Key Insights

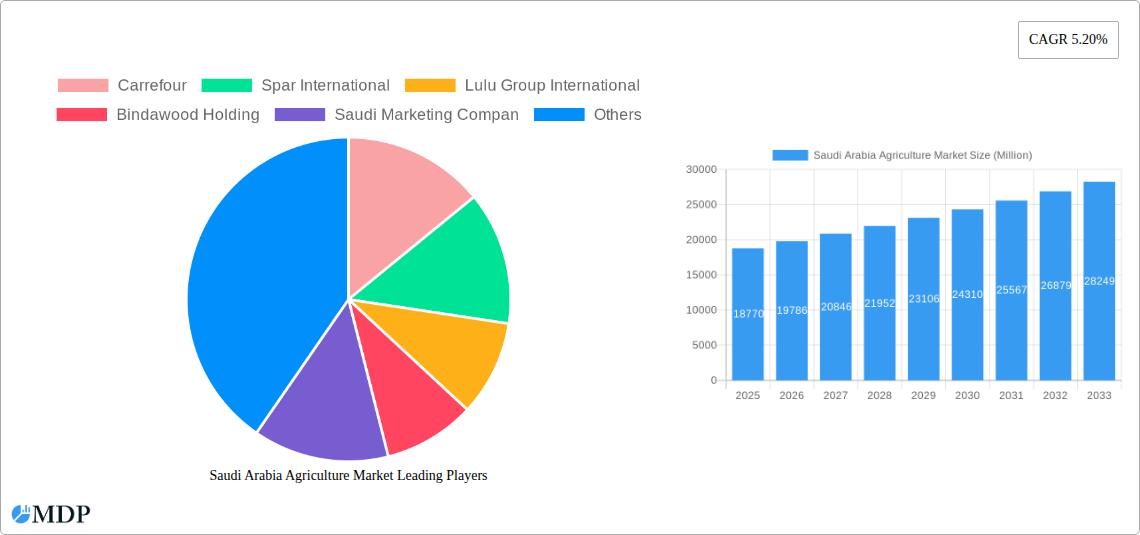

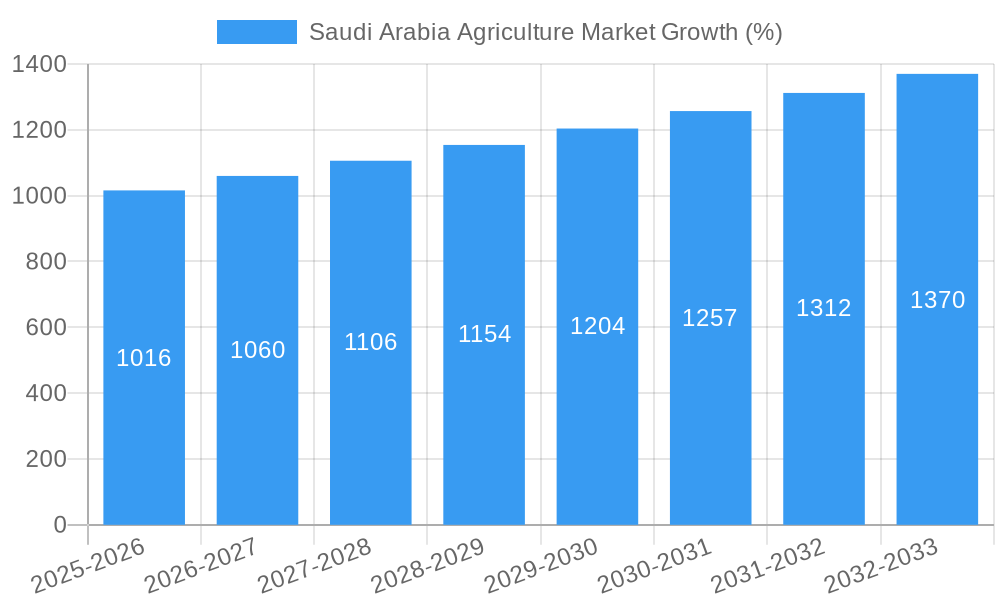

The Saudi Arabian agriculture market, valued at $18.77 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033. This expansion is fueled by several key drivers. Government initiatives promoting food security and diversification away from oil dependence are significantly boosting investment in modern agricultural technologies and infrastructure. A burgeoning population and rising disposable incomes are driving increased demand for a wider variety of fresh produce and processed food products. Furthermore, the Kingdom's strategic focus on sustainable agriculture practices, including water conservation techniques and precision farming, is contributing to enhanced productivity and efficiency. While challenges remain, such as water scarcity and reliance on imports for certain commodities, the overall market outlook remains positive.

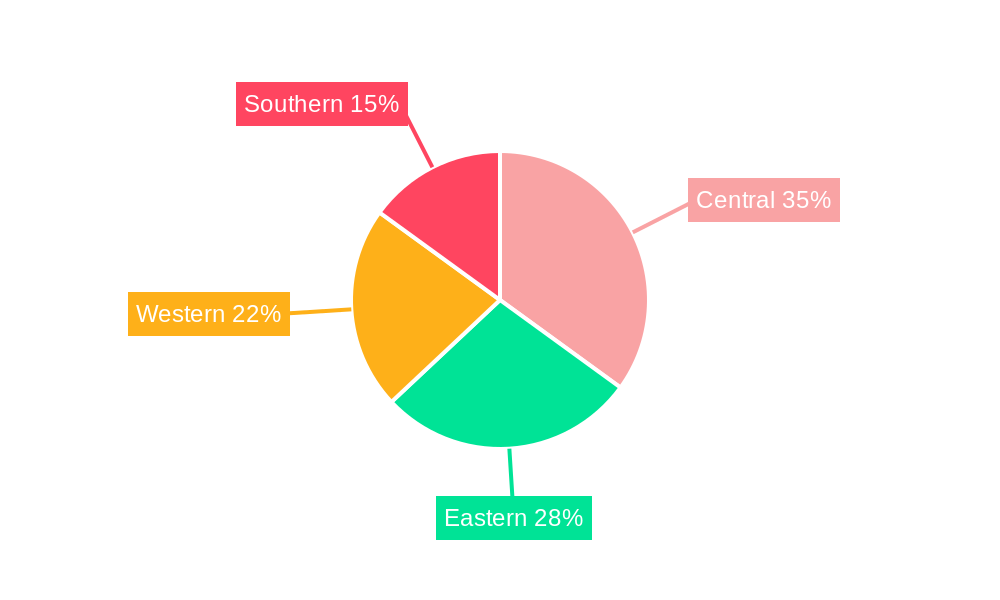

The market segmentation reveals strong performance across various agricultural sectors. Food crops and cereals constitute a significant portion of the market, followed by fruits and vegetables, reflecting the nation's growing consumer preference for fresh produce. The oilseeds and pulses segment also demonstrates notable growth potential, driven by increasing demand for locally-sourced protein sources. Key players like Carrefour, Spar International, Lulu Group International, Bindawood Holding, Saudi Marketing Company, and Abdullah Al-Othaim Markets are actively shaping the market landscape through investments in supply chains, retail infrastructure, and technological advancements. Regional variations exist, with Central and Eastern regions potentially exhibiting higher growth rates due to population density and proximity to major urban centers. The ongoing investments in logistics and cold chain infrastructure will further enhance the market’s efficiency and reach across all regions (Central, Eastern, Western, and Southern) of Saudi Arabia.

Saudi Arabia Agriculture Market Report: 2019-2033 Forecast

Unlocking Growth Opportunities in the Thriving Saudi Arabian Agriculture Sector

This comprehensive report provides a detailed analysis of the Saudi Arabia agriculture market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading segments, and key players. The report quantifies market values in Millions for key segments and analyzes the impact of various factors shaping the future of Saudi Arabian agriculture. Expect detailed analysis of production, consumption, import, export, and price trends across key segments: Food Crops/Cereals, Fruits, Vegetables, and Oilseeds and Pulses. Key players like Carrefour, Spar International, Lulu Group International, Bindawood Holding, Saudi Marketing Company, and Abdullah Al-Othaim Markets are profiled, highlighting their strategic positioning and market influence.

Saudi Arabia Agriculture Market Market Dynamics & Concentration

The Saudi Arabian agriculture market exhibits a moderately concentrated structure, with a few large players dominating specific segments. Market share is influenced by factors including established distribution networks, brand recognition, and access to capital for investment in technology and infrastructure. Innovation drivers include government initiatives promoting sustainable agriculture, water conservation technologies, and vertical farming. The regulatory framework, while supportive of growth, also includes stringent quality and safety standards. Product substitutes, such as imported agricultural goods, present competitive pressures. End-user trends toward healthier and more sustainably produced food are driving demand for organic and locally sourced products. M&A activity has been moderate, with approximately xx deals recorded in the historical period (2019-2024), largely focused on consolidating distribution channels and expanding market reach. The concentration ratio (CR4) for the overall market is estimated to be around xx% in 2025. Further consolidation is expected in the forecast period, driven by the need to scale operations and access advanced technologies.

Saudi Arabia Agriculture Market Industry Trends & Analysis

The Saudi Arabian agriculture market is characterized by significant growth driven by increasing population, rising disposable incomes, and government initiatives aimed at boosting domestic food production under Vision 2030. The market witnessed a CAGR of xx% during the historical period (2019-2024), and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements in irrigation, precision farming, and genetic modification. Consumer preferences are shifting towards healthier, more convenient, and sustainably produced food products. Competitive dynamics are shaped by both domestic and international players vying for market share. Market penetration of technologically advanced farming practices is steadily increasing, with estimates suggesting that xx% of farms utilize precision agriculture techniques in 2025. The adoption rate is projected to increase further, driven by government support and private sector investment.

Leading Markets & Segments in Saudi Arabia Agriculture Market

The Saudi Arabian agriculture market is geographically diverse, with varying strengths in different regions. However, the central and eastern regions are leading in terms of production volume for most segments.

- Food Crops/Cereals: Wheat and rice production dominates, driven by government support and favorable climatic conditions in certain areas. Consumption is high, leading to significant imports to meet the demand. Production in Millions of tons is estimated at xx in 2025.

- Fruits: Date production remains a significant segment with xx Million tons produced in 2025. High-value fruits like citrus and berries are also witnessing growth, driven by rising consumer demand.

- Vegetables: Tomato, potato, and onion production are leading the segment, with a combined production volume of xx Million tons in 2025. Consumption patterns are influenced by cultural preferences and seasonal variations.

- Oilseeds and Pulses: Production is relatively lower compared to other segments. However, the government's focus on food security is driving efforts to enhance production and reduce reliance on imports. Production in Million tons is projected at xx in 2025.

Key drivers for the dominance of these segments include government incentives, investments in irrigation infrastructure, and favorable climatic conditions in specific regions. Further, strategic import policies influence overall supply and demand dynamics.

Saudi Arabia Agriculture Market Product Developments

Recent product developments focus on enhancing crop yields, improving nutritional value, and extending shelf life. Technological advancements such as precision agriculture, hydroponics, and vertical farming are gaining traction. These innovations offer enhanced efficiency, reduced water consumption, and improved product quality, aligning with the government's sustainability goals. The market is witnessing an increased focus on developing climate-resilient crops and adopting sustainable agricultural practices.

Key Drivers of Saudi Arabia Agriculture Market Growth

Several factors drive growth in the Saudi Arabian agriculture market: Government initiatives like Vision 2030 aim to bolster domestic food production and reduce reliance on imports. Investments in irrigation infrastructure and technological advancements are enhancing productivity. Rising consumer incomes and population growth are fueling increased demand for agricultural products. Supportive regulatory policies and incentives further encourage investment and innovation within the sector.

Challenges in the Saudi Arabia Agriculture Market Market

The Saudi Arabian agriculture market faces several challenges: Water scarcity remains a significant constraint, impacting production yields in various regions. High input costs, including labor and fertilizers, affect profitability. The reliance on imported seeds and technologies presents a vulnerability. Competition from imported agricultural products puts pressure on local producers. These challenges necessitate strategic interventions and adaptive solutions.

Emerging Opportunities in Saudi Arabia Agriculture Market

The Saudi Arabian agriculture market presents significant opportunities: Technological advancements in areas like precision agriculture and vertical farming offer increased efficiency and sustainability. Strategic partnerships between local and international companies can enhance technology transfer and market access. Government initiatives to promote sustainable agriculture and food security create a favorable environment for long-term growth. Exploring alternative water sources and utilizing water-efficient irrigation techniques are crucial for future success.

Leading Players in the Saudi Arabia Agriculture Market Sector

- Carrefour

- Spar International

- Lulu Group International

- Bindawood Holding

- Saudi Marketing Company

- Abdullah Al-Othaim Markets

Key Milestones in Saudi Arabia Agriculture Market Industry

- 2020: Launch of the National Transformation Program, focusing on enhancing agricultural productivity.

- 2021: Increased investment in vertical farming technologies.

- 2022: Implementation of new regulations to promote sustainable agricultural practices.

- 2023: Significant investments in water conservation technologies.

- 2024: Several key M&A activities in the food retail sector.

Strategic Outlook for Saudi Arabia Agriculture Market Market

The Saudi Arabian agriculture market is poised for significant growth, driven by government support, technological advancements, and evolving consumer preferences. Strategic opportunities exist in adopting sustainable agricultural practices, investing in innovative technologies, and forging strategic partnerships. The focus on food security and diversification of agricultural production will continue to shape market dynamics in the coming years. The market's growth trajectory is optimistic, with potential for substantial value creation in the years to come.

Saudi Arabia Agriculture Market Segmentation

-

1. Type

- 1.1. Food Crops/Cereals

- 1.2. Fruits

- 1.3. Vegetables

- 1.4. Oilseeds and Pulses

Saudi Arabia Agriculture Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Agriculture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Increasing Food Security Concerns

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Food Crops/Cereals

- 5.1.2. Fruits

- 5.1.3. Vegetables

- 5.1.4. Oilseeds and Pulses

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Carrefour

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Spar International

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lulu Group International

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bindawood Holding

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Saudi Marketing Compan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abdullah Al-othaim Markets

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Carrefour

List of Figures

- Figure 1: Saudi Arabia Agriculture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Agriculture Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Agriculture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Agriculture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Saudi Arabia Agriculture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Agriculture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Agriculture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Saudi Arabia Agriculture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Agriculture Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Saudi Arabia Agriculture Market?

Key companies in the market include Carrefour, Spar International, Lulu Group International, Bindawood Holding, Saudi Marketing Compan, Abdullah Al-othaim Markets.

3. What are the main segments of the Saudi Arabia Agriculture Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 18.77 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Increasing Food Security Concerns.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Agriculture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Agriculture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Agriculture Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Agriculture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence