Key Insights

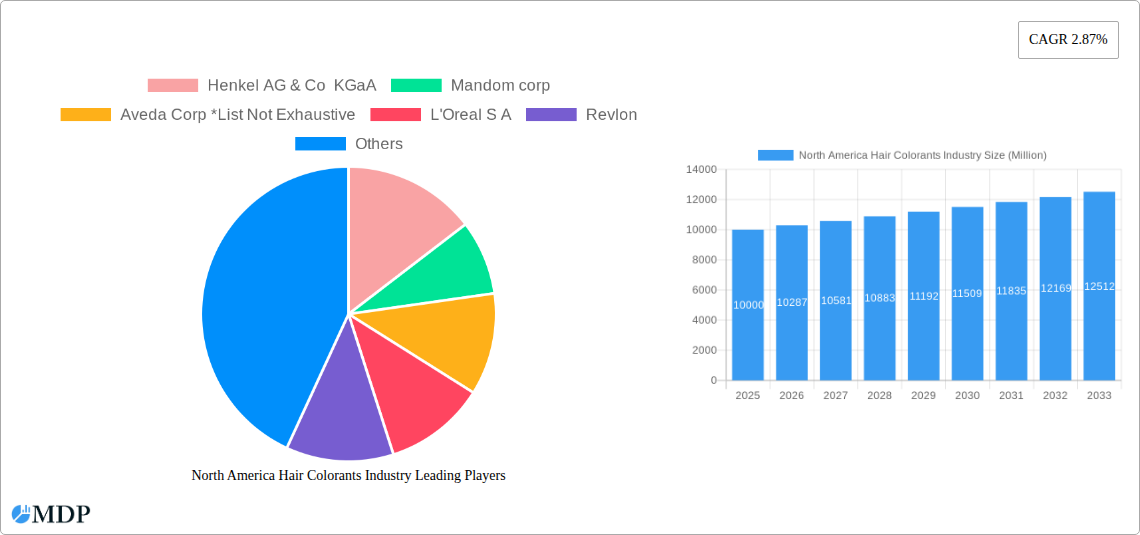

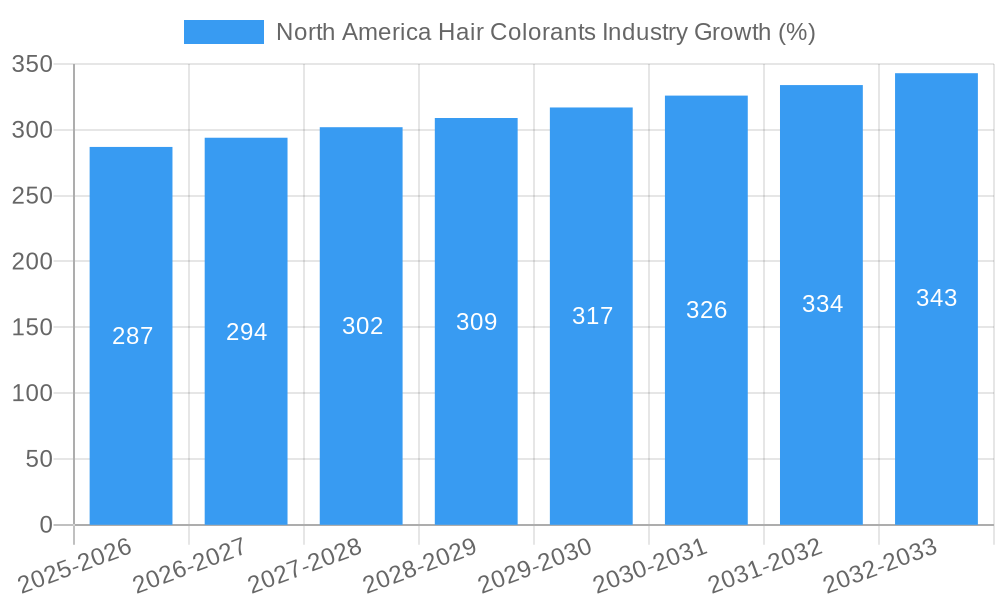

The North American hair colorants market, valued at approximately $X billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 2.87% from 2025 to 2033. This growth is fueled by several key drivers. The increasing prevalence of hair styling and coloring among millennials and Gen Z, coupled with a rising disposable income and a greater emphasis on personal appearance, significantly contribute to market expansion. Furthermore, the continuous innovation in hair colorant technology, leading to the development of gentler, more effective, and diverse products like ammonia-free options and natural colorants, caters to evolving consumer preferences and boosts market demand. The market segmentation reveals a strong preference for convenient distribution channels like supermarkets/hypermarkets and online stores, reflecting the changing retail landscape and consumer purchasing habits. While the rise of natural and organic hair colorants presents a significant opportunity, challenges persist. Price fluctuations in raw materials and increasing consumer awareness of the potential health implications of certain chemicals used in hair colorants could pose constraints to market growth. The competitive landscape is characterized by established players like L'Oréal, Henkel, and Kao Corporation, alongside smaller niche brands focusing on specific consumer segments. These companies are actively investing in research and development to offer innovative products and cater to evolving consumer demands.

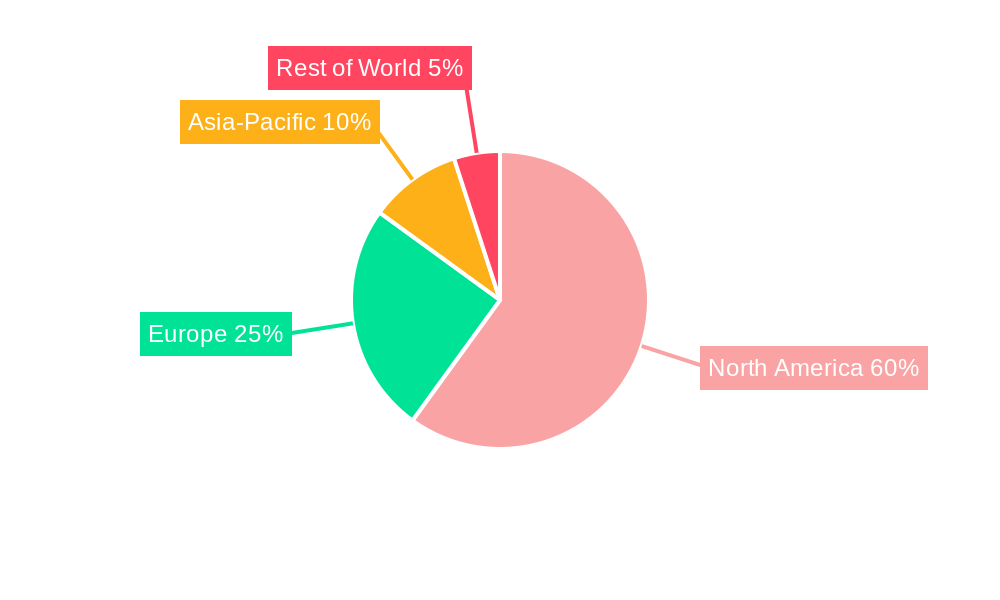

The regional dominance of North America in the hair colorants market is primarily driven by high per capita consumption in the US and Canada. The US market, in particular, showcases high consumer spending on beauty and personal care products, thereby fueling significant demand for hair colorants. Mexico, while exhibiting slower growth compared to the US and Canada, is projected to see increasing market penetration as awareness of hair coloring products and disposable incomes rise. Looking ahead, the market is poised for further expansion through strategic partnerships, mergers and acquisitions, and the continued development of advanced color technologies that improve performance, reduce harmful chemicals, and offer wider shades and application methods. This includes a focus on personalized hair color solutions and the incorporation of technology like AI in product development and marketing.

Uncover lucrative opportunities and navigate the complexities of the North American hair colorants market with this comprehensive report. This in-depth analysis provides a detailed overview of the industry's dynamics, trends, leading players, and future prospects from 2019 to 2033, with a focus on 2025. Maximize your understanding of this $XX Billion market and gain a competitive edge.

North America Hair Colorants Industry Market Dynamics & Concentration

This section analyzes the North American hair colorants market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The study period covers 2019-2033, with 2025 as the base and estimated year.

Market Concentration: The North American hair colorants market exhibits a moderately concentrated structure, with key players like L'Oréal S.A., Henkel AG & Co KGaA, and Revlon holding significant market share. Smaller players and private labels contribute to the remaining market share. We estimate the top 5 players control approximately xx% of the market in 2025.

Innovation Drivers: Ongoing research and development in hair color technology drives innovation, leading to improved formulations with better coverage, longer-lasting color, and gentler ingredients. Demand for natural and organic hair colorants also fuels innovation.

Regulatory Frameworks: Stringent regulations regarding ingredient safety and labeling influence product formulations and marketing claims. Compliance with these regulations is crucial for market participation.

Product Substitutes: Hair styling products, wigs, and hair extensions serve as substitutes for hair colorants, impacting market growth.

End-User Trends: Growing consumer awareness of hair health and natural ingredients influences demand for gentler and more sustainable hair color products. The rise of at-home hair coloring further shapes market dynamics.

M&A Activities: The industry has witnessed several M&A activities in recent years, driven by the need for expansion and market consolidation. We estimate xx M&A deals occurred between 2019 and 2024.

North America Hair Colorants Industry Industry Trends & Analysis

This section delves into the key trends shaping the North American hair colorants market. Our analysis incorporates market growth drivers, technological disruptions, consumer preferences, and competitive dynamics to provide a comprehensive understanding of the industry's trajectory. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Market penetration for at-home hair coloring kits is estimated at xx% in 2025.

The market is experiencing robust growth driven by increasing disposable incomes, changing fashion trends that favor diverse hair colors, and rising consumer demand for convenient and effective hair coloring solutions. Technological advancements, such as the development of ammonia-free and vegan formulations, are further propelling market expansion. Consumers are increasingly seeking natural and organic hair colorants, creating a niche market with substantial growth potential. The competitive landscape is dynamic, with established players and new entrants vying for market share through product innovation, aggressive marketing, and strategic acquisitions.

Leading Markets & Segments in North America Hair Colorants Industry

This section identifies the leading regions, countries, and segments within the North American hair colorants market.

By Product Type:

Permanent Colorants: This segment dominates the market due to its long-lasting color payoff and wide color range. Key drivers include consumer preference for lasting color and ease of application.

Semi-Permanent Colorants: This segment experiences moderate growth due to its lower commitment and gentler formulation.

Bleachers and Highlighters: This segment shows promising growth, driven by the increasing popularity of highlighting and balayage techniques.

Others: This category includes hair glosses, color refreshers, and other specialized hair color products.

By Distribution Channel:

Supermarkets/Hypermarkets: This channel remains the most dominant distribution channel due to its wide reach and convenience.

Specialty Stores: Specialty stores catering to hair care provide a platform for premium and professional hair color products.

Online Stores: The online channel is experiencing substantial growth, driven by the increasing popularity of e-commerce and the convenience it offers.

Convenience Stores: This channel provides limited access to basic hair color products.

The United States is the leading market, driven by high per capita disposable income and a strong preference for personalized hair coloring. Canada follows as a significant market, exhibiting a relatively stable growth rate.

North America Hair Colorants Industry Product Developments

Recent product innovations include ammonia-free formulations, natural ingredient-based colorants, and products specifically designed for grey hair coverage. These advancements cater to growing consumer demand for healthier and more sustainable hair coloring options, while also enhancing the market appeal for specific demographic segments. The adoption of innovative technologies, including AI-powered color matching tools, is revolutionizing the consumer experience.

Key Drivers of North America Hair Colorants Industry Growth

The growth of the North American hair colorants industry is fueled by several factors. Rising disposable incomes are leading to increased spending on personal care products, including hair colorants. Moreover, evolving fashion trends and an increased emphasis on self-expression are driving the demand for diverse hair color options. The industry also benefits from technological advancements in color technology, leading to more effective and gentler hair color products.

Challenges in the North America Hair Colorants Industry Market

The North American hair colorants market faces certain challenges, including stringent regulations on ingredients, which increase manufacturing costs. Fluctuations in raw material prices also impact profitability. Intense competition from established players and new entrants necessitates continuous product innovation and marketing strategies to maintain market share.

Emerging Opportunities in North America Hair Colorants Industry

Emerging opportunities are abundant within the North American hair colorants industry. The increasing demand for natural and organic products presents a significant opportunity for companies to develop and market sustainable and eco-friendly hair colorants. Furthermore, technological advancements, such as personalized color matching and AI-powered virtual try-on tools, are shaping the future of the industry. Expanding into emerging market segments, such as men's hair color and specialized hair color solutions for ethnic hair types, offers substantial growth potential.

Leading Players in the North America Hair Colorants Industry Sector

Key Milestones in North America Hair Colorants Industry Industry

- 2020: Increased focus on at-home hair coloring due to pandemic restrictions.

- 2021: Several major players launched new ammonia-free and vegan hair color products.

- 2022: Growth in online sales of hair colorants.

- 2023: Increased regulatory scrutiny on certain hair color ingredients.

- 2024: Several mergers and acquisitions among smaller hair color companies.

Strategic Outlook for North America Hair Colorants Industry Market

The North American hair colorants market holds significant growth potential, driven by favorable demographic trends, changing consumer preferences, and technological innovations. Strategic opportunities include investing in research and development to create innovative and sustainable hair color products, expanding distribution channels to reach new customer segments, and focusing on targeted marketing campaigns to highlight product benefits. The market will continue to evolve with a growing emphasis on personalization, convenience, and health consciousness, creating lucrative opportunities for agile and adaptable companies.

North America Hair Colorants Industry Segmentation

-

1. Product Type

- 1.1. Bleachers

- 1.2. Highlighters

- 1.3. Permanent Colorants

- 1.4. Semi-Permanent Colorants

- 1.5. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Speciality Stores

- 2.3. Online Stores

- 2.4. Convenience Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Hair Colorants Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Hair Colorants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure

- 3.3. Market Restrains

- 3.3.1. Prevalence of Counterfeit Goods

- 3.4. Market Trends

- 3.4.1. Emerging Styling Trend Among Young Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bleachers

- 5.1.2. Highlighters

- 5.1.3. Permanent Colorants

- 5.1.4. Semi-Permanent Colorants

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. Online Stores

- 5.2.4. Convenience Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bleachers

- 6.1.2. Highlighters

- 6.1.3. Permanent Colorants

- 6.1.4. Semi-Permanent Colorants

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. Online Stores

- 6.2.4. Convenience Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bleachers

- 7.1.2. Highlighters

- 7.1.3. Permanent Colorants

- 7.1.4. Semi-Permanent Colorants

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. Online Stores

- 7.2.4. Convenience Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bleachers

- 8.1.2. Highlighters

- 8.1.3. Permanent Colorants

- 8.1.4. Semi-Permanent Colorants

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. Online Stores

- 8.2.4. Convenience Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bleachers

- 9.1.2. Highlighters

- 9.1.3. Permanent Colorants

- 9.1.4. Semi-Permanent Colorants

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. Online Stores

- 9.2.4. Convenience Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Henkel AG & Co KGaA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Mandom corp

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Aveda Corp *List Not Exhaustive

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 L'Oreal S A

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Revlon

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Kao Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 COTY INC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: North America Hair Colorants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Hair Colorants Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Hair Colorants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Hair Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Hair Colorants Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Hair Colorants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Hair Colorants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Hair Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Hair Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Hair Colorants Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: North America Hair Colorants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Hair Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Hair Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Hair Colorants Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: North America Hair Colorants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Hair Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Hair Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Hair Colorants Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: North America Hair Colorants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Hair Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Hair Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: North America Hair Colorants Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Hair Colorants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Hair Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hair Colorants Industry?

The projected CAGR is approximately 2.87%.

2. Which companies are prominent players in the North America Hair Colorants Industry?

Key companies in the market include Henkel AG & Co KGaA, Mandom corp, Aveda Corp *List Not Exhaustive, L'Oreal S A, Revlon, Kao Corporation, COTY INC.

3. What are the main segments of the North America Hair Colorants Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure.

6. What are the notable trends driving market growth?

Emerging Styling Trend Among Young Consumers.

7. Are there any restraints impacting market growth?

Prevalence of Counterfeit Goods.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hair Colorants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hair Colorants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hair Colorants Industry?

To stay informed about further developments, trends, and reports in the North America Hair Colorants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence