Key Insights

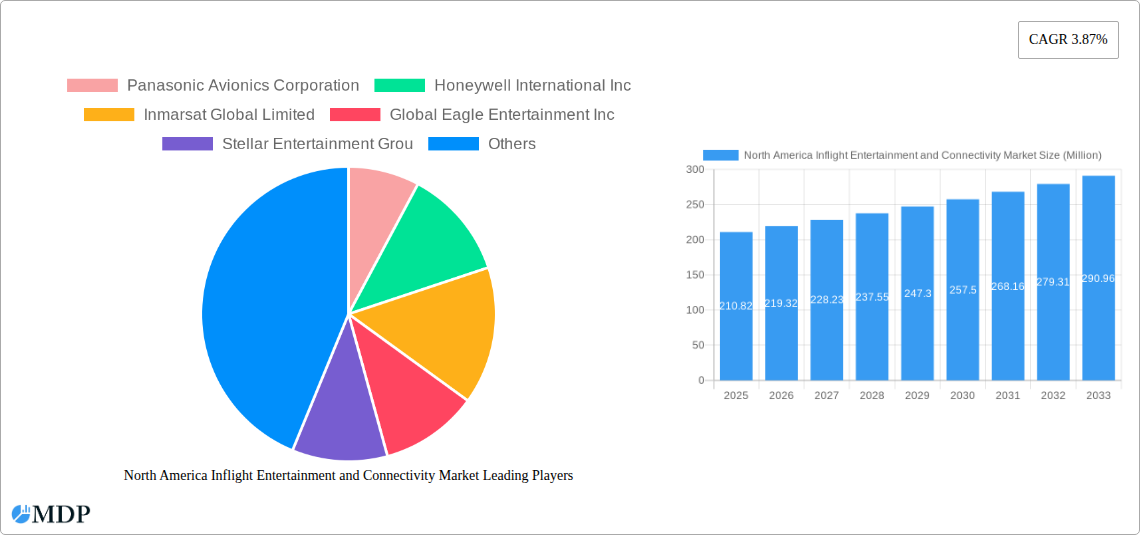

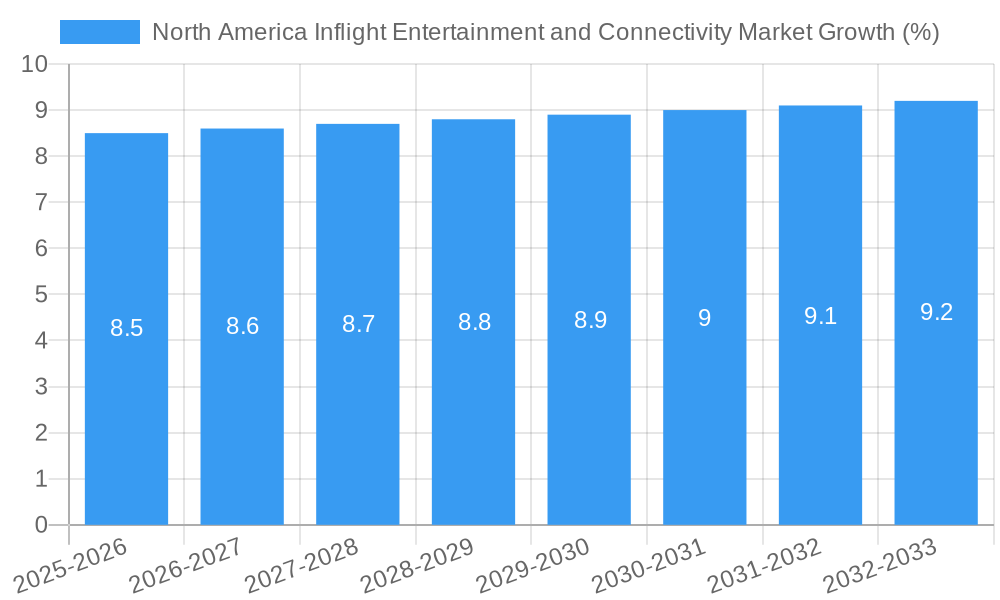

The North America inflight entertainment and connectivity (IFEC) market, valued at $210.82 million in 2025, is poised for steady growth, projected to expand at a compound annual growth rate (CAGR) of 3.87% from 2025 to 2033. This growth is driven by several factors. The increasing demand for high-speed internet access during flights, fueled by passenger expectations for seamless connectivity mirroring their ground-based experiences, is a primary driver. Furthermore, airlines are increasingly recognizing the value proposition of enhanced IFEC systems in attracting and retaining customers, leading to significant investments in upgrading their offerings. The market segmentation reveals a robust demand across various product categories, including hardware (such as seatback screens and Wi-Fi infrastructure), content (movies, TV shows, and games), and connectivity solutions (satellite-based and air-to-ground). The retrofit market is particularly dynamic, as airlines seek to modernize older fleets without the expense of completely replacing aircraft. Within the class segmentation, business and first-class passengers are likely to drive a higher demand for premium services, further fueling market expansion. The strong presence of major players like Panasonic Avionics, Honeywell, and Gogo indicates a competitive landscape with ongoing innovation in hardware and software solutions.

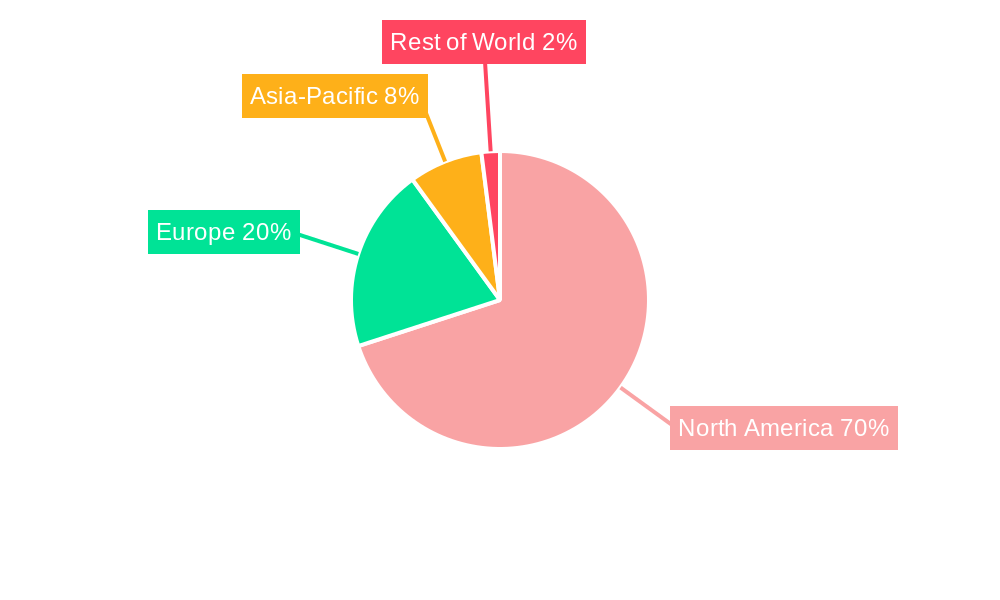

North America's dominance in the IFEC market stems from its mature aviation sector and high disposable income levels among its passengers. The US market, in particular, is expected to contribute substantially to the overall market value. However, factors like the high initial investment costs for implementing advanced IFEC systems and the need for regulatory approvals can act as potential restraints. Nonetheless, the long-term outlook for the North American IFEC market remains positive, driven by continuous technological advancements, expanding air travel, and the unwavering focus on improving the passenger experience. The evolution towards 5G and improved satellite technologies are expected to further fuel this growth trajectory, enhancing the quality and speed of connectivity offered. The competitive landscape will likely continue to see mergers, acquisitions, and technological advancements as companies strive to capture market share in this growing sector.

North America Inflight Entertainment and Connectivity Market Report: 2019-2033

Unlocking Growth in the North American Skies: A Comprehensive Analysis of the Inflight Entertainment and Connectivity Market

This comprehensive report provides a detailed analysis of the North America inflight entertainment and connectivity market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. The market is segmented by product (Hardware, Content, Connectivity), fit (Line-fit, Retrofit), and class (First Class, Business Class, Economy Class). The report projects a market value reaching xx Million by 2033, driven by key factors analyzed within.

North America Inflight Entertainment and Connectivity Market Market Dynamics & Concentration

The North American inflight entertainment and connectivity market exhibits a moderately consolidated structure, with key players holding significant market share. Market concentration is influenced by factors such as technological advancements, regulatory changes, and mergers and acquisitions (M&A) activities. The historical period (2019-2024) witnessed xx M&A deals, contributing to the consolidation. Innovation is a key driver, with companies constantly striving to enhance passenger experience through advanced hardware, high-speed connectivity, and engaging content. Stringent regulatory frameworks regarding data security and passenger safety also shape market dynamics. Product substitutes, such as personal electronic devices with streaming capabilities, pose a competitive challenge, while evolving end-user preferences, particularly among younger demographics, demand more personalized and interactive entertainment options.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- M&A Activity: An average of xx M&A deals per year were observed during 2019-2024.

- Innovation Drivers: Focus on 4K displays, high-speed broadband internet, and personalized content delivery systems.

- Regulatory Frameworks: Compliance with data privacy regulations and aviation safety standards.

North America Inflight Entertainment and Connectivity Market Industry Trends & Analysis

The North American inflight entertainment and connectivity market is experiencing robust growth, driven by increasing passenger demand for seamless connectivity and high-quality entertainment options. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors: the rising adoption of advanced technologies such as 5G and satellite-based connectivity, the increasing preference for personalized content and interactive entertainment, and the growing trend of airlines offering bundled packages of inflight entertainment and connectivity services. Furthermore, the competitive landscape is dynamic, with companies constantly innovating to differentiate their offerings and gain market share. Market penetration of high-speed internet connectivity on North American flights is steadily increasing, expected to reach xx% by 2033.

Leading Markets & Segments in North America Inflight Entertainment and Connectivity Market

The United States dominates the North American inflight entertainment and connectivity market, driven by a large air passenger base and extensive domestic air travel network. Within the market segmentation:

- Product: The Hardware segment holds the largest market share, followed by Connectivity and then Content. Growth in Hardware is driven by demand for enhanced displays and improved user interfaces. The Connectivity segment's growth is fueled by increased adoption of high-speed internet. Content is driven by demand for diverse and personalized offerings.

- Fit: Line-fit installations are prevalent in newly manufactured aircraft, while retrofit solutions cater to existing fleets, contributing significant market revenue.

- Class: First and Business Class segments currently exhibit higher spending per passenger on inflight entertainment and connectivity, driving premium pricing for services.

Key Drivers:

- Economic factors: Growth in disposable incomes and rising air travel.

- Technological advancements: Adoption of 5G, satellite-based connectivity, and advanced display technologies.

- Government regulations: Promoting high-speed internet accessibility on flights.

North America Inflight Entertainment and Connectivity Market Product Developments

Recent product innovations focus on enhancing passenger experience through improved hardware, advanced connectivity solutions, and personalized content offerings. The integration of 4K displays, high-speed Wi-Fi, and interactive entertainment systems are key trends. Companies are focusing on developing systems that integrate seamlessly with passenger devices and offer customized content based on individual preferences. This addresses consumer demand for greater personalization and convenience. The market fit for these innovative products is high, particularly among airlines seeking to enhance their brand image and passenger loyalty.

Key Drivers of North America Inflight Entertainment and Connectivity Market Growth

Several factors contribute to the market's growth:

- Technological advancements: 5G and satellite-based connectivity are significantly enhancing data speeds and reliability.

- Economic growth: Rising disposable incomes and increased air travel fuel demand for premium services.

- Regulatory support: Initiatives supporting in-flight connectivity infrastructure development.

Challenges in the North America Inflight Entertainment and Connectivity Market Market

The market faces challenges:

- High infrastructure costs: Deploying and maintaining advanced connectivity systems is expensive.

- Competitive pressures: The market is intensely competitive, with ongoing price wars.

- Regulatory hurdles: Navigating data privacy regulations and securing necessary approvals.

Emerging Opportunities in North America Inflight Entertainment and Connectivity Market

The long-term growth of the market is supported by several factors:

- Technological breakthroughs: Next-generation connectivity technologies will dramatically enhance speed and capabilities.

- Strategic partnerships: Collaboration between airlines, technology providers, and content companies is creating innovative offerings.

- Market expansion: Growth opportunities lie in expanding services to regional airlines and smaller aircraft.

Leading Players in the North America Inflight Entertainment and Connectivity Market Sector

- Panasonic Avionics Corporation

- Honeywell International Inc

- Inmarsat Global Limited

- Global Eagle Entertainment Inc

- Stellar Entertainment Group

- Safran SA

- Thales Group

- Lufthansa Systems

- Gogo Inc

- Burrana

- ViaSat Inc

Key Milestones in North America Inflight Entertainment and Connectivity Market Industry

- January 2021: Panasonic Avionics Corporation and IMG partnered to deliver live sports content to airlines globally.

- June 2022: Thales upgraded its Avant Up in-flight entertainment system with Optiq 4K QLED HDR display and Pulse charging unit.

Strategic Outlook for North America Inflight Entertainment and Connectivity Market Market

The North American inflight entertainment and connectivity market presents significant growth potential. Strategic investments in advanced technologies, strategic partnerships, and expansion into new markets will be crucial for companies seeking to capitalize on this opportunity. The focus on personalized content, seamless connectivity, and enhanced passenger experience will drive market growth in the coming years. Airlines that embrace innovation and adapt to evolving passenger preferences will be best positioned for success.

North America Inflight Entertainment and Connectivity Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Inflight Entertainment and Connectivity Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Inflight Entertainment and Connectivity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Connectivity Segment Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Inflight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Inflight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Inflight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Inflight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Inflight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Panasonic Avionics Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Inmarsat Global Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Global Eagle Entertainment Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Stellar Entertainment Grou

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Safran SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Thales Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lufthansa Systems

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Gogo Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Burrana

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ViaSat Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Panasonic Avionics Corporation

List of Figures

- Figure 1: North America Inflight Entertainment and Connectivity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Inflight Entertainment and Connectivity Market Share (%) by Company 2024

List of Tables

- Table 1: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Inflight Entertainment and Connectivity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Inflight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Inflight Entertainment and Connectivity Market?

The projected CAGR is approximately 3.87%.

2. Which companies are prominent players in the North America Inflight Entertainment and Connectivity Market?

Key companies in the market include Panasonic Avionics Corporation, Honeywell International Inc, Inmarsat Global Limited, Global Eagle Entertainment Inc, Stellar Entertainment Grou, Safran SA, Thales Group, Lufthansa Systems, Gogo Inc, Burrana, ViaSat Inc.

3. What are the main segments of the North America Inflight Entertainment and Connectivity Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 210.82 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Connectivity Segment Dominates the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2021, Panasonic Avionics Corporation and IMG extended and expanded their long-standing relationship to deliver live sports content to the world's leading airlines. The companies signed an agreement giving Panasonic Avionics all international in-flight rights to Sport 24 and Sport 24 Extra, the world's only global live sports channels. Airlines that offer Sport 24 and Sport 24 Extra are likely to be able to connect their passengers to unmissable live sporting moments from around the world with live content available in real-time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Inflight Entertainment and Connectivity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Inflight Entertainment and Connectivity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Inflight Entertainment and Connectivity Market?

To stay informed about further developments, trends, and reports in the North America Inflight Entertainment and Connectivity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence