Key Insights

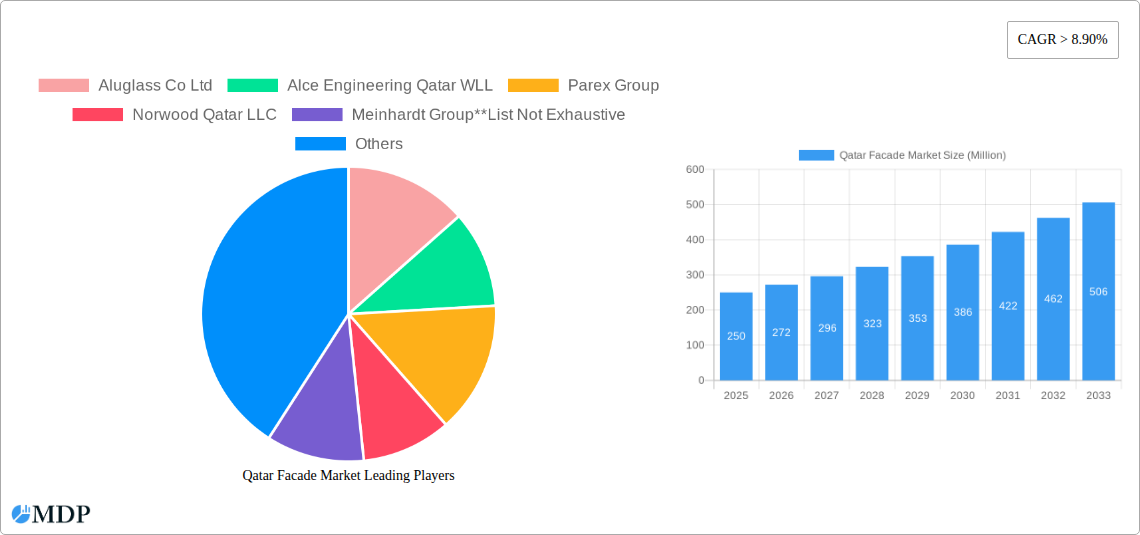

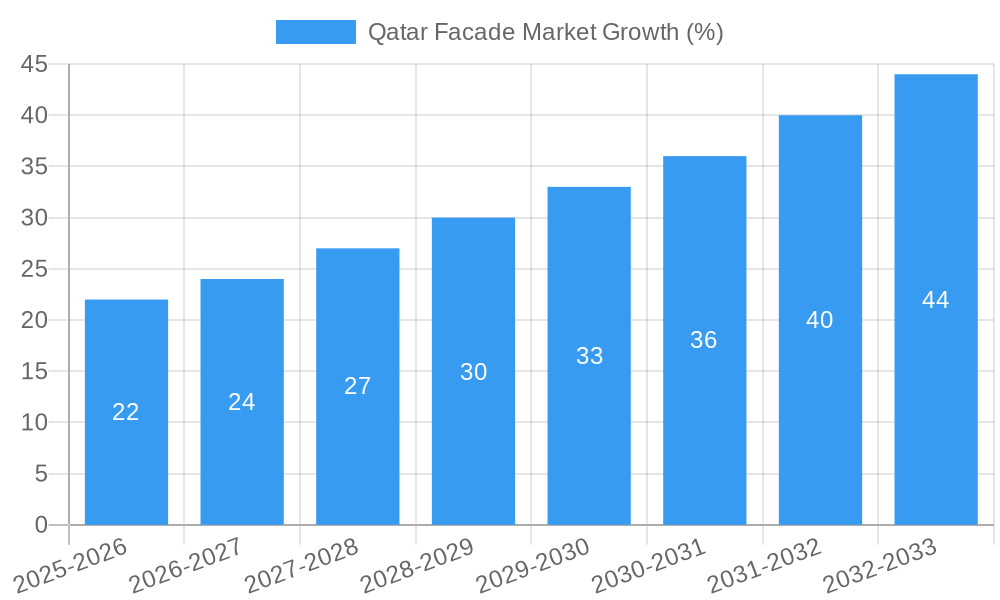

The Qatar facade market, valued at approximately $XXX million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 8.90% from 2025 to 2033. This growth is fueled by several key factors. The ongoing infrastructural development in Qatar, particularly in anticipation of and following major events like the FIFA World Cup, is a significant driver, demanding extensive facade solutions for new commercial and residential constructions. Furthermore, the increasing focus on energy efficiency and sustainable building practices is prompting a shift towards advanced ventilated facade systems and the adoption of materials with improved thermal performance. This trend is complemented by rising disposable incomes and a growing preference for aesthetically pleasing and modern architectural designs, further stimulating demand for high-quality facade materials and installations. Government initiatives promoting sustainable construction and real estate development are also contributing to market expansion.

The market segmentation reveals significant opportunities across different types, materials, and end-users. Ventilated facades are gaining traction due to their superior thermal performance and aesthetic appeal. Glass and metal continue to dominate the materials segment, although the use of sustainable and high-performance materials like fiber-reinforced polymers is expected to grow. The commercial sector holds the largest market share, driven by ongoing large-scale construction projects. However, the residential sector is also showing considerable growth owing to an expanding population and rising real estate demand. Competitive pressures exist amongst established players like Aluglass Co Ltd, Alce Engineering Qatar WLL, and Parex Group, alongside several other regional and international companies. This competitive landscape fosters innovation and drives price optimization within the market.

Qatar Facade Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar facade market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. Expect detailed analysis across key segments, including by type (ventilated, non-ventilated, others), material (glass, metal, plastic & fibres, stones & others), and end-user (commercial, residential, others). The report leverages extensive data and expert analysis to provide actionable insights for strategic decision-making. The market value is expected to reach xx Million by 2033, representing a robust CAGR of xx%.

Qatar Facade Market Dynamics & Concentration

The Qatar facade market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller players contributes to a competitive environment. Market concentration is influenced by factors like project size, technological capabilities, and client relationships. Innovation is a key driver, with companies continually seeking advanced materials, designs, and installation techniques to enhance energy efficiency, aesthetics, and durability. The regulatory framework plays a vital role, influencing building codes, sustainability standards, and safety regulations. Product substitutes, such as traditional cladding materials, face ongoing competition from innovative facade solutions. End-user trends, particularly towards sustainable and aesthetically appealing designs, shape market demand. Mergers and acquisitions (M&A) activity in the market has been moderate, with xx M&A deals recorded during the historical period (2019-2024), primarily focusing on consolidation and expansion.

- Market Share: Aluglass Co Ltd and Alce Engineering Qatar WLL hold a combined xx% market share.

- M&A Activity: An increase in M&A activity is anticipated over the forecast period, driven by the need for technological advancements and expansion into new markets.

Qatar Facade Market Industry Trends & Analysis

The Qatar facade market demonstrates consistent growth, fueled by significant infrastructural development, particularly in the commercial and residential sectors. The country's ambitious national vision drives substantial investment in new buildings and renovations, leading to heightened demand for innovative and aesthetically pleasing facade solutions. Technological advancements, including the adoption of Building Information Modeling (BIM) and advanced materials like high-performance glass and sustainable cladding options, are reshaping the industry. Consumer preferences are shifting towards energy-efficient and sustainable facade systems, impacting material choices and design preferences. The competitive dynamics are characterized by both established players and emerging companies vying for market share, resulting in ongoing innovation and price competition. This leads to a steady increase in market penetration of advanced facade systems.

Leading Markets & Segments in Qatar Facade Market

The commercial sector dominates the Qatar facade market, accounting for xx% of total revenue in 2025. This dominance stems from extensive construction activity, particularly within the hospitality, retail, and office sectors, fueling demand for aesthetically pleasing and energy-efficient facade systems. The ventilated facade segment holds the largest market share by type, driven by its superior thermal performance and aesthetic versatility. Glass remains the dominant material, due to its aesthetic appeal, durability, and ability to integrate with advanced technologies.

- Key Drivers for Commercial Sector Dominance:

- Large-scale infrastructure projects (e.g., stadiums, shopping malls, hotels).

- Government initiatives promoting economic diversification and sustainable development.

- Significant foreign investment in Qatar's economy.

- Key Drivers for Ventilated Facades:

- Superior thermal insulation and energy efficiency compared to other facade systems.

- Enhanced building aesthetics and design flexibility.

- Improved durability and reduced maintenance costs.

Qatar Facade Market Product Developments

Recent product innovations in the Qatar facade market have centered on sustainable, high-performance materials and integrated systems. The focus is on enhancing energy efficiency, reducing carbon footprint, and improving building aesthetics. Examples include advanced glass technologies offering improved insulation and solar control, as well as lightweight, durable materials like composite panels, promoting sustainable construction practices.

Key Drivers of Qatar Facade Market Growth

The Qatar facade market’s growth is propelled by several key factors: significant infrastructure development driven by the country’s economic diversification strategy; increasing government investments in sustainable building practices and energy-efficient technologies; and a growing preference for aesthetically pleasing and high-performance building facades.

Challenges in the Qatar Facade Market Market

The market faces challenges like fluctuating material costs, supply chain disruptions impacting project timelines and budgets, and intense competition from numerous players. Regulatory compliance can also present hurdles, requiring adherence to complex building codes and safety regulations.

Emerging Opportunities in Qatar Facade Market

Long-term growth is fueled by the increasing adoption of smart building technologies, the growing demand for sustainable and energy-efficient facades, and strategic partnerships between global and local players. Further market expansion can be attained through innovative product offerings tailored to specific market demands and customer needs.

Leading Players in the Qatar Facade Market Sector

- Aluglass Co Ltd

- Alce Engineering Qatar WLL

- Parex Group

- Norwood Qatar LLC

- Meinhardt Group

- Bemo International

- Quanto Bello Qatar

- Sollass Alu & Glass

- Everest Aluminum Co WLL

- Qatar Meta Coats W L L (QMC)

- Alumasa Qatar

Key Milestones in Qatar Facade Market Industry

- September 2022: The unveiling of the golden Lusail Stadium showcased the demand for innovative and visually striking facade designs. This landmark project highlighted the capabilities of leading architectural firms and the potential for high-value facade projects.

- November 2022: The agreement between Reflection Window + Wall (RWW) and Alutec WLL signals the expansion of advanced facade systems into the Middle East and the growing adoption of advanced manufacturing and installation technologies. This emphasizes the potential for increased production capacity and improved supply chain efficiency.

Strategic Outlook for Qatar Facade Market Market

The Qatar facade market shows immense potential for growth, driven by ongoing infrastructure development and increasing demand for high-performance and aesthetically pleasing facade solutions. Strategic opportunities exist for companies that can offer innovative products, efficient supply chains, and strong customer relationships. Focusing on sustainability, technological advancements, and collaborative partnerships will be crucial for securing long-term success in this competitive market.

Qatar Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Others

-

2. Material

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastic and Fibres

- 2.4. Stones and Others

-

3. End Users

- 3.1. Commercial

- 3.2. Residential

- 3.3. Others

Qatar Facade Market Segmentation By Geography

- 1. Qatar

Qatar Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Construction Industry to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Facade Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastic and Fibres

- 5.2.4. Stones and Others

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Aluglass Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alce Engineering Qatar WLL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Parex Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Norwood Qatar LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Meinhardt Group**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bemo International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Quanto Bello Qatar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sollass Alu & Glass

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Everest Aluminum Co WLL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qatar Meta Coats W L L (QMC)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alumasa Qatar

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Aluglass Co Ltd

List of Figures

- Figure 1: Qatar Facade Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Facade Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Qatar Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Qatar Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 5: Qatar Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Qatar Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Qatar Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Qatar Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 9: Qatar Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 10: Qatar Facade Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Facade Market?

The projected CAGR is approximately > 8.90%.

2. Which companies are prominent players in the Qatar Facade Market?

Key companies in the market include Aluglass Co Ltd, Alce Engineering Qatar WLL, Parex Group, Norwood Qatar LLC, Meinhardt Group**List Not Exhaustive, Bemo International, Quanto Bello Qatar, Sollass Alu & Glass, Everest Aluminum Co WLL, Qatar Meta Coats W L L (QMC), Alumasa Qatar.

3. What are the main segments of the Qatar Facade Market?

The market segments include Type, Material, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Construction Industry to Drive the Market Growth.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

November 2022: Reflection Window + Wall (RWW) agreed with Qatari company Alutec WLL to expand its supply chain into the Middle East. Furthermore, the two companies' agreement stated that they can both use an application that tracks the first steps of fabrication through job site installation. Alutec expected that it would soon have more than 3.1 million square feet of production space thanks to operational and under-construction facilities in Qatar, India, Ireland, and Thailand. This area is also to be used for RWW production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Facade Market?

To stay informed about further developments, trends, and reports in the Qatar Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence