Key Insights

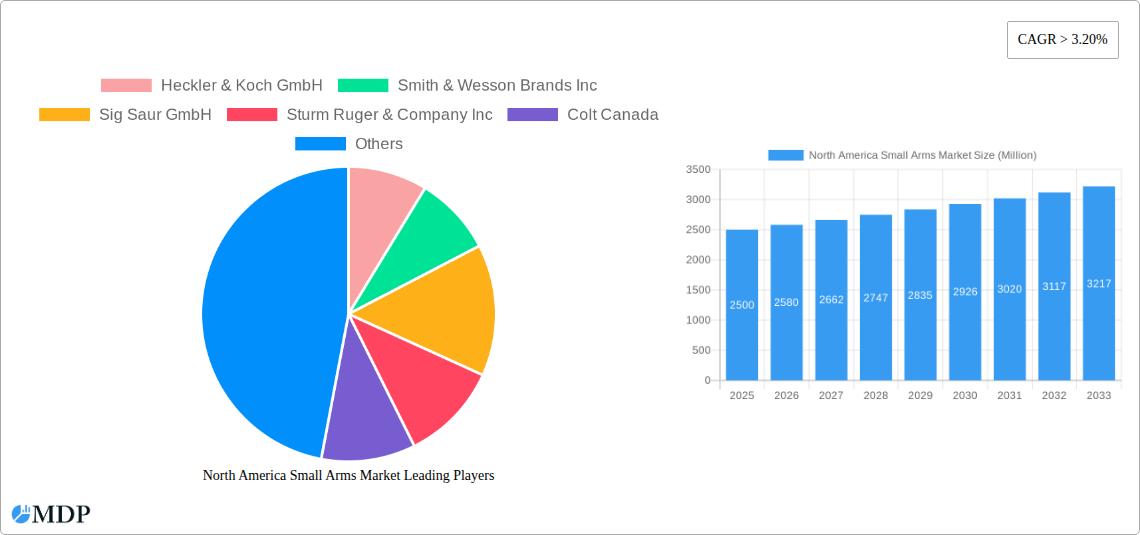

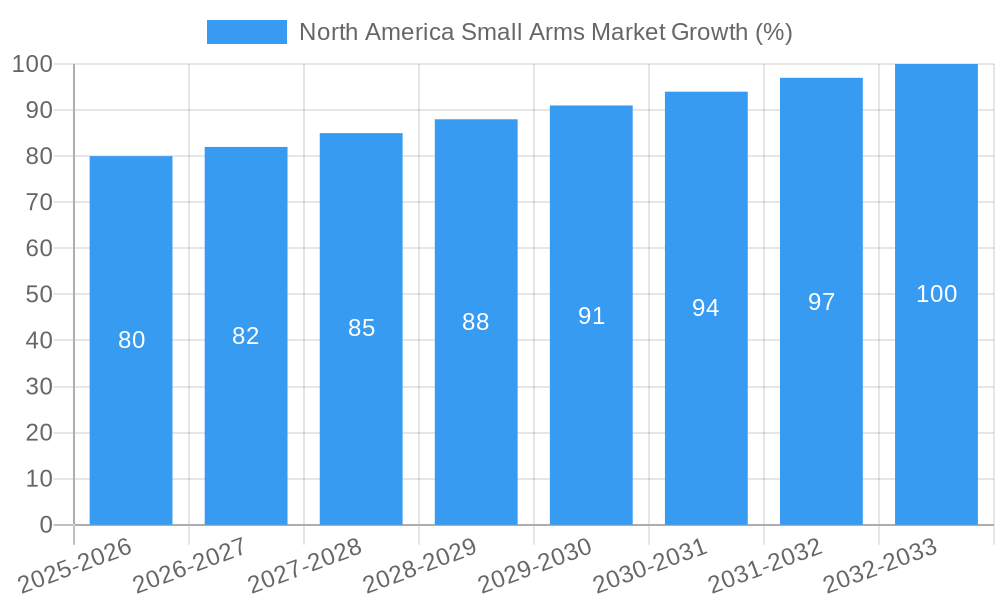

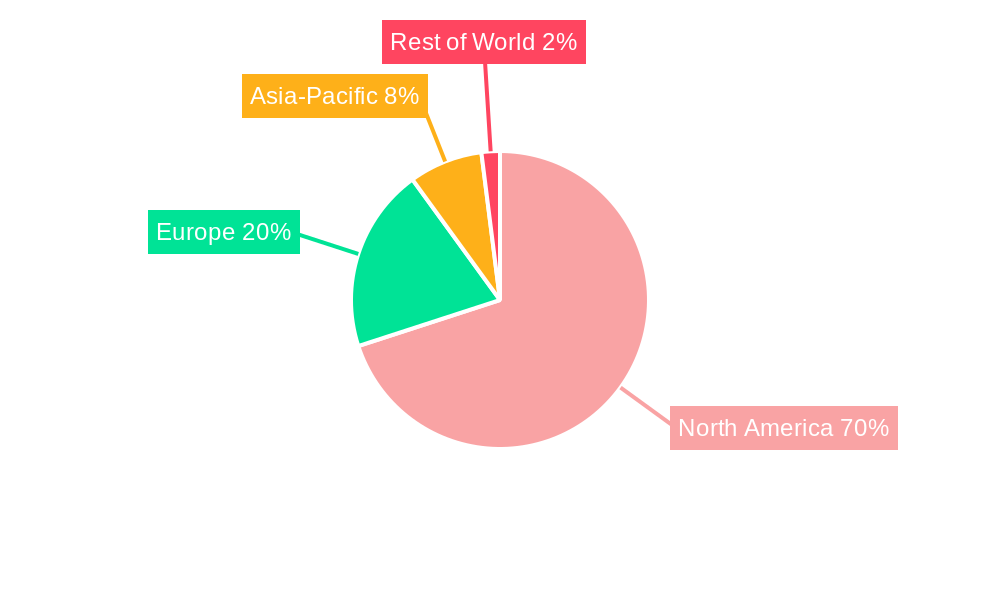

The North American small arms market, encompassing handguns, machine guns, shotguns, and rifles, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.20% from 2025 to 2033. This expansion is fueled by several key factors. Increased civil unrest and concerns about personal safety are driving demand among civilians, while law enforcement agencies continue to invest in modernizing their arsenals. The military sector, though potentially subject to fluctuating government budgets, represents a significant and stable portion of the market, particularly driven by ongoing modernization programs and potential geopolitical instabilities. Furthermore, technological advancements in firearm design, materials, and ammunition are leading to improved accuracy, reliability, and lethality, further stimulating market demand. The market is segmented by end-user (civil and law enforcement, military) and by type (handgun, machine gun, shotgun, rifle), allowing for targeted analysis of growth patterns within specific segments. While potential regulatory changes and economic downturns could pose some restraints, the overall outlook remains positive, particularly considering the strong demand from both civilian and professional users.

Growth within the North American market is expected to be most pronounced in the handgun segment, driven by personal protection concerns and an increase in concealed carry permits. The rifle segment will also see steady growth, driven by both civilian and military demand. The United States, being the largest market within North America, will continue to account for a significant share of the overall market value. However, Canada and Mexico are also expected to contribute to the region's growth, albeit at a slower rate. Leading manufacturers such as Heckler & Koch, Smith & Wesson, Sig Sauer, Sturm Ruger, Colt Canada, FN Herstal, and others will continue to compete intensely, focusing on innovation, product differentiation, and strategic partnerships to maintain market share in this dynamic and evolving landscape. The forecast period of 2025-2033 promises further expansion driven by the aforementioned factors, consolidating the North American region's position as a key player in the global small arms market.

North America Small Arms Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America small arms market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, industry trends, leading players, and future growth opportunities. This is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The report utilizes data from the historical period (2019-2024), the base year (2025), and the estimated year (2025), projecting the forecast period (2025-2033).

North America Small Arms Market Market Dynamics & Concentration

The North American small arms market is characterized by a moderate level of concentration, with a few major players holding significant market share. However, the market is also quite fragmented, with numerous smaller companies competing for a share of the overall market. Innovation is a key driver, with ongoing advancements in materials, technology, and design leading to improved performance, reliability, and safety of small arms. Stringent regulatory frameworks, particularly concerning licensing and sales, significantly impact market dynamics. These regulations vary across different jurisdictions within North America, adding complexity for manufacturers and distributors. The market also experiences competition from product substitutes, such as less-lethal weapons and alternative security solutions. End-user trends, influenced by factors like law enforcement strategies, military modernization efforts, and civilian self-defense preferences, dictate market demand. Furthermore, M&A activities contribute to market consolidation and reshape the competitive landscape.

- Market Share: Smith & Wesson Brands Inc. and Sturm Ruger & Company Inc. hold a combined xx% market share, while other major players like Heckler & Koch GmbH and Sig Saur GmbH hold xx% and xx% respectively. Smaller players collectively account for the remaining xx%.

- M&A Activity: The number of M&A deals in the North American small arms market during the historical period averaged approximately xx per year, reflecting a dynamic landscape with ongoing consolidation.

North America Small Arms Market Industry Trends & Analysis

The North American small arms market exhibits a steady growth trajectory, driven by a confluence of factors. Increased defense spending, particularly in the United States and Canada, contributes significantly to market expansion. Technological advancements, including the integration of smart technologies and improved materials science, are enhancing the performance and capabilities of small arms, driving demand for newer, more sophisticated models. Consumer preferences, shaped by factors such as self-defense concerns and recreational shooting activities, sustain demand for civilian-oriented firearms. Competitive dynamics are marked by ongoing innovation, branding, and marketing efforts. Key players constantly strive to differentiate their products through advancements in technology, design, and marketing to gain market share.

- CAGR: The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033).

- Market Penetration: The market penetration of advanced technologies in small arms is expected to reach xx% by 2033.

Leading Markets & Segments in North America Small Arms Market

The United States remains the dominant market for small arms in North America, driven by robust demand from both the civilian and military sectors. Within the end-user segment, the Civil and Law Enforcement segment exhibits higher demand compared to the Military segment, owing to a significant civilian gun ownership base and ongoing law enforcement modernization initiatives. In terms of types, Handguns maintain the largest market share due to both civilian and law enforcement demand, followed by Rifles.

- Key Drivers for US Dominance:

- Strong civilian gun ownership culture

- Robust defense budget and military spending

- Well-established firearms manufacturing base

- Key Drivers for Civil and Law Enforcement Segment:

- Growing demand for personal self-defense firearms

- Increasing investments in modern law enforcement equipment.

- Key Drivers for Handgun Segment:

- Popularity as a self-defense weapon

- Extensive range of models and customizations.

North America Small Arms Market Product Developments

Recent product developments focus on incorporating advanced materials, enhancing ergonomics, and improving accuracy and reliability. This includes the use of lightweight polymers, advanced sighting systems, and improved ammunition technology. These innovations aim to provide superior performance, user-friendliness, and enhanced competitive advantages for manufacturers. The market is also witnessing the integration of smart technologies such as advanced sensors and data analytics.

Key Drivers of North America Small Arms Market Growth

Several factors propel the growth of the North American small arms market. Significant defense spending by both the US and Canadian governments necessitates regular updates and procurement of newer small arms technology. Economic growth, particularly in the US, positively impacts consumer disposable income, leading to increased demand for civilian firearms. However, favorable regulations regarding the civilian ownership of firearms in some jurisdictions also contribute to market growth.

Challenges in the North America Small Arms Market Market

The North American small arms market faces several challenges. Stricter regulatory environments in certain jurisdictions can curb sales and limit product availability. Supply chain disruptions, impacting the availability of raw materials and components, can affect production capacity and lead times. Intense competition among established players and emerging entrants necessitates continuous innovation and cost optimization. These challenges can collectively impact market growth and profitability.

Emerging Opportunities in North America Small Arms Market

The North American small arms market presents several promising opportunities. Technological breakthroughs, such as the development of more efficient and precise small arms technology, are creating new market segments and increasing demand. Strategic partnerships among manufacturers and technology providers are likely to result in collaborative efforts to produce innovative products and expand market reach. Furthermore, exploration of new and emerging markets within North America can help manufacturers find new revenue streams.

Leading Players in the North America Small Arms Market Sector

- Heckler & Koch GmbH

- Smith & Wesson Brands Inc

- Sig Saur GmbH

- Sturm Ruger & Company Inc

- Colt Canada

- FN Herstal SA

- Para US

- Cadex Defence

Key Milestones in North America Small Arms Market Industry

- October 2022: The Canadian government awarded MD Charlton a USD 3.2 million contract to supply 7,000 Sig Sauer P320 handguns to the Canadian Army, highlighting ongoing military procurement activities.

- March 2022: The US Army announced its intention to acquire 29,000 next-generation rifles and machine guns for testing, signaling advancements in military small arms technology and potential future procurements.

Strategic Outlook for North America Small Arms Market Market

The North American small arms market is poised for continued growth, driven by technological innovations, increasing defense spending, and sustained demand from the civilian sector. Strategic opportunities lie in focusing on product differentiation through advanced technologies, fostering strategic partnerships, and effectively navigating regulatory landscapes. Companies that can effectively adapt to evolving market dynamics and consumer preferences are well-positioned to capitalize on this market's long-term growth potential.

North America Small Arms Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Small Arms Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Small Arms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Segment Expected to Continue its Dominance During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Small Arms Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Small Arms Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Small Arms Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Small Arms Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Small Arms Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Heckler & Koch GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Smith & Wesson Brands Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sig Saur GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sturm Ruger & Company Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Colt Canada

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 FN Herstal SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Para US

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cadex Defence

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Heckler & Koch GmbH

List of Figures

- Figure 1: North America Small Arms Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Small Arms Market Share (%) by Company 2024

List of Tables

- Table 1: North America Small Arms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Small Arms Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Small Arms Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Small Arms Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Small Arms Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Small Arms Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Small Arms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Small Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Small Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Small Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Small Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Small Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Small Arms Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Small Arms Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Small Arms Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Small Arms Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Small Arms Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Small Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Small Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Small Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Small Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Small Arms Market?

The projected CAGR is approximately > 3.20%.

2. Which companies are prominent players in the North America Small Arms Market?

Key companies in the market include Heckler & Koch GmbH, Smith & Wesson Brands Inc, Sig Saur GmbH, Sturm Ruger & Company Inc, Colt Canada, FN Herstal SA, Para US, Cadex Defence.

3. What are the main segments of the North America Small Arms Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Segment Expected to Continue its Dominance During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: The Canadian government announced that MD Charlton had been awarded a contract worth USD 3.2 million to supply new pistols for the Canadian Army. National Defence Minister Anita Anand made the announcement, revealing that as part of the agreement, the British Columbia-based company would provide 7,000 C22 full-frame modular handguns (Sig Sauer P320), along with holster systems, spares, and training.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Small Arms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Small Arms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Small Arms Market?

To stay informed about further developments, trends, and reports in the North America Small Arms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence