Key Insights

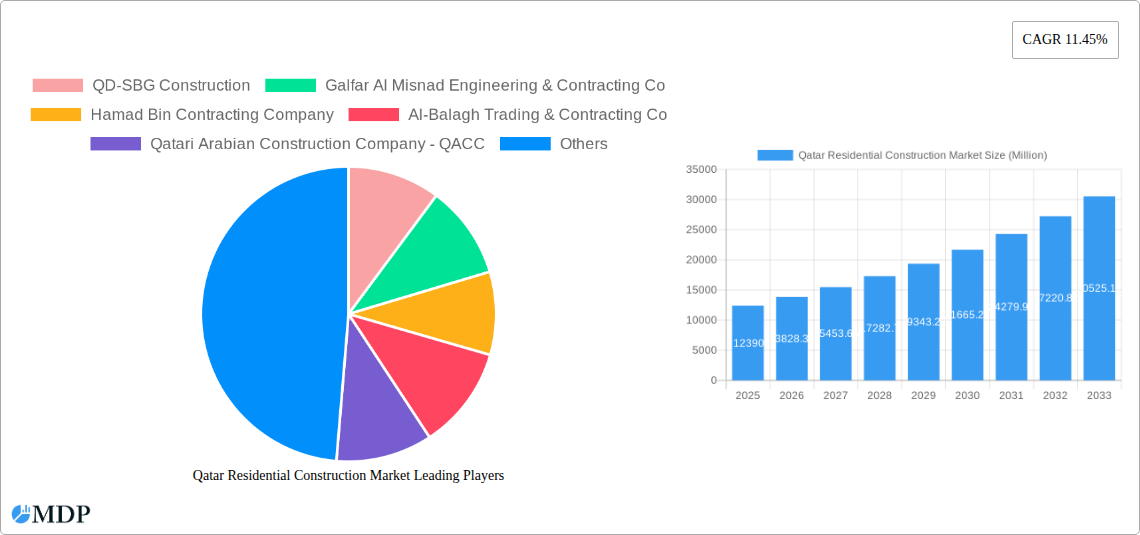

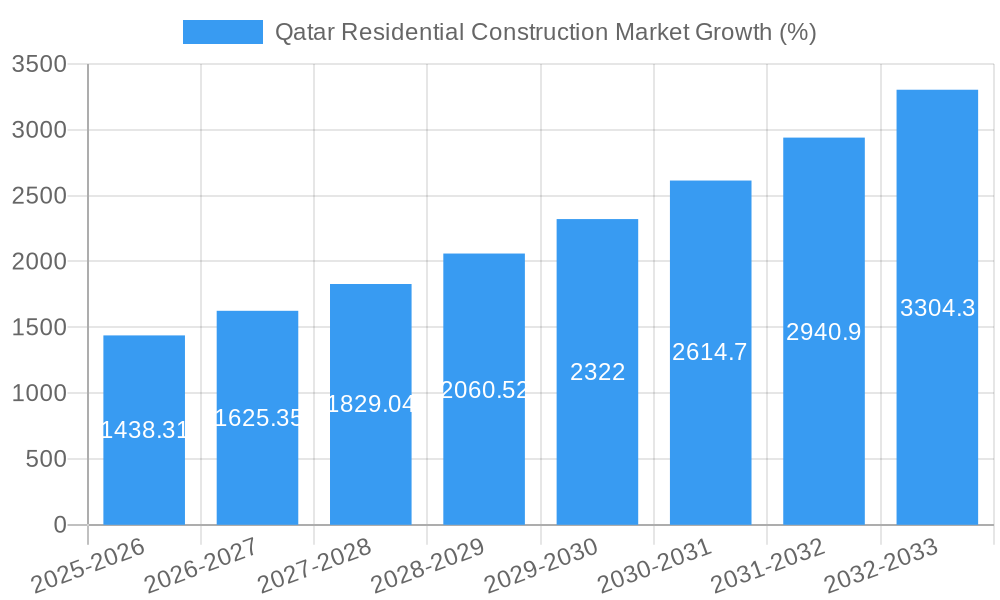

The Qatar residential construction market exhibits robust growth potential, projected to reach a market size of $12.39 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.45% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Qatar's ambitious infrastructure development plans, particularly in preparation for and beyond the FIFA World Cup, have significantly boosted demand for residential units. The government's focus on urban development and its commitment to expanding housing options for both citizens and expatriates further contribute to market growth. Secondly, a burgeoning population and rising disposable incomes are creating a surge in demand for quality housing, particularly apartments, condominiums, and villas. The market also benefits from a steady influx of foreign investment, particularly in luxury residential projects. Finally, government initiatives promoting sustainable construction practices are shaping the market towards environmentally responsible and energy-efficient buildings.

However, the market is not without its challenges. Rising construction material costs and labor shortages can potentially impede growth. Fluctuations in global oil prices, which impact the Qatari economy, could also influence investment levels in the residential sector. Moreover, stringent building codes and regulations, while aimed at ensuring quality and safety, can sometimes increase project costs and timelines. Despite these restraints, the overall outlook remains optimistic, with the strong underlying demand for housing and continuous governmental support promising a significant growth trajectory for the Qatar residential construction market through 2033. The segmentation by type (apartments & condominiums, villas, other types) and construction type (new construction, renovation) provides further insights into market dynamics and opportunities for investors and stakeholders. Key players such as QD-SBG Construction, Galfar Al Misnad, and others are well-positioned to capitalize on this expanding market.

Qatar Residential Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar residential construction market, offering valuable insights for investors, stakeholders, and industry professionals. The report covers market dynamics, trends, leading players, and future growth opportunities, utilizing data from 2019 to 2024 (historical period), 2025 (base and estimated year), and projecting to 2033 (forecast period). With a focus on key segments like apartments & condominiums, villas, and new construction vs. renovation, this report is your essential guide to understanding this dynamic market. Expect detailed analysis of key players like QD-SBG Construction, Galfar Al Misnad, and more. Download now to gain a competitive edge!

Qatar Residential Construction Market Dynamics & Concentration

The Qatar residential construction market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. The estimated market share of the top 5 players in 2025 is approximately xx%. However, a considerable number of smaller, specialized firms also contribute to the overall market activity. Innovation within the sector is driven by the need for sustainable building materials, advanced construction techniques, and efficient project management. The regulatory framework, including building codes and environmental regulations, significantly impacts construction practices. Product substitutes, such as prefabricated housing, are gradually gaining traction, presenting both opportunities and challenges for traditional construction methods. End-user trends, characterized by a growing preference for energy-efficient and technologically advanced housing, influence market demands. Mergers and acquisitions (M&A) activity in the sector remains relatively moderate, with an estimated xx M&A deals concluded in the period 2019-2024. The sector is dynamic with fluctuating market dynamics influenced by fluctuating oil prices.

- Market Concentration: Top 5 players hold approximately xx% market share (2025 estimate).

- Innovation Drivers: Sustainable materials, advanced techniques, efficient project management.

- Regulatory Framework: Building codes, environmental regulations.

- Product Substitutes: Prefabricated housing.

- End-User Trends: Preference for energy-efficient and smart homes.

- M&A Activity: Approximately xx deals (2019-2024).

Qatar Residential Construction Market Industry Trends & Analysis

The Qatar residential construction market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the nation's robust economic growth, sustained population increase, and ongoing infrastructural development associated with mega-events like the FIFA World Cup. The market penetration of sustainable building practices is gradually increasing. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and advanced construction technologies, are enhancing efficiency and productivity. Consumer preferences are shifting towards high-quality, sustainable, and technologically advanced homes. Competitive dynamics are shaped by pricing strategies, project delivery timelines, and the ability to meet evolving consumer demands. Several key factors are projected to drive demand including the continued expansion of Lusail City and ongoing government investments in infrastructure, specifically in relation to housing for the ever-growing population. Market penetration of smart home technology is estimated to reach xx% by 2033.

Leading Markets & Segments in Qatar Residential Construction Market

The dominant segment within the Qatar residential construction market is Apartments & Condominiums, driven by increased urbanization and demand for affordable housing. New construction accounts for a larger share compared to renovation projects, reflecting the ongoing expansion of urban areas.

Key Drivers for Apartments & Condominiums:

- High population density and urbanization.

- Government initiatives promoting affordable housing.

- Strong demand from expatriates and young professionals.

Key Drivers for New Construction:

- Large-scale infrastructure projects.

- Government investments in real estate development.

- Expansion of urban areas.

Dominance analysis shows that the Apartments & Condominiums segment significantly outpaces other types due to a higher volume of projects and demand from a growing population. New construction projects also dominate due to the sustained investment in new residential communities, largely driven by population growth and government initiatives.

Qatar Residential Construction Market Product Developments

Recent product innovations focus on sustainable building materials, energy-efficient designs, and smart home integration. The emphasis on prefabrication and modular construction is gaining traction due to enhanced efficiency and reduced construction timelines. These developments aim to improve sustainability and enhance the living experience, providing a strong competitive advantage for builders and developers. Technological advancements such as BIM continue to improve efficiency and deliver enhanced accuracy on projects.

Key Drivers of Qatar Residential Construction Market Growth

Several factors are driving the growth of the Qatar residential construction market:

- Economic Growth: Qatar's strong GDP growth fuels investment in real estate.

- Population Growth: The increasing population necessitates more housing units.

- Government Initiatives: Government investments in infrastructure and housing projects.

- Mega-events: Events like the FIFA World Cup stimulate construction activity.

These combined factors contribute to the continuous expansion of the residential construction sector.

Challenges in the Qatar Residential Construction Market Market

The market faces several challenges:

- Labor Shortages: A shortage of skilled labor can lead to project delays and cost overruns (estimated impact: xx% project delays).

- Material Costs: Fluctuating material prices affect project profitability.

- Regulatory Compliance: Complex regulatory procedures can slow down project approvals.

These factors can significantly impact project timelines and profitability.

Emerging Opportunities in Qatar Residential Construction Market

Long-term growth catalysts include technological advancements, strategic partnerships, and exploration of new construction methods. Sustainable and smart building technologies present significant opportunities, as do partnerships with international developers to access expertise and capital. The expansion into new geographic regions and diversification of building types (e.g., eco-friendly housing) further present promising avenues for growth.

Leading Players in the Qatar Residential Construction Market Sector

- QD-SBG Construction

- Galfar Al Misnad Engineering & Contracting Co

- Hamad Bin Contracting Company

- Al-Balagh Trading & Contracting Co

- Qatari Arabian Construction Company - QACC

- Q-MEP Contracting

- Alseal Contracting And Trading Company

- Ramco Trading & Contracting

- Al Majal International Trading And Contracting Company Wll

- Bemco Contracting Company Qatar

- Domopan Qatar W L

- Midmac Contracting Co W L L

- Lupp International Qatar L L C

- Porr Construction Qatar W L L

Key Milestones in Qatar Residential Construction Market Industry

- July 2022: Qatar First Bank LLC purchases The Gateway Plaza building in Richmond, Virginia, expanding its US real estate portfolio. This signifies increased international investment interest in real estate.

- August 2022: Ascott's acquisition of Oakwood Worldwide significantly expands its serviced apartment portfolio, showcasing consolidation within the hospitality sector and its impact on the demand for residential properties.

Strategic Outlook for Qatar Residential Construction Market Market

The Qatar residential construction market holds significant long-term potential, driven by continued economic growth, population expansion, and government support. Strategic opportunities exist in embracing sustainable building practices, leveraging technological innovations, and forging strategic partnerships to capitalize on the anticipated growth. Focusing on high-quality, efficient, and sustainable projects will be crucial for success in this evolving market.

Qatar Residential Construction Market Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Villas

- 1.3. Other Types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

Qatar Residential Construction Market Segmentation By Geography

- 1. Qatar

Qatar Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Qatar's Residential Market is Slightly Improving

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Villas

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 QD-SBG Construction

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Galfar Al Misnad Engineering & Contracting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hamad Bin Contracting Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al-Balagh Trading & Contracting Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Qatari Arabian Construction Company - QACC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Q-MEP Contracting

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alseal Contracting And Trading Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ramco Trading & Contracting

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al Majal International Trading And Contracting Company Wll

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bemco Contracting Company Qatar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Domopan Qatar W L

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Midmac Contracting Co W L L

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Lupp International Qatar L L C*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Porr Construction Qatar W L L

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 QD-SBG Construction

List of Figures

- Figure 1: Qatar Residential Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Residential Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Qatar Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: Qatar Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Qatar Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Qatar Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Qatar Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 8: Qatar Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Residential Construction Market?

The projected CAGR is approximately 11.45%.

2. Which companies are prominent players in the Qatar Residential Construction Market?

Key companies in the market include QD-SBG Construction, Galfar Al Misnad Engineering & Contracting Co, Hamad Bin Contracting Company, Al-Balagh Trading & Contracting Co, Qatari Arabian Construction Company - QACC, Q-MEP Contracting, Alseal Contracting And Trading Company, Ramco Trading & Contracting, Al Majal International Trading And Contracting Company Wll, Bemco Contracting Company Qatar, Domopan Qatar W L, Midmac Contracting Co W L L, Lupp International Qatar L L C*List Not Exhaustive, Porr Construction Qatar W L L.

3. What are the main segments of the Qatar Residential Construction Market?

The market segments include Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.39 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Qatar's Residential Market is Slightly Improving.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

July 2022: The Gateway Plaza building in Richmond, Virginia, USA, has been purchased by Qatar First Bank LLC (public) (QFB). A wonderful addition to the bank's investment portfolio, the new acquisition is a Class AA trophy asset with a 330,000-square-foot area that was built in 2015 as a build-to-suit building and will continue to ensure steady cash flows. With a goal to increase its presence and level of knowledge in the US real estate market, the new investment marks QFB's eleventh US real estate property and its fourteenth investment under its new Shari'a-compliant real estate investment strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Residential Construction Market?

To stay informed about further developments, trends, and reports in the Qatar Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence