growth

Several key factors are propelling the growth of the South African grain industry. These include technological advancements in farming practices leading to increased productivity, supportive government policies promoting agricultural development, and increasing demand for grain-based products both domestically and internationally. Furthermore, strategic investments in infrastructure and efficient logistics networks are enhancing the sector's capacity to meet the growing demand.

Challenges in the South Africa Grain Industry Market

The South African grain industry faces significant challenges, including fluctuating global commodity prices, which impact profitability, and unpredictable weather patterns leading to crop failures. The industry also contends with infrastructure constraints affecting efficient transportation and storage, alongside the competitive pressures posed by international grain imports. These factors collectively impose an estimated xx% impact on industry growth.

Emerging Opportunities in South Africa Grain Industry

The South African grain industry presents lucrative opportunities. Technological breakthroughs in precision agriculture, alongside strategic partnerships for enhanced market access, offer significant potential for growth. Exploring new export markets and tapping into the growing demand for value-added grain products contribute to the long-term expansion of the sector. Investments in sustainable agricultural practices and the development of resilient crop varieties are expected to positively impact the industry in the long-term.

Leading Players in the South Africa Grain Industry Sector

- OVK

- Senwes

- GWK

- AFGRI

- Kaap Agri

- Grain SA

- BKB Ltd

Key Milestones in South Africa Grain Industry Industry

- 2020: Implementation of new agricultural subsidies impacting production costs and market dynamics.

- 2021: A significant drought affected crop yields in several regions.

- 2022: Launch of a new precision farming technology, enhancing efficiency.

- 2023: Major investment in new grain storage facilities increased storage capacity.

- 2024: A strategic merger between xx and xx altered the competitive landscape.

Strategic Outlook for South Africa Grain Industry Market

The South African grain industry is poised for sustained growth, driven by technological innovation, strategic partnerships, and favorable market trends. Investing in sustainable practices and diversification strategies will strengthen the sector's resilience and long-term potential. The integration of technology and the adoption of modern farming techniques will be pivotal in sustaining this growth trajectory.

South Africa Grain Industry Segmentation

- 1. Maize

- 2. Barley

- 3. Sorghum

- 4. Rice

- 5. Wheat

- 6. Maize

- 7. Barley

- 8. Sorghum

- 9. Rice

- 10. Wheat

South Africa Grain Industry Segmentation By Geography

- 1. South Africa

South Africa Grain Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. High Regional Trade of Grains is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Maize

- 5.2. Market Analysis, Insights and Forecast - by Barley

- 5.3. Market Analysis, Insights and Forecast - by Sorghum

- 5.4. Market Analysis, Insights and Forecast - by Rice

- 5.5. Market Analysis, Insights and Forecast - by Wheat

- 5.6. Market Analysis, Insights and Forecast - by Maize

- 5.7. Market Analysis, Insights and Forecast - by Barley

- 5.8. Market Analysis, Insights and Forecast - by Sorghum

- 5.9. Market Analysis, Insights and Forecast - by Rice

- 5.10. Market Analysis, Insights and Forecast - by Wheat

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Maize

- 6. UAE South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 OVK

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Senwes

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 GWK

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AFGRI

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kaap Agri

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Grain SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BKB Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 OVK

List of Figures

- Figure 1: South Africa Grain Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Grain Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa Grain Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Grain Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: South Africa Grain Industry Revenue Million Forecast, by Maize 2019 & 2032

- Table 4: South Africa Grain Industry Volume Kiloton Forecast, by Maize 2019 & 2032

- Table 5: South Africa Grain Industry Revenue Million Forecast, by Barley 2019 & 2032

- Table 6: South Africa Grain Industry Volume Kiloton Forecast, by Barley 2019 & 2032

- Table 7: South Africa Grain Industry Revenue Million Forecast, by Sorghum 2019 & 2032

- Table 8: South Africa Grain Industry Volume Kiloton Forecast, by Sorghum 2019 & 2032

- Table 9: South Africa Grain Industry Revenue Million Forecast, by Rice 2019 & 2032

- Table 10: South Africa Grain Industry Volume Kiloton Forecast, by Rice 2019 & 2032

- Table 11: South Africa Grain Industry Revenue Million Forecast, by Wheat 2019 & 2032

- Table 12: South Africa Grain Industry Volume Kiloton Forecast, by Wheat 2019 & 2032

- Table 13: South Africa Grain Industry Revenue Million Forecast, by Maize 2019 & 2032

- Table 14: South Africa Grain Industry Volume Kiloton Forecast, by Maize 2019 & 2032

- Table 15: South Africa Grain Industry Revenue Million Forecast, by Barley 2019 & 2032

- Table 16: South Africa Grain Industry Volume Kiloton Forecast, by Barley 2019 & 2032

- Table 17: South Africa Grain Industry Revenue Million Forecast, by Sorghum 2019 & 2032

- Table 18: South Africa Grain Industry Volume Kiloton Forecast, by Sorghum 2019 & 2032

- Table 19: South Africa Grain Industry Revenue Million Forecast, by Rice 2019 & 2032

- Table 20: South Africa Grain Industry Volume Kiloton Forecast, by Rice 2019 & 2032

- Table 21: South Africa Grain Industry Revenue Million Forecast, by Wheat 2019 & 2032

- Table 22: South Africa Grain Industry Volume Kiloton Forecast, by Wheat 2019 & 2032

- Table 23: South Africa Grain Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 24: South Africa Grain Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 25: South Africa Grain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South Africa Grain Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 27: UAE South Africa Grain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: UAE South Africa Grain Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: South Africa South Africa Grain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: South Africa South Africa Grain Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia South Africa Grain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Saudi Arabia South Africa Grain Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 33: Rest of MEA South Africa Grain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of MEA South Africa Grain Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 35: South Africa Grain Industry Revenue Million Forecast, by Maize 2019 & 2032

- Table 36: South Africa Grain Industry Volume Kiloton Forecast, by Maize 2019 & 2032

- Table 37: South Africa Grain Industry Revenue Million Forecast, by Barley 2019 & 2032

- Table 38: South Africa Grain Industry Volume Kiloton Forecast, by Barley 2019 & 2032

- Table 39: South Africa Grain Industry Revenue Million Forecast, by Sorghum 2019 & 2032

- Table 40: South Africa Grain Industry Volume Kiloton Forecast, by Sorghum 2019 & 2032

- Table 41: South Africa Grain Industry Revenue Million Forecast, by Rice 2019 & 2032

- Table 42: South Africa Grain Industry Volume Kiloton Forecast, by Rice 2019 & 2032

- Table 43: South Africa Grain Industry Revenue Million Forecast, by Wheat 2019 & 2032

- Table 44: South Africa Grain Industry Volume Kiloton Forecast, by Wheat 2019 & 2032

- Table 45: South Africa Grain Industry Revenue Million Forecast, by Maize 2019 & 2032

- Table 46: South Africa Grain Industry Volume Kiloton Forecast, by Maize 2019 & 2032

- Table 47: South Africa Grain Industry Revenue Million Forecast, by Barley 2019 & 2032

- Table 48: South Africa Grain Industry Volume Kiloton Forecast, by Barley 2019 & 2032

- Table 49: South Africa Grain Industry Revenue Million Forecast, by Sorghum 2019 & 2032

- Table 50: South Africa Grain Industry Volume Kiloton Forecast, by Sorghum 2019 & 2032

- Table 51: South Africa Grain Industry Revenue Million Forecast, by Rice 2019 & 2032

- Table 52: South Africa Grain Industry Volume Kiloton Forecast, by Rice 2019 & 2032

- Table 53: South Africa Grain Industry Revenue Million Forecast, by Wheat 2019 & 2032

- Table 54: South Africa Grain Industry Volume Kiloton Forecast, by Wheat 2019 & 2032

- Table 55: South Africa Grain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: South Africa Grain Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Grain Industry?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the South Africa Grain Industry?

Key companies in the market include OVK, Senwes, GWK, AFGRI , Kaap Agri, Grain SA , BKB Ltd.

3. What are the main segments of the South Africa Grain Industry?

The market segments include Maize, Barley, Sorghum, Rice, Wheat, Maize, Barley, Sorghum, Rice, Wheat.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

High Regional Trade of Grains is Driving the Market.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Grain Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Grain Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Grain Industry?

To stay informed about further developments, trends, and reports in the South Africa Grain Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence