Key Insights

The North American haircare market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by several key factors. Increased consumer awareness of hair health and the rising popularity of natural and organic haircare products are significant contributors to market expansion. The preference for premium and specialized haircare solutions, catering to diverse hair types and concerns (e.g., hair loss, damage repair, color protection), fuels premium product segment growth. Furthermore, the burgeoning online retail sector provides convenient access to a wider product range, boosting market reach and sales. The dominance of established players like L'Oréal, Unilever, and Procter & Gamble is expected to continue, although smaller, niche brands focusing on sustainability and specific hair needs are gaining traction. Competition is fierce, necessitating continuous innovation in product formulations and marketing strategies. This includes leveraging digital marketing and influencer collaborations to connect with younger demographics.

Despite the positive growth outlook, certain challenges persist. Fluctuations in raw material prices and economic downturns can impact consumer spending on non-essential items like premium haircare products. Additionally, regulatory changes regarding ingredient safety and environmental concerns related to packaging waste pose ongoing challenges for manufacturers. To maintain market share and profitability, companies are focusing on sustainable packaging options, ethical sourcing, and transparent ingredient labeling, aligning with the increasing consumer demand for environmentally conscious products. The market's segmentation across product types (shampoo, conditioner, hair loss treatments, etc.) and distribution channels (online, supermarkets, specialty stores) provides opportunities for targeted marketing and product diversification. Future growth will depend on successfully navigating these challenges while capitalizing on emerging trends and consumer preferences. A continued focus on personalized haircare solutions and technological advancements in product development will be crucial for sustained market success in North America.

North America Haircare Market Report: 2019-2033

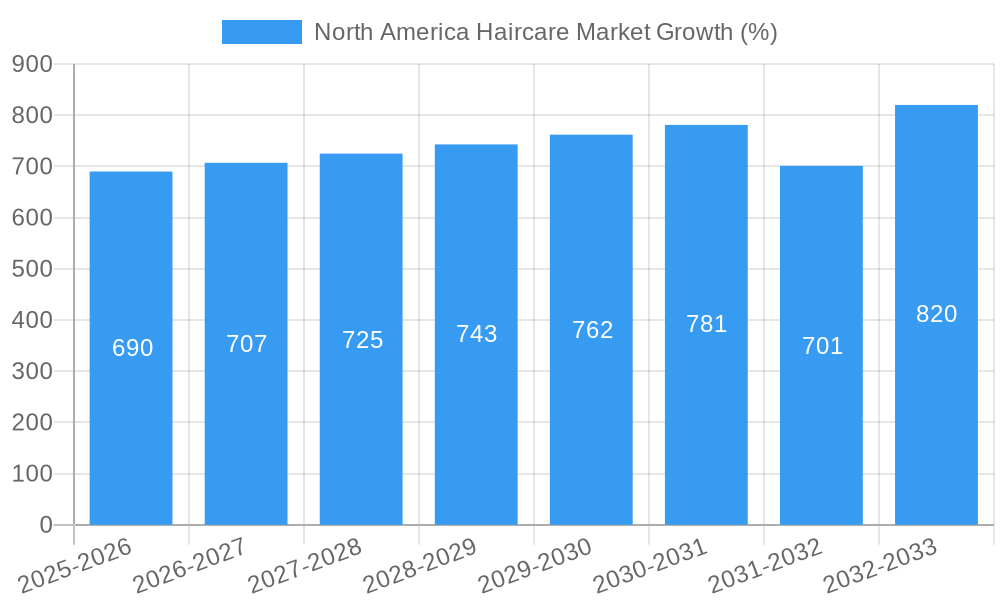

This comprehensive report provides a detailed analysis of the North America haircare market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report covers key market dynamics, trends, leading players, and future opportunities. The market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Haircare Market Dynamics & Concentration

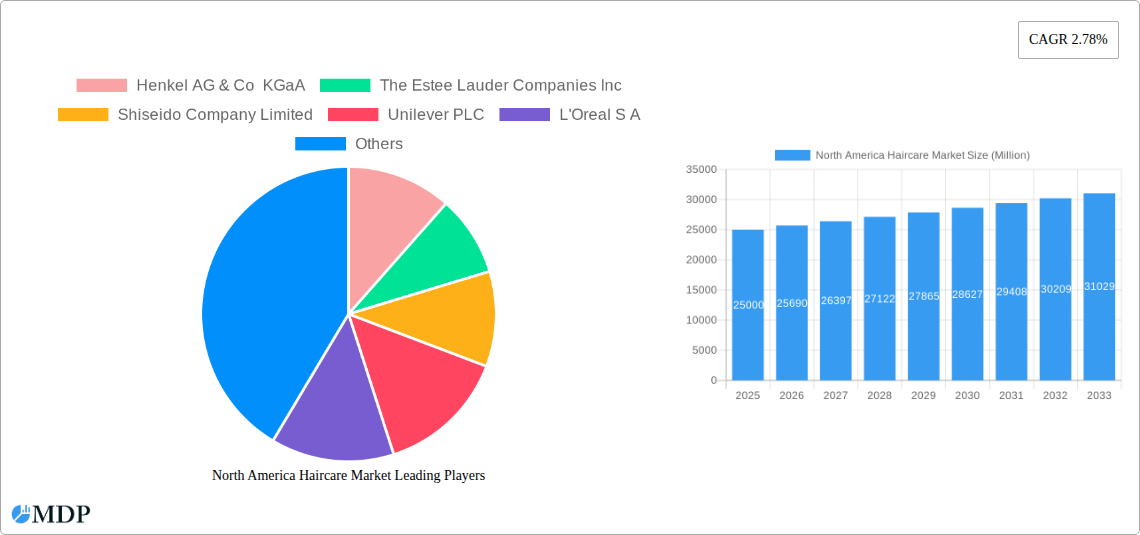

The North America haircare market is characterized by a high level of competition, with several multinational corporations holding significant market share. Key players such as Henkel AG & Co KGaA, The Estée Lauder Companies Inc, Shiseido Company Limited, Unilever PLC, L'Oréal S A, Natura & Co, John Paul Mitchell Systems, Procter & Gamble Company, Kao Corporation, and Alticor (Amway Corporation) contribute significantly to the overall market value, estimated at xx Million in 2025. Market concentration is moderate, with the top 5 players holding approximately xx% of the market share in 2025.

- Market Concentration: The market exhibits moderate concentration with the top 5 players holding approximately xx% of the market share in 2025.

- Innovation Drivers: Growing consumer demand for natural, organic, and sustainable haircare products, coupled with technological advancements in formulation and packaging, are key innovation drivers.

- Regulatory Frameworks: FDA regulations regarding product safety and labeling significantly impact market dynamics. Stringent regulations on chemical composition and marketing claims necessitate compliance from all market participants.

- Product Substitutes: The availability of homemade remedies and DIY haircare solutions presents a degree of substitution, although branded products dominate the market.

- End-User Trends: Growing awareness of scalp health, increasing demand for personalized haircare solutions, and a rising preference for convenient and easy-to-use products are key end-user trends shaping market growth.

- M&A Activities: The number of M&A deals in the haircare sector fluctuates, with xx deals recorded in 2024, primarily driven by companies seeking to expand their product portfolios and geographic reach.

North America Haircare Market Industry Trends & Analysis

The North American haircare market is experiencing robust growth, driven by several factors. The increasing awareness of hair health and the rise of personalized haircare have fueled demand. Consumers are increasingly seeking products tailored to their specific hair type and concerns. This trend, coupled with the growing popularity of natural and organic ingredients, is reshaping the market landscape. Technological advancements in product formulation, such as the incorporation of innovative ingredients and advanced delivery systems, are further driving growth. The “skinification” of haircare, a major trend, involves applying skincare principles and ingredients to hair products. The market's CAGR is estimated at xx% between 2025 and 2033. Market penetration of premium and specialized haircare products is also rising steadily, reflecting the increased willingness of consumers to invest in high-quality solutions. Competitive dynamics are intense, with existing players innovating and new entrants emerging. This leads to an ever-evolving market landscape marked by fierce competition in terms of product differentiation, marketing, and pricing.

Leading Markets & Segments in North America Haircare Market

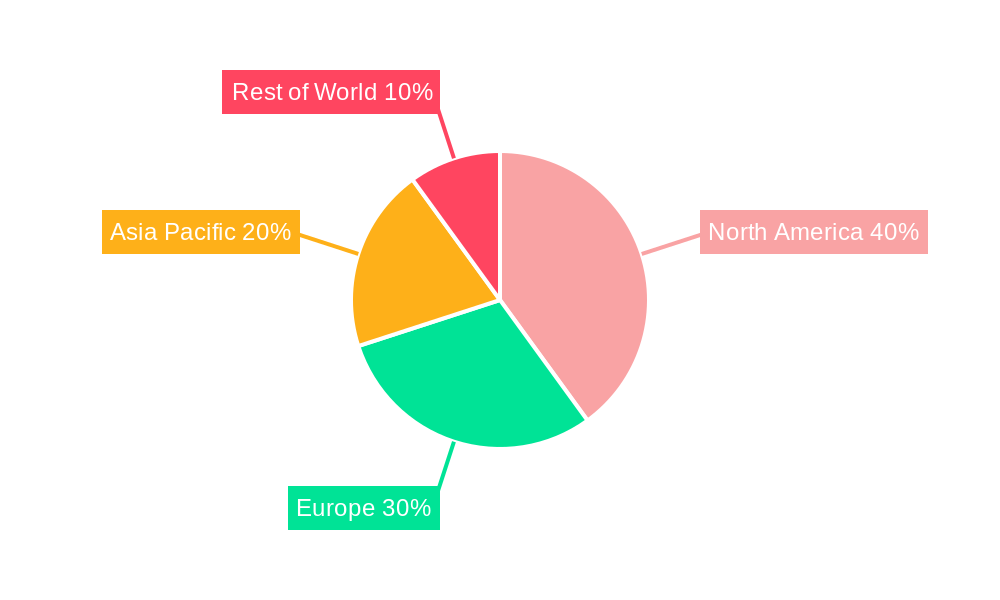

The US dominates the North American haircare market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily attributable to its large population base and high per capita spending on personal care products. Canada represents the second largest market within the region.

- Dominant Product Type: Shampoo maintains its leading position within the product type segment, owing to its widespread use and established market presence.

- Dominant Distribution Channel: Supermarkets/hypermarkets constitute the largest distribution channel due to their extensive reach and accessibility to consumers. However, the online retail segment is rapidly gaining traction, experiencing strong growth fuelled by the increasing prevalence of e-commerce.

Key Drivers for Dominant Segments:

- Shampoo: High frequency of use and wide consumer base.

- Supermarkets/Hypermarkets: Extensive reach, wide product assortment, and convenient shopping experiences.

- Online Retail: Convenience, wider selection, and targeted marketing efforts.

North America Haircare Market Product Developments

Recent product developments reflect the growing emphasis on natural ingredients, sustainability, and personalized haircare solutions. Several key players have launched products featuring organic extracts, plant-based formulations, and customized treatment regimens. Innovation in packaging, such as utilizing eco-friendly materials and reducing waste, is also gaining momentum. Technological advancements are streamlining the product development process and ensuring superior product quality and efficacy. These new product introductions cater to the evolving consumer preferences and market demands.

Key Drivers of North America Haircare Market Growth

Several factors are driving the growth of the North American haircare market. The rising disposable incomes and increasing consumer spending on personal care products are key contributing factors. Furthermore, the growing awareness of hair health and the consequent demand for high-quality haircare products is another major driver. Technological advancements in product formulation, marketing, and distribution channels are also playing a crucial role.

Challenges in the North America Haircare Market

The North American haircare market faces several challenges. Increasing competition among established brands and new entrants creates pressure on pricing and profitability. Fluctuations in raw material prices impact production costs. Strict regulatory compliance requirements pose challenges for manufacturers. Supply chain disruptions can lead to production delays and impact product availability.

Emerging Opportunities in North America Haircare Market

Significant opportunities exist for growth in the North American haircare market. Expanding into niche segments, such as personalized haircare and specialized treatments, offers untapped potential. Developing sustainable and eco-friendly products aligns with growing consumer preferences. Strategic partnerships and collaborations can enhance market reach and brand visibility. The increasing adoption of digital marketing and e-commerce strategies presents opportunities to reach a wider consumer base.

Leading Players in the North America Haircare Market Sector

- Henkel AG & Co KGaA

- The Estée Lauder Companies Inc

- Shiseido Company Limited

- Unilever PLC

- L'Oréal S A

- Natura & Co

- John Paul Mitchell Systems

- Procter & Gamble Company

- Kao Corporation

- Alticor (Amway Corporation)

- List Not Exhaustive

Key Milestones in North America Haircare Market Industry

- August 2021: Garnier's launch of Whole Blends Shampoo Bars signifies a shift towards sustainability in the haircare industry.

- September 2022: Estée Lauder's The Ordinary expands into haircare, reflecting the "skinification" trend.

- December 2022: P&G's Ouai Anti-Dandruff Shampoo launch showcases innovation in addressing specific hair concerns.

Strategic Outlook for North America Haircare Market

The North American haircare market presents significant growth potential, driven by increasing consumer spending, technological innovation, and the rising awareness of hair health. Companies should focus on developing sustainable and customized products that cater to diverse consumer needs. Strategic partnerships and collaborations will be vital for expanding market reach and strengthening brand positioning. Embracing digital marketing and e-commerce strategies is crucial for maximizing growth opportunities in this dynamic market.

North America Haircare Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Loss Treatment Products

- 1.4. Hair Styling Products

- 1.5. Perms and Relaxants

- 1.6. Hair Colorants

- 1.7. Other Product Types

-

2. Distribution channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Pharmacies/Drug Stores

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Haircare Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Haircare Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Skin Care Products

- 3.4. Market Trends

- 3.4.1. Growing Influence of Social Media and Impact of Digital Technology on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Loss Treatment Products

- 5.1.4. Hair Styling Products

- 5.1.5. Perms and Relaxants

- 5.1.6. Hair Colorants

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Pharmacies/Drug Stores

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Shampoo

- 6.1.2. Conditioner

- 6.1.3. Hair Loss Treatment Products

- 6.1.4. Hair Styling Products

- 6.1.5. Perms and Relaxants

- 6.1.6. Hair Colorants

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Pharmacies/Drug Stores

- 6.2.5. Online Retail Stores

- 6.2.6. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Shampoo

- 7.1.2. Conditioner

- 7.1.3. Hair Loss Treatment Products

- 7.1.4. Hair Styling Products

- 7.1.5. Perms and Relaxants

- 7.1.6. Hair Colorants

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Pharmacies/Drug Stores

- 7.2.5. Online Retail Stores

- 7.2.6. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Shampoo

- 8.1.2. Conditioner

- 8.1.3. Hair Loss Treatment Products

- 8.1.4. Hair Styling Products

- 8.1.5. Perms and Relaxants

- 8.1.6. Hair Colorants

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Pharmacies/Drug Stores

- 8.2.5. Online Retail Stores

- 8.2.6. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Shampoo

- 9.1.2. Conditioner

- 9.1.3. Hair Loss Treatment Products

- 9.1.4. Hair Styling Products

- 9.1.5. Perms and Relaxants

- 9.1.6. Hair Colorants

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Pharmacies/Drug Stores

- 9.2.5. Online Retail Stores

- 9.2.6. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Haircare Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Henkel AG & Co KGaA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 The Estee Lauder Companies Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Shiseido Company Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Unilever PLC

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 L'Oreal S A

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Natura & Co

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 John Paul Mitchell Systems

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Procter & Gamble Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Kao Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Alticor (Amway Corporation)*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: North America Haircare Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Haircare Market Share (%) by Company 2024

List of Tables

- Table 1: North America Haircare Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 4: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Haircare Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Haircare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Haircare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Haircare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Haircare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 13: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 17: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 21: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Haircare Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: North America Haircare Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 25: North America Haircare Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Haircare Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Haircare Market?

The projected CAGR is approximately 2.78%.

2. Which companies are prominent players in the North America Haircare Market?

Key companies in the market include Henkel AG & Co KGaA, The Estee Lauder Companies Inc, Shiseido Company Limited, Unilever PLC, L'Oreal S A, Natura & Co, John Paul Mitchell Systems, Procter & Gamble Company, Kao Corporation, Alticor (Amway Corporation)*List Not Exhaustive.

3. What are the main segments of the North America Haircare Market?

The market segments include Product Type, Distribution channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products.

6. What are the notable trends driving market growth?

Growing Influence of Social Media and Impact of Digital Technology on the Market.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Skin Care Products.

8. Can you provide examples of recent developments in the market?

Dec 2022: P&G's Ouai improved its anti-dandruff shampoo category with the new launch, Ouai's Anti-Dandruff Shampoo, which contains an FDA-approved ingredient such as 2% salicylic acid formulated to relieve dandruff symptoms and break down dandruff-causing bacteria to soothe the scalp. It debuted on the Sephora App and will appear on Sephora's and Ouai's websites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Haircare Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Haircare Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Haircare Market?

To stay informed about further developments, trends, and reports in the North America Haircare Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence