Key Insights

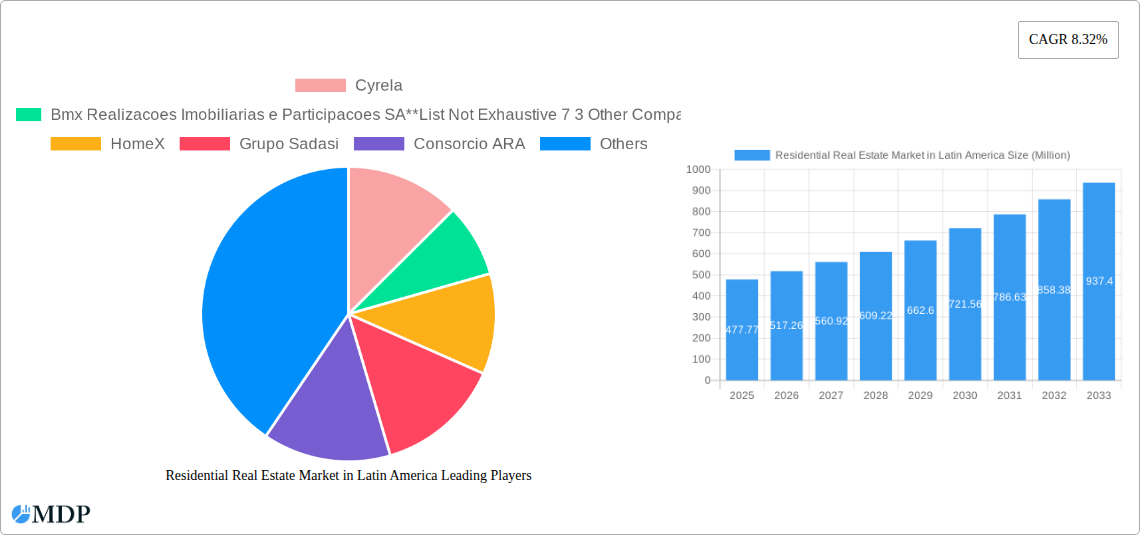

The Latin American residential real estate market, valued at $477.77 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.32% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization across the region is driving demand for housing, particularly in major metropolitan areas like São Paulo, Mexico City, and Buenos Aires. A burgeoning middle class with rising disposable incomes is also a significant contributor, enabling more individuals to afford homeownership. Government initiatives aimed at stimulating the construction sector and improving access to mortgages further support market expansion. The market is segmented by property type, with apartments and condominiums representing a significant portion, reflecting a preference for urban living and higher-density housing. Landed houses and villas cater to a different segment of the market, primarily those seeking more space and privacy. Competition is intense, with major players such as Cyrela, MRV Engenharia, and Grupo Sadasi vying for market share alongside international firms like JLL and CBRE. Challenges remain, including economic instability in some Latin American countries, fluctuations in construction material costs, and the need for improved infrastructure in certain areas to support the growth of new housing developments.

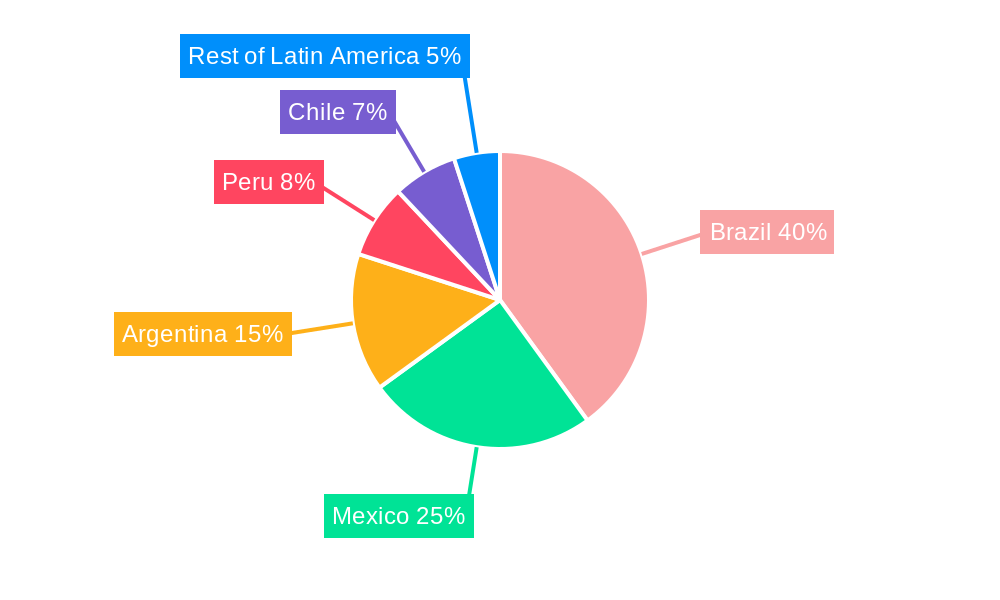

The forecast period (2025-2033) anticipates continued growth, albeit potentially with some moderation depending on macroeconomic conditions and government policies. Factors such as interest rate fluctuations and inflation will influence affordability and consequently impact sales. The continued expansion of the middle class and urban population, coupled with ongoing infrastructure development and strategic investments from both domestic and international players, however, will likely ensure sustained positive market momentum. Analyzing specific country-level performance within Latin America will be crucial for a deeper understanding of market nuances and investment opportunities. Brazil, Mexico, and Argentina are expected to remain the largest markets, with considerable growth potential also present in Peru and Chile, offering opportunities for investors and developers alike. This dynamic landscape necessitates continuous monitoring of regional economic trends and regulatory changes to effectively navigate the evolving residential real estate sector.

Residential Real Estate Market in Latin America: 2019-2033 Forecast

Uncover lucrative investment opportunities and navigate the dynamic landscape of Latin America's residential real estate sector with this comprehensive market report. This in-depth analysis, covering the period 2019-2033 (Base Year: 2025), provides crucial insights into market dynamics, leading players, and future growth prospects. From market concentration and M&A activity to technological disruptions and emerging opportunities, this report is an essential resource for investors, developers, and industry stakeholders.

Residential Real Estate Market in Latin America Market Dynamics & Concentration

The Latin American residential real estate market is characterized by a diverse landscape with varying levels of concentration across different countries and segments. Market share is dominated by a few large players, such as Cyrela and MRV Engenharia e Participacoes SA, but also includes a significant number of smaller, regional developers. The market exhibits a dynamic interplay of factors influencing its concentration.

- Innovation Drivers: Technological advancements, such as PropTech solutions improving efficiency and customer experience, are driving innovation.

- Regulatory Frameworks: Varying regulations across countries impact market access and development timelines. Streamlined processes in some regions foster growth, while bureaucratic hurdles in others create challenges.

- Product Substitutes: The availability of affordable rental options and alternative housing models can impact demand for owner-occupied properties.

- End-User Trends: A growing young population, urbanization, and shifting preferences towards sustainable and smart homes are key end-user trends shaping demand.

- M&A Activities: The number of M&A deals in the period 2019-2024 totaled approximately xx, indicating a moderate level of consolidation. Major players are actively seeking to expand their market share through acquisitions. For example, xx% of all M&A deals involved companies with a market share exceeding 5%.

Residential Real Estate Market in Latin America Industry Trends & Analysis

The Latin American residential real estate market is experiencing significant growth, driven by a confluence of factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, fueled by several key trends:

- Market Growth Drivers: Rapid urbanization, population growth, and increasing middle-class disposable income are significant market drivers. Government initiatives promoting affordable housing also contribute to expansion.

- Technological Disruptions: The rise of PropTech companies and the adoption of digital tools are transforming market operations, improving efficiency, and enhancing the customer experience. Market penetration of PropTech solutions is projected to reach xx% by 2033.

- Consumer Preferences: Demand is shifting towards sustainable, energy-efficient homes with modern amenities and smart home technology. Preference for apartments and condominiums in urban centers is increasing.

- Competitive Dynamics: The market is increasingly competitive, with both large multinational companies and local players vying for market share. Competition is driving innovation and improvements in service quality.

Leading Markets & Segments in Residential Real Estate Market in Latin America

Brazil and Mexico continue to be the leading markets for residential real estate in Latin America, representing xx% and xx% of the total market value, respectively. Within these markets, Apartments and Condominiums constitute the largest segment, driven by urbanization and affordability.

Key Drivers for Dominance:

- Brazil: Strong economic growth (prior to recent fluctuations), expanding middle class, and government initiatives supporting housing development.

- Mexico: High population growth, increasing urbanization, and demand for affordable housing in major cities.

- Apartments and Condominiums: Higher affordability compared to landed houses, increasing density in urban areas, and preference for low-maintenance living.

Landed Houses and Villas: This segment shows a moderate growth, primarily driven by high-income consumers seeking larger living spaces and privacy in select urban and suburban areas. Market share is expected to remain at around xx% throughout the forecast period.

Residential Real Estate Market in Latin America Product Developments

Product innovation in the Latin American residential real estate market centers on incorporating sustainable and smart technologies. Developers are focusing on energy-efficient designs, renewable energy sources, and smart home features to enhance the appeal and value of their properties. This trend aligns with growing consumer demand for eco-friendly and technologically advanced housing solutions. This focus on sustainable and smart features allows developers to command premium pricing and attracts environmentally conscious buyers.

Key Drivers of Residential Real Estate Market in Latin America Growth

Several factors contribute to the growth of the Latin American residential real estate market:

- Economic Growth: Periods of economic prosperity fuel demand and investment.

- Technological Advancements: PropTech solutions enhance efficiency and create new opportunities.

- Government Policies: Initiatives promoting affordable housing and infrastructure development drive market expansion.

Challenges in the Residential Real Estate Market in Latin America Market

The sector faces challenges such as:

- Regulatory Hurdles: Complex and inconsistent regulations across different countries create barriers to investment and development.

- Supply Chain Issues: Disruptions in the supply chain can impact construction costs and project timelines.

- Economic Volatility: Economic downturns can decrease consumer confidence and investment. The xx% drop in GDP in [affected country] in [year] resulted in a xx% decrease in new residential construction starts.

Emerging Opportunities in Residential Real Estate Market in Latin America

The market presents significant opportunities for growth, particularly in:

- Affordable Housing: Meeting the demand for affordable housing in rapidly urbanizing areas presents a considerable opportunity.

- Sustainable Development: Focus on environmentally friendly building materials and energy-efficient designs will attract increasingly eco-conscious buyers.

- Strategic Partnerships: Collaborations between developers, technology providers, and financial institutions can unlock further expansion.

Leading Players in the Residential Real Estate Market in Latin America Sector

- Cyrela

- Bmx Realizacoes Imobiliarias e Participacoes SA

- 7 3 Other Companies

- HomeX

- Grupo Sadasi

- Consorcio ARA

- Mrv Engenharia e Participacoes SA

- Groupe CARSO

- Multiplan Real Estate Asset Management

- JLL

- CBRE

Key Milestones in Residential Real Estate Market in Latin America Industry

- November 2023: CBRE launches the Latam-Iberia platform, aiming to boost investment and collaboration in the real estate sector across both regions. This initiative has the potential to significantly increase foreign investment in Latin America's residential real estate market.

- May 2023: CJ do Brasil's USD 57 Million plant expansion in Piracicaba, Brazil, creates 650 new jobs and includes residential development, indicating increased demand for housing near industrial hubs.

Strategic Outlook for Residential Real Estate Market in Latin America Market

The future of Latin America's residential real estate market looks promising, with significant opportunities for growth in both existing and emerging markets. Strategic partnerships, technological innovations, and a focus on sustainable development will play pivotal roles in shaping the sector's trajectory. The market's long-term success will hinge on addressing challenges related to regulatory frameworks, infrastructure development, and economic stability. The expected increase in urbanization, coupled with the rise of the middle class, will continue to fuel demand for housing.

Residential Real Estate Market in Latin America Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Colombia

- 2.4. Rest of Latin America

Residential Real Estate Market in Latin America Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Colombia

- 4. Rest of Latin America

Residential Real Estate Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization

- 3.3. Market Restrains

- 3.3.1. Accelerated Increase in Construction Costs

- 3.4. Market Trends

- 3.4.1. Increase in Urbanization Boosting Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Colombia

- 5.2.4. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Colombia

- 5.3.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Mexico Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Colombia

- 6.2.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Colombia

- 7.2.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Colombia

- 8.2.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Latin America Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Mexico

- 9.2.2. Brazil

- 9.2.3. Colombia

- 9.2.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Brazil Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 11. Argentina Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 12. Mexico Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 13. Peru Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 14. Chile Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Latin America Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Cyrela

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bmx Realizacoes Imobiliarias e Participacoes SA**List Not Exhaustive 7 3 Other Companie

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 HomeX

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Grupo Sadasi

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Consorcio ARA

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mrv Engenharia e Participacoes SA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Groupe CARSO

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Multiplan Real Estate Asset Management

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 JLL

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 CBRE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Cyrela

List of Figures

- Figure 1: Residential Real Estate Market in Latin America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Residential Real Estate Market in Latin America Share (%) by Company 2024

List of Tables

- Table 1: Residential Real Estate Market in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Residential Real Estate Market in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market in Latin America?

The projected CAGR is approximately 8.32%.

2. Which companies are prominent players in the Residential Real Estate Market in Latin America?

Key companies in the market include Cyrela, Bmx Realizacoes Imobiliarias e Participacoes SA**List Not Exhaustive 7 3 Other Companie, HomeX, Grupo Sadasi, Consorcio ARA, Mrv Engenharia e Participacoes SA, Groupe CARSO, Multiplan Real Estate Asset Management, JLL, CBRE.

3. What are the main segments of the Residential Real Estate Market in Latin America?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 477.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization.

6. What are the notable trends driving market growth?

Increase in Urbanization Boosting Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

Accelerated Increase in Construction Costs.

8. Can you provide examples of recent developments in the market?

November 2023: CBRE, a prominent global consultancy and real estate services firm, unveiled its latest initiative, the Latam-Iberia platform. The platform's primary goal is to reinvigorate the real estate markets in Europe and Latin America while fostering investment ties between the two regions. By enhancing business collaborations and amplifying the visibility of real estate solutions, CBRE aims to catalyze growth in the sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market in Latin America?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence