Key Insights

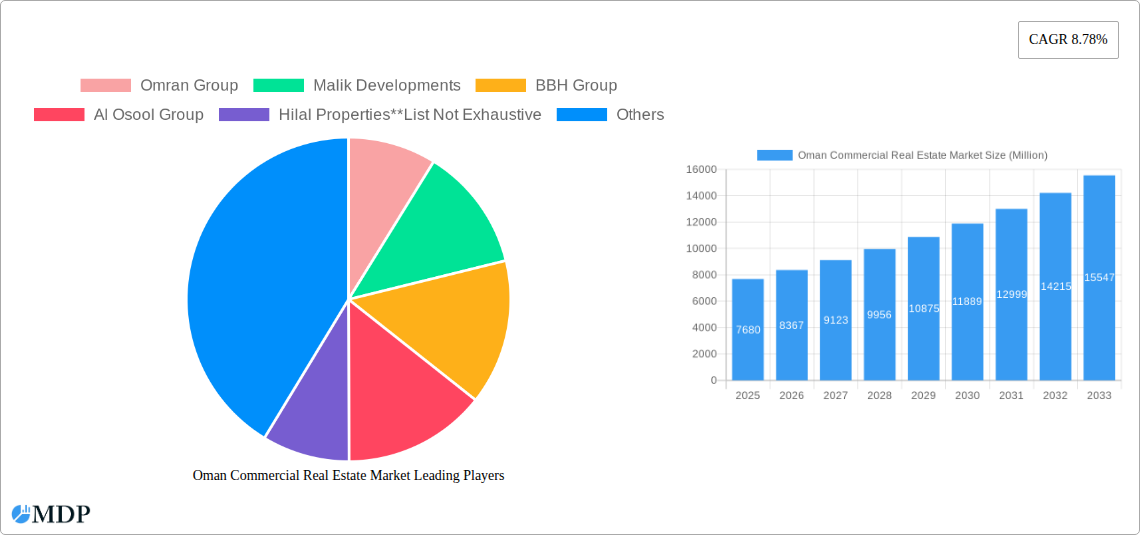

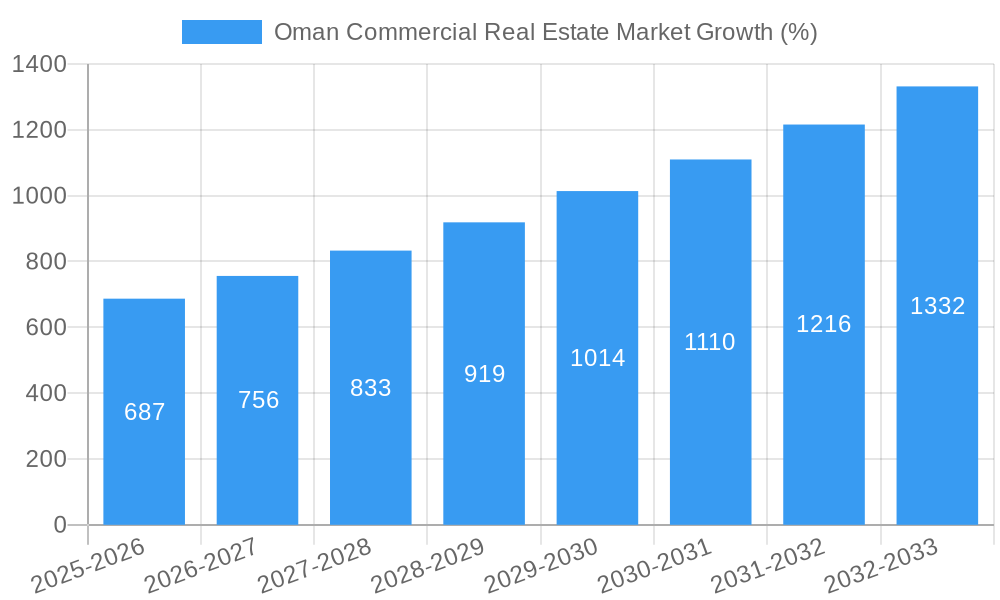

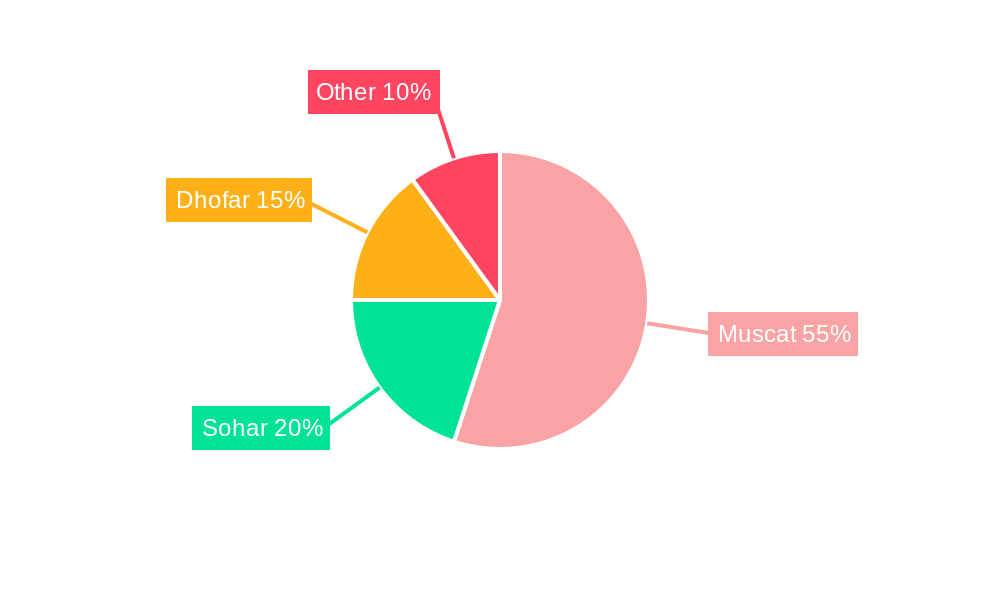

The Oman commercial real estate market, valued at $7.68 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 8.78% from 2025 to 2033. This expansion is fueled by several key drivers. Government initiatives aimed at diversifying the economy beyond oil, coupled with significant infrastructure development projects, are attracting substantial foreign investment and boosting demand for office, retail, and industrial spaces. The tourism sector's growth, particularly in key cities like Muscat, Sohar, and Dhofar, is also significantly contributing to the demand for hospitality and retail properties. Furthermore, a burgeoning population and rising urbanization are increasing the need for residential spaces, particularly within the multi-family segment. However, challenges remain. Fluctuations in global oil prices could impact investor confidence, while the availability of skilled labor and the regulatory environment could pose constraints to market growth. The market segmentation reveals a diverse landscape, with offices, retail, and logistics likely leading the expansion given the current economic diversification strategies. Major players like Omran Group, Malik Developments, and BBH Group are shaping the market with their large-scale projects, though the competitive landscape is dynamic, encompassing both established players and emerging local firms.

The forecast period (2025-2033) presents significant opportunities for investors and developers. Strategic partnerships, technological advancements in construction and property management, and a focus on sustainable development will be crucial for success. The key cities—Muscat, Sohar, and Dhofar—offer distinct investment profiles, with Muscat's established infrastructure attracting high-end projects, while Sohar and Dhofar are poised for growth driven by port expansion and tourism development respectively. Understanding the specific dynamics of each city and segment is essential for navigating the market's complexities and capitalizing on its growth potential. A focus on innovative design, flexible lease terms, and environmentally friendly practices will likely enhance market competitiveness and attract a wider range of investors and tenants.

Oman Commercial Real Estate Market Report: 2019-2033 Forecast

Unlocking Investment Opportunities in Oman's Thriving Real Estate Sector

This comprehensive report provides an in-depth analysis of the Oman commercial real estate market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this study unveils market dynamics, key trends, leading players, and future growth opportunities. Benefit from detailed segmentation by property type (Offices, Retail, Industrial, Logistics, Multi-family, Hospitality) and key cities (Muscat, Sohar, Dhofar), supported by robust data and expert analysis. Expect a detailed forecast for the 2025-2033 period, providing a clear roadmap for strategic decision-making. The total market value is predicted to reach xx Million by 2033.

Oman Commercial Real Estate Market Dynamics & Concentration

The Oman commercial real estate market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Omran Group, Malik Developments, BBH Group, Al Osool Group, and Hilal Properties are among the key players, although the market is not dominated by a few, leaving room for new entrants and smaller firms. Market share data for 2024 indicates Omran Group holds approximately 15% of the market, while Malik Developments holds approximately 10%. The remaining market share is distributed across numerous players.

- Innovation Drivers: Government initiatives promoting sustainable construction and smart city developments are driving innovation.

- Regulatory Framework: Stable regulatory policies and streamlined approval processes contribute to market stability.

- Product Substitutes: The rise of co-working spaces and flexible office solutions presents a moderate challenge to traditional office rentals.

- End-User Trends: Growing demand for modern, energy-efficient commercial spaces drives market growth.

- M&A Activity: The number of M&A deals in the sector has increased slightly to approximately 12 in 2024, indicating a growing consolidation trend.

Oman Commercial Real Estate Market Industry Trends & Analysis

The Oman commercial real estate market is experiencing robust growth, fueled by several factors. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at 5%, with a projected CAGR of 6% between 2025 and 2033. Market penetration of modern, energy-efficient buildings is steadily increasing, driven by government incentives and a rising preference for sustainable construction. Significant investments in infrastructure development, particularly in Muscat, are further boosting the market's appeal.

Technological disruptions, such as the adoption of smart building technologies and proptech solutions, are transforming the industry, enhancing efficiency, and improving tenant experience. Consumer preferences are shifting towards flexible and adaptable workspaces, while competition remains dynamic, with both established players and new entrants vying for market share.

Leading Markets & Segments in Oman Commercial Real Estate Market

Muscat dominates the commercial real estate market, accounting for approximately 70% of the total market value in 2024. Its status as the nation's capital and major economic hub drives this dominance. However, Sohar and Dhofar are also experiencing significant growth, fueled by government investments in infrastructure and diversification initiatives.

Muscat's Dominance:

- Strong economic activity and concentration of businesses.

- Well-developed infrastructure and accessibility.

- Government support for large-scale development projects.

Office Segment Leadership: The office segment leads the market in terms of value and transaction volume, driven by a steady increase in corporate activity.

Growth in other segments: The retail and hospitality segments exhibit significant growth potential, linked to tourism expansion and rising consumer spending.

Oman Commercial Real Estate Market Product Developments

The market is witnessing increased adoption of sustainable building materials, smart building technologies, and innovative design solutions. These advancements enhance energy efficiency, improve tenant comfort, and increase the overall value proposition of commercial properties. The focus on sustainable development aligns with Oman's broader commitment to environmental sustainability. Furthermore, the integration of proptech solutions is streamlining operations and enhancing tenant engagement.

Key Drivers of Oman Commercial Real Estate Market Growth

Several key factors drive the growth of Oman's commercial real estate market:

- Government initiatives: Supportive government policies and investments in infrastructure are creating a favorable environment for investment.

- Economic diversification: Oman's efforts to diversify its economy beyond oil are boosting various sectors, leading to increased demand for commercial space.

- Tourism growth: The expansion of the tourism sector is generating demand for hospitality and related commercial properties.

- Foreign investment: Increasing foreign direct investment contributes to the overall growth of the real estate market.

Challenges in the Oman Commercial Real Estate Market Market

The market faces challenges including:

- High construction costs: The cost of construction materials and labor remains a significant hurdle for developers.

- Financing constraints: Securing financing for large-scale projects can be challenging for some developers.

- Bureaucracy: Navigating regulatory procedures and obtaining necessary approvals can be time-consuming.

Emerging Opportunities in Oman Commercial Real Estate Market

Significant opportunities lie in sustainable development projects, the expansion of logistics facilities to support the growing trade sector, and the development of mixed-use developments integrating residential, commercial, and recreational spaces. The growing tourism sector presents substantial potential for hospitality and related commercial real estate.

Leading Players in the Oman Commercial Real Estate Market Sector

- Omran Group

- Malik Developments

- BBH Group

- Al Osool Group

- Hilal Properties

- Al Tamman Real Estate

- Alfardan Group

- WUJHA

- Shanfari Group

- Al-Taher Group

- Hamptons International & Partners LLC

- Diamonds Real Estate

Key Milestones in Oman Commercial Real Estate Market Industry

- November 2023: Relaunch of the Blue City project (BAT) backed by the Oman Investment Authority (OIA), signaling significant investment in large-scale developments.

- July 2023: Omran's plans for Madinat Al Irvine East, a large mixed-use development, showcase the focus on creating modern, attractive business and tourism destinations.

Strategic Outlook for Oman Commercial Real Estate Market Market

The Oman commercial real estate market is poised for continued growth, driven by sustained government investment, economic diversification, and increasing foreign investment. Strategic partnerships between local and international players are likely to play a significant role in shaping the market's future trajectory. The focus on sustainable and technologically advanced developments will further enhance the market's attractiveness to investors and tenants.

Oman Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

-

2. Key Cities

- 2.1. Muscat

- 2.2. Sohar

- 2.3. Dhofar

Oman Commercial Real Estate Market Segmentation By Geography

- 1. Oman

Oman Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Population4.; Foreign Investments

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost

- 3.4. Market Trends

- 3.4.1. Hospitality sector witnessing lucrative growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Sohar

- 5.2.3. Dhofar

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Omran Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Malik Developments

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BBH Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Osool Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hilal Properties**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al Tamman Real Estate

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alfardan Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WUJHA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shanfari Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al-Taher Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hamptons International & Partners LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Diamonds Real Estate

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Omran Group

List of Figures

- Figure 1: Oman Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Commercial Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Oman Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Oman Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Oman Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Oman Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Oman Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Oman Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Commercial Real Estate Market?

The projected CAGR is approximately 8.78%.

2. Which companies are prominent players in the Oman Commercial Real Estate Market?

Key companies in the market include Omran Group, Malik Developments, BBH Group, Al Osool Group, Hilal Properties**List Not Exhaustive, Al Tamman Real Estate, Alfardan Group, WUJHA, Shanfari Group, Al-Taher Group, Hamptons International & Partners LLC, Diamonds Real Estate.

3. What are the main segments of the Oman Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.68 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Population4.; Foreign Investments.

6. What are the notable trends driving market growth?

Hospitality sector witnessing lucrative growth.

7. Are there any restraints impacting market growth?

4.; High Cost.

8. Can you provide examples of recent developments in the market?

November 2023: The long-delayed Blue City project in Oman was relaunched under the auspices of the Grand Blue City Development Company, which is backed by the sovereign wealth fund Oman Investment Authority (OIA). The project is also known by the Arabic acronym (BAT).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Oman Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence